Re-enrolment into a workplace pension scheme

Re-enrolment is the process where the employer must re-enrol certain staff into a workplace pension scheme. This applies to staff who were members previously, but chose to opt-out or cease active membership of that scheme.

An employer must choose a re-enrolment date that falls in the three months either side of the third anniversary of their staging date or duties start date (the ‘re-enrolment window’). The date can be any day of the month that the employer chooses, so for employers whose duties started on 1 October 2015, they could choose to re-enrol on any day between 1 July and 31 December 2018. This gives them a six-month window in which they can choose a re-enrolment date, but they must have the same re-enrolment date for all staff they have to re-enrol.

An assessment should be performed on the chosen re-enrolment date, and any workers identified as being ‘eligible jobholders’ at that point should be enrolled back into the pension scheme as a result *.

How Payroll Manager handles re-enrolment

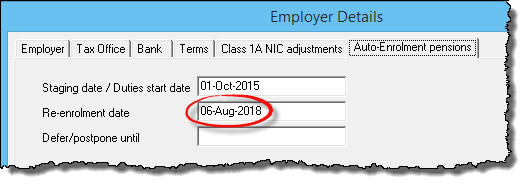

Enter the re-enrolment date

Once you have decided on a suitable re-enrolment date click ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager, select the ‘Auto-Enrolment pensions‘ tab, and enter the relevant date (replacing any date that may already be present).

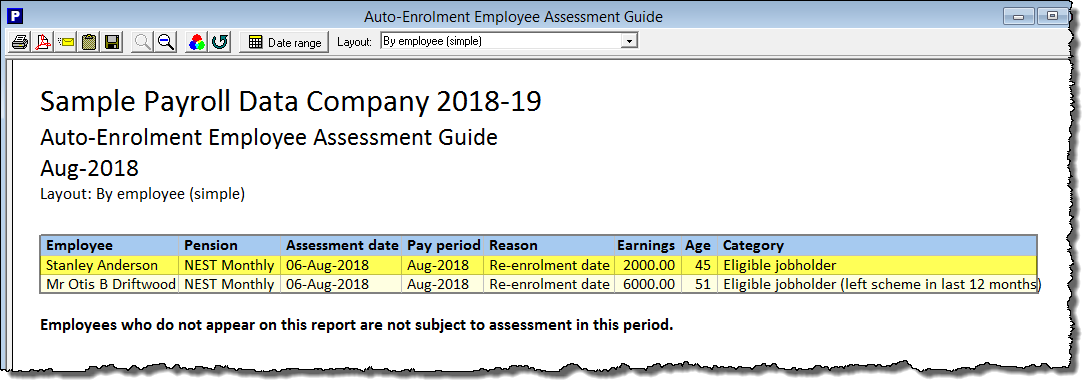

Assessment

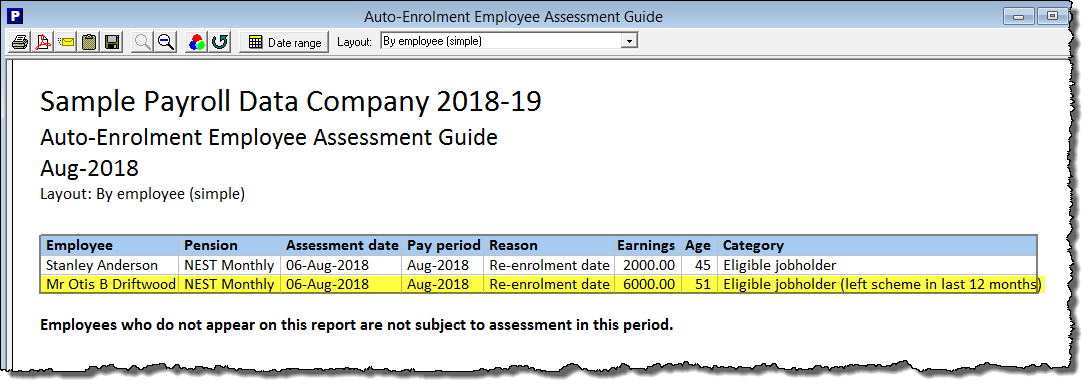

When you run an assessment (‘Pensions‘ then ‘Assessment‘ from the main menu in Payroll Manager) on the re-enrolment date, those workers that were previously members of the workplace pension scheme but have since ‘opted out’ or ‘left’ the pension scheme will be assessed to establish whether or not they should be re-enrolled. Those appearing on the assessment report as ‘Eligible jobholders’ should be enrolled back into the scheme at that point. (Note: If a worker left or opted out of the pension scheme less than 12 months before the re-enrolment date then the employer can choose whether or not they wish to re-enrol them at this point. Please see the section headed ‘Exceptions’ towards the bottom of this guide for more details).

