Salary Sacrifice Pension Schemes

A ‘Salary Sacrifice’ pension is where employees agree to give up part of their salary in return for pension contributions so that both the employer and employees pay lower National Insurance contributions. Employers set up a salary sacrifice arrangement by changing the terms of their employee’s employment contract .Employers using salary sacrifice should take specialist employment advice on how best to vary the employment contract.

It is very important that you understand the implications and limitations of salary sacrifice pension arrangements and how these can affect the employee (including minimum wage implications and an employee’s entitlement to statutory payments). Moneysoft is not able to offer advice in this area, and we strongly recommend that you read the guidance provided by your own pension scheme provider before proceeding further. The ‘links’ section at the bottom of this guide provides links to some of the main pension providers support pages. In most cases you will need to make changes to your pension scheme setup on your scheme providers website before using salary sacrifice (e.g. NEST Pensions require that you set up a new ‘group’ for salary sacrifice employees).

This guide shows how to set up a salary sacrifice pension scheme in Payroll Manager. If you have an existing (non salary sacrifice) pension scheme already set up in Payroll Manager and wish to move employees to a new salary sacrifice arrangement then start from step 1 of this guide. If you are setting up a pension scheme for the first time in Payroll Manager, then you can ignore steps 1 and 2 and go straight to step 3 of this guide.

1. Cease employee / employer contributions to the ‘old’ pension scheme:

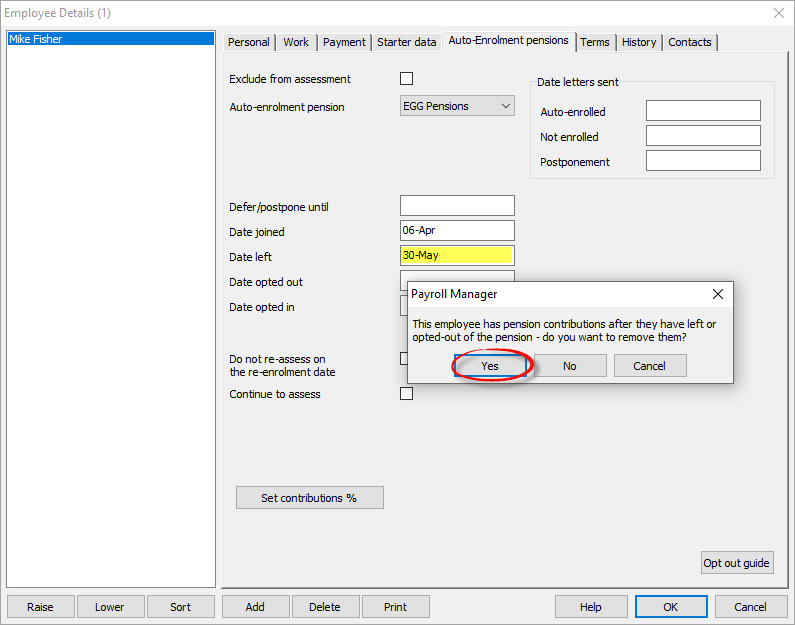

– From the main menu in Payroll Manager, click ‘Employees‘ then ‘Employee Details‘, then click on the ‘Auto-Enrolment pensions‘ tab, and select the relevant employee.

– Enter a date into the ‘Date left‘ field. This should be the last date that you wish contributions to be made for that particular pension scheme. The software will identify if there are pension contributions/percentages entered after this date, and will offer to remove them. Answer ‘Yes‘ when prompted to do so, then click ‘OK‘. Repeat this process for each applicable employee.

