Submission Log

Payroll Manager keeps a record of all RTI returns sent to HMRC and stores these in the ‘Submission Log‘. This log also contains a record of the ‘HMRC response‘ to each successful submission, which serves as proof that RTI returns have been accepted by HMRC. Each Payroll Manager data file has its own Submission Log, containing details of RTI returns submitted for that employer in that particular tax year.

The submission log may prove useful if you have a dispute with HMRC about how much tax or NIC is due, as it contains a complete record of the exact information that has been submitted to (and received by) HMRC via your RTI returns.

Viewing the Submission Log

1) Make sure that you have the appropriate payroll file open for the tax year in question, then click ‘Tools‘ then ‘Online Filing‘ from the main menu, and select ‘Submission Log‘

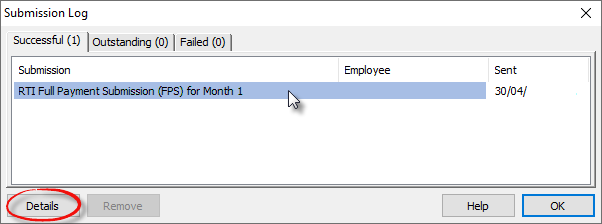

The submission log is divided into three sections – the tabs along the top allow you to view the relevant information:

- Successful – Submissions in this section have been sent to HMRC, and HMRC have responded saying that the submission has been successfully received, and is in the correct format.

- Outstanding – This means that the submission has been sent, but that Payroll Manager is still awaiting a response back from HMRC.

- Failed – This means that the submission has been received by HMRC, but that HMRC have rejected the submission, for whatever reason. (Details of why the submission was rejected can be viewed by following the steps below).

2) Single-click on a submission that you wish to view, then click on the ‘Details‘ button.

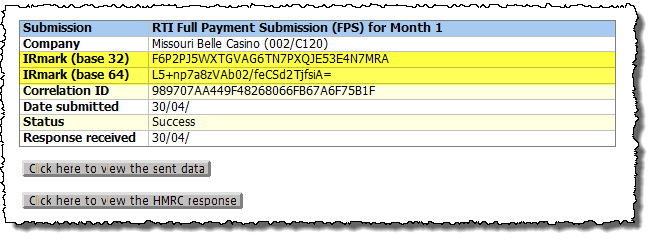

3) A summary of the submission will appear, including the date and time of the submission and the associated ‘IR Mark‘ (see ‘IR Mark’ section towards the bottom of this guide for more details).

For successful submissions you then have options to view the ‘Sent data‘ and also the ‘HMRC response‘ by clicking on the appropriate button. (If the submission has failed then the accompanying HMRC error message will be displayed instead).

Viewing the ‘Sent Data’

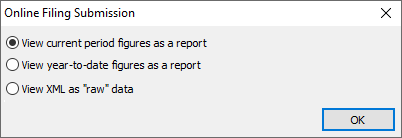

4) Click the button marked ‘Click here to view the sent data‘. This is the data that was sent to HMRC by Payroll Manager when you filed the RTI return. You will be presented with three options:

RTI submissions are sent to HMRC in a format called ‘xml’. These xml submissions typically contain up to 50 lines of data per employee, as well as information about the employer, the payroll software and many other items of data. This means that a typical RTI return may contain many hundreds or thousands of lines of data, making it relatively difficult to be read by a human. For this reason, Payroll Manager allows you to view selected items of data form the RTI return in a more user-friendly ‘report’ format, as well as giving you the option to view the full xml file if you wish.

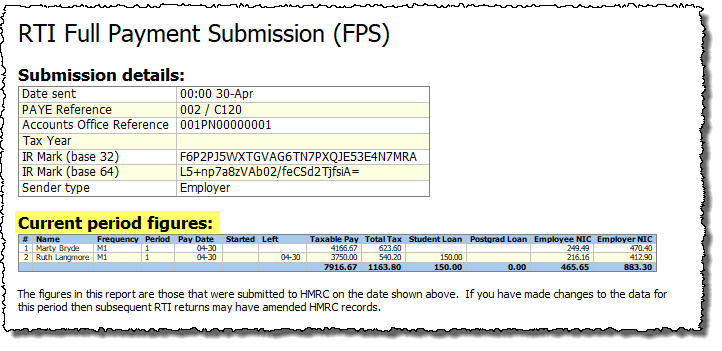

Viewing data for the current pay period as a report.

i) Select the option to ‘View current period figures as a report‘ and click ‘OK‘.

