Pay count report

The ‘Pay count report‘ displays the pay history of an employee over a specified period of time, and disregards any ‘blank’ pay periods from the totals. It can be useful if you wish to calculate the average pay of an employee over a specified period of time, and wish to disregard periods in which the employee was not paid.

If for example you are looking to determine the total amount paid in the ’52 week holiday pay reference period’ in order to manually calculate the holiday pay for an employee who is irregularly paid, then this report can help. (See https://www.gov.uk/government/publications/simplifying-holiday-entitlement-and-holiday-pay-calculations/holiday-pay-and-entitlement-reforms-from-1-january-2024 for HMRC guidance on calculating holiday pay).

How to produce the Pay count report

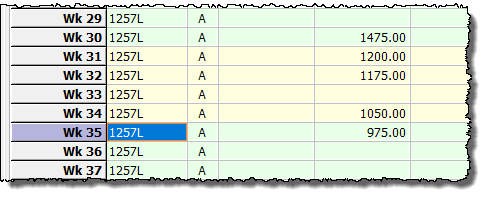

1. On the ‘Pay Details‘ screen, select the relevant employee, and highlight the pay period up until which you wish to run the report. In this example, the employer wishes to report on the last 52 occasions that the employee was paid, starting with week 35.

2. From the main menu click ‘Analysis‘ then ‘Pay count report‘.

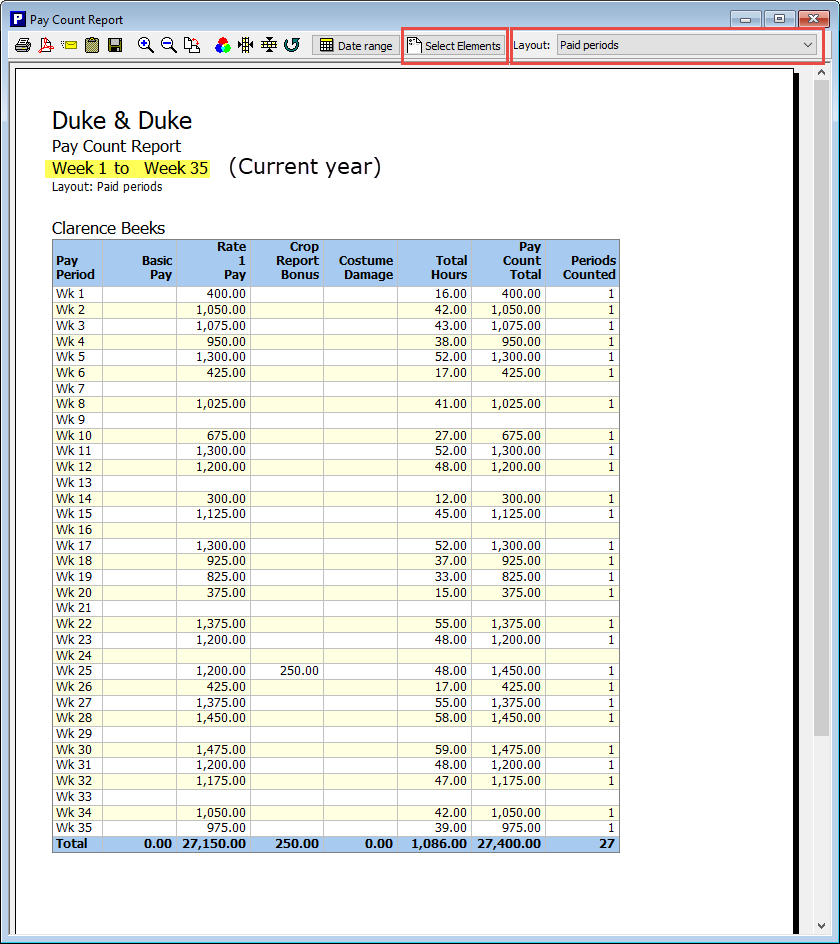

3. The report shows details from the pay period that you have selected back to the first pay period of the year. It is then necessary to use the ‘Select Elements‘ and ‘Layout‘ options (highlighted in red, above) at the top of the report screen in order to display the particular information that you require. The ‘Examples‘ section towards the bottom of this guide shows how you might select different elements / layouts according to the particular type of information that you require.

