State Pension Age

The State Pension age is the earliest age that an individual can start receiving their State Pension, and is worked out based on the date of birth. If an employee chooses to continue to work after reaching their State Pension Age then their subsequent earnings are not liable to employee National Insurance deductions.

Previously the State Pension Age for women was different to that of men, but various legislative changes during the past few years have meant that the State Pension Age for men and women has now been brought into alignment (for those born after 6 December 1953).

The Government regularly review the State Pension Age, which is due to rise over the coming years. Tables detailing this changes can found at https://www.gov.uk/government/publications/state-pension-age-timetable/state-pension-age-timetable

How Payroll Manager deals with the State Pension Age

Payroll Manager uses the date of birth that is entered for an employee (on the ‘Employee Details – Personal‘ screen) to determine the pay period in which that particular employee has reached State Pension Age. From this pay period onward the employee will cease to make employee National Insurance contributions on their earnings, although employer National Insurance contributions are still payable.

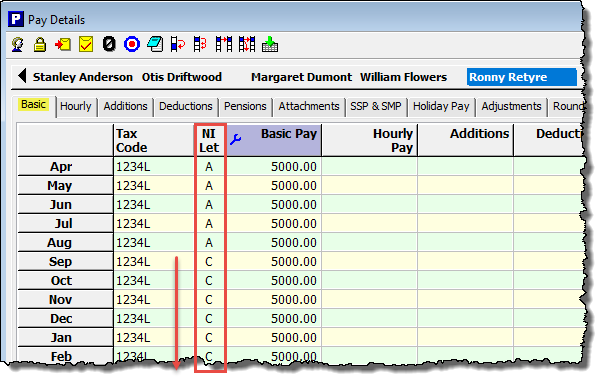

In order for these contributions to be calculated correctly, Payroll Manager will automatically assign National Insurance table letter ‘C’ to an employee for each pay period including the one in which they reach Sate Pension Age onward. This change can be viewed on the ‘Pay Details’ screen.

In the example below, the employee reached State Pension Age in September, so the NIC table letter changes to ‘C’ from that pay period onward. The employee will cease to have National Insurance deducted from their pay from September onwards (although employer NIC contributions are still due).

Checking the State Pension Age

HMRC have a tool which allows you to check the state pension age of an individual, given their date of birth and gender – this tool is available at www.gov.uk/state-pension-age