Shared Parental Pay (ShPP)

Overview

Employees may be able to get Shared Parental Leave (SPL) and Statutory Shared Parental Pay (ShPP) if they’ve had a baby or adopted a child. Employees can start SPL if they’re eligible and they or their partner end their maternity or adoption leave or pay early. The remaining leave will be available as SPL The remaining pay may be available as ShPP Employees can take SPL in up to 3 separate blocks. They can also share the leave with their partner if they’re also eligible. Parents can choose how much of the SPL each of them will take.

You should refer to the GOV.UK Employer Guide on Shared Parental Leave and Pay before processing ShPP as this guide gives full details of the documents, notice and evidence required from an employee in order for their SPL to commence. The guide also has download links to a number of forms that can be used by an employer in order to process ShPP.

How to process in Payroll Manager

There are a number of items that you will need to obtain from the employee in order to process ShPP in Payroll Manager:

- Their partners name and National Insurance number.

- The date that the employee intends to start their SPL, and the number of weeks they intend to take. Please note that Payroll Manager is NOT able to calculate the number of weeks of ShPP that the employee is entitled to, and that this should be calculated manually (according to the rules specified in the GOV.UK Employer Guide on Shared Parental Leave and Pay).

You should then follow the relevant section of the guide below, depending on whether or not the employee has already taken parenting leave for that child:

- Refer to section A if the employee has already received Statutory Paternity Pay (SPP) and now wishes to receive ShPP.

- Refer to section B if the employee has received Statutory Maternity Pay (SMP), has since returned to work, and now wishes to receive ShPP

- Refer to section C if the employee has not previously taken any SPP or SMP, but now wishes to claim ShPP.

A – ShPP for an employee who has already received Statutory Paternity Pay (SPP)

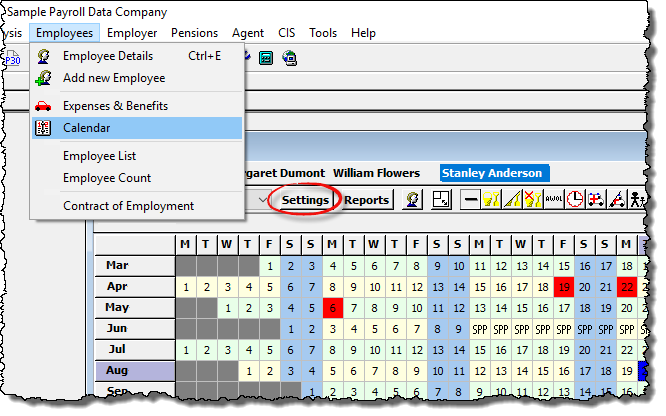

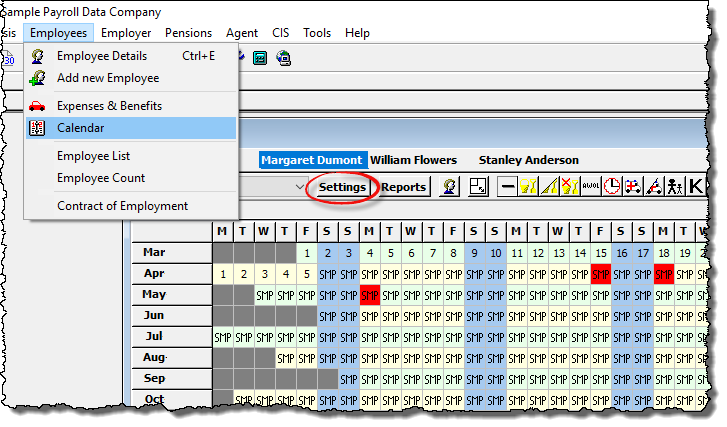

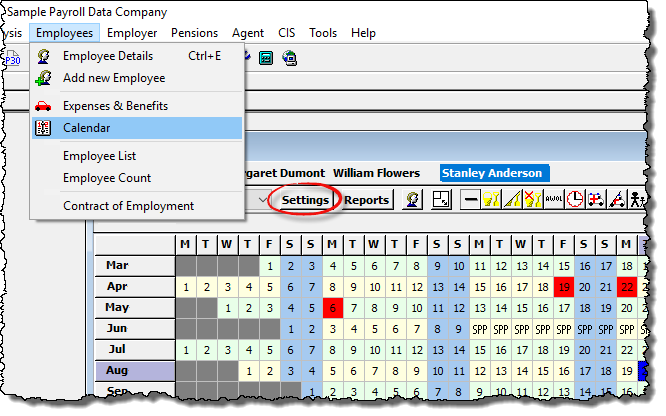

- Click ‘Employees‘ then ‘Calendar‘ from the main menu in Payroll Manager, select the applicable employee, and click on the ‘Settings‘ button

