"Oh my days! I really wish I had found this software before! ... I was using a system that was so expensive in comparison, being hassled by them to buy further add ins to comply with auto pension regulations, and it was not the easiest system ... now I have Payroll Manager, payroll is actually a joy! It is so easy to use and complies ... Love Love Love it ... and so does by boss £??'s better off and a happy manager 🙂

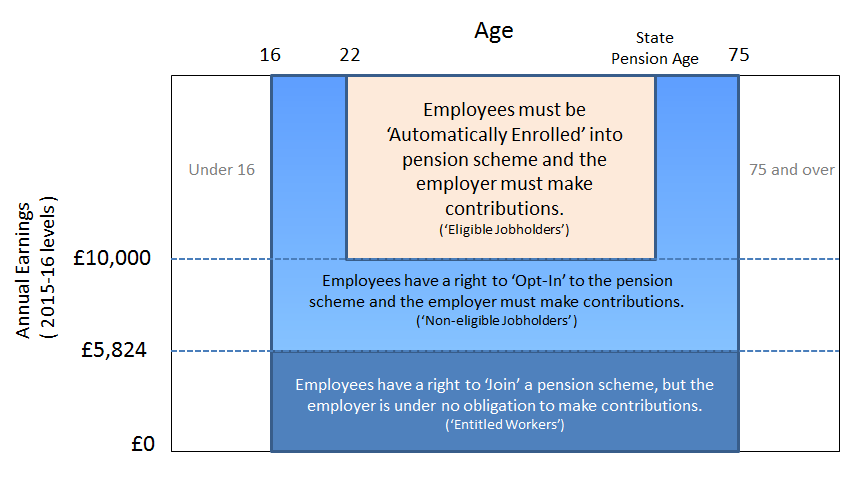

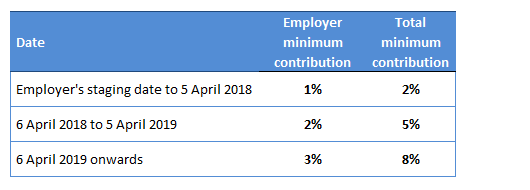

New legislation on workplace pensions will affect every employer with staff working for them in the UK. This brief guide is designed to give an overview of the new duties and spells out how Moneysoft Payroll Manager can help with the process. More detailed information including user guides for specific pension providers can be found on the Auto enrolment support section of our website.