Employer National Insurance Contribution (NIC) changes from April 2025

In the Autumn Budget of 2024 the Chancellor announced four changes to employer National Insurance contributions (NICs), all of which take effect at the start of the 2025-26 tax year (6 April 2025).

- A reduction of the secondary Class 1 National Insurance (employer) threshold from £9,100 to £5,000 per annum.

- An increase to the main rate of secondary Class 1 National Insurance (employer) contributions from 13.8% to 15%.

- An increase to the maximum Employment Allowance claim amount per year from £5,000 to £10,500.

- The removal of the £100,000 restriction where employers with an employer NIC liability above this level in the previous tax year were unable to claim the Employment Allowance.

Payroll Manager will handle all of these changes automatically. Some examples of how these changes may affect typical payrolls are given below.

1) Employers NIC Threshold and Rate changes

National Insurance contributions (for non-directors) are calculated on a ‘pay period by pay period’ basis. In order to calculate the employers NIC due in any one pay period it is first necessary to divide the annual secondary threshold (ST) by the number of pay periods in the year. Employers NIC is then calculated on all pay in that period which is above the weekly / monthly secondary threshold.

- In tax year 2024-25 the annual ST is £9,100, the weekly ST is £175, and the monthly ST is £758

- In tax year 2025-26 the annual ST is £5,000, the weekly ST is £96, and the monthly ST is £417

Employer NIC is then calculated as a percentage of the employee’s pay in that period that exceeds the ST.

- In tax year 2024-25 the rate of employer NIC is 13.8%

- In tax year 2025-26 the rate of employer NIC is 15.0%

The effect of this reduction in the ST and the increase in the employer NIC percentage means that there will be an increase in the amount of employer NIC due for many employees from 6 April 2025, as illustrated in the examples below:

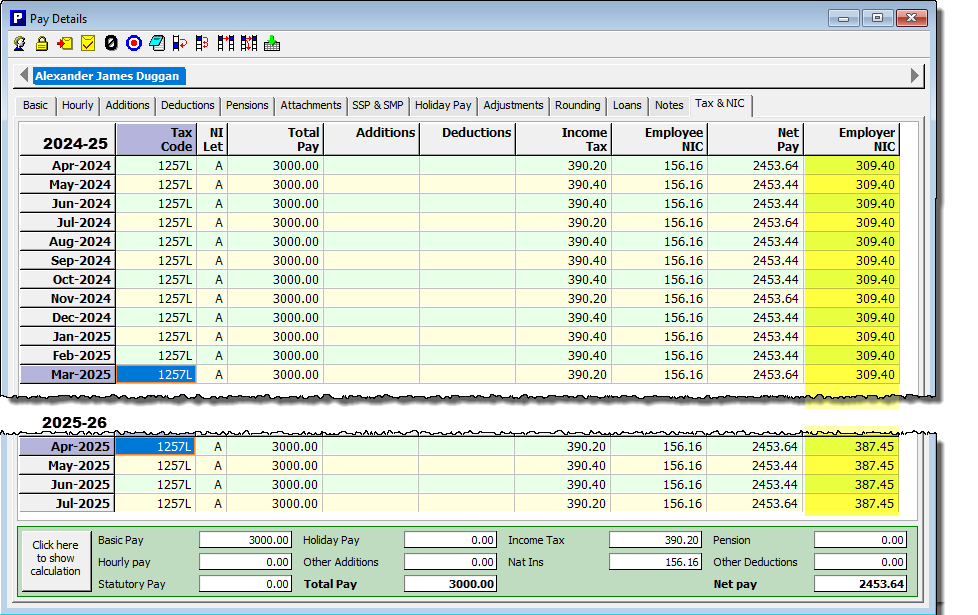

Example 1. Employee ‘Alexander James Duggan’ is paid a regular amount of £3000 per month.

In 2024-25, the monthly pay for this employee that is above the ST is £2,242 (i.e. £3000 minus the ST of £758), so the employer NIC due is £2,242 x 13.8% = £309.40

In 2025-26, the monthly pay for this employee that is above the ST is £2,583 (i.e. £3000 minus the ST of £417), so the employer NIC due is £2,583 x 15.0% = £387.45

Note that there have been no changes to the rates / thresholds relevant to calculating employee (primary) NIC for 2025-26 (in Example 1, employee NIC remains at £156.16 per month), so the employee will not see any changes to their take home pay/payslip. It is only the employer that is affected by these particular changes.

