Holiday Pay for irregular hours and part-year workers (from April 2024)

The Government has made changes to the Working Time Regulations relating to holiday entitlement and holiday pay calculations for ‘Irregular Hours’ and ‘Part-Year’ workers, which apply to holiday leave years from 1 April 2024. These changes mean that employers with these types of employees have a choice of 2 methods to use to calculate holiday leave and pay. (These changes apply to Great Britain only – employers in Northern Ireland should refer to the legislation in the ‘Links’ section at the bottom of this guide).

The 2 methods are as follows:

- Holiday entitlement Accrual method – The employee accrues holiday entitlement each time that they work for the employer. The amount of leave is accrued in units of hours, and is based on the amount of hours worked. Typically, holiday entitlement for these workers is calculated as 12.07% of actual hours worked in a pay period. The employee accrues ‘holiday hours’ each time that they work, and then uses this entitlement at a time of their choosing. The rate at which holiday pay is paid is based on the average of the employees pay during the 52 week ‘reference period’ immediately prior to the period of leave.

- Rolled up Holiday Pay (RHP) – The employee is paid their holiday pay at the same time as their normal pay, as an additional amount which is ‘rolled-up’ with their normal pay. RHP is calculated as 12.07% of the employees total pay in a pay period, and is shown as a separate item on the payslip.

The Government has published guidance ( Holiday pay and entitlement reforms from 1 January 2024 – GOV.UK ) on the new regulations which gives definitions of ‘irregular’ and ‘part-year’ workers, and also provides worked examples on the different schemes for calculating holiday entitlement and holiday pay for such workers. We recommend that you read the Government guidance thoroughly before proceeding further.

This guide shows how Payroll Manager can help with the calculation of holiday pay for irregular hours / part-year workers using any of the above methods.

Holiday Entitlement Accrual method

There are two distinct steps involved in the calculation of holiday pay using this method: Calculating the accrual of leave entitlement, and the payment of holiday pay.

- Accrual – Leave entitlement is accrued in units of hours, and is based on the amount of hours worked. Typically, holiday entitlement will be calculated as 12.07% of actual hours worked in a pay period

- Payment – The rate at which holiday pay is paid is based on the average of the employee’s pay in a 52 week ‘reference period’ immediately preceding the period of leave.

Setting up the accrual in Payroll Manager

This feature is available from tax years 2024-2025 onwards in Payroll Manager, and is not available in tax year 2023-24.

1) Ensure that the employee meets the Government definition of either an ‘irregular paid’ or ‘part-year’ worker- see GOV.UK – Definition of an irregular hour worker and a part-year worker

2) Go to the ‘Pay Details‘ screen, select the appropriate employee, and click on the ‘Holiday Pay‘ tab.

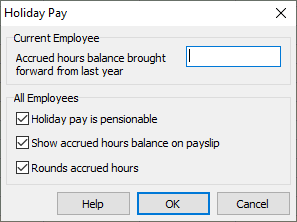

3) Click on the blue ‘spanner’ symbol (‘settings’) in the column headed ‘Accrued Hours’ and choose the relevant settings for this employee:

- Accrued hours balance brought forward from last year: You should only enter a figure into this box if that particular employee has a balance of accrued hours that you wish to carry forward to the start of this year, otherwise leave this blank.

- Holiday pay is pensionable: tick / untick as applicable, according to the rules of any workplace pension scheme that the employee may be a member of.

- Show accrued hours on balance on payslip: tick this if you wish for the accrued hours totals to be displayed on the employee payslip.

- Rounds accrued hours: according to Section 15B of the The Working Time Regulations 1998 (see links below) , where the amount of accrued leave includes a fraction of an hour then fraction amounts less than 30 minutes are rounded down (to zero) and fraction amounts of 30 minutes or more are rounded up to an hour. Payroll Manager will use this system of rounding by default. If you wish to disregard this regulation so that no rounding is applied automatically, then untick the box.