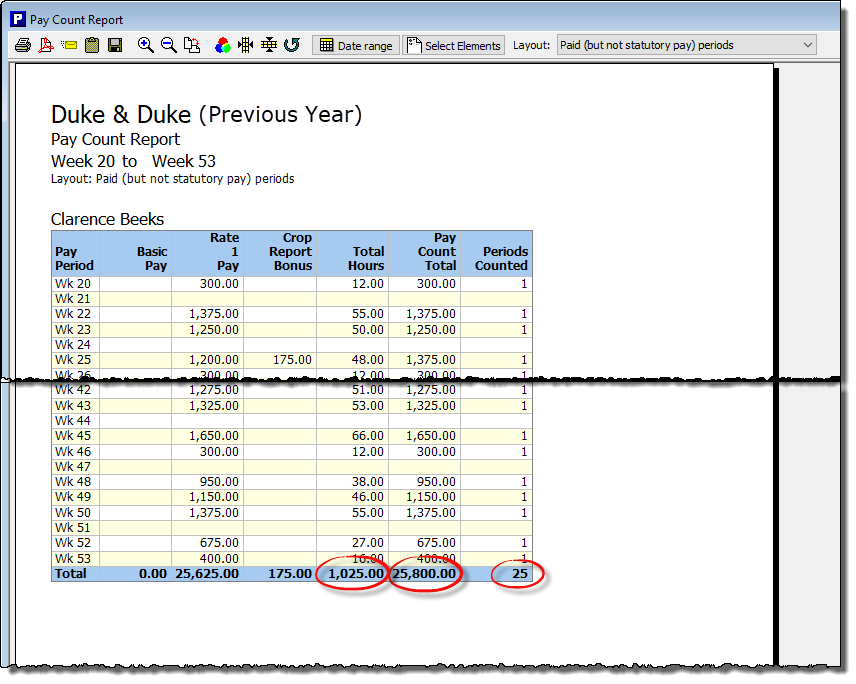

4. On occasions where the employer needs to report on the last 52 times that the employee was paid, it will often be necessary to open the payroll file for the previous tax year and produce another ‘Pay Count Report’ covering the remaining pay periods. i.e. in the graphic above, the report shows the last 27 weeks that the employee was paid. It is then necessary to go back to the previous tax year to obtain data for the 25 weeks prior to that in order to calculate a 52 week total. (If you were not using Payroll Manager to process payroll in the previous year then you would need to do this manually).

5. Click ‘File‘ then ‘Open‘ and open the file for the previous tax year.

6. Select the relevant employee, then click ‘Analysis‘ then ‘Pay count report‘ from the main menu.

7. Click on the ‘Select Elements‘ button at the top of the report, and select the relevant pay elements to include, as per step 3, above.

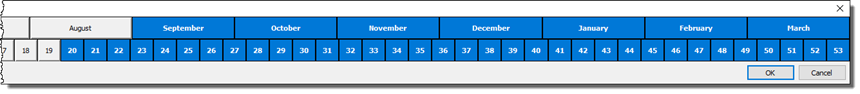

8. By default a report for the previous year will show all pay periods in that year. Click on the ‘Date range‘ button at the top of the report, select the range of pay periods that you wish to include (by clicking and dragging your mouse pointer across the range of periods), and click ‘OK‘.

It may take a bit of trial and error with the ‘Date Range’ selector in order to arrive at the correct number of pay periods, especially if some of these periods contain zero pay for the employee

Examples

Example 1: To determine the Average Hourly Pay for an irregularly paid / part-year worker in order to calculate their holiday pay.

i) Select the relevant employee, and highlight the pay period up until which you wish to run the report (i.e. the pay period immediately preceding the holiday leave), as per steps 1 and 2 above. (In this example the employee is on parenting leave from week 36, and so the report should be run up until week 35).