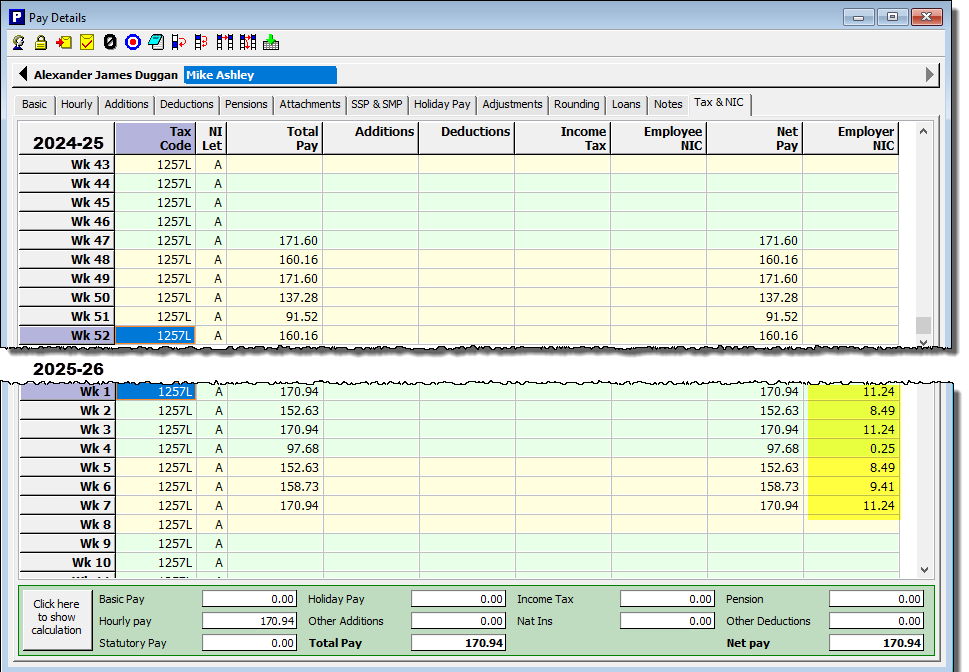

Example 2. Employee ‘Mike Ashley’ works an irregular number of hours per week, and is typically paid below £175.

In 2024-25, the weekly pay for this employee is always below the ST (which is £175), and so no employer NIC is payable.

In 2025-26, the weekly pay for this employee is still below £175, but because it now exceeds the new, lower ST (£96/week) then employer NIC becomes payable (see highlighted section in the graphic below).

Again, as in Example 1,the employee NIC is not affected, but the employer will now be liable to pay employer NIC in respect of this employee when in the previous year there was no liability.

Important: The examples given above are for typical employees aged between 21 and State Pension age. Other classes of employee, such as those outside of this age range, as well as ‘Qualifying Veterans‘, ‘Freeport or Investment Zone‘ employees, and ‘Qualifying Apprentices‘ are subject to different thresholds and rates. Please see our guide National Insurance categories and rates – Moneysoft for more information.

