Tips, gratuities, service charges and troncs

The rules regarding tips, gratuities, service charges and Troncs are quite complex, and are beyond the scope of this guide. More detailed information about the PAYE tax & National Insurance due on such payments can be found in the GOV.UK Guidance on tips, gratuities, service charges and troncs – GOV.UK (www.gov.uk) . See also the ‘Links’ section at the bottom of this guide.

This guide shows how to set up a new ‘Additions’ column within Payroll Manager in order to record payments of tips, gratuities etc to an employee.

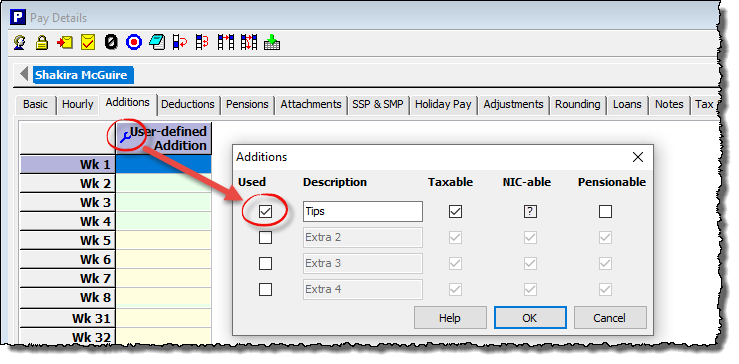

1) Click on the ‘Additions‘ tab on the ‘Pay Details‘ screen, then click on any one of the the blue ‘spanner’ symbols in one of the column headings.

2) Tick the next available ‘Used‘ box in the ‘Additions’ setup screen that appears, and add a relevant description (e.g. ‘Tips’)

3) Complete the ‘Taxable’, ‘NIC-able’ and ‘Pensionable’ boxes as applicable:

- The ‘Taxable‘ box should be ticked in all cases, as all tips are taxable.

- The ‘NIC-able‘ box should be ticked / unticked depending on whether or not National Insurance Contributions are due on the payment. Factors that affect this include whether or not a Tronc scheme is in place, and whether the payment is in respect of a tip or of a mandatory service charge. You should refer to the GOV.UK Guidance on tips, gratuities, service charges and troncs – GOV.UK (www.gov.uk) for more information.

- The ‘Pensionable’ box would normally be ‘unticked’ (unless the pension scheme rules stipulate that tips are subject to pension contribution deductions). Click ‘OK‘ when you have finished.

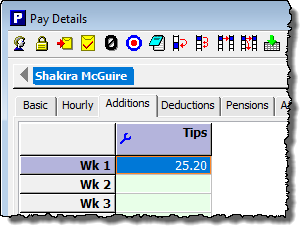

4) Enter the amount of the tips payment in the relevant pay period.

Links

GOV.UK E24 Guide: tips, gratuities, service charges and troncs

GOV.UK: Code of practice on fair and transparent distribution of tips