This report shows the taxable pay for each employee, and also the items that make up the employer’s liability to HMRC i.e. Tax, Student/Postgraduate Loan deductions, Employee NIC and Employer NIC. The report also shows the start date/leaving date of any new starters /leavers. The figures in this report are for the current pay period only.

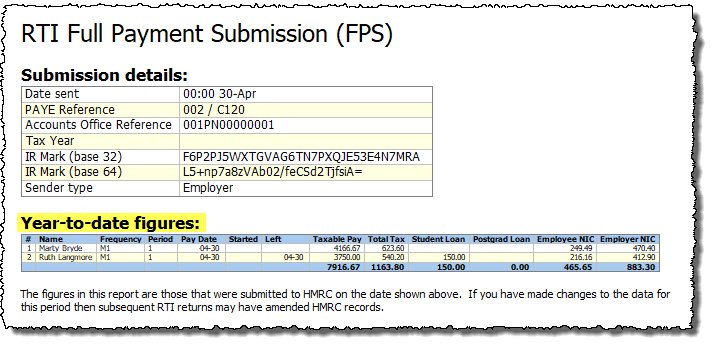

Viewing data for the Year-to-date as a report.

ii) Select the option to ‘View year-to-date figures as a report‘ and click ‘OK‘.

This report shows the taxable pay for each employee, and also the items that make up the employer’s liability to HMRC i.e. Tax, Student/Postgraduate Loan deductions, Employee NIC and Employer NIC. The report also shows the start date/leaving date of any new starters /leavers. The figures in this report show the cumulative year to date totals for each employee. Please note that employees that have left employment in previous pay periods will not be included in this report.

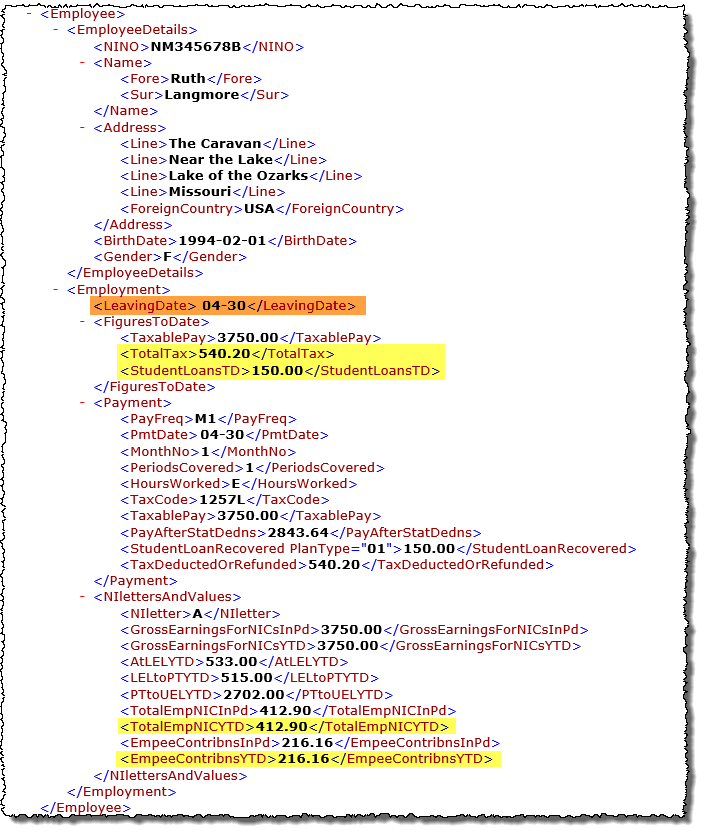

Viewing the complete RTI submission data in xml format.

iii) Select the option to ‘View XML as “raw” data‘ and click ‘OK‘.

