Scottish Earnings Arrestment (EA)

This guide explains what to do in Payroll Manager if a Sheriff Officer in Scotland issues a formal notice to an employer instructing them to implement a Scottish Earnings Arrestment (EA) (sometimes called an ‘Earnings Arrestment Order’, ‘Wage Arrestment Order’ or simply ‘Scottish Arrestment’) in respect of an employee. Moneysoft Payroll Manager has all of the relevant rules and tables for the Earnings Arrestment built in, and so once the relevant details have been entered into the software the amounts to be deducted from an employee in each pay period will be calculated automatically.

How an EA operates

An Earnings Arrestment is a type of Diligence in Scotland, and is one of the procedures that Sheriff Officers can use to recover debts owed to creditors. When a Sheriff Officer arrests the wages of an individual, they serve an Earnings Arrestment Schedule on the employer. This instructs the employer to make deductions from the employee’s pay in each pay period. The calculation of deductions are made according to a prescribed set of tables (see ‘Links’ section at the bottom of this guide).

The EA comes into force on the date that it is received by the employer. It will specify:

- The name of the debtor (the employee).

- A reference, specific to that particular Earnings Arrestment.

- The total amount of debt to be paid and details of whom and when to pay.

The employer should then start making deductions from the employee’s pay as soon as possible, according to a set of tables as prescribed in the regulations, and should continue to do so until the debt is paid. It is likely that a copy of these tables will be issued to the employer as part of the notification process. Payroll Manager has these tables built-in, and so can perform the necessary calculations automatically.

How to enter the details of the EA in Payroll Manager

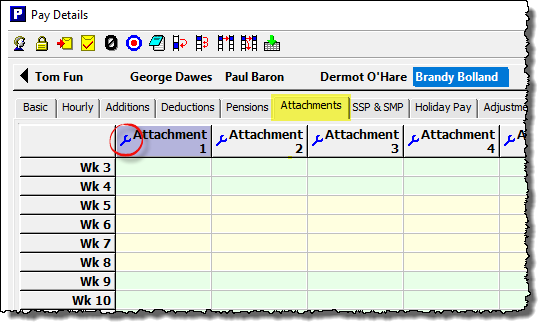

1) Select the appropriate employee on the ‘Pay Details‘ screen.

2) Click on the ‘Attachments‘ tab, then click on the (blue spanner) ‘Settings‘ button in the next available column.

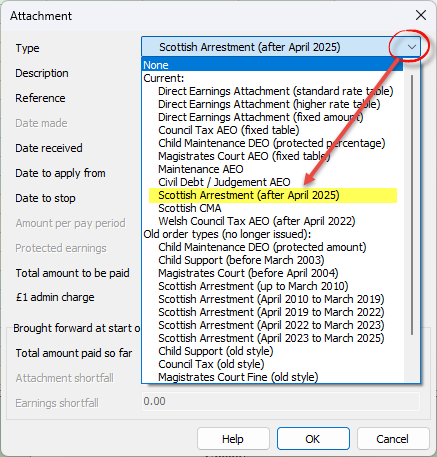

3) Select the most recent ‘Scottish Arrestment‘ type from the drop-down list:

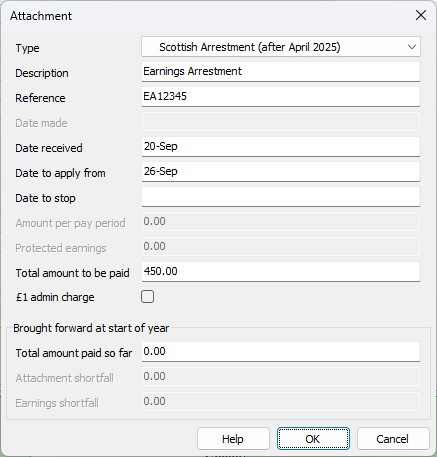

4) Complete the other fields on this screen as per the instructions below:

– Description: – Enter a description for this particular attachment – this can be whatever you like (e.g. ‘Earnings Arrestment’) and is only used as a column ‘label’ on the ‘Pay Details’ screen for that particular attachment, and also appears on the employee payslip.

