Statutory Sick Pay (SSP)

This guide is designed to assist you when processing periods of sickness for your employees.

When one of your employees has time off sick, you may need to pay them Statutory Sick Pay (SSP). Payroll Manager is able to determine whether or not your employee is entitled to SSP and if so automatically calculate how much is due.

Basic rules of SSP

There are a number of rules which determine whether or not an employee is eligible to be paid SSP, and also the amount of SSP that they should receive. Payroll Manager has these rules built-in, and can automatically calculate the amount of SSP to be paid (if any) once a period of sickness has been recorded on the ‘Calendar’ screen. The rules themselves can found in the GOV.UK Statutory Sick Pay (SSP): employer guide.

The normal rules state that:

- In order to be eligible to claim SSP the employee’s earnings must be at or above the ‘Lower Earnings Limit’, which is £125 in 2025-26 ( £123 in 2024-25 ).

- In order for SSP to be payable a ‘Period of Incapacity for Work’ (PIW) must be formed. A PIW is only formed when the employee is sick for 4 or more consecutive days. Sickness periods of 3 days or less do NOT constitute a PIW. [Note: The Government is proposing to change this rule via the ‘Employment Rights Bill’ of 2025, so that a PIW will be formed from day 1 of sickness. See FAQ section, below].

- When a PIW has been formed, the first 3 working days are called ‘waiting days‘, for which NO SSP is due. SSP is then payable from the 4th working day onwards.

- If a new PIW is formed within 8 weeks of the end of a previous PIW then these two PIWS are ruled as being ‘linked’. If the employee qualified for SSP in the first of these PIWs, then SSP is payable for the second PIW and will start from the first working day of this period of sickness (i.e. no waiting days are required).

- SSP can continue for up to 28 weeks.

Recording the period of sickness

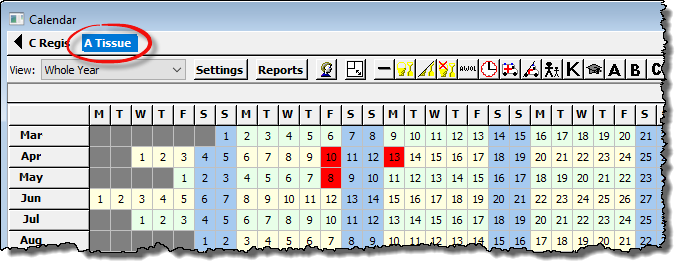

1) – From the main menu, click on ‘Employees – Calendar’, then select the appropriate employee.

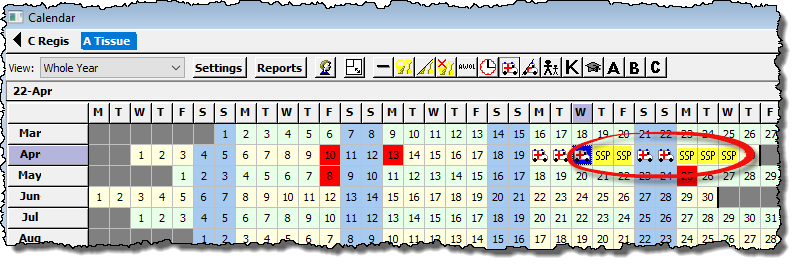

2) – Click the first day on the calendar that the employee was sick and then click on the ‘Ambulance/Sickness’ symbol from the calendar toolbar. This day will now be set as a ‘sick’ day.

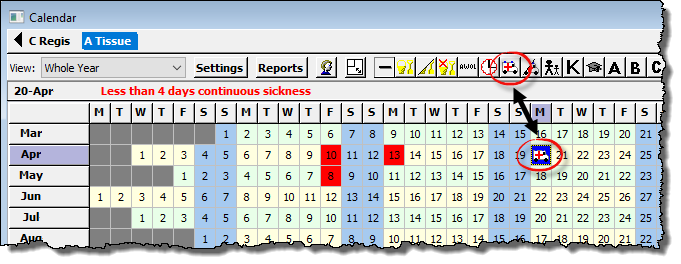

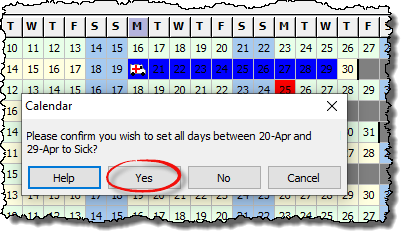

3) – Click back on the first day of sickness (which will now show an ambulance symbol), hold down the left mouse button and drag along the calendar, selecting the amount of days off sick. A dialogue box will appear asking you to confirm the amount of days selected are correct. Each of these days will now be set as ‘sick’ days.

