Employment Allowance

Many organisations are able to claim the Employment Allowance (EA) in order to reduce their employer Class 1 National Insurance contributions.

The Employment Allowance is £10,500 2025-26 (the EA was £5000 in 2024-25).

The application of the rules regarding eligibility to claim the EA are beyond the scope of Payroll Manager and you should consult the information provided by the government to determine whether or not you can claim. See GOV.UK – Claim Employment Allowance for more information.

How to claim the Employment Allowance in Payroll Manager

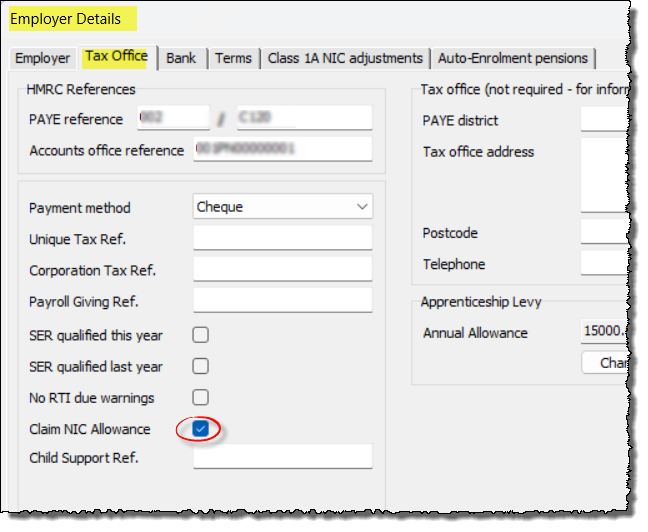

Payroll Manager schedules an Employer Payment Summary (EPS) at the end of the first month of each tax year to inform HMRC whether or not an employer is claiming the EA. In order for this EPS to contain the correct information, Payroll Manager will display a message prompting you to declare whether or not you are claiming the EA when you create a payroll data file for the new tax year. You can also access this screen by clicking ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager and selecting the ‘Tax Office‘ tab. (Note: If you are claiming the EA for a tax year prior to April 2020 then the screen that you see will differ from that shown below).

For Tax Year 2025-26

From tax year 2025-26 the Employment Allowance is no longer considered to be ‘de minimis state aid’, and so the questions that referred to this in previous years are no longer present. To claim the Employment Allowance in 2025-26 you simply need to tick the box marked ‘Claim NIC Allowance’ on the ‘Employer – Employer Details – Tax Office‘ screen.

For tax Year 2024-25

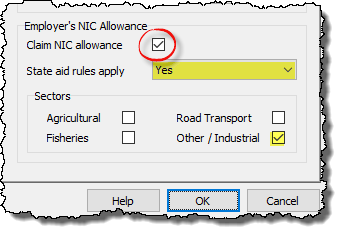

You should consult the GOV.UK web page Changes to Employment Allowance , which will help you to correctly complete the relevant sections on this screen.

- If you are claiming the EA then tick the Claim NIC allowance box.

- If State Aid rules apply to your business then select ‘Yes‘ (the GOV.UK document linked above suggests that “de minimis state aid will apply to most businesses claiming the EA“.)

- Tick the business sector(s) that applies to you. (Note: Moneysoft does not know/ is not able to tell you which sector your business is in – please contact HMRC if you are in any doubt about which box/boxes to tick).

How does Payroll Manager handle the Employment Allowance?

If you are claiming the Employment Allowance then you need to inform HMRC via an Employers Payment Summary (EPS). If you have ticked ‘Yes, this employer qualifies..’ then Payroll Manager will schedule an EPS for 5 May which you should submit when you are ready to do so. You only need to inform HMRC once per tax year that you are claiming the Employment Allowance, so any further EPS submissions will not include this information.

The Employment Allowance does not affect the amount of NIC calculated, it only affects what the employer pays to HMRC. The amount owed is only calculated at the end of each month (or quarter), so you will not ‘see’ the allowance until then. The allowance will not show on a payslip or on any reports detailing what has been deducted from employees – it will only appear on reports showing what the employer owes. Payroll Manager will automatically calculate the Employers Allowance up to the maximum limit in each tax year.

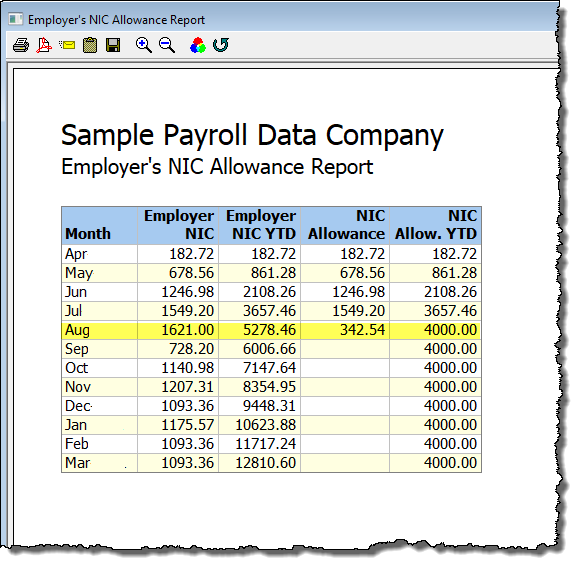

A report showing the amount of EA claimed month by month (below) can be produced by selecting ‘Analysis‘ then ‘Employer’s NIC Allowance‘ from the main menu in Payroll Manager. This report will also show when the allowance has been ‘used-up’ (in the tax month of August in the example below).

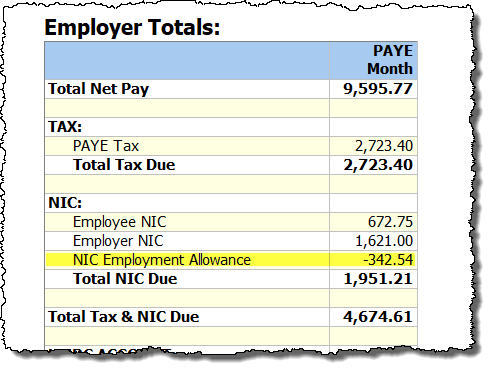

The Employment Allowance is also shown on the ‘Pay – Employer’s Summary for Tax Period‘ report (below), and serves to reduce the total NIC due to HMRC in that particular period.

FAQ

- I am taking over a payroll mid way through the year and am using the ‘Tools – Mid Year Start’ feature. How do I enter the employment allowance that has already been used up/is still remaining? – Payroll Manager is able to calculate this automatically. When you enter ‘mid year start’ figures into the system, one of the fields that you need to complete for each employee is ‘Employer NIC’. Payroll Manager then calculates the total Employer NIC entered and compares it to that years Employment Allowance limit. From this Payroll Manager can determine how much of the allowance (if any) remains.

- What if I can’t see the allowance on these reports? – If you cannot see the allowance, check that you are set to claim it by clicking ‘Employer – Employer Details – Tax Office’ and ensure that you have the ‘Claim NIC Allowance’ box checked.

- I need to claim the EA for a previous tax year – how can I do this? Please refer to our guide Claiming/Un-claiming the Employment Allowance for a previous year.

Links

Employment Allowance: further guidance for employers – GOV.UK