- Click ‘OK’ when you have finished.

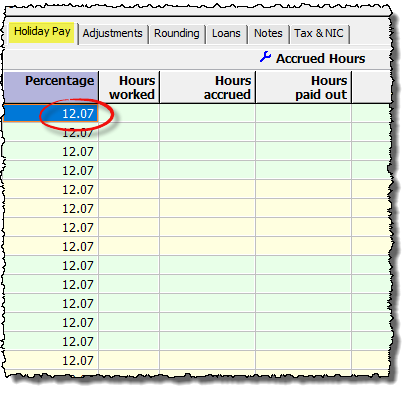

4) Enter ‘12.07’ into the ‘Accrued Hours – Percentage‘ column for the pay period from which you wish the accrual to begin, then press the ‘Enter‘ key on your keyboard. (The 12.07% figure is based on the fact that all workers are entitled to 5.6 weeks leave. If the employee’s contract states that they are entitled to more than 5.6 weeks leave then you need to calculate a different percentage to use – see ‘Accrual FAQs’ (below).

5) Hold down ‘ALT‘ and ‘=‘ on the keyboard so that this percentage is copied down to the end of the year.

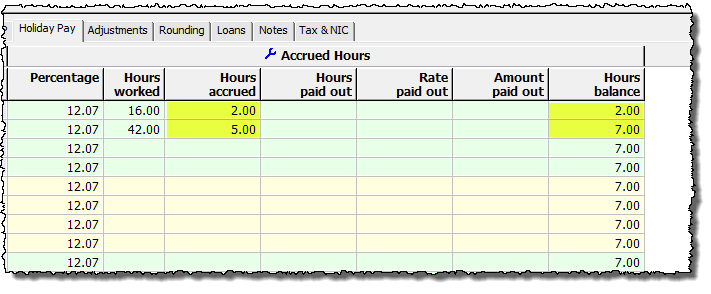

6) For periods where the employee is working, and has their working hours entered in the ‘Hourly’ column(s) of the ‘Pay Details’ screen, Payroll Manager will automatically calculate 12.07% of their ‘Hours worked’ and will add the result to the ‘Hours balance’ for that employee. Payroll Manager will, by default, round these amounts up or down to the nearest whole hour, according to the Government guidance (see step 3 of the GOV.UK example-of-how-statutory-holiday-entitlement-is-accrued ). Amounts of 30 minutes or more are rounded up, whereas amounts less than 30 minutes are rounded down. A running total of the number of hours accrued by the employee is displayed in the ‘Hours balance’ column.

IMPORTANT: If an employee is away on statutory leave

Employees continue to accrue holiday entitlement during periods of statutory leave (e.g. Sick Leave, Maternity Leave etc.), but rather than being based on the hours worked during these periods (which will typically be zero), the accrued hours amount is determined by the average number of hours worked in the 52 weeks prior to the commencement of the statutory leave (not including weeks when the employee was on sick or other statutory leave). This is not something that Payroll Manager is able to calculate automatically, and instead the user will need to calculate the relevant amount of holiday hours to be accrued for any pay periods that include one or more days of statutory leave, and manually enter the result in the ‘Hours accrued‘ column.

Payroll Manager has a report which can help with this calculation, called the ‘Pay Count report‘ (see Example 2 of the Pay count report – Moneysoft for details of how to do this). Once you have established the average number of hours worked by the employee, you would multiply this by 12.07% and manually enter the result into the ‘Hours accrued’ column (this will override any percentage figure that was previously present for that particular pay period).

