Student Loan and Postgraduate Loan Deductions

Student and Postgraduate loan repayments are often collected through payroll. A deduction is made from the employee’s pay and paid to HMRC as part of the employer’s PAYE payments. The amount of the deduction is determined by the employee’s level of earnings and the ‘Plan Type’ of the student loan in place. Payroll Manager is able to make the necessary calculations and deductions automatically.

Plan types, thresholds and calculations

Student loan and postgraduate loan deductions are dependent on employees pay, and are taken as a percentage of the employee’s earnings above a certain threshold. The threshold is determined by the ‘Plan type’ of the particular loan. The various plan types are as follows:

- Student Loan Plan1 : Applies to all students that lived in Scotland or Northern Ireland when they started their course, and also to those that lived in England or Wales and started their course before September 2012

- Student Loan Plan 2: Applies to students that lived in England or Wales and who started their course after September 2012.

- Student Loan Plan 4 : Applies to Scottish borrowers only.

- Postgraduate Loan (PGL): These are a relatively new type of loan and were introduced in April 2019.

- Student Loan Plan 5: Applies to students who started their course after August 2023. Students won’t be expected to make repayments to plan 5 student loans until April 2026 at the earliest, even if they leave their course early – see Student loans: a guide to terms and conditions for more information.

The annual thresholds and percentages for each plan type are shown in the table below:

| 2023-24 | 2024-25 | 2025-26 | ||||||

| Annual Threshold | Rate | Annual Threshold | Rate | Annual Threshold | Rate | |||

| Plan 1 | £22,015 | 9% | £24,990 | 9% | £26,065 | 9% | ||

| Plan 2 | £27,295 | 9% | £27,295 | 9% | £28,470 | 9% | ||

| Plan 4 | £27,660 | 9% | £31,395 | 9% | £32,745 | 9% | ||

| PGL | £21,000 | 6% | £21,000 | 6% | £21,000 | 6% | ||

The annual threshold is divided by the number of pay periods in the year (i.e. by 12 for monthly paid employees, and by 52 for weekly paid employees) to give the threshold for each pay period. The relevant percentage is then applied to all pay above that threshold.

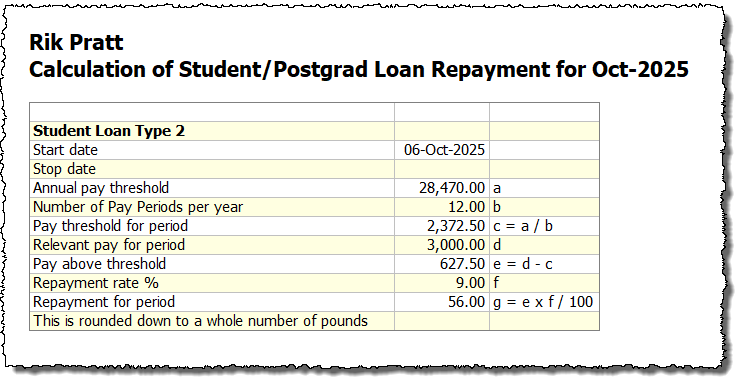

Example calculation.

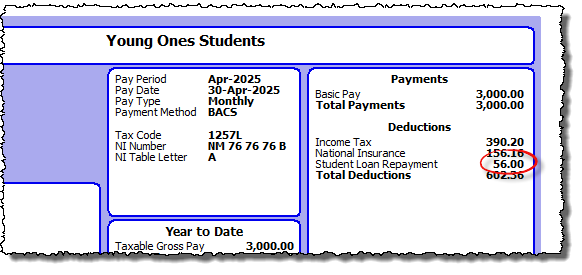

A monthly paid employee earning £3000 month in 2025-26 with a Plan 2 student loan in operation:

- Annual threshold for plan type 2 loan is £28,470 – the monthly threshold is £28470/12 = £2372.50

- Monthly earnings above threshold is £3000 – £2372.50 = £627.50

- Deduction is 9% of earnings above the threshold. 9% of 627.50 (rounded down to nearest pound) = £56.00

