Redundancy and Termination payments

This guide shows how to enter redundancy / termination payments (i.e. payments made when an employee’s employment is terminated) into Payroll Manager. It does NOT cover ‘Payments in Lieu of Notice (PILONs)’, which are treated the same as any other pay (i.e they are subject to tax and NIC).

HMRC rules state that termination payments are entirely free of employee and employer class 1 NIC, and also that the first £30,000 of the payment is free of tax.

For larger termination payments, that part which is above the £30,000 threshold is liable to tax (and from 6 April 2020 is also liable to Class 1A employer NIC).

Calculating the amount of the termination payment

The GOV.UK website gives detailed information about how to proceed when you need to make staff redundant, including a ‘Statutory Redundancy Pay’ calculator which will help you to determine the amount of redundancy pay that employee(s) are entitled to receive (Payroll Manager is not able to calculate redundancy pay as it is based on a number of variables, some of which are not stored within the payroll data).

You should consult the Making Staff Redundant page of GOV.UK to determine the rules and amounts that will be paid before proceeding with the rest of this guide.

Entering the termination payment into Payroll Manager

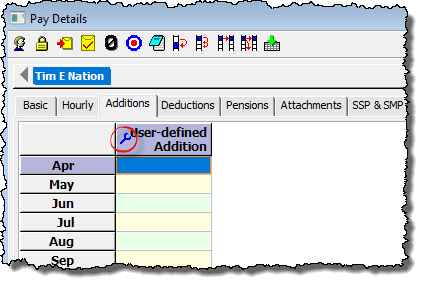

1. Create a new column to enter the payment. Click on the ‘Additions‘ tab on the ‘Pay Details‘ screen, then click on the blue ‘spanner‘ symbol in any of the available column headings.

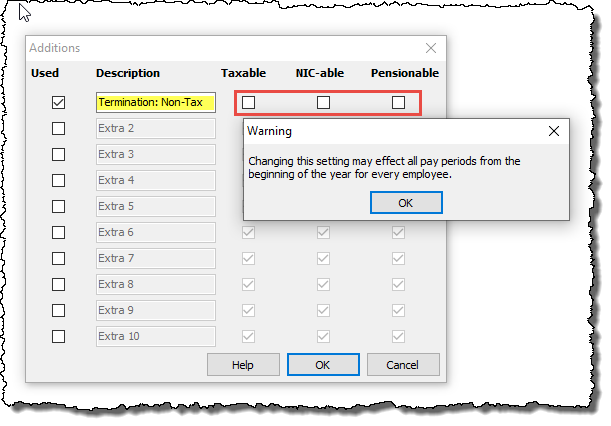

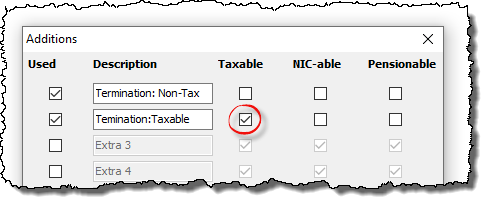

Tick the ‘used‘ box in the next available row, add a suitable description (e.g. Termination: Non-Tax), and make sure that the ‘Taxable’, ‘NIC-able’ and ‘Pensionable’ boxes are all un-ticked. You may see a warning message when doing this. As you are creating a brand new column that has not been used before then it is safe to click ‘OK‘. You have now created a new column.

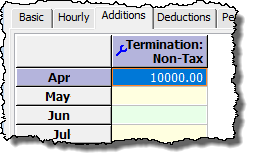

2. If the termination payment is £30,000 or less then enter the amount in the column that you have just created and ignore steps 3 to 7 below.

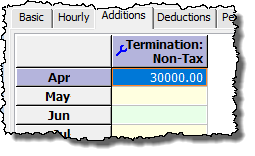

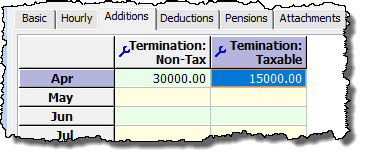

3. If the payment amount is more than £30,000 then enter the first £30,000 in the column that you have just created then move on to step 4 below.

4. Create a further additions column (by clicking on the blue spanner as before). Add a suitable description (e.g. ‘Termination: Taxable’) and make this addition Taxable, but not NICable or pensionable, Click ‘OK‘.

5. Enter the balance of the termination payment (i.e. the amount which exceeds £30,000) into this new column.

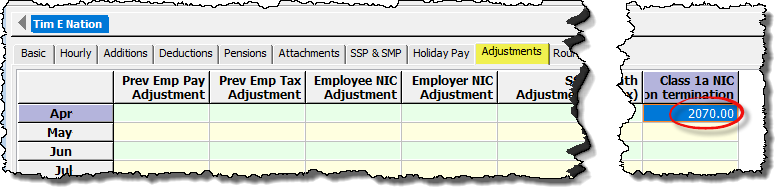

6. Work out the Class 1A NIC due on the termination payment. This is 13.8% of the amount that exceeds £30,000. e.g. if the total termination payment was £45,000, then the Class 1A NIC is £15,000 * 13.8% = £2070. (Note: the rate of Class 1A NIC rises to 15.00% from April 2025).

7. Click on the ‘Adjustments‘ tab on the ‘Pay Details‘ screen and enter the amount that you have calculated in step 6 above in the ‘Class 1A NIC on termination‘ column. The Class 1A NIC amount will be added to the employer tax and NIC liabilty for that particular tax period, and will show as an item on the ‘Pay – Employers Summary for tax period‘ report.

Links

GOV.UK Guide – Making Staff Redundant