Making a payment of holiday pay using Payroll Manager

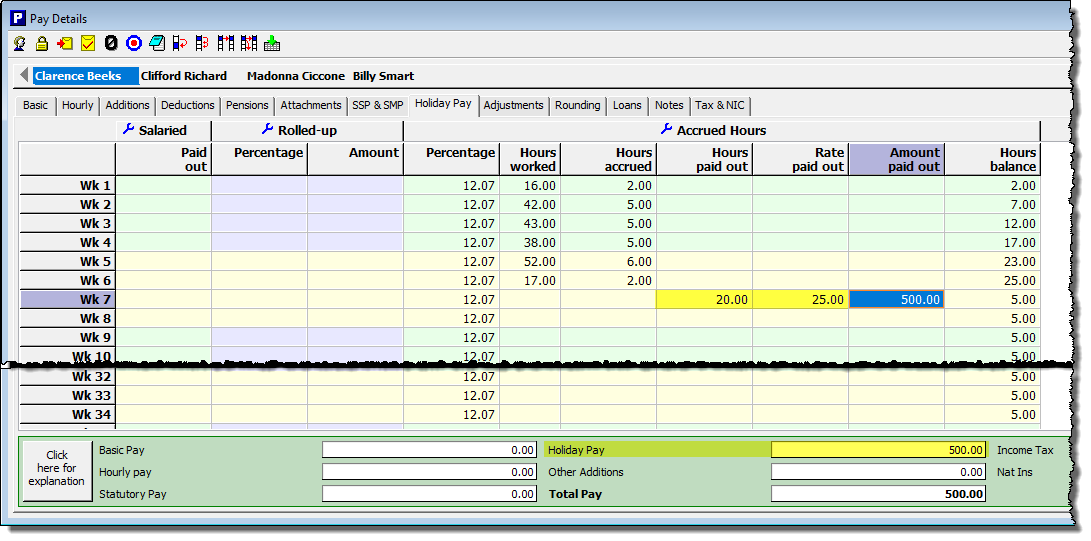

When an employee wishes to use some of their accrued holiday entitlement, the employer needs to calculate a suitable hourly rate at which it should be paid. The calculated rate is then multiplied by the number of accrued holiday hours being used in that period to determine the amount of holiday pay to be paid. Payroll Manager is not able to calculate the holiday pay rate automatically, instead the rate must be calculated by the user, based on a 52 week ‘reference period’ (see Holiday pay and entitlement reforms from 1 January 2024 – GOV.UK ), and then manually entered in the ‘Rate paid out’ column of the Holiday Pay screen. If the employee has only ever been paid at one rate during the reference period, and they have never received any bonuses or commission, then then the calculation is simple, and the normal hourly rate is the one to use. If the employee has been paid at more than one rate, or has received overtime or bonus payments then the ‘Average’ rate should be calculated. Payroll Manager has a report which can help with this calculation, called the ‘Pay Count report‘ (see Example 1 of the Pay count report – Moneysoft for details of how to do this).

Please note that there is currently no clear guidance available from HMRC as to what rate to use for the payment of holiday pay when the ’52 week average’ calculation results in hourly rate that is lower than the National Minimum Wage applicable for that particular employee. We would advise that you contact ACAS and/ or HMRC for a definitive answer of what rate to use in such cases.

Once the rate has been determined, click on the ‘Holiday Pay’ tab on the ‘Pay Details’ screen, and enter the number of hours the employee is choosing to take in the ‘Hours paid out‘ column. Then enter the ‘Rate paid out‘ figure. Payroll Manager will multiply these items together to arrive at a ‘Amount paid out‘ figure, which will then appear on the payslip for that period.

Accrual FAQs

FAQ: Why are holiday hours accrued at a rate of 12.07%? All employees are entitled to a minimum of 5.6 weeks leave in a year. 12.07% is 5.6 weeks expressed as a percentage of the number of working weeks in a year. (i.e. 52 weeks – 5.6 weeks = 46.4 weeks, and 5.6 / 46.4 =12.07%) . Using 12.07% to calculate holiday entitlement or pay for irregular hours or part-year workers keeps their entitlement in line with that of a regular full-time worker. If the employee contract states that they are entitled to more than the statutory 5.6 weeks, then a different percentage must be calculated and used. e.g. if the contracted entitlement is 6 weeks, then you would use 13.04% instead, as 6 / 46 = 13.04%)

FAQ: What if I don’t want to round the accrued hours figure up or down each pay period? – The Government guidance suggests that such rounding should be applied (see Holiday pay and entitlement reforms from 1 January 2024 – GOV.UK (www.gov.uk) ), but if you don’t wish to apply this rounding then click on the blue ‘spanner’ (settings) symbol in the ‘Accrued hours’ column heading, and untick the box marked ‘Rounds accrued hours’. This setting applies to ALL pay periods from the beginning of the tax year.