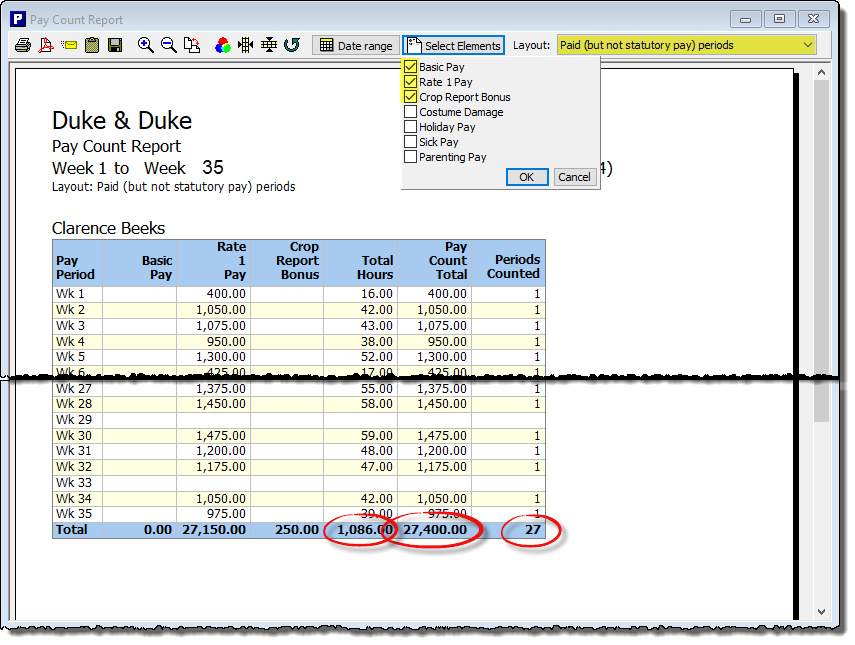

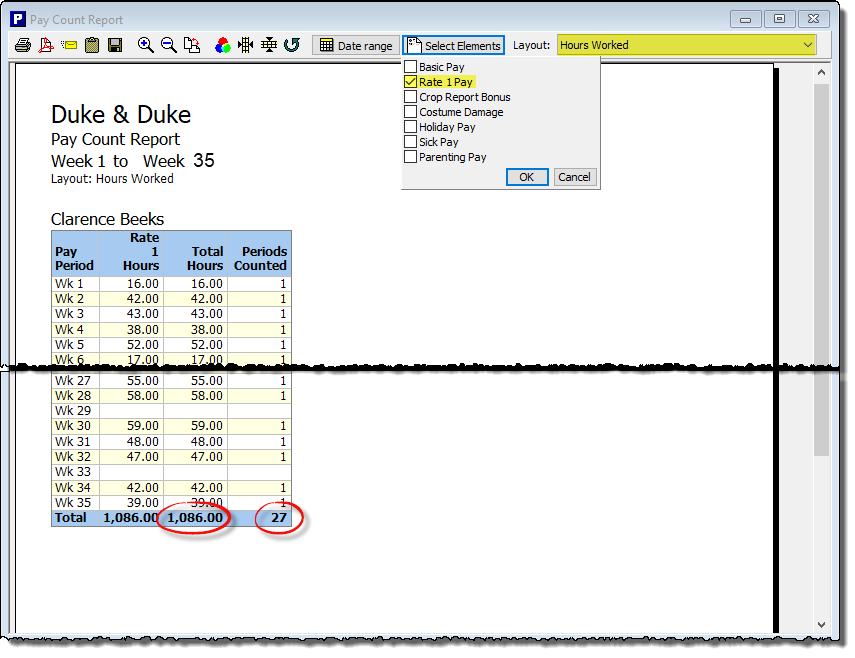

ii) Click on the ‘Select Elements‘ button at the top of the report, and select the pay elements that you wish to include in the report. Typically you would select all of the pay elements that constitute ‘normal pay’, which would include any bonuses and overtime. You should exclude (i.e. ‘untick’) the ‘Sick Pay’ and ‘Parenting Pay’ elements. Click ‘OK‘ when you have finished selecting elements.

