National Insurance Contributions relief for employers who hire armed forces veterans

In the spring budget of 2020, the Chancellor announced the introduction of a National Insurance holiday for employers that hire former members of the UK regular armed forces. The holiday will exempt employers from any National Insurance contributions liability on a veteran’s salary up to the Upper Secondary Threshold (£50,270 per year) in their first year of civilian employment (the employee will still be liable for National Insurance contributions).

This relief will be available from April 2021. Employers will be able to claim this relief for 12 months starting from the first day of the veterans first civilian employment after leaving Her Majesty’s armed forces. Subsequent employers will be able to claim this relief during this 12 month period.

From April 2021 to March 2022, employers will still need to pay the associated secondary Class 1 National Insurance contributions as normal and then claim it back retrospectively following the end of the 2021-22 tax year. From April 2022 onwards, the secondary (employers) NIC relief will automatically be calculated by Payroll Manager and is claimed directly via payroll.

More information can be found at gov.uk/government/publications/national-insurance-contributions-relief-for-employers-who-hire-veterans

How will Payroll Manager handle the NIC holiday for veterans?

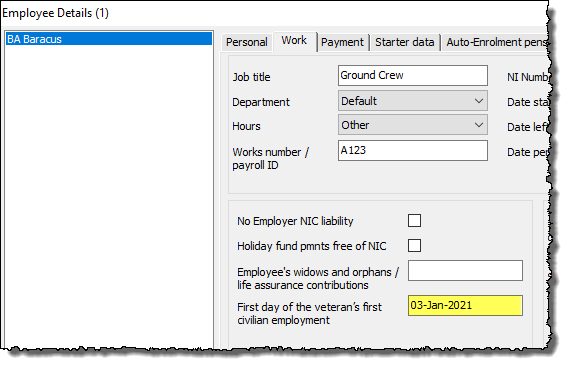

If you have taken on a qualifying veteran (as per the rules specified in gov.uk/government/publications/national-insurance-contributions-relief-for-employers-who-hire-veterans ) then click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, and select the ‘Work‘ tab.

Enter the first day of the veteran’s first civilian employment in the box provided. If this is the veteran’s first job since leaving the armed forces then this date will be the same as their start date of employment with this employer. If the veteran has been employed elsewhere since leaving the armed forces, then you would need to establish their first day of civilian employment with their first employer, and enter that date.

For tax year 2021-22: Entering a date in this box will have no effect on the calculation of employer NIC in the tax year 2021-22, as HMRC rules state that employer NIC is to be paid as normal during this year, then claimed back retrospectively following the end of the tax year (see instructions below).

For tax year 2022-23: Payroll Manager will automatically calculate the correct amount of employer NIC due (if any) for veterans in employment.

How to reclaim Veterans Employer NIC following the end of the 2021-22 tax year

There are 2 conditions that must be met before you can reclaim any overpaid employer NIC in respect of veterans that worked for you during 2021-22:

- You must have already filed all of your FPS returns for 2021-22 using Payroll Manager (i.e. the FPS for month 12 if you have monthly paid employees, or the FPS for week 52 if you have weekly paid employees),

- The date must be 6 April 2022 or later, as HMRC systems cannot accept claims before this date.

If both of these conditions are true then please proceed as below, making sure that you have the relevant 2021-22 payroll data file open first.

1 – ‘Lock-in’ a record of what has already been paid to HMRC

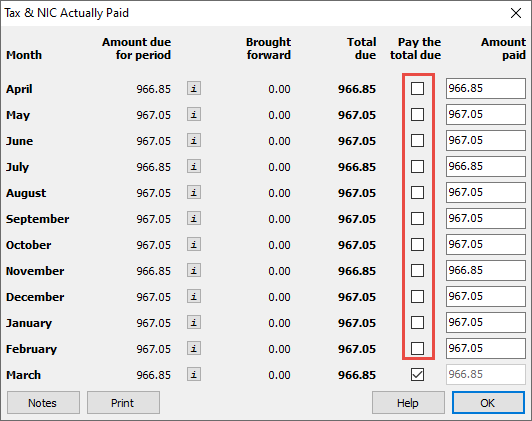

Click ‘Pay‘ then ‘Tax & NIC actually paid‘ from the main menu in Payroll Manager. This report shows the payments that have already been made to HMRC.

Untick each of the boxes in the ‘Pay the total due‘ column for the periods for which you have already made a payment of Tax & NIC to HMRC. e.g. if you have already paid HMRC for April through to February, then untick the first 11 months, but leave the final month (March) ticked. (If you have already made a payment to HMRC for the final tax period, then untick all of the boxes). Click ‘OK‘ when you have finished.

(Note: If you pay HMRC on a quarterly basis rather than monthly, then you will see 4 tax periods on this screen, rather than 12. The same principle applies, and you should untick the boxes for any tax period for which you have already made a payment to HMRC)

2 – Ensure that the ‘First day of the veteran’s first of civilian employment’ has been entered.

Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, then click on the ‘Work‘ tab. Enter the ‘First day of the veteran’s first civilian employment (as below)

If this is the veteran’s first job since leaving the armed forces then this date will be the same as their start date of employment with this employer. If the veteran has been employed elsewhere since leaving the armed forces, then you would need to find out what their first day of civilian employment was with a previous employer, and enter that date instead. It is important to get this date right, as employer NIC relief for veterans ends 12 months after they first commenced civilian employment. Click ‘OK‘ after entering / confirming the date.

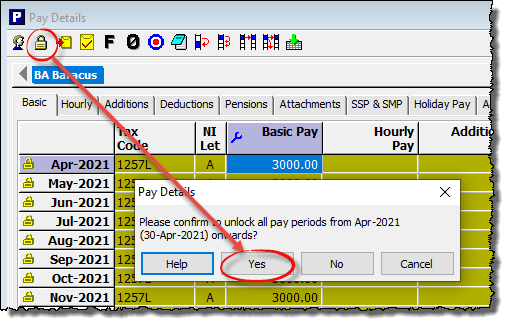

3 – Unlock previous pay periods.

Go to the ‘Pay – Pay Details‘ screen, select the relevant employee, then single-click on the first pay period of the tax year (e.g. ‘April’, or ‘wk1’). Click on the ‘Lock/Unlock‘ button on the toolbar, an confirm that you wish to unlock all pay periods (see below).

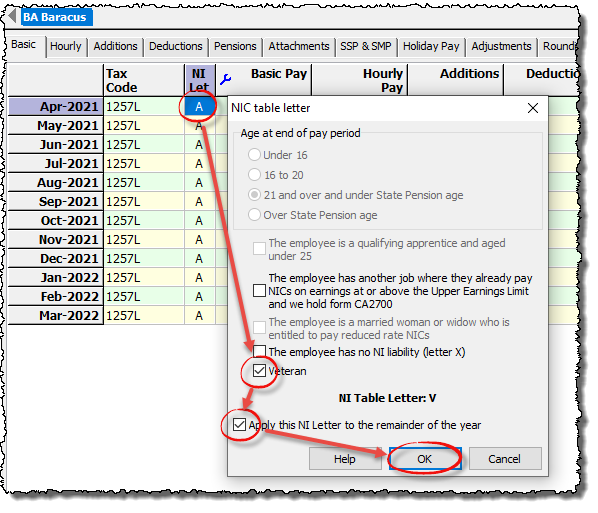

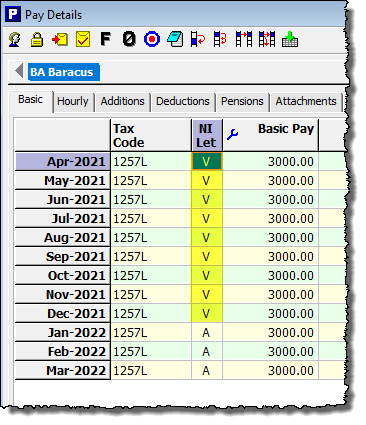

4 – Set the NI category to V (for veterans)

Triple-click on the NI letter in the first pay period of the year. A box will appear (as below). Tick the box marked ‘Veteran‘, then tick the box marked ‘Apply this NI letter to the remainder of the year‘, and click ‘OK‘. (Note: You will not see the option to select ‘Veteran’ unless you have already filed all of your FPS returns for 2021-22).

Payroll Manager will assign the NI category of ‘V’ to all applicable pay periods (i.e. all pay periods within 12 months of the veteran’s first date of civilian employment) and will recalculate the employer NIC due for each of these periods.

Special Circumstance: If the veteran has left your employment and has already been reported as a leaver in a previous FPS then please see the FAQ section, below.

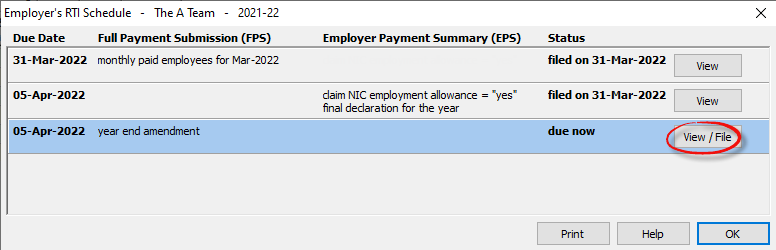

5 – File a Year End Amendment – FPS to HMRC

It is necessary to file a ‘Year End Amendment – FPS‘ to inform HMRC of the updated Employer NIC amounts. Please remember that HMRC will not accept a YEA which contains details of veterans until after 6 April 2022. Click ‘Pay‘ then ‘Employer’s RTI schedule‘ from the main menu in Payroll Manager. The schedule will show a ‘Year End Amendment’ FPS. Click on the ‘View/File‘ button to see details.