FAQ: What if the 52 week average hourly rate calculation gives a result that is lower than the current National Minimum Wage rate applicable for the employee? There is currently no clear guidance available from HMRC as to what rate to use for the payment of holiday pay when the ’52 week average’ calculation results in hourly rate that is lower than the National Minimum Wage applicable for that particular employee. We would advise that you contact ACAS and/ or HMRC for a definitive answer of what rate to use in such cases.

Rolled-up Holiday Pay

Rolled-up holiday pay (RHP) is the name given to the practice whereby employers pay holiday pay to their employees at the same time as paying their earnings, rather than when they are away on holiday. This practice was previously deemed unlawful by the Court of Justice of the European Union (CJEU) but the recent legislation makes provisions for employers to use this method for leave years from 1 April 2024 onwards. This method can ONLY be used for irregular hours / part-year workers, and CANNOT be used for workers in Northern Ireland.

- RHP was introduced via the amendments to the Working Time Regulations for leave years starting from 1 April 2024 (Not allowable in Northern Ireland)

- In each pay period, RHP is calculated at 12.07% of the employees pay, and paid to them at the same time as their normal pay as an addition to their wages.

- The employee does not receive RHP whilst they are on holiday.

- During periods of statutory leave (e.g Sick leave or parenting leave) the amount of RHP paid is based on the average RHP that they have been paid in previous periods, rather than being based on the Sick/parenting pay. The employer will need to calculate this themselves (see below).

- It is up to the employer to offer this scheme if they wish – the employee cannot ‘force’ the employer to offer the RHP scheme.

- RHP does not mean that the employee can work 52 weeks a year – it is still the duty of the employer to ensure that workers using this scheme take a minimum of 5.6 weeks leave per year.

Setting up the Rolled Up Holiday Pay in Payroll Manager

This feature is available from tax years 2024-2025 onwards in Payroll Manager, and is not available in tax year 2023-24.

1) Ensure that the employee meets the Government definition of either an ‘irregular paid’ or ‘part-year’ worker- see GOV.UK – Definition of an irregular hour worker and a part-year worker

2) Go to the ‘Pay Details‘ screen, select the appropriate employee, and click on the ‘Holiday Pay‘ tab.

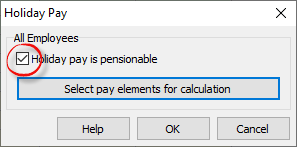

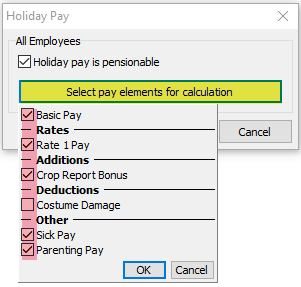

3) Click on the blue ‘spanner’ symbol (‘settings’) in the column headed ‘Rolled-up’, and tick / untick the ‘Holiday pay is pensionable‘ box, according to the rules of any workplace pension scheme that the employee may be a member of. Then click on the button marked ‘Select pay elements for calculation’.

4) A box will appear where you can select all pay elements that are to be included in the calculation of Rolled-up Holiday Pay. Select all applicable elements and click ‘OK‘, then click ‘OK‘ again on the next screen to continue.