The complete RTI submission will appear on the screen, in the same format that it is sent to HMRC. This format is more difficult to read, but does contain every single piece of information that has been received by HMRC when you submitted that RTI return. The items highlighted in yellow are the year to date figures for Tax, Student/Postgrad loans, Employer NIC and Employee NIC.

Note: If your computer does not display the xml file in a ‘readable’ format (i.e. the data is not shown in a similar format as the graphic above) then please refer to our guide Viewing XML files in Microsoft Edge

How the ‘IR Mark’ proves that HMRC have received the data that you have sent.

When you go to the ‘Tools – Online Filing – Submission Log’ screen, then highlight an FPS and click on the ‘Details’ button, a report appears showing details of when the FPS was sent/received. Towards the top of this report is something called an ‘IR Mark’ (see the graphic in item 3 of this guide).

A new IR Mark is generated each time that you submit an RTI return. In order to produce an IR Mark, Payroll Manager takes every single character present in the body of the RTI return (i.e. all of the alphanumeric characters present in the employees’ names, addresses, pay, tax, National Insurance contributions etc.) and then applies a ‘cryptographic hash function’ (as specified by HMRC) to that data. The resulting ‘IR Mark’ is unique to the contents of that particular RTI return. HMRC chooses to display the same IR Mark in two different formats, called “base 32” and “base 64” encoding (in a similar way that the number ’57’ in our normal ‘decimal’ system can also be displayed as ‘111001’ in binary).

On receipt of the RTI return, HMRC apply the very same formula to the data that they have received, and generate their own IR Mark. The HMRC IR Mark is then reported back to the software in the ‘HMRC response’ to Payroll Manager. If the IR Mark of the ‘Sent Data’ (item 3 of this guide) matches the IR Mark of the ‘HMRC response’ then this serves as proof that HMRC have received the exact information (character for character) that was sent in that particular RTI submission, as HMRC can only produce an identical IR Mark if they have received identical payroll data.

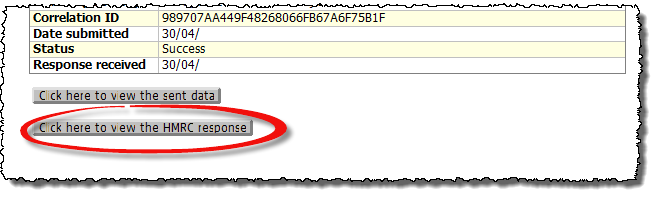

Viewing the HMRC response

5) Click ‘Tools – Online Filing – Submission Log‘ from the main menu in Payroll Manager, then single click on the RTI that you would like to view, and click the ‘Details‘ button.

Click on the button marked ‘Click here to view the HMRC response’.

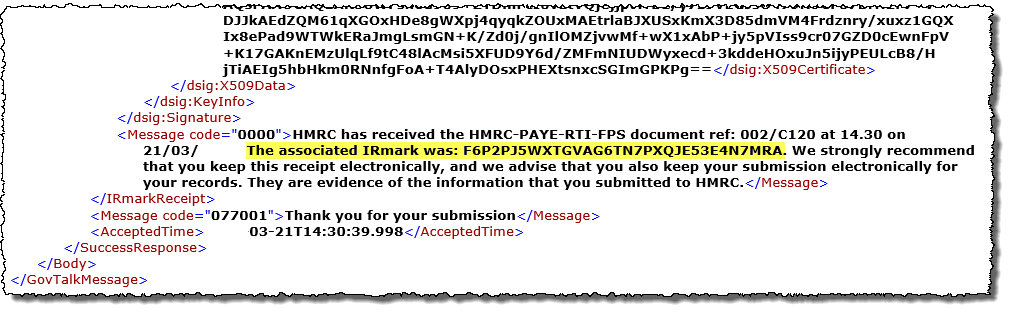

The HMRC response contains lots of coded information (below), much of which can be ignored. The important information appears towards the bottom of the report, where you will see confirmation that the submission has been received by HMRC, along with the associated ‘IR Mark’

If you look at the IR Mark for each of your successful submissions to HMRC, then you will see that they all match. This serves as proof that HMRC have received the exact same data that you have sent. If HMRC later say that their systems hold different information, then this would suggest that something has gone wrong internally with HMRC own systems, as you can prove they have received the correct information from your payroll system.