Guide to running the payroll

This guide is designed to be used as a ‘checklist’ of procedures to be followed each time that you run your payroll. You should follow these procedures in the order suggested to ensure that the RTI data sent to HMRC is accurate and complete. Please note that this is not a definitive list, but a ‘standard’ guide for day-to-day payroll. For more detailed guides on each specific task please refer to the Support section of our website.

1) – Enter the details of new starters and leavers

Make sure that you have entered the details of all employees that have joined or have left your employment since the previous pay period. This starter and leaver information is sent to HMRC as part of your next RTI submission.

- To add new employees click ‘Employees’ from the main menu in Payroll Manager, then click ‘Add new Employee’.

- To mark someone as a leaver, click ‘Employees’ from the main menu in Payroll Manager, then click ‘Employee Details’ and select the ‘Work’ tab. Enter the employee’s leaving date. Also ensure that you remove any pay that may be entered on the ‘Pay Details’ screen for this employee in pay periods after their leaving date.

2) – Enter all pay details

Make sure that you have entered the pay details of each employee that is due to be paid in this period. Click ‘Pay – Pay Details’ to add or edit pay.

3) – Enter any statutory pay that may be due

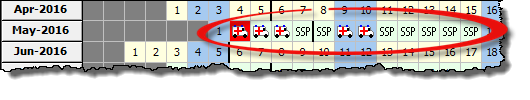

Sick pay, Maternity Pay and Paternity pay is all entered on the ‘Calendar’ screen. If you have employees that are due to receive statutory pay then check that you have entered up-to-date information by clicking ‘Employees – Calendar’ from the menu.

4) – Auto Enrolment Pensions

If your company has an auto enrolment pension scheme then you will need to run an ‘Assessment’ at this point, otherwise move on to the next step

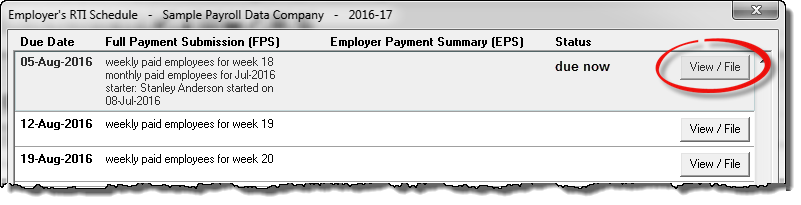

5) – Produce and file the RTI report using the Employer’s RTI schedule

Click on the ![]() button to show the ‘Employers RTI Schedule’ then click on relevant period.

button to show the ‘Employers RTI Schedule’ then click on relevant period.

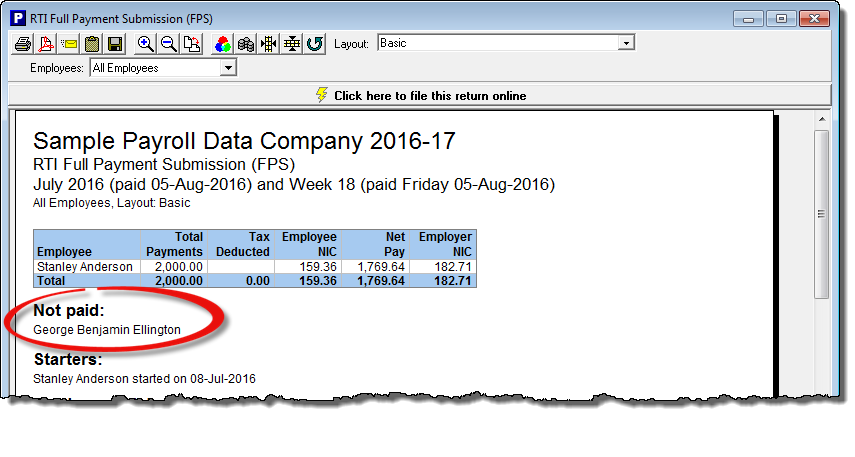

Check the RTI Full Payment Submission (FPS) report which gives details of all employees that are being paid in this period. This report also shows details of employees that are NOT being paid in this period, which serves as ‘double-check’ that you have entered each employees pay correctly.

Click on the button ‘Click here to file this return online’ to file the FPS return to HMRC.

6) – Produce the employees payslips

Click ‘Pay – Employees Payslips’ and choose the employees that you wish to produce payslips for. Click the ‘All’ button to select all employees. You can then print or email the payslips as appropriate.

7) – Pay the employees

Click ‘Pay – Payments – Payments Summary’ to produce a report showing how much each employee is to be paid. You can then make arrangements to pay each employee.

8) – Backup your data

We recommend that you make backups of your payroll data on a regular basis – it is good practice to do this each time that you run your payroll. Click ‘File – Utilities – Backup/Restore’ to see the various backup options.