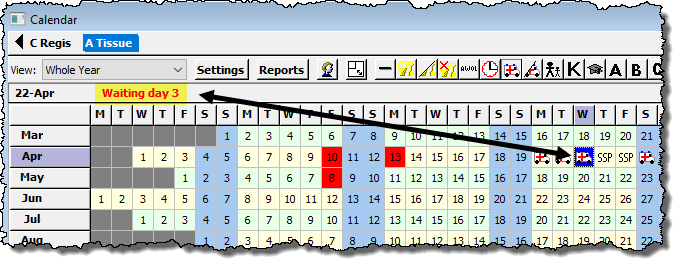

When highlighting the sick days, you must select all days that the employee was sick, regardless of whether these are working days or not, in order for the software to correctly calculate SSP. The employee must be sick for four consecutive days or more in order to qualify for SSP. (4 or more consecutive days off sick forms a ‘Period of Incapacity for Work’ or ‘PIW‘) – The first three working days of this sick leave are classed as Waiting Days and no SSP is payable for these.

On the next working day following the 3rd waiting day the ambulance symbol changes to SSP, indicating that statutory sick pay is now payable.

Adding SSP to the payslip

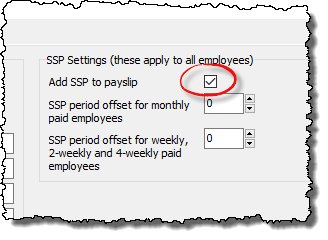

4) – To add SSP to an employee’s payslip, click on the ‘Settings’ button, select the Sickness tab and click in the box ‘Add SSP to Payslip’.

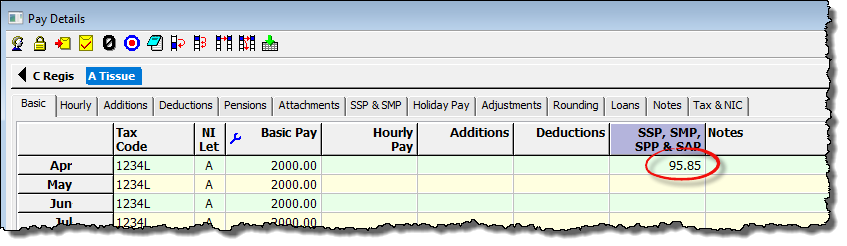

5) – The SSP payable will then appear in the Pay Details screen in the ‘SSP, SMP, SPP & SAP’ column in the relevant pay period. For tax year 2025-26 the weekly rate of SSP is £118.75 (the weekly rate for 2024-25 is £116.75).

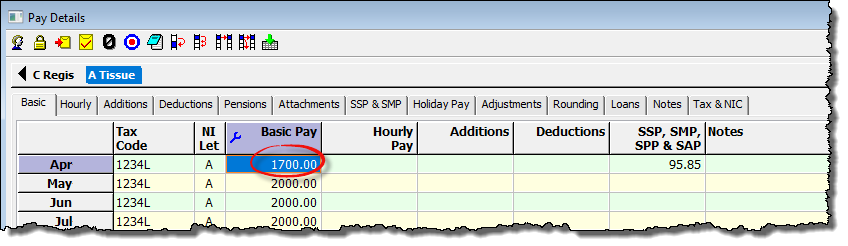

6) – Note that SSP will be added to any other pay currently entered for that employee. If you already have other items of pay entered for the employee for that particular pay period then it may be necessary for you to adjust their pay to account for the fact that the employee was off sick. There are no fixed rules for this, and so Payroll Manager will not reduce an employees pay automatically when they are absent due to sickness. Instead you should make these changes manually according to the contract of employment between the employee and the employer. In the example below, the Basic Pay for April has been manually adjusted by the user (i.e. reduced by £300) in respect of the employee absence.

FAQS

I have added ambulance\sickness symbol to the calendar but no SSP is being paid, why? – There are a number of reasons why Payroll Manager may not calculate the payment of SSP.

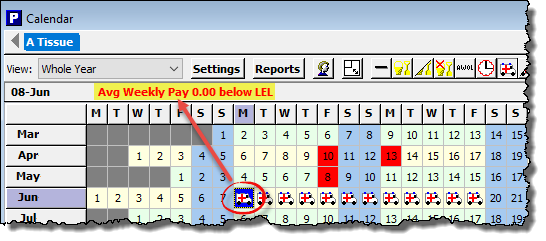

1) The ‘Average weekly pay’ of the employee is not high enough for them to qualify for SSP. The average weekly pay (taken over an 8 week period prior to them becoming sick) must be at or above the ‘Lower Earnings Limit (LEL)’ for that year. The LEL for 2025-26 is £125 (the LEL for 2024-25 was £123). To see if this is the cause, click on the first ambulance\sickness symbol that you have added to the calendar. e.g.