Starting Student Loan deductions for NEW employees

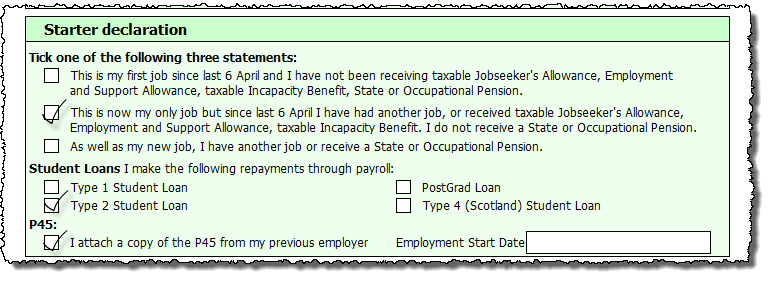

When taking on a new employee you should ask them to complete a new employee form on which they can declare which plan type student loan they have (if any). This form can be produced by clicking ‘Forms‘ from the main menu in Payroll Manager and then ‘Blank New Employee Form‘. (If the employee provides a P45 on joining then this will also confirm that they were making Student Loan Repayments via their previous employer, but does not tell you which plan type to use).

Note: HMRC guidance states “If your employee doesn’t know which plan type they’re on, ask them to contact the Student Loan Company. If they’re still unable to confirm their plan type, start making deductions using Plan type 1 until you receive further instructions from HMRC”

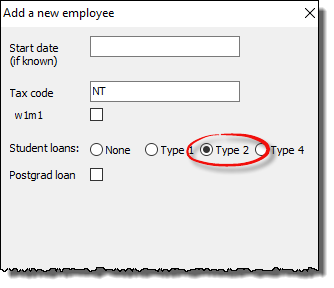

– When adding a new employee to the payroll (after clicking ‘Employees’ then ‘Add New Employee’ in Payroll Manager) you are taken through a number of input screens, one of which allows you to enter the Student loan Plan Type:

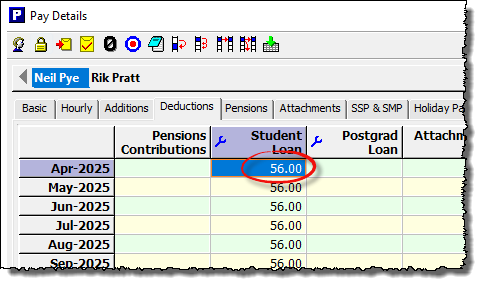

– After entering these details (providing that you already have pay entered for this employee), Payroll Manager will calculate the relevant student loan deduction amounts automatically, and display them in the ‘Deductions’ section of the ‘Pay Details’ screen.

Student loan repayments appear in the ‘Deductions’ section of the employee’s payslip:

Note: If you forgot to add details of the student loan plan type when first adding the employee to the payroll or have made a mistake when doing so then please follow the instructions below.

Starting (or editing) Student Loan deductions for existing employees

You may receive instructions from HMRC to start making student loan deductions from an existing employee either via form SL1 ‘Start Notice’ (which will tell you which plan type is applicable) or via a ‘Generic Notification Service student loan reminder’ message (in which case you should ask the employee which plan type you should use).

Note: HMRC guidance states “If your employee doesn’t know which plan type they’re on, ask them to contact the Student Loan Company. If they’re still unable to confirm their plan type, start making deductions using Plan type 1 until you receive further instructions from HMRC.”

To start making the appropriate deductions follow the instructions below:

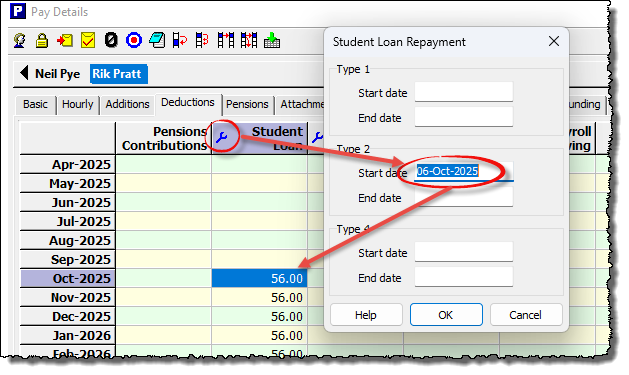

– Go to the ‘Pay Details‘ screen in Payroll Manager, click on the ‘Deductions‘ tab and select the appropriate employee.

