VAT: Domestic reverse charge for building and construction services

Overview

The domestic reverse charge (referred to as the reverse charge) is a major change to the way VAT is collected in the building and construction industry.

It comes into effect on 1 March 2021 and means the customer receiving the service will have to pay the VAT due to HMRC instead of paying the supplier. It will only apply to individuals or businesses registered for VAT in the UK (although it will not apply to consumers). This will affect you if you supply or receive specified services that are reported under the Construction Industry Scheme (CIS).

Moneysoft is not able to advise on whether or not the reverse charge will apply to your particular business – you should consult the GOV.UK publication VAT: domestic reverse charge for building and construction services for further guidance on how the new scheme operates.

This guide shows how to enter transactions that are subject to the reverse charge in our Money Manager 7 Business Edition software, and also includes a few notes for users of our Payroll Manager software about how this may affect the way that you enter payments to CIS subcontractors.

Money Manager 7 Business Edition entries

If you have a sale or a purchase that is subject to the reverse charge, then you can specify this in Money Manager by adding the letter ‘r’ (for ‘reverse) in brackets to the description field for that particular entry. The (r) tells Money Manager that this transaction is subject to the reverse charge so that the VAT is handled in the correct way. Details of how to enter both sales and purchase transactions are shown in more detail below:

SALES:

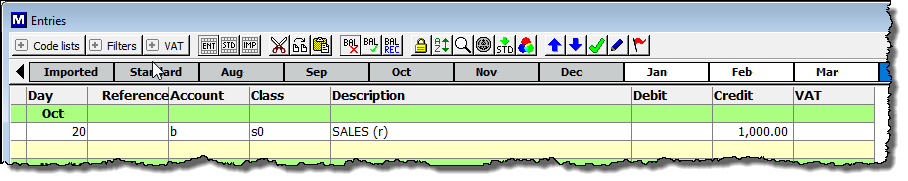

- Enter a lower case letter (r) in brackets in the Description column of the Entries screen (e.g. “SALES (r)” as per the example below).

- Enter the net amount in the Credit column.

- Leave the VAT column blank.

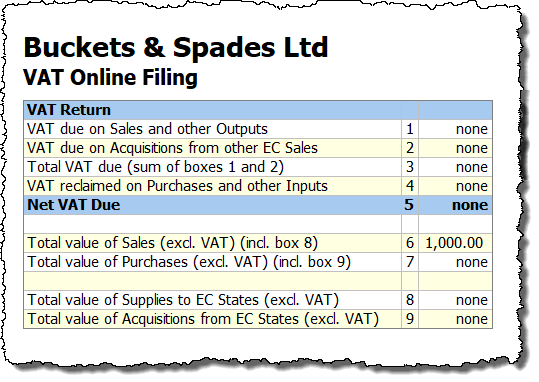

The entry will then appear as an output on the VAT return, with the net amount in box 6:

PURCHASES:

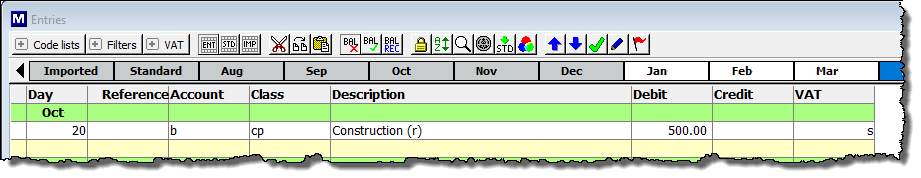

- Enter a lower case letter (r) in brackets in the Description column of the Entries screen (e.g. “Construction (r)” as per the example below).

- Enter the net amount in the Debit column.

- Enter s (or whatever code you use for standard rate VAT) in the VAT column.

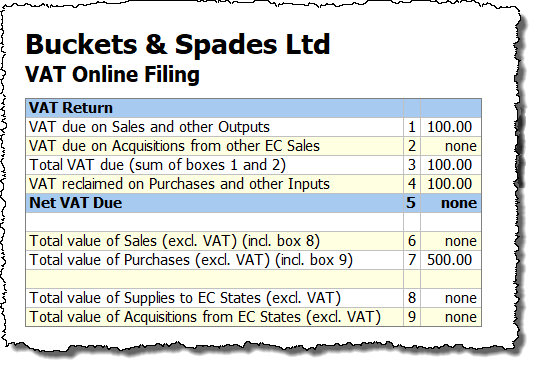

The entry will then appear as an input and as an output on the VAT return, with the net amount in box 7, and the VAT amount in boxes 1, 3 and 4:

So the VAT amount is added in boxes 1 and 3, and is then subtracted again in box 4, so the net effect is that no extra VAT is due.

Payroll Manager – payments to CIS subcontractors

If you use our Payroll Manager software to process payments under the CIS scheme, and receive an invoice from a CIS subcontractor which is subject to the reverse charge then you would not enter any VAT amounts onto the ‘CIS – Payment Details’ screen, as the VAT due on that transaction will not form part of the payment made to that subcontractor.