Statutory Pay Recovery and Compensation

Employers can reclaim a certain percentage of employees’ Statutory Maternity, Statutory Paternity, Statutory Adoption, Statutory Parental Bereavement, Statutory Shared Parental Pay and Statutory Neonatal Care Pay from the Government (the recovery of Statutory Sick Pay was abolished in April 2014). For the purpose of this guide we refer to these items of pay as ‘Statutory Parenting Pay‘ .The amount of Statutory Parenting Pay that an employer can reclaim is dependent on whether or not the business qualifies for ‘Small Employers’ Relief’ (see below).

Small Employers Relief (SER)

A ‘small employer’ is one who paid (or was liable to pay) total gross Class 1 NIC of £45,000 or less in the individual employee’s qualifying tax year, which is the last complete tax year before:

- the ‘qualifying week’ – the 15th week (Sunday to Saturday) before the week of the due date

- the ‘matching week’ – the week (Sunday to Saturday) your employee was told they’d been matched with a child by the adoption agency

- the date on the official notification if the employee is adopting a child from another country

- the ‘qualifying week’ – the week (Sunday to Saturday) before the death of the child or stillbirth, for Statutory Parental Bereavement Pay

Those employers below the £45,000 limit qualify for SER, and also receive an additional amount of ‘NIC compensation’ for the amount of employer NIC payable on the statutory parenting payments. Those employers above the £45,000 threshold do not qualify for SER or NIC compensation.

How much can be recovered?

Employers that do not qualify for SER are able to recover 92% of the amount of Statutory Parenting Pay paid to their employees.

Employers that do qualify for SER are able to recover 100% of the amount of Statutory Parenting Pay paid to their employees, plus an additional 8.5% ‘NIC compensation’.

(Note: from April 2026 the ‘NIC Compensation’ percentage increases from 8.5% to 9% – Payroll Manager will implement this change automatically).

How Payroll Manager handles this

Payroll Manager is able to determine whether or not an employer qualifies for Small Employers Relief automatically, by looking at the Class 1 NIC liability for previous tax years to see if it was above or below the £45,000 threshold. If you have recently started using Payroll Manager and do not have a payroll file for the previous tax year, then it is necessary to tell the software whether or not the employer qualifies for SER.

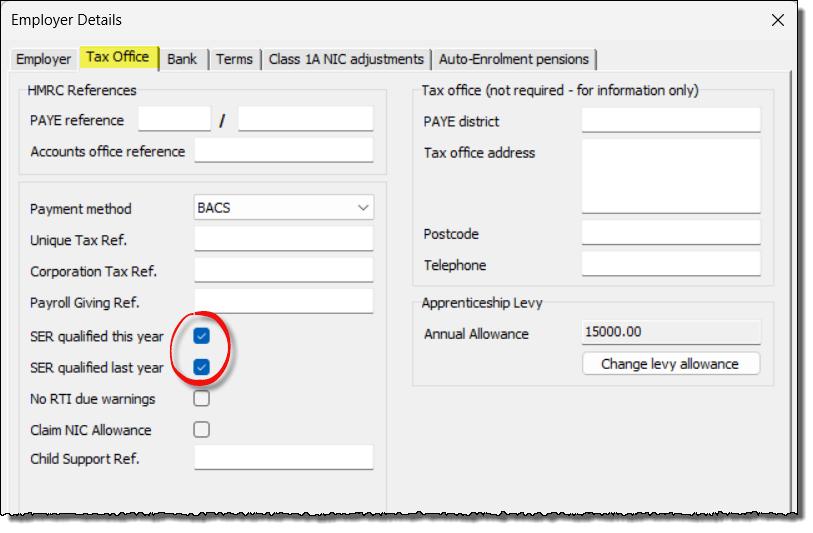

Click ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager, then click on the ‘Tax Office‘ tab.

- If the employer Class 1 NIC liability was £45,000 or less in the previous tax year, then tick the box marked ‘SER qualified this year‘ (as the criteria for qualifying for SER this year depends on the Class 1 NIC liability of the previous year).

- If the employer Class 1 NIC liability was £45,000 or less in the year prior to the previous tax year, then you should also tick the box marked ‘SER qualified last year‘.

- If the employer Class 1 NIC liability was above £45,000 then you should leave these boxes unticked.

- Payroll Manager will automatically tick/untick the correct boxes if you were using the software to process payroll in previous tax years.