– Click on the ‘blue spanner‘ symbol at the top of the ‘Student Loan Repayments‘ column (or the ‘Postgrad Loan Repayments‘ column for postgraduate loans) and enter a ‘Start date‘ in the relevant box. HMRC ask that you ‘start making deductions from the next available pay day‘ so the date that you enter should be that employee’s next pay date. IMPORTANT: Do not enter a date earlier than this, even if the notice specifies an earlier date, as doing so may affect previous pay periods.

– Leave the ‘End date’ box empty. This should only be used when you wish to stop the calculation of student loan deductions. Click ‘OK‘

Payroll Manager will calculate and display the relevant student loan deductions on the ‘Pay Details’ screen and on the employee’s payslip.

Checking Student loan calculations

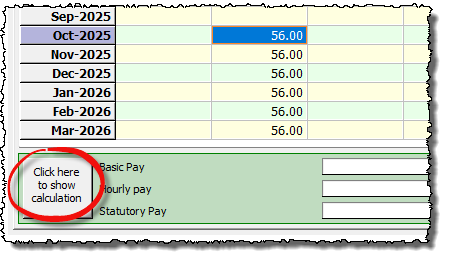

If you wish to see how Payroll Manager has calculated a student loan deduction for a particular pay period, then click on the button marked ‘Click here to show calculation‘ at the bottom-left hand side of the ‘Pay Details‘ screen..

..then select the ‘Student / Postgrad Loan Repayments‘ option.

This report allows you to check that you have selected the correct student loan type and start date.

Stopping student loan deductions

If you receive form SL2 ‘Stop Notice’ from HMRC then you should enter an ‘End Date’ into the Student Loan Repayment box in Payroll Manager (on the same screen as you entered the ‘Start Date’). Payroll Manager will stop calculating deductions from that point onwards.

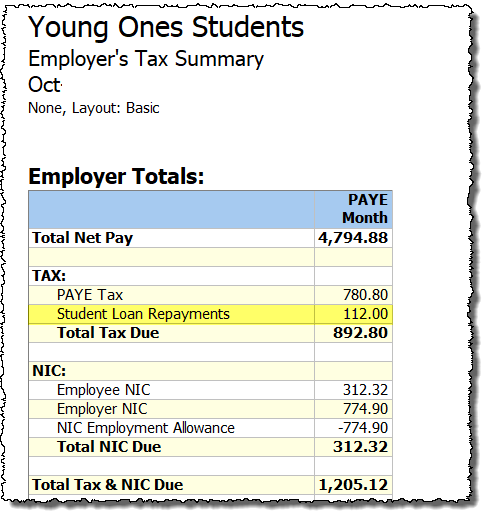

Paying Student Loan Deductions to HMRC

Student Loan Deductions are reported to HMRC via RTI FPS returns. The deducted amounts are then paid to HMRC together with the PAYE Tax due for that period. Student Loan Deduction amounts are summarised on the ‘Pay‘ – ‘Employers Summary for Tax Period‘ report.

FAQs

An employee has not yet earned above the annual threshold but the software is still calculating deductions – why? – The annual threshold is divided by the number of pay periods in a year in order to determine the monthly or weekly threshold. If an employee earns above the monthly or weekly threshold then student loan deductions will be collected via PAYE regardless of their pay in other periods.

What if the employees pay does not exceed the annual threshold in a particular tax year – are they able to reclaim any student loan repayments that they have made? Yes, this is possible, but this is not done via the payroll. Instead the employee should contact the Student Loans company directly to request a refund – see Repaying your student loan: Getting a refund – GOV.UK (www.gov.uk)

Links

HMRC Student Loan Repayments: Guidance for Employers

Student loan and postgraduate loan repayment guidance for employers – GOV.UK (www.gov.uk)