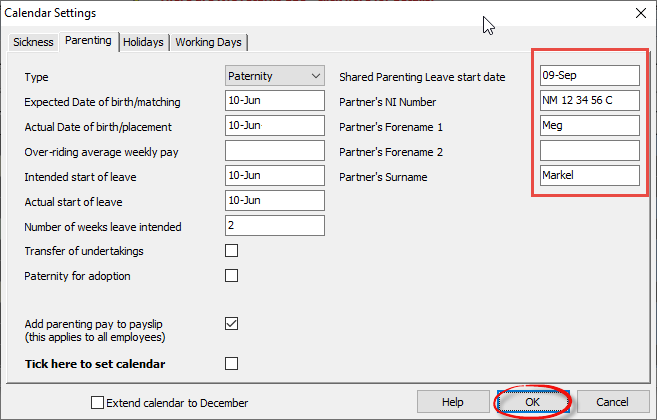

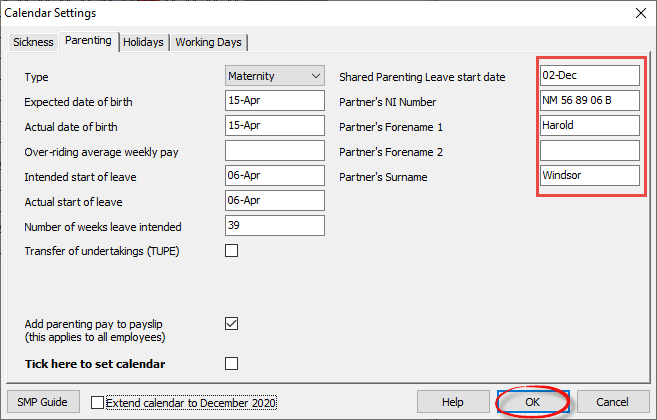

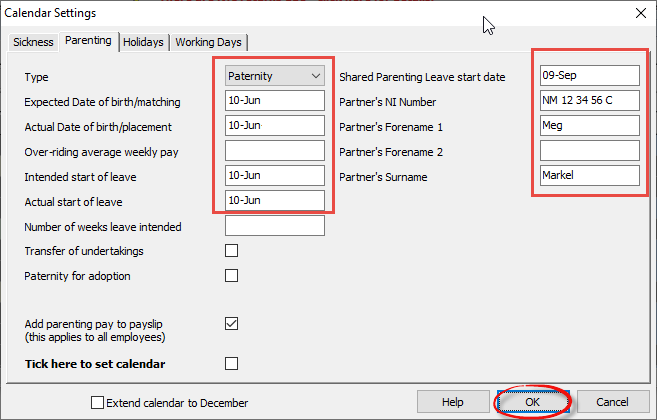

- Click on the ‘Parenting‘ tab along the top of the screen, enter the date that the Shared Parental Leave (SPL) is to start for that employee in the right-hand section of the screen (in red, below), and enter the name and National Insurance Number of the employee’s partner. Click ‘OK‘

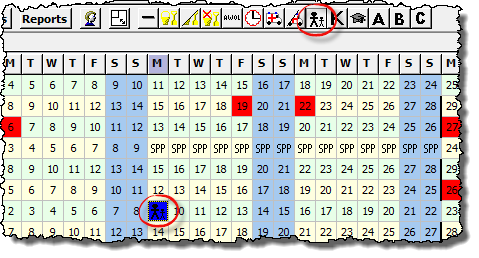

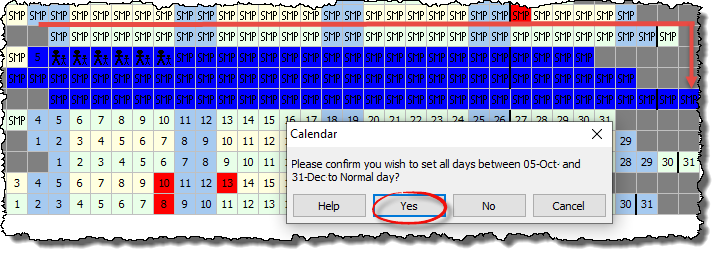

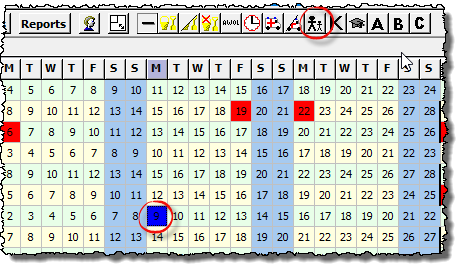

- Click on the day that the SPL is to start, then click on the Parenting leave button

on the toolbar.

on the toolbar.

