Statutory Neonatal Care Pay (SNCP)

An employee may be eligible for Neonatal Care Leave and Statutory Neonatal Care Pay if they or their partner have a child that requires neonatal care. The child must enter into neonatal care within 28 days of birth and spend at least 7 continuous days in care. The entitlement applies to parents of children born on or after 6 April 2025 and who are employed in England, Scotland or Wales. Neonatal Care Leave and Statutory Neonatal Care Pay is not currently available for those employed in Northern Ireland.

There are a number of criteria which determine eligibility for SNCP, and the decision as to whether or not an employee qualifies for payment is outside of the scope of Payroll Manager. If an employee wishes to claim SNCP then you should read HMRC guidance to determine the eligibility of the employee to SNCP and amount due, and then enter this manually into Payroll Manager.

GOV.UK provides an online calculator which allows you to calculate SNCP for an employee – please see Calculate your employee’s Statutory Neonatal Care Pay

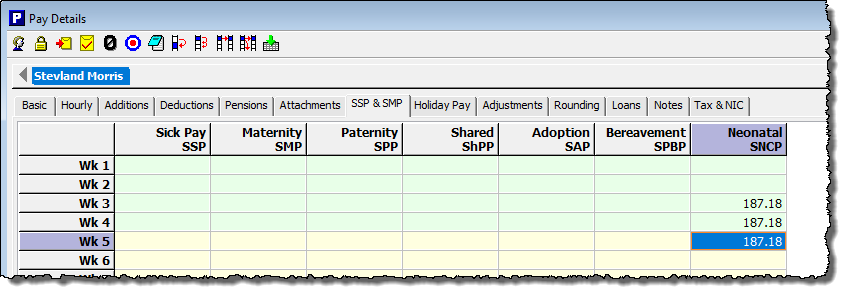

How to enter SNCP amounts into Payroll Manager

Payroll Manager does not automatically calculate SNCP, as there are many variables which lie outside the scope of the software. Instead, you should determine whether or not SNCP is due, and then manually enter the amount on the ‘Pay Details’ screen of the software.

Go to the ‘Pay Details‘ screen, select the relevant employee, then click on the ‘SSP & SPP‘ tab.

Enter the amount of SNCP to be paid to the employee in the ‘Neonatal SNCP‘ column for the relevant pay period. You should calculate and enter the amount according to how many complete weeks of SNCP the employee is to receive in that particular pay period.

Any SNCP paid will automatically appear on an EPS report for the applicable month(s).

Links

EIM76400 – Statutory Neonatal Care pay: Summary – HMRC internal manual – GOV.UK