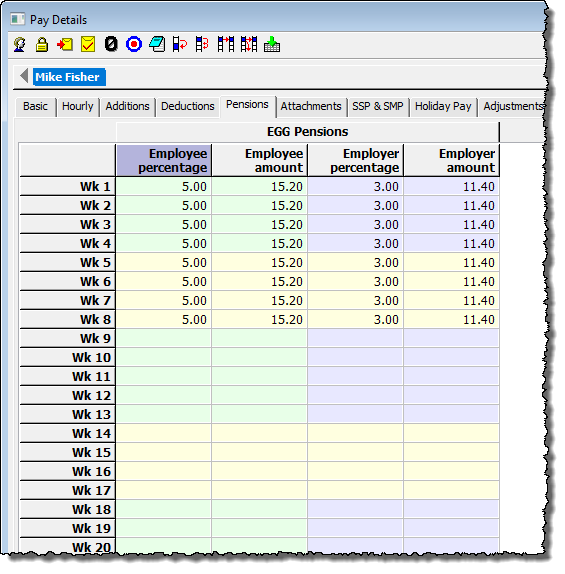

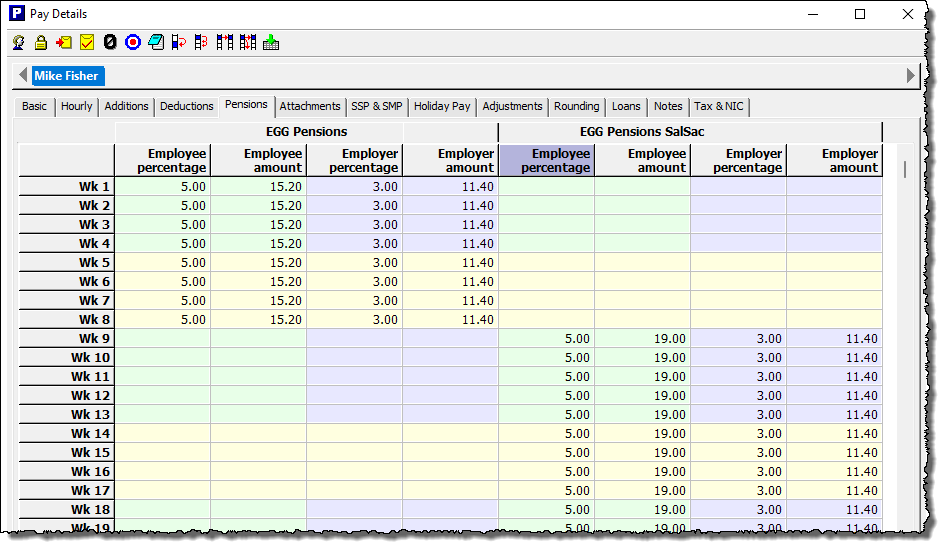

– Go to the ‘Pay Details‘ screen, click on the ‘Pensions‘ tab and check that contributions/percentages cease in the correct pay period (see example, below). Make manual adjustments on this screen if necessary.

2. Report the final contributions to the ‘old’ pension scheme

It is very important that you finish everything that you need to do with regards to reporting /uploading the final pension contribution details to the ‘old’ pension scheme, before proceeding to step 3 of this guide.

3. Add details of the ‘new’ pension scheme to Payroll Manager

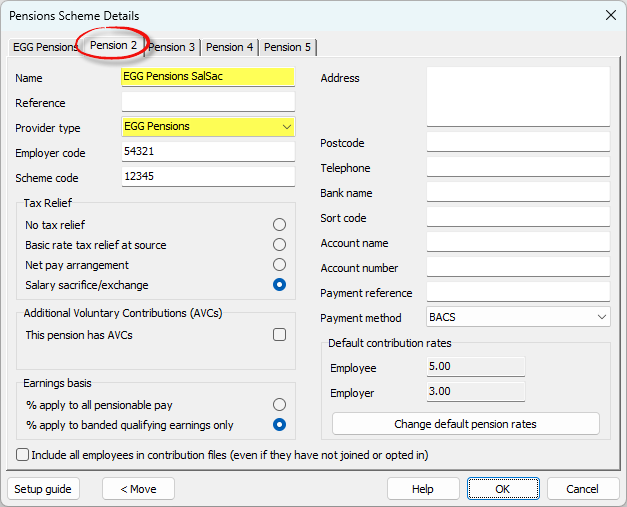

If you have not already set up the details of the new pension scheme then click ‘Pensions‘ then ‘Pension scheme details‘ from the main menu in Payroll Manager.

– Click on the next available unused tab along the top of the screen (in this example, the tab marked ‘Pension 2’), and proceed to enter the details of the ‘new’ pension scheme. We have specific guides which help with this – see Pension Set Up Guides for more details. Click ‘OK‘ when you have finished.