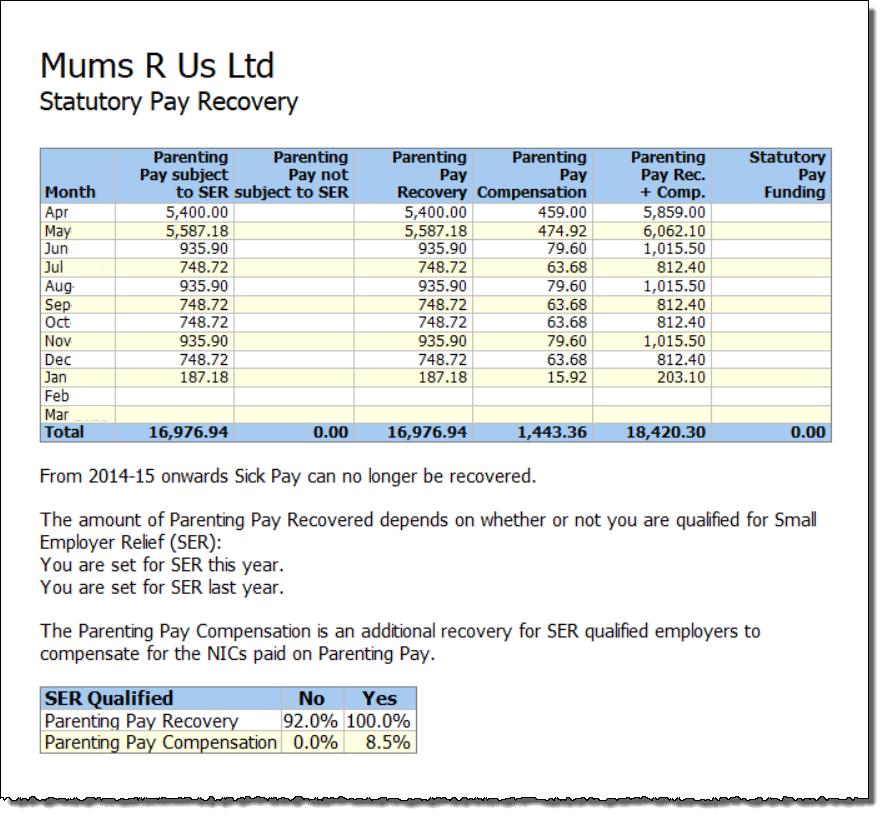

The ‘Statutory Pay Recovery’ report shows a breakdown of all Statutory Parenting Pay and recoverable amounts on a tax period by tax period basis. Click ‘Analysis‘ then ‘Statutory Pay Recovery‘ from the main menu in Payroll Manager to view this report:

Reporting Statutory Pay Recovery to HMRC

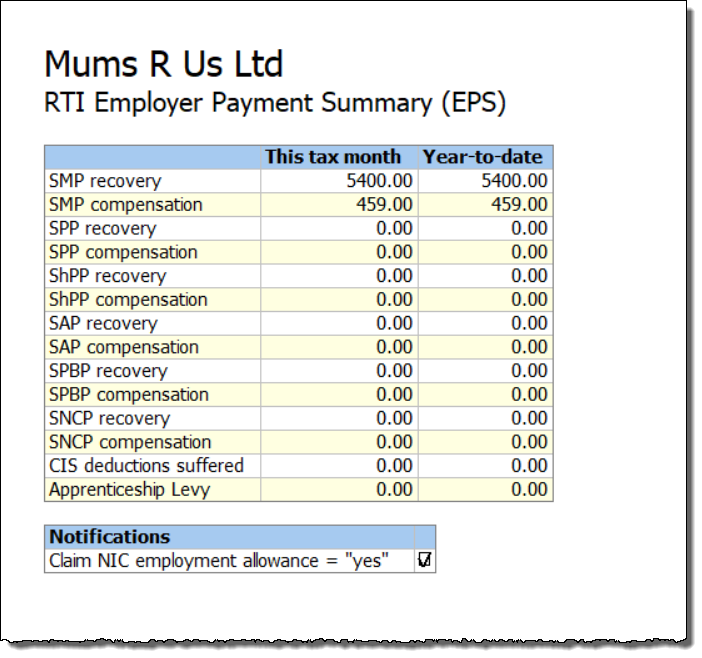

Statutory Parenting Pay recovery and Compensation amounts are reported to HMRC via an ‘Employer Payment Summary – EPS’. Payroll Manager will automatically schedule an EPS on the ‘Pay – Employers RTI schedule‘ screen for tax periods that contain recoverable amounts. The EPS shows a breakdown of the different Statutory Parenting Pay recovery and compensation amounts.

How it is Statutory Parenting Pay actually recovered?

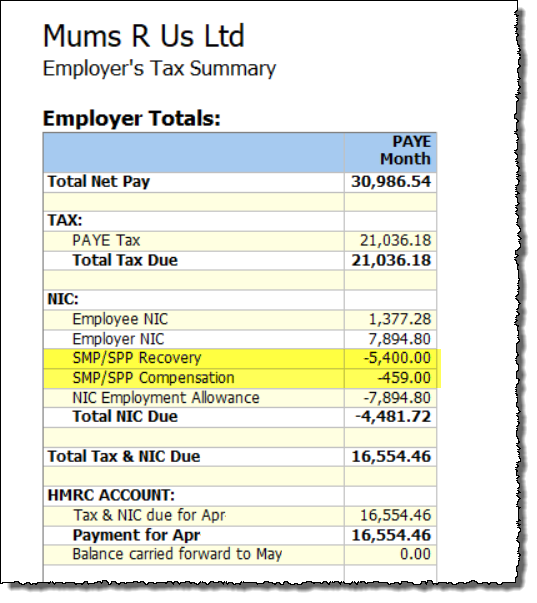

Recovery is achieved by reducing the monthly or quarterly PAYE amounts payable to HMRC. Payroll Manager calculates this automatically. Click ‘Pay‘ and then ‘Employers Summary for Tax Period‘ from the main menu in Payroll Manager to see how the Recovery and Compensation amounts affect the amount due to HMRC for a particular tax period.

Links

Get financial help with statutory pay: What you can reclaim – GOV.UK

SPM180100 – Paying and Recovering – SSP: historical information – HMRC internal manual – GOV.UK