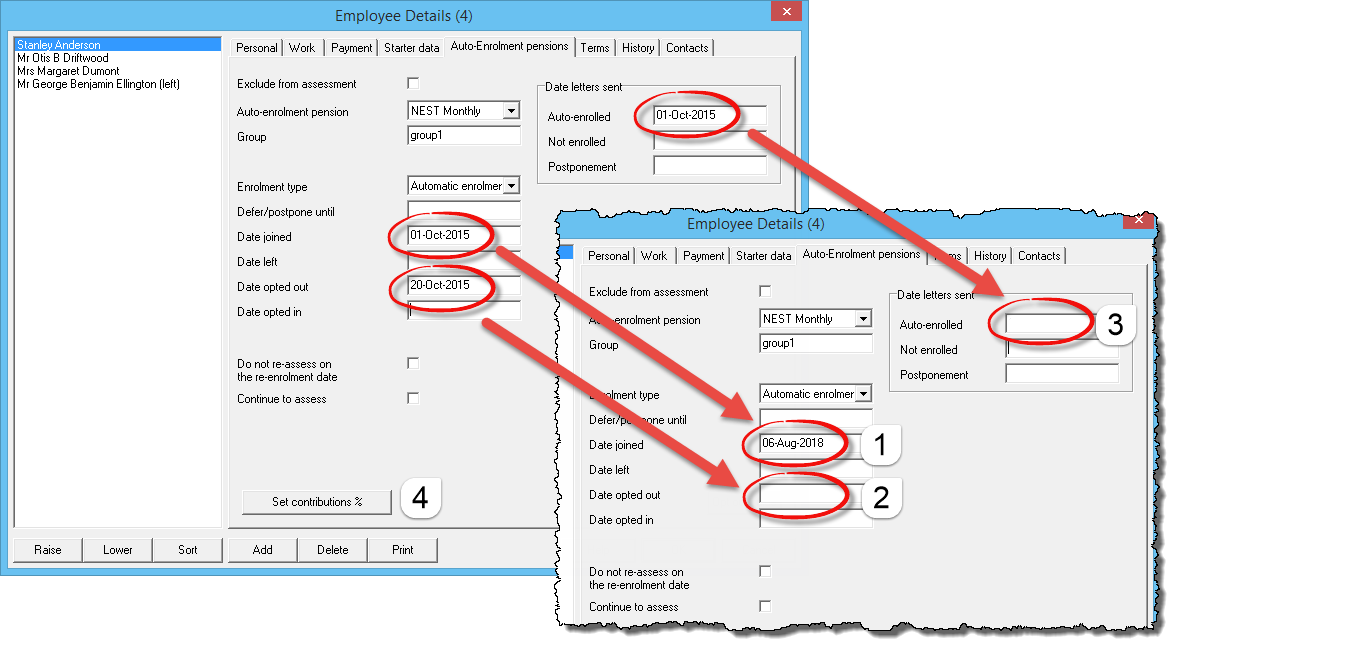

Adding a worker back into the pension scheme.

Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, select the ‘Auto-Enrolment pensions‘ tab, and select the relevant employee. Edit the information on this screen as follows:

- Replace the original ‘Date joined’ with the new date that the employee is joining the pension following re-assessment.

- Remove the ‘Date opted out’ (or ‘date left’ if the employee left the pension scheme outside of the ‘opt-out’ period).

- Remove the ‘Auto-enrolled’ letter date sent (if present).

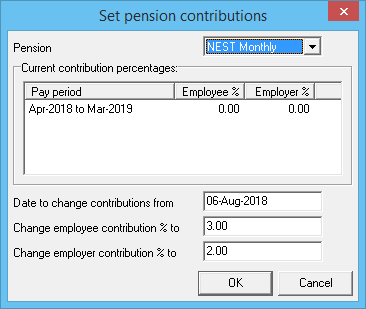

- Click on the button marked ‘Set contributions %‘, set the appropriate pension deductions, and click ‘OK‘.

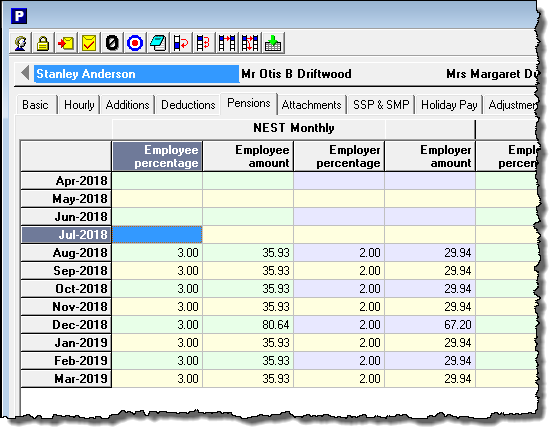

Go to the ‘Pay Details‘ screen, click on the ‘Pensions‘ tab to check that you have set the contribution amounts correctly.

Communicate with the employee(s)

Letters should be sent to those workers who are joining the pension scheme following re-enrolment. Some pension companies will handle this for you. If you wish to produce these letters yourself click ‘Pensions‘ then ‘Letters‘ then ‘Enrolled‘ and select the relevant employee(s). There is not a separate template to use when re-enrolling an employee, and so the format of this letter is identical to the one used when they originally joined the pension scheme. There is no requirement to produce letters for workers that are not joining the scheme following the re-enrolment procedure.

Telling the pension provider

The process of re-enrolment is the same as it is for auto enrolling your workers. Once you’ve completed the assessment for re-enrolment, identified any eligible jobholders and added these details in Payroll Manager all you need to do is follow the same steps you normally take when you enrol someone into your pension scheme for the first time.

* Exceptions

In certain circumstances an employer can choose not to enrol a worker into the pension scheme at the re-enrolment date, even though the assessment may have identified them as an ‘eligible jobholder’. There is no legal requirement to re-enrol workers who:

- have given in their notice to end their employment with you.

- have been given notice of dismissal by you.

- have left or opted out of the pension scheme during the 12 month period prior to the re-enrolment date, although you can include them if you want to. Such employees will appear on the Assessment report with a category of ‘Eligible jobholder (left scheme in last 12 months)‘.

Re-declaration of compliance

You must complete a ‘Re-declaration of compliance’ with The Pensions Regulator (TPR) within 5 months of the opening of your re-enrolment window, regardless of whether or not you have re-enrolled any workers into your pension scheme. This procedure is done independently of Payroll Manager – for more information please see The Pensions Regulator: Re-declaration of compliance.

Links

The Pensions Regulator (TPR): Re-enrolment guide

NEST: Managing your three year re-enrolment duties