Employer National Insurance Contribution changes from April 2025

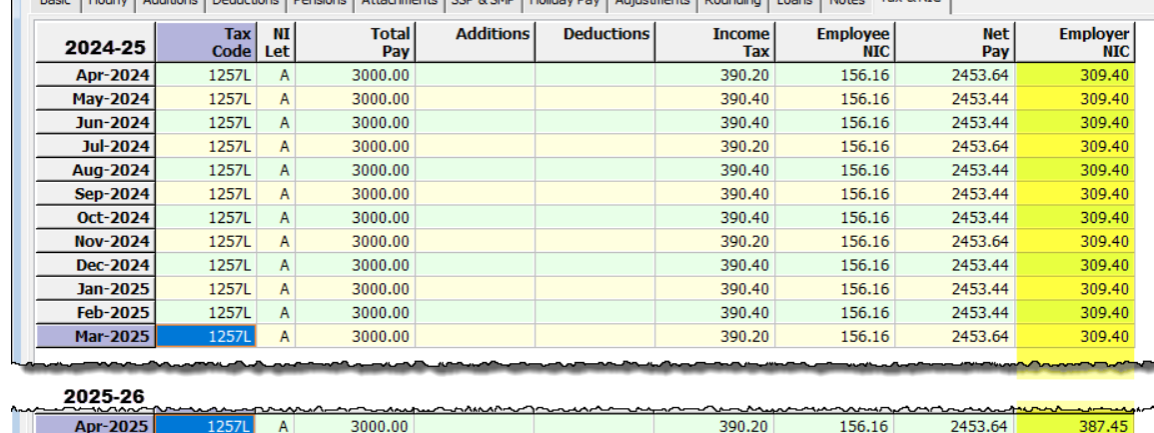

In the Autumn Budget of 2024 the Chancellor announced four changes to employer National Insurance contributions (NICs), all of which take effect at the start of the 2025-26 tax year (6 April 2025).

- A reduction of the secondary Class 1 National Insurance (employer) threshold from £9,100 to £5,000 per annum.

- An increase to the main rate of secondary Class 1 National Insurance (employer) contributions from 13.8% to 15%.

- An increase to the maximum Employment Allowance claim amount per year from £5,000 to £10,500.

- The removal of the £100,000 restriction where employers with an employer NIC liability above this level in the previous tax year were unable to claim the Employment Allowance.

Payroll Manager will handle all of these changes automatically. For more information please see the guide Employer National Insurance Contribution (NIC) changes from April 2025