National Insurance Contributions (NICs) in 2023-24

In his Autumn Statement on 22 November 2023 the Chancellor announced that there would be a decrease in the rate of Employee National Insurance, from 12% to 10%, effective from 6 January 2024. A Payroll Manager software update will apply these changes automatically.

This short guide is designed to show how these changes may affect the pay of a typical employee. (The guide does not cover NICs made by the employer, which are not affected by this change, nor does it cover NICs for a director, which instead can be found in the following guide Directors NIC ).

What are the NIC rates for 2023-24 ?

The level at which employees start paying National Insurance Contributions (NICs) in a pay period is called the ‘Primary Threshold’ (PT). The PT is £242 for weekly paid employees, and £1048 for monthly paid employees. If an employee’s pay in a period exceeds the ‘Upper Earnings Limit‘ (UEL), then they pay NICs at a different rate on those earnings. The UEL is £967 for weekly paid employees, and £4189 for monthly paid employees.

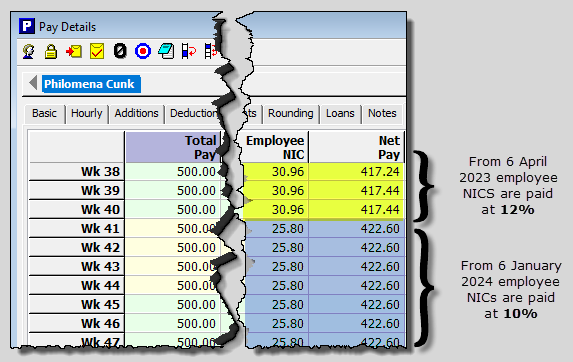

From 6 April 2023 to 5 January 2024 employees pay NICs at a rate of 12%* on earnings between the PT and UEL, and at a rate of 2% on earnings that exceed the UEL.

From 6 January 2024 onwards, (due to the changes announced by the Chancellor), employees pay NICs at a rate of 10%* on earnings between the PT and UEL, and at a rate of 2% on earnings that exceed the UEL.

(*There are some exceptions to this – e.g. employees that have reached State Pension Age will pay no employee NICs at all, and those employees who have ‘deferred’ will pay NICs at a lower rate. See GOV.UK – Rates and thresholds for employers 2023 to 2024 for full details).

Note: It is the Pay Date of the employee that determines which rates to use for the calculation of NICs, and not when the work was done. e.g. For weekly paid employees paid on Friday 5th January 2024 the rate is 12%. For weekly paid employees paid on Friday 12th January 2024 the rate is 10%.

How does this affect the pay of a typical employee?

Because of the decrease to the rate of NICs from January 2024, a typical employee on a set salary will see a reduction in NICs from 6 January 2024 onwards, as the rate at which employees pay NIC is reduced from 12% to 10%.

The example below shows how the NIC of a typical weekly paid employee on a fixed weekly salary of £500 changes from 6 January 2024. A similar pattern would be observed for employees with other pay frequencies.

How does Payroll Manager handle the changes to the rate of NICs ?

Payroll Manager has all of the NIC rules, thresholds and rates built in, and will handle all of these NIC calculations automatically. You should ensure that you run an update to Payroll Manager whenever you are prompted to do so by the software. If you wish, you can view the rates and thresholds being used by the software by clicking ‘Analysis‘ then ‘Tax & NIC rates‘ from main menu in Payroll Manager.

If you wish to view the detailed NIC calculation for a particular employee then click on the ‘Click here for explanation‘ button towards the bottom-left of the ‘Pay Details‘ screen, then select ‘NIC‘.

How do I ensure that my copy of Payroll Manager has been updated with the new rates?

Payroll Manager will automatically prompt you to run an update to implement these changes. The update was published in the first week of December 2023.