iii) Click on the drop-down ‘Layout‘ selector at the top of the report, and choose the ‘Pay (but not statutory pay) periods‘ layout. The report will automatically refresh, and will show all pay periods in which the employee was paid, excluding any pay periods in which the employee received statutory Sick or Parenting pay.

At the bottom of the report you will see the ‘Total Hours’, ‘Pay Count Total’ and the ‘Periods Counted’. You will notice that any ‘blank’ periods have not been included in the ‘Periods Counted’ total. In this example there are only 27 pay periods being counted in that particular tax year, so it is necessary to then run a similar Pay Count report to include the pay for 25 periods of the previous tax year, in order to establish the ‘Pay Count Total’ over a 52 week period (below):

To calculate the average hourly rate over the 52 paid weeks, add together the ‘Pay Count Total’ figures from the report for each of the tax years, then divide this by the sum of the ‘Total Hours’ of the two reports.

i.e. (27,400 + 25,800) / (1086 + 1025) = £25.20.

Example 2: To determine the average number of hours worked in the 52 weeks prior to the commencement of statutory leave, in order to calculate the amount of holiday leave entitlement an employee will accrue when on sick or parenting leave.

i) Select the relevant employee, and highlight the pay period up until which you wish to run the report (i.e. the pay period immediately preceding the sick/parenting leave), as per steps 1 and 2 above. (In this example the employee is on parenting leave from week 36, and so the report should be run up until week 35).

ii) Click on the ‘Select Elements‘ button at the top of the report, and select the pay elements that you wish to include in the report. Make sure that you have selected all of the ‘hourly paid’ elements which have been used to record the pay for this employee. Click ‘OK‘ when you have finished selecting elements.

iii) Click on the drop-down ‘Layout‘ selector at the top of the report, and choose the ‘Hours Worked‘ layout. The report will automatically refresh, and will show all pay periods in which the employee worked.

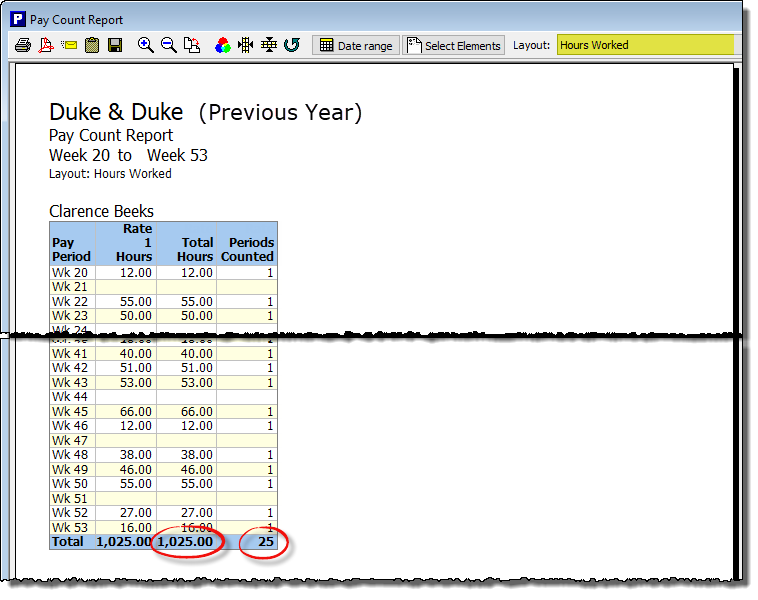

At the bottom of the report you will see the ‘Total Hours’ and the ‘Periods Counted’. You will notice that any periods in which the employee did not work are not been included in the ‘Periods Counted’ total. In this example there are only 27 pay periods being counted in that particular tax year, so it will be necessary to then run a similar Pay Count report to include the hours worked for 25 pay periods of the previous tax year, in order to establish the ‘Total Hours’ over a 52 week period (below).

