Payroll corrections and RTI returns

If you discover an error in your payroll after sending a Full Payment Submission (FPS) to HMRC (e.g. you entered an incorrect amount of pay or omitted the leaving date for an employee) , then in order to resolve this issue HMRC require that the correct Year to Date figures, together with any updated employee information is sent in the next scheduled FPS (i.e. you should NOT attempt to resubmit an FPS nor send an additional one – see HMRC Fix problems with running payroll for more details).

Once you have made the necessary amendments to your data, Payroll Manager will automatically include the correct year to date figures and employee information in the next available FPS.

If you have already filed all of your regular FPS returns for the tax year (even if you have not yet sent the final EPS), or if you need to make an amendment to a previous tax year then after making your corrections Payroll Manager will automatically create an additional ‘Year End Amendment – FPS’, to inform HMRC of the changes that you have made.

This guide provides step by step guidance on how to make your amendments and submit them to HMRC. The guidance applies for the current tax year, and for previous tax year going back to 2020-21. If you need to make amendments to tax years prior to this then please see the ‘FAQ’ section at the bottom of this guide.

1) Making changes to the employee’s pay

First make sure that you have the payroll file open for the tax year that you wish to amend (click ‘File – Open’ and select the relevant file if it is not already open in Payroll Manager)

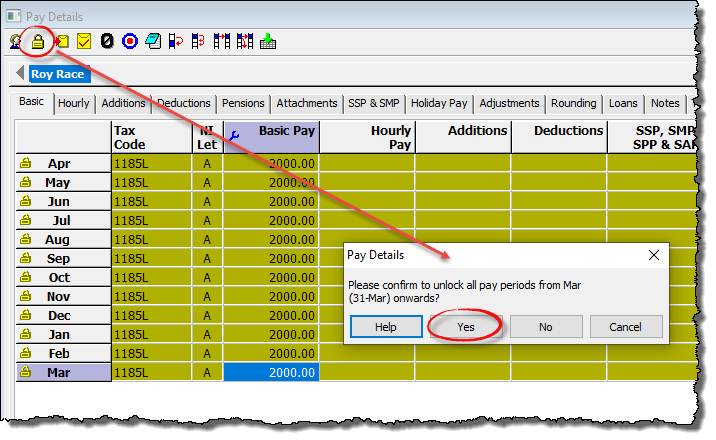

If you need to correct a figure on the ‘Pay Details’ screen then you will need to ‘unlock’ the relevant pay period(s) first. Go to the ‘Pay Details’ screen, select the relevant employee and click on the pay period that you wish to amend. Then press ‘CTRL-U’ on the keyboard (or click the ![]() button on the Pay Details toolbar) and confirm that you wish to unlock this period.

button on the Pay Details toolbar) and confirm that you wish to unlock this period.

Having unlocked a period, you can proceed to make the relevant changes to an employee’s pay. If you need to make an amendment to any Statutory Pay items (SSP, SMP etc), then this should be done on the ‘Employees – Calendar’ screen. You may need to issue the employee with an amended payslip after making these changes.

Special circumstance: If an employee has already been reported as having left in an earlier FPS you subsequently need to make a change to the pay that has been reported for them, then you should also click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, select the ‘Work‘ tab, and tick the box marked ‘Re-submit RTI leaver details‘, then click ‘OK‘. The leaving information and updated year to date figures for this employee will then be resent in the next available FPS.

2) Missing Starter or Leaver information

If you discover that an employee has left but you have already filed the RTI return for the period in which they left, then simply click ‘Employees‘ then ‘Employee Details‘, click on the ‘Work‘ tab and enter the ‘Date left‘. These details will then be sent in the next available FPS.

If a new employee has joined but was not included in the relevant FPS then simply add the details of that new employee, including the correct ‘Date Started‘. These details will then be sent in the next available FPS.

3) Updating the ‘Tax & NIC actually paid’ screen

If you are editing a period other than the final pay period of the year for which the Tax & NIC has already been paid to HMRC, then click ‘Pay’ then ‘Tax & NIC actually paid’ from the main menu in Payroll Manager. Then manually enter the amount that was actually paid to HMRC in the ‘Amount Paid’ field for any pay period that you have amended (you may need to untick the ‘Pay the total due’ box in order to be able to do this). The figure that you enter may be different from the amount shown in the ‘Total Due’ column because of the changes that you have just made. In all cases you should ensure that you arrange to pay HMRC the correct amount due as a result of any amendments that you make.

If your correction is for a previous year and as a result you owe more money to HMRC then you should arrange to pay them as soon as possible. If the correction means that you are in credit then you should contact HMRC for advice on what to do.

4) Sending the corrected information to HMRC

If you still have FPS returns to make in that particular tax year then there is nothing further that you need to do at this point. When you submit your next regular FPS to HMRC it will contain the updated year to date figures. These figures are included in the underlying code of all FPS returns (although for simplicity you will not see them displayed on the screen). If your amendments included changes to the Parenting Pay for an employee (SMP, SPP etc) then the relevant corrected year to date totals will also be automatically included in the next available ‘Employer Payment Summary (EPS).

5) If you have already sent the final FPS for that particular tax year (i.e. you have already sent the FPS for week 52 / month 12)

In cases where you have already submitted the final FPS for that particular tax year then you will need to submit an additional FPS to inform HMRC of the changes. Payroll Manager calls this additional submission a ‘Year End Amendment – FPS (below).