– Reference: Enter the reference number specific to that particular order.

– Date received: Enter the date that the the order was received by the employer.

– Date to apply from: Enter the next pay date for that particular employee. You should make sure that the date that you enter is for a pay period for which the employee has not yet been paid.

– Date to stop: Leave this field blank. Payroll Manager will automatically stop making deductions once the ‘Total Amount to be paid’ (see below) as been reached. If the Sheriff Officer later contacts the employer to request that deductions are should be stopped for any reason, then the relevant date can be entered here.

– Amount per pay period: This field will be greyed out in all cases as it is not applicable to EA calculations which are made by way of ‘fixed tables’ ,built into Payroll Manager.

– Protected earnings: This box will be greyed-out in all cases, as it does not apply to Earnings Arrestments.

– Total amount to be paid: Enter the ‘Outstanding Amount‘ of debt to be recovered, as specified on the documentation issued by the Sheriff Officer. Payroll Manager will automatically stop calculating deductions once this limit has been reached.

– £1 admin charge: Earnings Arrestment rules state that the employer is allowed to deduct £1 for each pay period in which an EA deduction is made if they wish, to cover their own admin costs. This is optional – tick/untick the box accordingly.

– Brought forward at start of year – Total amount paid so far: this field is for situations where you are using Payroll Manager for the first time for a particular employer, and an employee has a EA which has been in operation before the start of the tax year, or if you are starting to use Payroll Manager mid way through the tax year, having used other software previously. The box allows you to enter the amount that has already been paid by the employee, effectively reducing the ongoing balance.

Click ‘OK‘ when you have finished entering information on this screen.

