National Insurance categories and rates

Employers use an employee’s National Insurance category letter when they run payroll to work out how much National Insurance they both need to contribute. Most employees are assigned NI category letter A.

The NI letter is primarily determined by the age of the employee.

- Employees aged between 21 and State Pension age will typically be assigned letter A

- Employees aged 16-20 will typically be assigned letter M

- Employees aged under 16 will be assigned letter X

- Employees that have reached State Pension Age will be assigned letter C

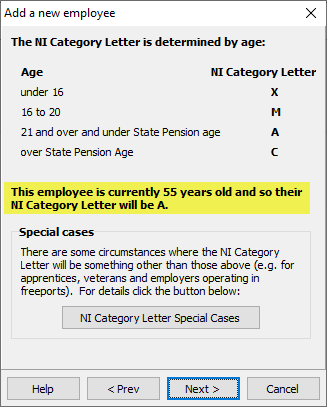

Payroll Manager assigns the correct National Insurance category letter when you first add an employee to the system. After entering the name, date of birth etc. of the employee you are taken to a screen similar to that below.

In this example, the employee is aged 55, and so will be assigned NI letter A.

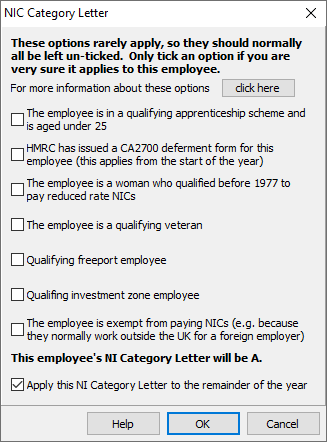

In most cases it is the age of the employee alone that will determine the correct NI category letter to use. However, there are some other circumstances which need to be considered. If any of these apply then you should click on the button marked ‘NI Category Letter Special Cases‘ and select whichever of the following apply (which may be more than one).

You should be aware that by selecting any of these options the calculation of employer and/or employee NIC will be affected, so you should only select these options if you are absolutely sure that they apply. If you tick one of these options in error then this may result in an underpayment of NIC to HMRC for which you will then be liable.

If none of these conditions apply then you should leave each of the boxes unticked.

- H – If the employee is in a qualifying apprenticeship scheme and is aged under 25 then select this option. The employee will be assigned NI letter H

- J or Z – If the employee has applied to HMRC to defer their NI contributions because they are already paying them in another job, and if HMRC has issued the employer a CA2700 certificate of deferment then select this option. Payroll Manager will assign letter J (or letter Z if they are also aged under 21)

- B – If the employee is a woman who qualified before 1977 to pay reduced rate NICs then select this option. The employee will be assigned letter B. (Note: this is a very rare situation and should only be selected if you are absolutely sure that it applies. Letter ‘B’ cannot be used for employees born after 5 April 1961).

- V – If the employee is a qualifying armed services veteran then select this option. The employee will be assigned letter V (unless the employee would otherwise have been assigned letter B, C or J, in which case letter V will not be assigned). For more information about qualifying veterans please see National Insurance contributions relief for employers who hire armed forces veterans

- F, I, L, S – If the employee is a qualifying Freeport employee then select this option. Payroll Manager will assign letter F ( or letter I if the employee is also a woman who qualified before 1977 to pay reduced rate NICs, letter L if the employee also has a deferment form CA2700, or letter S if the employee has also reached state pension age). From April 2025 onwards HMRC also require that you provide the ‘Workplace postcode’ for any qualifying ‘Freeport’ employee in each RTI return- please see the Freeports Employer NIC relief guide for more information.

- N, E, D, K – If the employee is a qualifying Investment Zone employee then select this option. Payroll Manager will assign letter N ( or letter E if the employee is also a woman who qualified before 1977 to pay reduced rate NICs, letter D if the employee also has a deferment form CA2700, or letter K if the employee has also reached state pension age). From April 2025 onwards HMRC also require that you provide the ‘Workplace postcode’ for any qualifying ‘Investment Zone’ employee in each RTI return- please see the Investment Zone Employer NIC relief guide for more information.

- X – If the employee is entirely exempt from paying NICs (e.g. if they work outside of the UK for a foreign employer) then select this option. The employee will be assigned letter X. Note that letter X means that no employee or employer NIC will be calculated on the earnings of this employee, so only select this option if you are absolutely sure that it applies.

A table of rates for employee and employer can be found at National Insurance rates and categories – GOV.UK (www.gov.uk)

FAQs

Does the National Insurance number of the employee affect how much National Insurance they pay? – No, the employee’s National Insurance number (NINO) and the NI category letter are two entirely different things, and are not connected in any way. It is only the NI category letter that affects the calculation of NIC. The NINO only serves to identify that particular employee to HMRC, and has no effect on any calculations.

I have selected the incorrect NI Category letter – how do I change it? – Double-click on the NI category letter on the ‘Pay Details‘ screen to make changes. You should NOT edit any pay periods that have already been processed.

Links

National Insurance rates and categories: GOV.UK (www.gov.uk)

Employing an apprentice – GOV.UK (www.gov.uk)

Defer your National Insurance – GOV.UK (www.gov.uk)

Veterans : Employer further guide to PAYE and National Insurance contributions – GOV.UK (www.gov.uk)