Statutory Paternity Pay (SPP)

When an employee takes time off work because their partner is having a baby or adopting a child then they may be eligible to claim Statutory Paternity Pay (SPP). The rules which determine whether or not an employee is entitled to SPP are built into Payroll Manager. The employee must:

- Earn at least £125 per week in 2025-26 (£123 per week in 2024-25). For monthly paid employees the average weekly pay is based on the employees earnings over a 2 month period.

- Have been continuously employed by that employer for a least 26 weeks up until the ‘Qualifying Week’ (or ‘Matching Week for adoption). The ‘Qualifying Week’ is the 15th week before the baby is due, so in practice the employee must have been employed for at least 41 weeks before the expected date of birth of the child.

The employee can choose to take either 1 or 2 complete weeks of leave The rules regarding SPP change In England, Scotland and Wales from from tax year 2024-25 onwards (For Northern Ireland, see ‘Links’ section at the bottom of this guide).

- Up until 2024, This leave cannot start before date of birth, must be taken all in one go, and must end within 56 days following the birth of the child (or due date, if the baby is born early).

- From 6 April 2024 onward, Statutory Paternity Leave cannot start before date of birth, can be taken in blocks of 2 separate weeks if desired, and must end within 52 weeks following the birth of the child.

SPP is paid at at either 90% of the employee’s average weekly earnings, or at the statutory rate, whichever is the lower. For 2025-26 the statutory rate is £187.18 (for 2024-25 the statutory rate is £184.03).

Please see Paternity pay and leave: Overview – GOV.UK (www.gov.uk) for further details.

Entering details into Payroll Manager

Details of the Paternity leave is entered on the Calendar screen. Payroll Manager then applies the relevant rules and automatically calculates any SPP due.

- Click ‘Employees‘ and then ‘Calendar‘ from the main menu in Payroll Manager.

- Ensure that you have the correct employee selected.

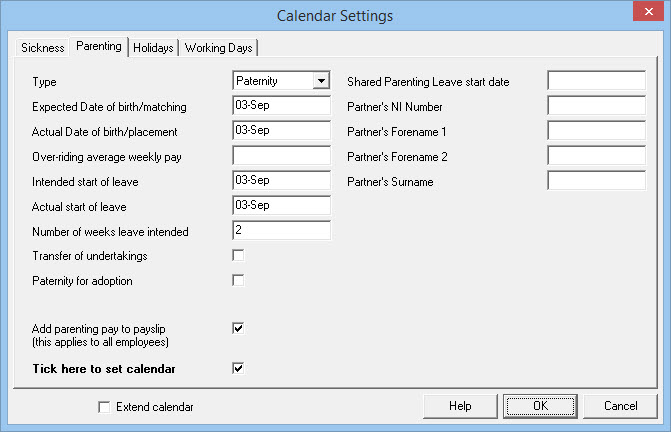

- Click on the ‘Settings‘ button on the calendar screen and then select the ‘Parenting‘ tab. Fill in the boxes as follows:

- Expected Date of birth/matching – Enter the expected date of birth of the child. The expected date of birth will have been recorded by a doctor on the ‘MAT B1’ form issued to the mother.

- Actual Date of birth/placement – Enter the date that the baby was born. Please note that the rules on Paternity Pay stipulate that Paternity Pay cannot start before the date of birth of the child.

- Over-riding average weekly pay – Under normal circumstances this box should be left blank., In some circumstances (e.g. perhaps you have just taken over the processing of the payroll from someone else) Payroll Manager will not have enough pay history recorded for this employee and you should enter whatever was previously calculated as the ‘Average weekly pay’ for this employee in this box.

- Intended start of leave – Enter the date that the employee intends to start their leave. If this date is unknown then leave this field empty.

- Actual start of leave – Enter the date that the employee begins their leave. Please note that the rules on Paternity Pay stipulate that Paternity Pay cannot start before the date of birth of the child.

- Number of weeks leave intended – Enter either 1 or 2 in this box.

- Transfer of undertakings – under normal circumstances you would leave this box unticked. If the employee has recently (within the last 12 months) been transferred to this employer under ‘TUPE’ regulations then tick this box. You should also tick this box if the employee has been employed for 26 weeks or more, but has had a change of pay frequency during the last 26 weeks.

- Paternity for adoption – If the paternity leave is being taken due to adoption of a child then tick this box, otherwise leave it unticked.

- Add parenting pay to payslip – In normal circumstances you would ‘tick‘ this box, which has the effect of adding the SPP as an item of the employees payslip.

- Tick here to set calendar – tick this box when you have completed entering the details above, and click ‘OK‘

[ A message will appear regarding workplace pension contributions during parental leave asking if you wish to see more details. We would recommend that you read the guide provided before continuing. For the purpose of this particular guide it is assumed that you have already done so].

How Payroll Manager displays SPP

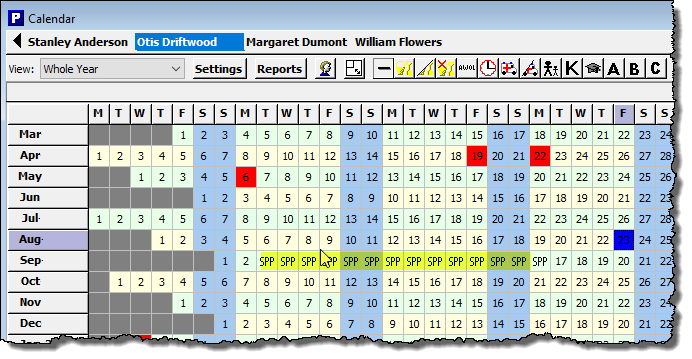

Details of the paternity leave and of any SPP due will be shown on the ‘Calendar’ screen. In the example below, 2 weeks of SPP has been calculated.

A full report of the parenting leave with an explanation of how the SPP has been calculated can be produced by clicking on the ‘Reports‘ button on the calendar and selecting the ‘Parenting‘ option. This report can be issued to the employee if required.

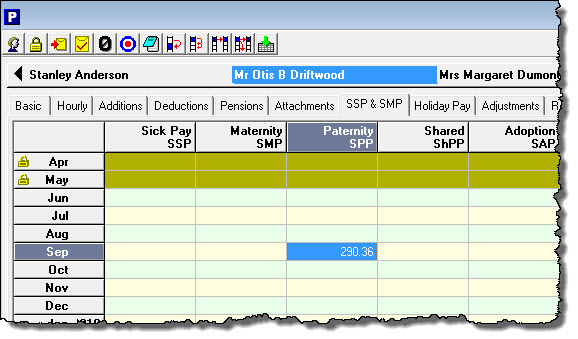

The calculated SPP will be displayed on the ‘SSP & SMP‘ tab of the ‘Pay Details‘ screen.

Reclaiming SPP

SPP can be reclaimed from HMRC by offsetting against any tax & NIC payment due in the same tax period. Payroll Manager will automatically reclaim the correct amounts and will schedule an ‘EPS’ (Employer Payment Summary) to inform HMRC of these amounts.

From April 2024 onwards

If an employee has already taken 1 week of SPP, and then chooses to take a further week of SSP (having worked in the interim period), then this is allowed under the new SPP rules, provided that the leave is taken within 52 weeks of the birth/placement of the child.

To enter the second week of SPP, click on the date that the employee wishes to begin the second week of SPP (which must be the same day of the week as the original period of SPP), then click on the ‘Parenting Leave’ ![]() button on the toolbar. Repeat this for the remaining 6 days of the SPP leave week.

button on the toolbar. Repeat this for the remaining 6 days of the SPP leave week.