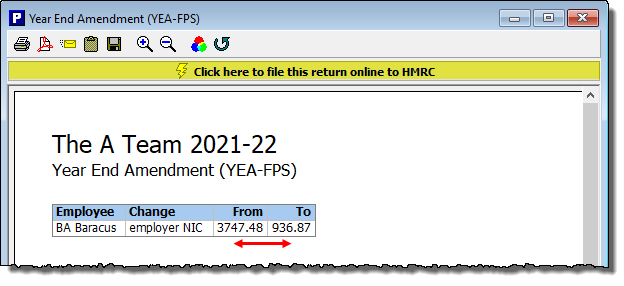

The Year End Amendment report shows a summary of the changes that will be reported to HMRC. Click on the button marked ‘Click here to file this return online to HMRC‘ to submit the YEA-FPS

6 – Arrange to pay HMRC the correct amount

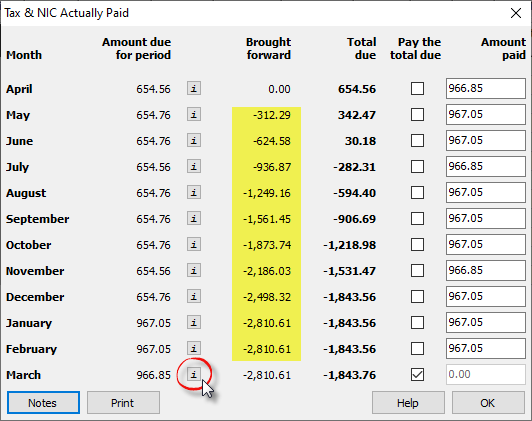

Click ‘Pay‘ then ‘Tax & NIC actually paid‘ from the main menu in Payroll Manager.

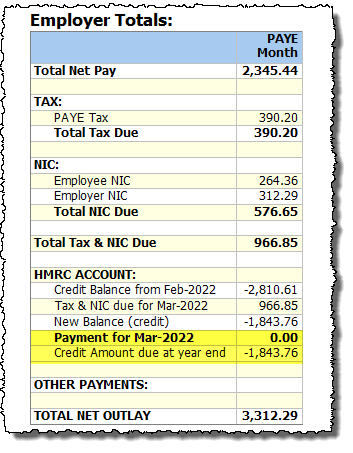

This screen may now contain different figures compared to when you viewed it in Step 1 (above). You may see figures in the ‘Brought forward’ column to indicate that the ‘overpayment’ of Employer NIC from one period has been carried forward to the next period. Click on the ‘i‘ button in the final tax period to produce the ‘Employers Summary for Tax Period‘ report (below).

If you have not yet made your final payment to HMRC for the 2021-22 tax year then the ‘Payment for Mar-2022‘ figure shows how much you should now pay to HMRC. This figure includes any adjustments made to recover employer NIC in respect of employees that are qualifying veterans. In some cases, this figure may be zero, and a ‘Credit Amount‘ may show in the row below. In such cases you should contact HMRC to ask them how to go about recovering this ‘overpayment’ of NIC for that tax year.

If you have already made your final payment to HMRC then the ‘Payment for Mar-2022’ field will show how much you have already paid. As above, if there is a figure in the ‘Credit Amount’ field then you should contact HMRC in order to recover this amount.

FAQs

I am also claiming the Employment Allowance for 2021-22 – will this affect things? Possibly. If the entire £4000 of Employment Allowance allowable for the tax year has not been ‘used up’ on the Employer NIC for other employees, then you may find that the Employer NIC for Veterans and the Employment Allowance effectively cancel each other out. You should not worry about this, as Payroll Manager will handle these calculations automatically, and the amounts to pay HMRC as advised in Step 6 of this guide still apply.

What about employees that were are NIC categories B, C or J? – These employees benefit from paying a reduced rate of employee NIC, and as such NI category ‘V’ should not be used for them (Payroll Manager will automatically prevent letter V from being allocated for such employees). If you do employee a qualifying Veteran from one of these groups then you should write to HMRC in order to claim any NIC relief due. Please see 2022 to 2023: Employer further guide to PAYE and National Insurance contributions – GOV.UK (www.gov.uk) for more details.

What if the veteran has already left this employment and has been reported as a leaver on an earlier FPS? – If an employee has already been reported as having left in an earlier FPS you subsequently need to make a change to the pay that has been reported for them, then you should also click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, select the ‘Work‘ tab, and tick the box marked ‘Re-submit RTI leaver details‘, then click ‘OK‘. The leaving information and updated year to date figures for this employee will then be resent in the next available FPS.

Links

National Insurance contributions relief for employers who hire veterans – GOV.UK (www.gov.uk)

Claim National Insurance contributions relief for veterans as an employer