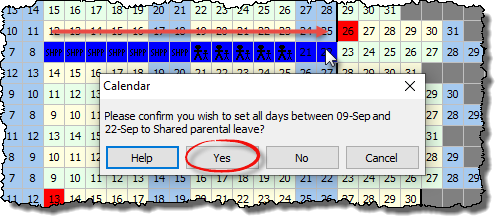

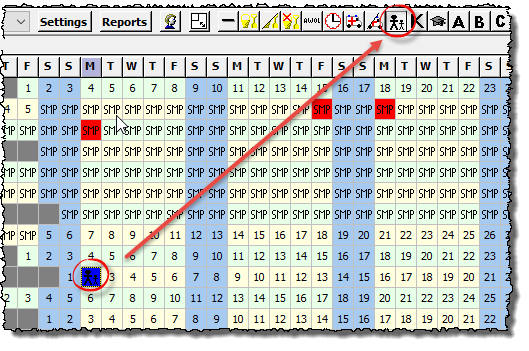

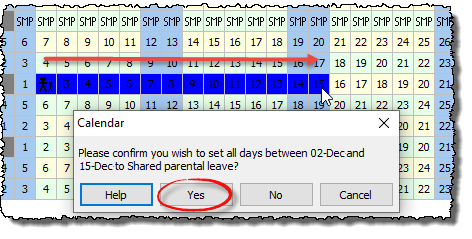

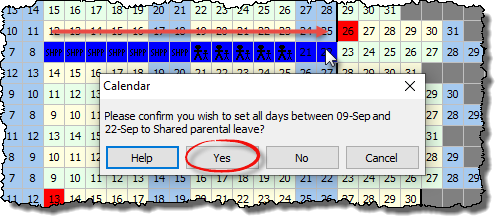

- Click on the first day of SPL again, keep the left mouse key depressed, drag the cursor to the right (and down if applicable) until the cursor covers the last day of SPL, and then release the mouse button. A message will appear asking you to confirm that you wish to set these days to Shared parental leave. Answer ‘Yes‘. Please be aware that ShPP is only payable for complete weeks, so you must ensure that you enter complete weeks (multiples of 7 days) on the calendar.

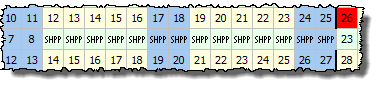

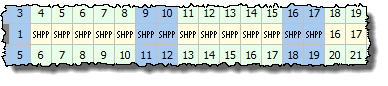

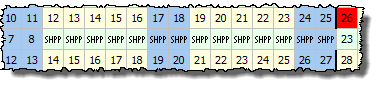

- A series of ‘SHPP’ symbols will appear on the calendar to indicate the days for which ShPP is payable.

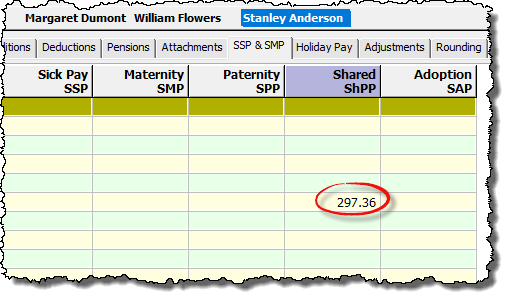

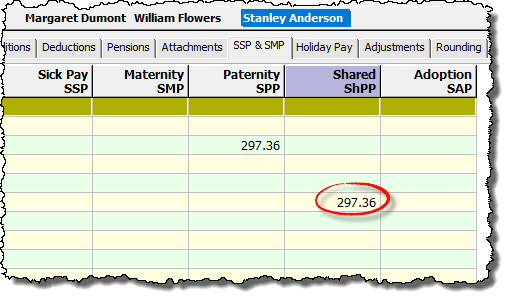

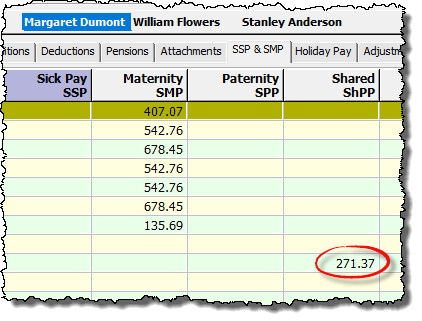

- Click on the ‘Reports‘ button on the calendar and select ‘Parenting‘ if you wish to see details of the ShPP calculation and allocation. ShPP will automatically appear on the ‘Pay Details‘ screen.