So the average number of hours worked over the 52 week reference period is (1086 + 1025) / 52 = 40.60.

Example 3: To determine the average amount of Rolled Up Holiday Pay (RHP) paid to an employee in the 52 weeks prior to the commencement of statutory leave, in order to calculate the amount of RHP an employee will receive when on sick or parenting leave.

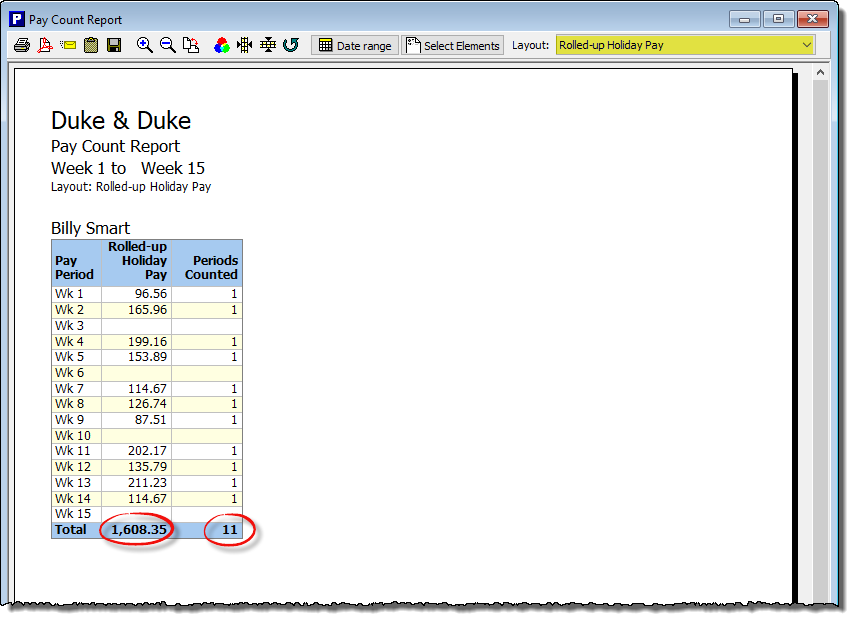

i) Select the relevant employee, and highlight the pay period up until which you wish to run the report (i.e. the pay period immediately preceding the sick/parenting leave), as per steps 1 and 2 above. (In this example the employee is on parenting leave from week 16, and so the report should be run up until week 15).

ii) It is not necessary to use the ‘Select Elements’ button at the top of the report, as this has no influence on the ‘Rolled-up Holiday Pay’ report layout.

iii) Click on the drop-down ‘Layout‘ selector at the top of the report, and choose the ‘Rolled-up Holiday Pay‘ layout. The report will automatically refresh, and will show all pay periods in which the employee received Rolled-up Holiday Pay.

At the bottom of the report you will see the ‘Total Rolled-up Holiday Pay’ and the ‘Periods Counted’. You will notice that any periods in which the employee did not receive RHP are not included in the ‘Periods Counted’ total. In this example there are only 11 pay periods being counted in that particular tax year. As Rolled-up Holiday Pay was only introduced (through the amended Working time Regulations) as an acceptable method from 1 April 2024, then it is not possible or necessary to go back before that date to calculate the average amount of RHP the employee has received. You should therefore simply divide the total ‘Rolled-up Holiday Pay’ (here, £1608.35) by the available ‘Periods Counted’ (in this case, 11) to arrive at an average RHP paid (i.e. £1608.35/11 = £146.23). It will not be until at least April 2025 when you will be able to take an average of RHP over a 52 week period.

Links

Holiday pay and entitlement reforms from 1 January 2024 – GOV.UK (www.gov.uk)

Holiday Pay for irregular hours and part-year workers – Moneysoft