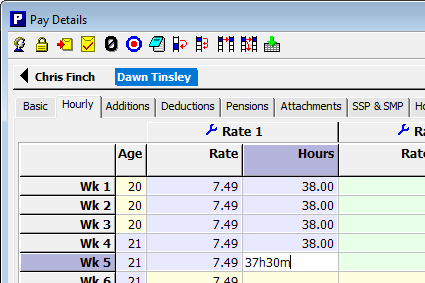

Hourly pay – entering the number of hours worked

We have recently made a small change to the way that the number of hours an employee works can be input on the ‘Pay Details’ screen in Payroll Manager. Previously e.g. if an employee worked 37 1/2 hours, then it was necessary to enter ‘37.5’ into the ‘Hours worked’ column. It is now possible to…