How EA deductions are calculated

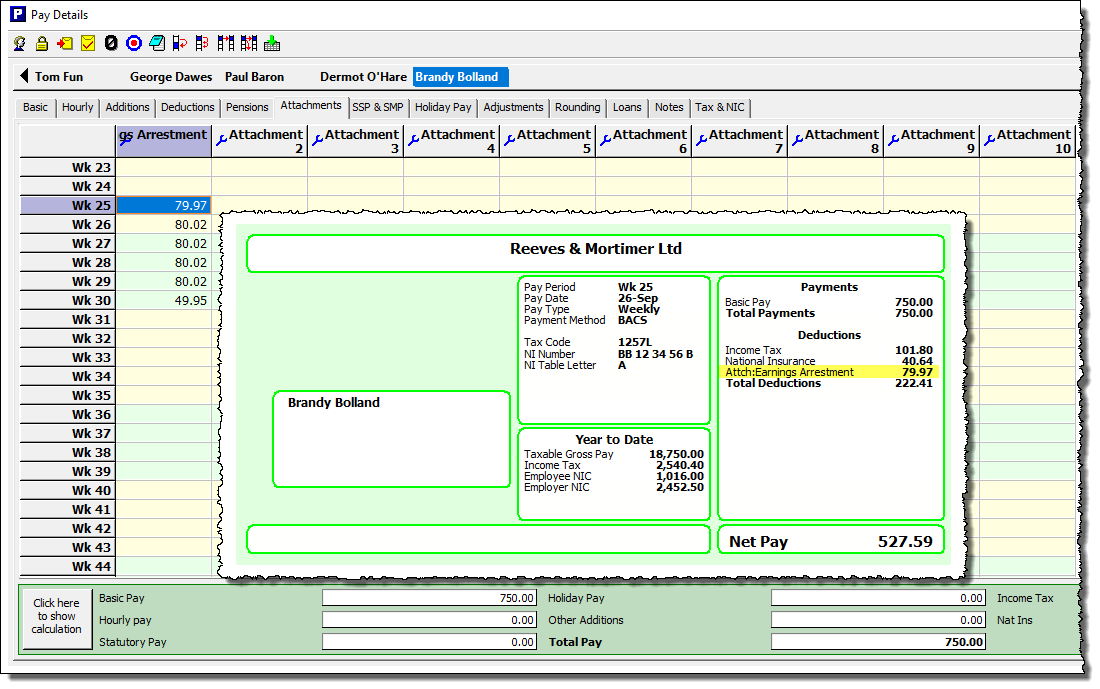

Payroll Manager automatically calculates the amount to be deducted from the employee each pay period, according to the rules and deduction tables specified by the regulations.. These rules and tables are built into the software. The calculated deduction amounts are then shown in the ‘Attachments‘ column of the ‘Pay Details‘ screen and are also itemised on the employee payslip.

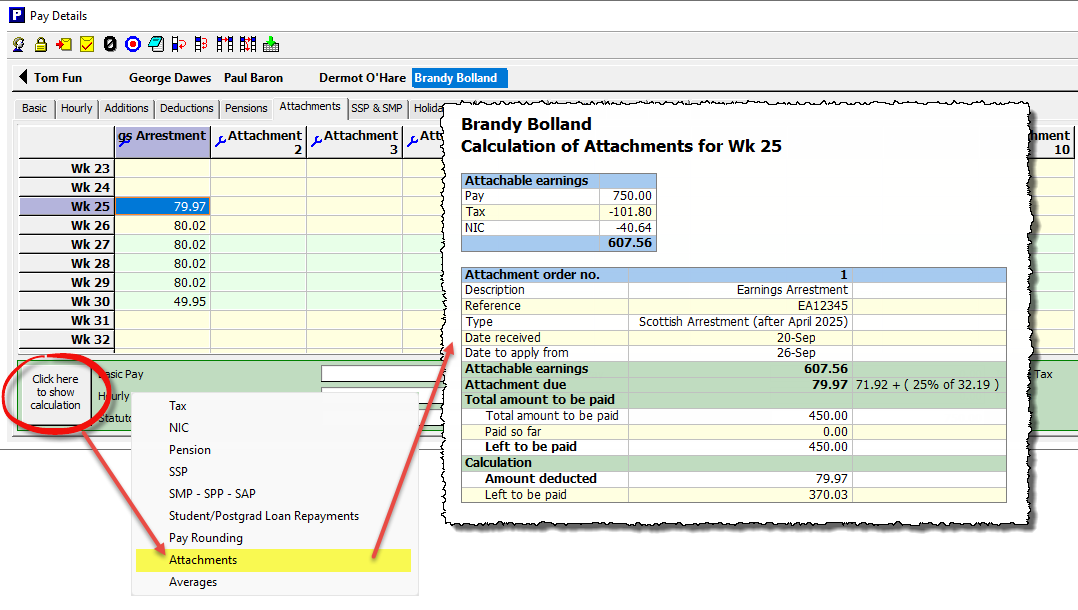

If you wish to see a full breakdown of how Payroll Manager has calculated the EA deduction then click the button marked ‘Click here to show calculation‘ towards the bottom-left of the Pay Details screen, and select ‘Attachments‘.

Note that the actual deduction is based on the ‘Attachable Earnings‘, which is not the same as the gross pay, but instead is the employee’s pay after the deduction of tax, national insurance, student/postgraduate loans, pension contributions and statutory parenting payments such as SMP.

Ending or editing a EA – changes of circumstances

Payroll Manager will continue to calculate EA deductions until the ‘Total amount to be paid’ has been reached, or if an employee leaves employment. If the employer is contacted by the Sheriff Officer asking them to end the EA then this can be done as per the instructions below:

1) Click on the (blue spanner) ‘Settings‘ button in the column relating to the EA (i.e. the one that is ‘ending’).

2) Enter a ‘Date to stop‘ and click ‘OK‘. The ‘Date to stop’ should be the pay date of the last period for which you wish the EA to operate. Make sure that the date you enter is NOT in a pay period that has already been paid.

