Statutory Parental Bereavement Pay (SPBP)

The Government introduced a new entitlement to Parental Bereavement Leave and Pay (SPBP) in April 2020. This provides parents who lose a child or suffer a stillbirth with an employment right to take two weeks off work. Eligible employees are entitled to two weeks’ statutory pay.

There are a number of criteria which determine eligibility for SPBP, and the decision as to whether or not an employee qualifies for payment is outside of the scope of Payroll Manager. If an employee wishes to claim SPBP then you should read HMRC guidance to determine the eligibility of the employee to SPBP and amount due, and then enter this manually into Payroll Manager. See Manually calculate your employee’s Statutory Parental Bereavement Pay for more details.

The weekly rate of SPBP in 2025-26 is £187.18 or 90% of the employee’s average weekly earnings, whichever is lower. (The rate for 2024-25 is £184.03).

How to enter into Payroll Manager

Payroll Manager does not automatically calculate SPBP, as there are many variables which lie outside the scope of the software. Instead, you should determine whether or not SPBP is due, and then manually enter the amount on the ‘Pay Details’ screen of the software.

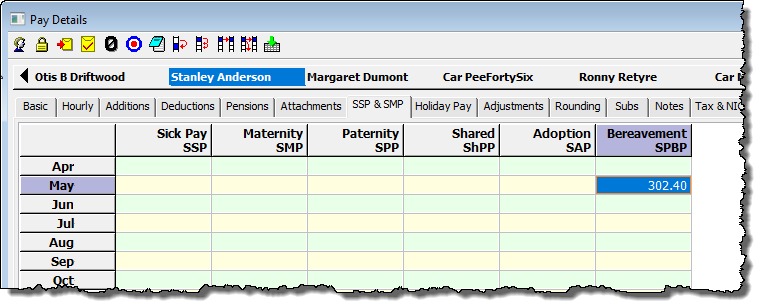

Go to the ‘Pay Details‘ screen, select the relevant employee, then click on the ‘SSP & SPP‘ tab.

Enter the amount of SPBP to be paid to the employee in the ‘Bereavement SPBP‘ column for the relevant pay period. You should calculate and enter the amount according to how many complete weeks of SPBP the employee is to receive in that particular pay period.

Any SPBP paid will automatically appear on an EPS report for the applicable month(s).

Statutory Parental Bereavement Pay and Leave in Northern Ireland from 6th April 2026

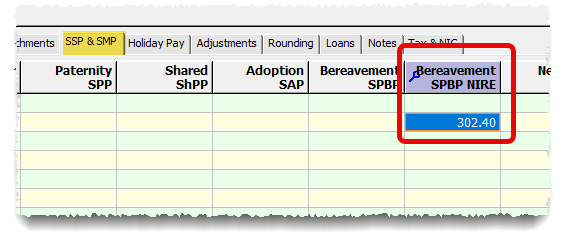

From 6 April 2026 Statutory Parental Bereavement Pay will also be available to families in Northern Irelend. Figures should be entered in the column marked ‘Bereavement SPBP NIRE‘ in the ‘SSP & SMP‘ section of the ‘Pay Details‘ screen (e.g. below):

HMRC require that in order to claim SPBP in Northern Ireland, the ‘Workplace Postcode‘ of that particular employee must be provided via the RTI return. Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, then select the ‘Work‘ tab to enter the Workplace Postcode (e.g. below):