B – ShPP for an employee who has already received Statutory Maternity Pay (SMP) and has since returned to work.

- Click ‘Employees‘ then ‘Calendar‘ from the main menu in Payroll Manager, select the applicable employee, and click on the ‘Settings‘ button

- Click on the ‘Parenting‘ tab along the top of the screen, enter the date that the Shared Parental Leave (SPL) is to start for that employee in the right-hand section of the screen (in red, below), and enter the name and National Insurance Number of the employee’s partner. Click ‘OK‘

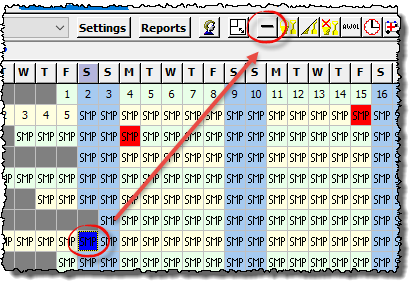

- In some circumstances the employee may have returned to work before the end of their previously set SMP period. If this is the case then you should remove any SMP symbols from the calendar for days following the return to work. To do this, click on the day that the employee returned to work, then click on the ‘Normal day‘

button on the toolbar.

button on the toolbar. Click back on the day that the employee returned to work, keep the left mouse key depressed, drag the cursor the the right (and down if applicable) until the cursor covers the last day that is marked as SMP, and then release the mouse button. A message will appear asking you to confirm that you wish to set these days to a ‘Normal day’. Answer ‘Yes‘.

Click back on the day that the employee returned to work, keep the left mouse key depressed, drag the cursor the the right (and down if applicable) until the cursor covers the last day that is marked as SMP, and then release the mouse button. A message will appear asking you to confirm that you wish to set these days to a ‘Normal day’. Answer ‘Yes‘.

- To set the ShPP, click on the day that the SPL is to start, then click on the Parenting leave button

on the toolbar.

on the toolbar.

- Click on the first day of SPL again, keep the left mouse key depressed, drag the cursor to the right (and down if applicable) until the cursor covers the last day of SPL, and then release the mouse button. A message will appear asking you to confirm that you wish to set these days to Shared parental leave. Answer ‘Yes‘. Please be aware that ShPP is only payable for complete weeks, so you must ensure that you enter complete weeks (multiples of 7 days) on the calendar.

- A series of ‘SHPP’ symbols will appear on the calendar to indicate the days for which ShPP is payable.

- Click on the ‘Reports‘ button on the calendar and select ‘Parenting‘ if you wish to see details of the ShPP calculation and allocation. ShPP will automatically appear on the ‘Pay Details‘ screen.

C – ShPP for an employee who has not taken any SPP/SMP previously.

- Click ‘Employees‘ then ‘Calendar‘ from the main menu in Payroll Manager, select the applicable employee, and click on the ‘Settings‘ button

- Click on the ‘Parenting‘ tab along the top of the screen. Set the ‘Type‘ to either ‘Paternity’ (for fathers) or ‘Maternity (for mothers), and then complete the four date fields on the left hand side of the screen. Enter the date that the Shared Parental Leave (SPL) is to start for that employee in the right-hand section of the screen (in red, below), and enter the name and National Insurance Number of the employee’s partner. Click ‘OK‘

- Click on the day that the SPL is to start, then click on the Parenting leave button

on the toolbar.

on the toolbar.

- Click on the first day of SPL again, keep the left mouse key depressed, drag the cursor to the right (and down if applicable) until the cursor covers the last day of SPL, and then release the mouse button. A message will appear asking you to confirm that you wish to set these days to Shared parental leave. Answer ‘Yes‘. Please be aware that ShPP is only payable for complete weeks, so you must ensure that you enter complete weeks (multiples of 7 days) on the calendar.

- A series of ‘SHPP’ symbols will appear on the calendar to indicate the days for which ShPP is payable.

- Click on the ‘Reports‘ button on the calendar and select ‘Parenting‘ if you wish to see details of the ShPP calculation and allocation. ShPP will automatically appear on the ‘Pay Details‘ screen.