Outstanding RTI Submissions – HMRC technical problems

Occasionally HMRC experience technical problems with their online filing systems and you may find that there is a delay between the submission of your RTI return and the response from HMRC.

You should contact HMRC Online Services on 0300 200 3600 in the first instance to ask them how to proceed.

In the majority of cases HMRC may instruct you to wait for their response to be sent, in which case you should simply wait a day or two before checking again.

If HMRC prove to be unhelpful in this matter then you may choose to resubmit the return by following the steps below:

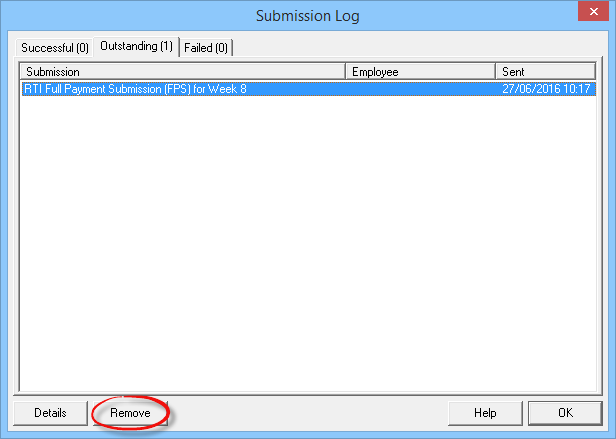

- From the main menu in Payroll Manager click ‘Tools’ then ‘Online Filing’ then ‘Submission Log’.

- Click on the ‘Outstanding’ tab along the top of the window.

- Single click on the outstanding submission to highlight it, and then click the ‘Remove’ button at the bottom of the window.

- Answer ‘Yes’ to the question “Are you sure you want to remove this outstanding submission”, then click ‘OK’.

- If you know that HMRC have actually already received the original submission (e.g. HMRC systems show the correct amounts being due to them) then there is nothing further that you need to do, and you do not need to resubmit the return.

- If you choose to resubmit the return then click ‘Pay’ then ‘Employer’s RTI schedule’ from the main menu in Payroll Manager and resubmit the RTI return.

Please be aware that if you choose to resubmit your return after the pay date then the return may be marked as being ‘late’. You should contact HMRC for reassurances on this matter before resubmitting.