The Statutory Deductions Tables (as laid down by Schedule 2 of the Debtors (Scotland) Act 1987) may from time to time be varied by order of the Lord Advocate. If an employer is sent a copy of the new Statutory Deductions Tables then they should NOT amend any existing Earnings Arrestments that are in place. Instead they should follow steps 1 and 2 above to ‘end’ the original EA, and then set up a brand new EA and specify the new arrestment ‘Type’. The most recent version of the tables came into force on 6 April 2025. Payroll Manager is updated in advance so the the relevant Scottish Arrestment tables will always be available to select.

Reports in Payroll Manager

Payroll Manager has a number of reports available to help with the administration of EA.

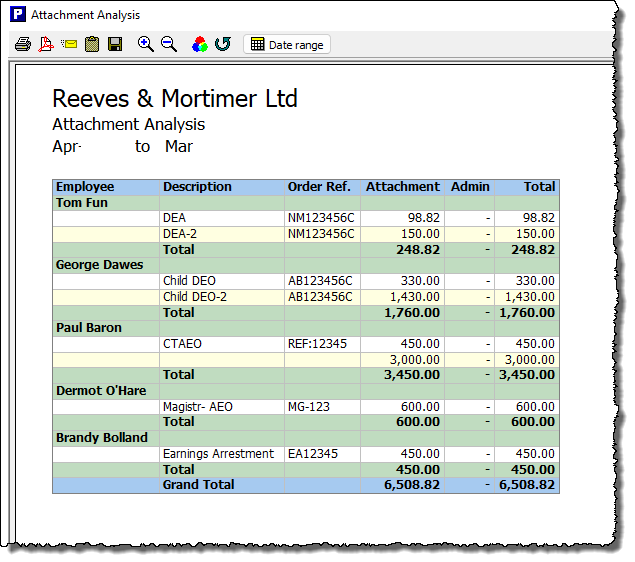

Click ‘Analysis‘ then ‘Attachments‘ from the main menu in Payroll Manager to view a report which gives the details of all attachments in operation for each employee.

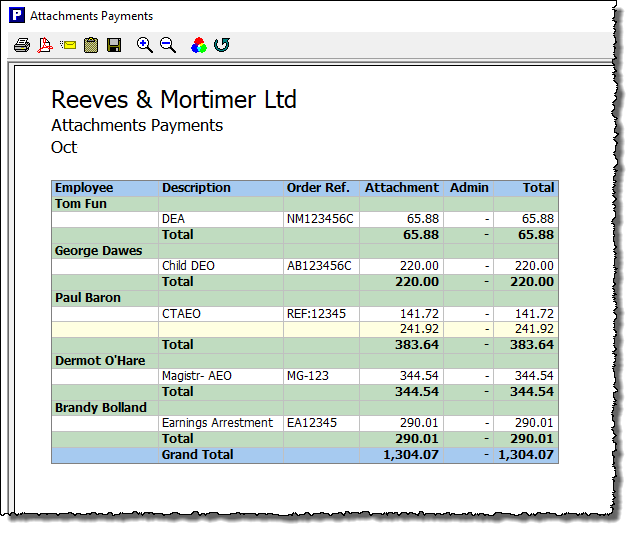

Click ‘Pay‘ then ‘Payments‘ and select ‘Attachments report’ to see a list of attachment payments due in any one particular pay period.

Making payments to the creditor

Payment should be made to the creditor named on the arrestment schedule. The documentation provided by the Sheriff Officer when issuing the EA will give details of how and when to make such payments.

FAQ

If an employee has a number of different attachments in operation at the same time, which one takes priority? – Different attachment orders take priority over each other according to their type (e.g. Scottish Arrestment, Child Maintenance, Council Tax, DEA etc) and the date that they were issued. Payroll Manager has all of the rules regarding priority built-in, and will automatically apply attachments in the correct priority order.

Links

Tables – The Diligence against Earnings (Variation) (Scotland) Regulations 2024