The Year End Amendment – FPS

A ‘Year End Amendment – FPS’ is used to report corrections to HMRC if you have already filed all of the regular FPS returns that were due in that tax year. Payroll Manager will automatically schedule an FPS if one is required. The software will not create a Year End Amendment – FPS if there are still regular FPS to send in that tax year (see step 4).

You do not need to have filed your final Employer Payment Summary – EPS for the year before filing the Year End Amendment – FPS.

Sending a Year End Amendment – FPS

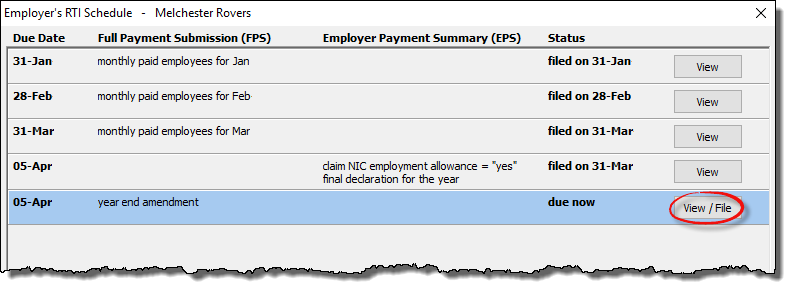

After making your amendments, click ‘Pay‘ and then ‘Employers RTI Schedule‘ from the main menu in Payroll Manager.

Payroll Manager will display a ‘Year End Amendment’ FPS at the bottom of the schedule. Click the ‘View / File‘ button to show details of the return. Payroll Manager will detect any changes since the last FPS, and will produce a report showing these changes. You should print a copy of this report for your records (or save a pdf copy if you wish).

(Note: if for some reason you do not see a Year End Amendment return at the bottom of this list, click ‘Employees – Employee Details – Work‘ from the main menu in Payroll Manager, select the employee that you wish to include on this return, then tick the box marked ‘Force inclusion on Year End Amendment FPS’ .This box will only appear if all regular FPS returns have already been sent for that tax year).

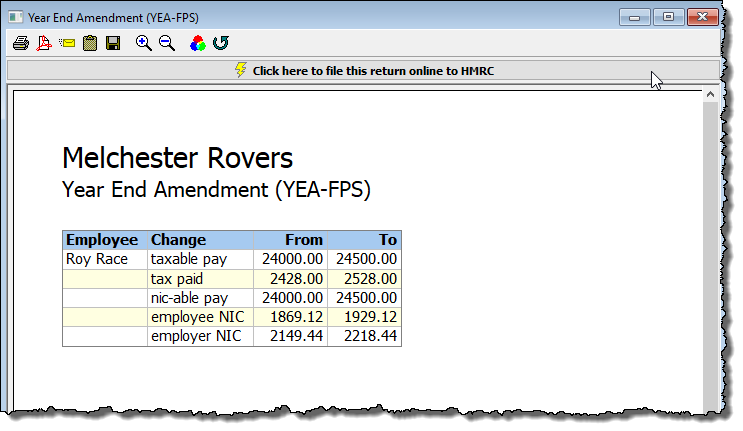

Viewing the contents of the Year End Amendment – FPS

The Year End Amendment – FPS reports the updated year to date information to HMRC. The ‘From‘ column shows the previously submitted year to date figure – the ‘To‘ column shows the new year to date figure which will be submitted to HMRC in the Year End Amendment – FPS.

(In the example above, the year-to-date taxable pay of the employee has changed from £24000 to £24500 – reflecting the additional £500 paid to them in March. Tax & NIC figures have also changed accordingly.)

Click on the bar marked ‘Click here to file this return online to HMRC‘ to file the return – the submission will be made in the same way as other RTI returns.

If the changes that you have made affect the parenting pay (SMP, SPP etc) for an employee, then Payroll Manager will also schedule a Year End Amendment – EPS, which you should also submit to HMRC.

FAQ

– What about the final EPS for the year – does it matter if I have already sent it / not sent it yet?

No – it is fine to send the YEA-FPS, regardless of whether or not you have sent the final EPS for the year.

– Does Payroll Manager keep a record of each YEA-FPS that has been submitted?

Yes – details of all RTI submissions can be viewed by clicking ‘Tools‘ then ‘Online Filing‘ from the main menu in Payroll Manager and then selecting ‘Submission log‘. You will then be able to view the updated Year to Date figures that were sent to HMRC on the YEA-FPS.

– Someone at HMRC has asked me to ‘resubmit’ an RTI return from an earlier period. How do I do this?

HMRC systems are notorious for creating ‘duplicate records’ on their database if they receive more than one FPS for the same pay period. Unfortunately some of their support advisors appear to be unaware of this and may request that you resubmit a return in order to solve an issue at their end. You should never attempt to resubmit an RTI return, and should instead ensure that the correct year-to-date information is sent in the next available FPS, as per the instructions in this guide.

– I need to submit a correction for tax year 2019-20 or earlier, can I send a Year End Amendment – FPS?

No. A Year End Amendment – FPS can only be sent for tax years 2020-21 onward. For amendments to earlier tax years please see Payroll corrections for tax years 2019-20 and earlier