2) Employment Allowance Increase

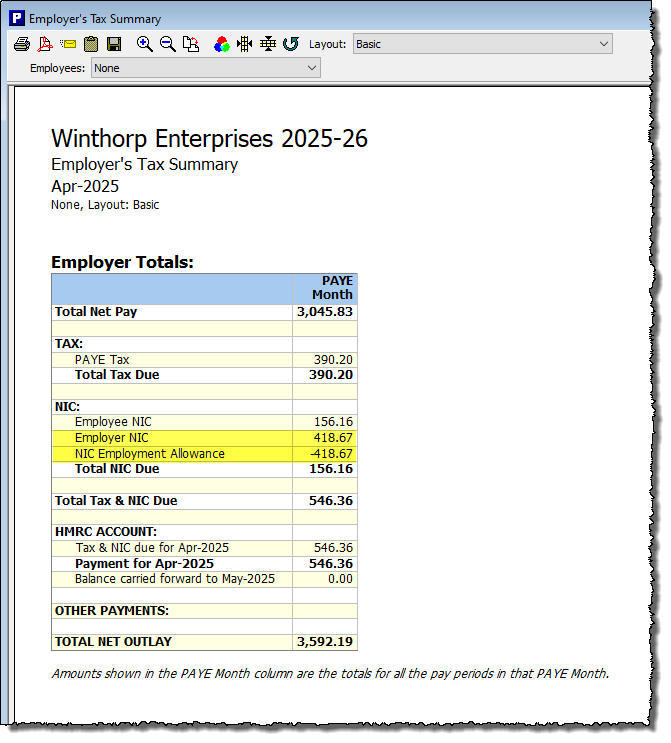

The Employment Allowance (EA) allows eligible employers to reduce their annual National Insurance liability to HMRC. Eligible employers pay less employers National Insurance each tax period until the EA has been ‘used up’, or the tax year ends (whichever is sooner). From tax year 2025-26 the maximum amount of Employment Allowance that can be claimed rises to £10,500 (it was £5000 in 2024-25)

Our guide to the Employment Allowance shows how Payroll Manager handles Employment Allowance claims. In some cases, depending on an employer’s particular circumstances, the potential additional employer NICs that arise as a result of the Secondary Threshold and employers NIC percentage rate changes may be somewhat offset by the increase in the available Employment Allowance.

The ‘Pay – Employers Summary for TAX period‘ report, accessible from the main menu in Payroll Manager, shows the total amount of employer NIC calculated in a tax period, as well as any available Employment Allowance amounts utilised in that period.

3) Directors

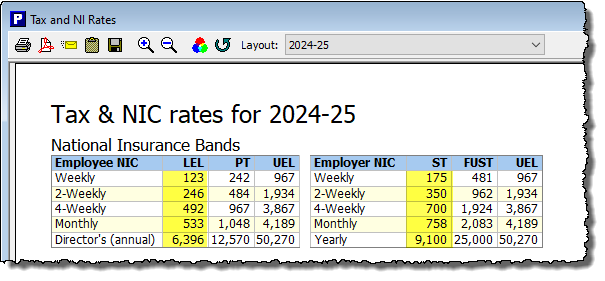

Some company directors choose their level of salary according to the LEL and ST. By paying themselves a salary which at least matches the ‘Lower Earnings Limit’ (LEL) they maintain their State Pension entitlement (and other benefits) for the tax year.

Example 3. A director with a salary of £9,100 in 2024-25

The LEL for 2024-25 is £6,396, and the ST is £9,100. A director paying themselves an annual salary of £9,100 in 2024-25 is therefore paid an amount which is above the LEL, maintaining their State Pension entitlement, but not at a level that incurs any employer NIC liability as their pay does not exceed the annual ST of £9,100. The graphic below shows the LEL, ST (and other) thresholds for 2024-25;

The situation is different in 2025-26, as the ST (£5,000) is now lower than the LEL (£6,500) ;

If in 2025-26 the director chooses to pay themselves at a level which meets or exceeds the LEL (which in 2025-26 rises to £6,500 per annum), they will also be paying themselves an amount which exceeds the ST (£5,000). This means that employer (secondary) NIC will then be due on their payments.

Moneysoft is not able to offer advice as to the optimal level of salary to be paid to a director, which instead should be discussed with an accountant. The example above is simply designed to serve as an illustration as to how the NIC changes for 2025-26 may affect such decisions.

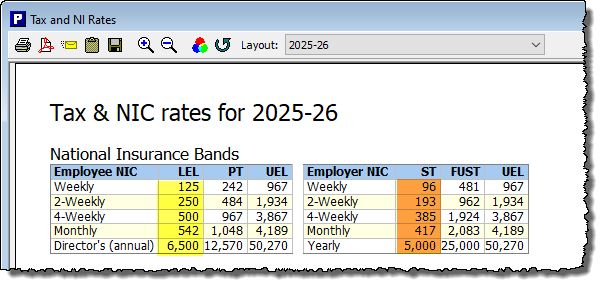

The NIC thresholds and percentages for each tax year can be viewed within Payroll Manager by clicking ‘Analysis‘ then ‘Tax & NIC rates‘ from the main menu. The ‘Layout‘ selector at the top of the report allows you to select the relevant year.