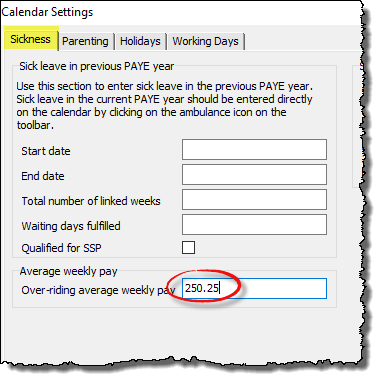

If you see a message indicating the Average Weekly Pay is below the LEL, then this means that the employee does not earn enough to qualify for SSP. EXCEPTION: In cases where the employee has been working for the employer for less than 8 weeks then you should calculate what the employees normal pay would have been if they were not sick, and use that figure instead. To do this, click on the ‘Settings’ button on the calendar, then on the ‘Sickness’ tab, and enter your calculated figure in the ‘Over-riding average weekly pay’ box.

If this figure is above the LEL then this will trigger the payment of SSP.

2) The sickness period that you have entered on the calendar is not in this tax year, or continues into the following tax year.

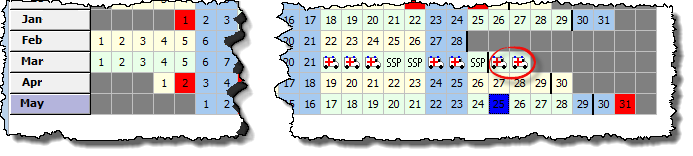

By default, The ‘Calendar’ screen allows you to enter periods of sickness in this tax year, and also into the first few months of the next tax year. If you enter sick days after the last pay day of the year, then the symbols on the calendar will remain as ‘ambulance’ symbols, and not change to ‘SSP’ symbols. This is because SSP for those particular days will be paid in the following tax year. e.g.

In the example above, the monthly pay date has been set to 29th March (signified by the small, black, vertical line on the calendar screen). The SSP for 30th and 31st March, which are after the final pay day for the year, will be paid in the following year.

What about ‘linked’ periods of sickness? – If an employee has a further PIW (i.e. a period of sickness of 4 consecutive days or more) and there is a gap of less than 56 days between the start of this new PIW and the end of the previous PIW, then any ‘waiting days’ served in the original PIW count towards the three waiting days required in the second PIW. Payroll Manager ‘links’ PIWs automatically. Note that if any of these periods of sickness are less than 4 days then they will not constitute a ‘PIW’ and therefore will not link with each other.

Can the employer reclaim SSP from HMRC? – No. Prior to April 2014, small employers could recover a proportion of the total SSP paid to their employees via what was called the ‘Percentage Threshold Scheme. This scheme came to an end in April 2014, and since then SSP has been entirely employer funded. The Government scheme for reclaiming Covid related SSP closed in March 2022

My employee does not have a normal working pattern of Monday to Friday – what should I do? – By default, Payroll Manager assumes that each employee has a working pattern of Monday to Friday, and calculates SSP accordingly. To set a different working pattern select the ‘Working Days’ layout of the calendar from the drop-down selector towards the top-left of the calendar. If the employee works the same weekly pattern for the whole year then specify the working days on this screen. If the employee has a ‘variable working pattern’ then select this option and mark each working day on the calendar individually.

What happens after the employee has received SSP for 28 weeks ? – Payroll Manager will automatically stop paying SSP after 28 weeks. The employee may then be able to apply for Employment and Support Allowance (ESA). Click on the ‘Reports‘ button on the ‘Calendar‘ screen and select ‘Sickness (SSP1)‘ to produce a SSP1 form to issue to the employee.

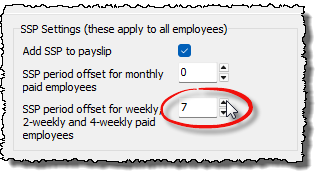

What if the employees work a week in hand – how do I get the SSP to show in the correct pay period? – Click on the ‘Settings‘ button on the calendar screen and select the ‘Sickness‘ tab. Adjust the ‘SSP period offset for weekly, 2-weekly and 4-weekly paid employees‘ setting. This field is initially set to ‘0’. Setting it to ‘7’ will ‘shift’ the payment of SSP back by one week. Please be aware that this setting will apply retrospectively to ALL employees with weekly, 2-weekly and 4-weekly pay frequencies, so you should use it with caution, and ideally set it at the beginning of the tax year.

Will SSP soon be available from day 1 of sickness? – The ‘Employment Rights Bill’ of 2025 includes a proposal for a ‘PIW’ to be formed from day 1 of sickness. This rule is not likely to come into effect until 2026 at the earliest (see Next Steps to Make Work Pay (web accessible version) – GOV.UK) Payroll Manager will automatically apply the new rule as an when it becomes law.

Links

GOV.UK – Statutory Sick Pay (SSP): Employer Guide

GOV.UK – Statutory Sick Pay: employee fitness to work

Employer form SSP1: Statutory Sick Pay and an employee’s claim for benefit – GOV.UK