4. Add employee(s) to the new pension scheme and set contributions

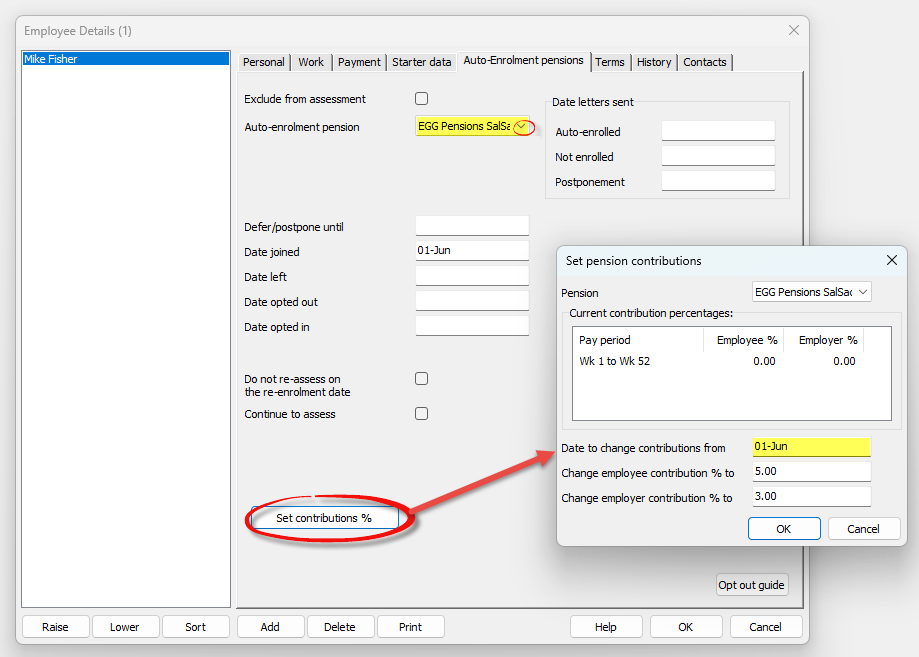

– Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, then click on the ‘Auto-Enrolment pensions‘ tab, and select the relevant employee.

– Select the new ‘Auto-enrolment pension’ from the drop-down list (i.e. the scheme that you set up as a ‘salary sacrifice’ pension in step 3).

– For some pension schemes you will need to provide extra employee specific information (e.g. the ‘Group’ for NEST Pensions) on this screen.

– Remove any dates which may currently be entered in the ‘Date joined’, ‘Date left’, ‘Date opted out’ and ‘Date opted in’ fields (which are those which were used for the ‘old’ pension scheme, if applicable). Do not edit or remove any dates that are entered in the ‘Date letters sent’ section at the top-right of the screen.

– Enter a new ‘Date joined‘ (which is the date from which you wish contributions to be made to the new pension scheme).

– Click on the ‘Set contributions %‘ button to set the relevant contribution percentages. You should specify both the employee % and the employer %, then click ‘OK‘ and ‘OK‘ again when you have finished.

Note: Because the pension has been set to ‘salary sacrifice’ the sum of the calculated employee and employer contribution amounts will be reported to the pension provider as an ’employer’ contribution only e.g. if you specify and employee contribution of 5% an employer contribution of 3% then the reported employer contribution will be the addition of these two amounts (i.e. 8%).

– Repeat these steps for each applicable employee.

Go to the ‘Pay Details‘ screen, then click on the ‘Pensions‘ tab to check that the percentages have been entered correctly.

Salary Sacrifice pension contributions are taken off the employee’s pay before the calculation of tax and National Insurance.

5. Reporting contributions to your pension provider

You will now be able to produce ‘upload files’ (enrolment and/or contribution files) for the ‘new’ pension scheme. If you have some employees in a salary sacrifice scheme and others in a non-salary sacrifice scheme then you may need to produce two upload files per pay period to report pension contribution amounts to your scheme provider.

Links

Salary sacrifice for employers – GOV.UK

NEST Pensions – Salary Sacrifice

NOW: Pensions – Salary Sacrifice Arrangements

The People’s Pension – Salary Sacrifice