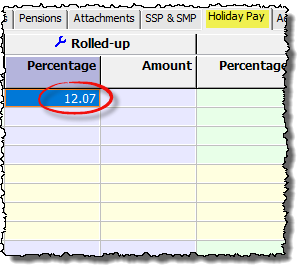

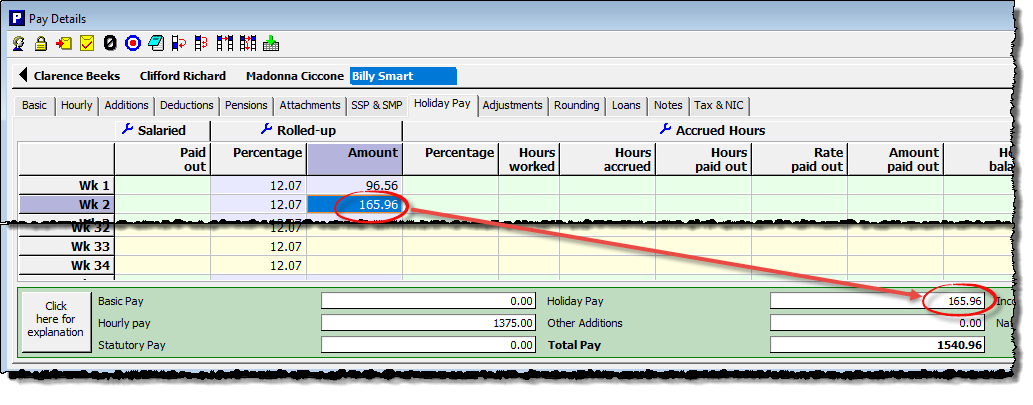

5) Enter ‘12.07’ into the ‘Rolled-up percentage‘ column for the first period that you wish to calculate RHP.

6) Hold down ‘CTRL and =‘ on the keyboard so that this percentage is copied down to the end of the year.

7) For periods where the employee is working, Payroll Manager will automatically calculate the RHP as 12.07% of their pay in each period, and add this as a separate item on the payslip.

IMPORTANT: If an employee is away on statutory leave

The employee is still entitled to receive RHP during periods of statutory leave (e.g. Sick Leave, Maternity Leave etc), but rather than being based on their pay during these leave periods, the RHP amount is based on the average amount of RHP they received in the preceding 52 weeks (or a shorter period if they have been receiving RHP for less than 52 weeks). The user will need to calculate the relevant amount of RHP to be paid in that period, and manually enter this in the ‘Amount’ column.

Payroll Manager has a report which can help with this calculation, called the ‘Pay Count report‘ (see Example 3 of the Pay count report – Moneysoft for details of how to do this). If the employee has been on the RHP scheme for a period less than 52 weeks, then use that period instead to calculate the average RHP to use.

To enter the calculated amount, click on the ‘Rolled-up Amount‘ column, and type the figure in the relevant pay period(s), entering the same figure into all subsequent periods for that particular period of statutory leave. This will override the 12.07% amount for each of those periods.

Important: RHP does not mean that the employee can work 52 weeks a year – it is still the duty of the employer that they take the equivalent of 5.6 weeks holiday per year (difficult to establish, and outside of the scope of PM)

RHP FAQs

FAQ: Why is Rolled up holiday pay calculated at 12.07% of an employees earnings? 12.07% is the statutory minimum holiday entitlement in a year (5.6 weeks) expressed as a percentage of the number of working weeks in a year ( i.e. 52 weeks – 5.6 weeks = 46.4 weeks, and 5.6 / 46.4 =12.07% ). Using 12.07% to calculate holiday entitlement or pay for irregular hours or part-year workers keeps their entitlement in line with that of a regular full-time worker. The Working Time Regulations do not allow for any other percentage to be used when calculating RHP.

Links

The Working Time Regulations 1998 (legislation.gov.uk)

Holiday entitlement: Entitlement – GOV.UK (www.gov.uk)

Holiday pay and entitlement reforms from 1 January 2024 – GOV.UK (www.gov.uk)