Statutory Maternity Pay (SMP)

Overview

This guide is designed to assist you when processing periods of maternity leave for your employees.

SMP is paid to an employee by their employer, it is payable for up to 39 weeks, although the employee is entitled to a maximum of 52 weeks leave.

Payroll Manager will automatically calculate if an employee is entitled to SMP – this is based on how long they have worked for the employer and how much they are paid. As a rough guide their average weekly pay should be above £123 in 2024-25 (£123 in 2023-24), and they should have worked for you 26 weeks prior to the qualifying week (the qualifying week is 15 weeks prior to the expected date of birth).

SMP is payable at 90% of the employee’s average weekly pay for 6 weeks and then at a rate of £184.03 in 2024-25 ( £172.48 in 2023-24 ), or 90% of the average weekly wage whichever is lower.

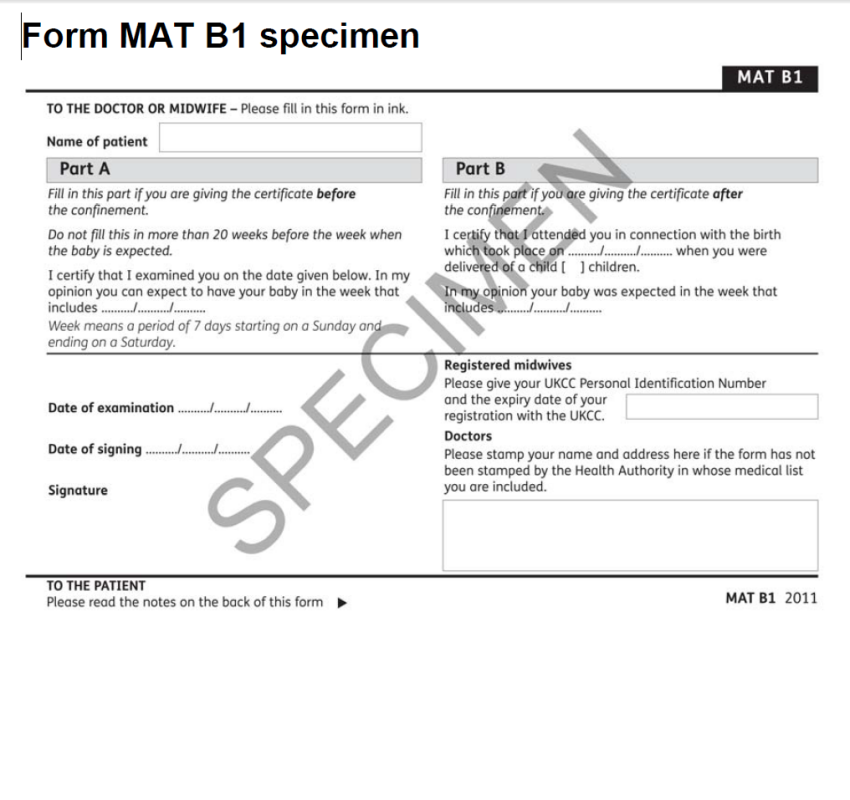

Your employee should inform you of the date they wish their leave to begin and how many weeks of maternity leave that they intend to take. They should also provide you with medical evidence of their pregnancy, this would normally take the form of a MAT B1 form (typically issued around the 20th week of pregnancy).

Entering SMP into Payroll Manager

SMP is recorded on the Calendar screen within Payroll Manager (click on the

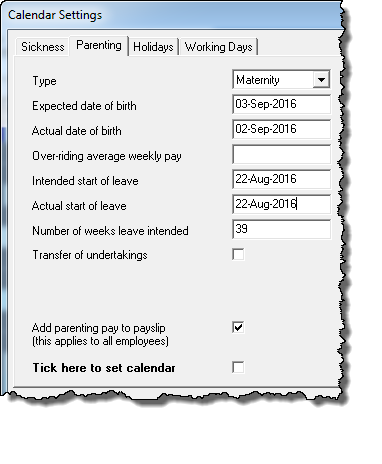

SMP is recorded on the Calendar screen within Payroll Manager (click on the ![]() button). From the calendar screen select the appropriate employee, then click the ‘Settings’ button and then ‘Parenting’ and select the type, in this case ‘Maternity’

button). From the calendar screen select the appropriate employee, then click the ‘Settings’ button and then ‘Parenting’ and select the type, in this case ‘Maternity’

Enter the ‘Expected date of birth’ (from the MAT B1 form)

‘Actual date of birth’ would normally be left blank unless already known

‘Over-riding average weekly pay’ would normally be left blank (occasionally you may need to enter a figure in this box, for example if there is insufficient payment history)

Enter the ‘Intended start of leave’ and ‘Actual start of leave’

You will also need to enter the ‘number of weeks leave’ the employee intends to take (typically 39).

‘Transfer of undertakings’ would normally be left un-ticked (unless the employee is subject to the “Transfer of Undertakings”/”TUPE” regulations)

Tick the box marked ‘Add parenting pay to payslip’

Tick the box marked ‘Tick here to set calendar’ and then click ‘OK’

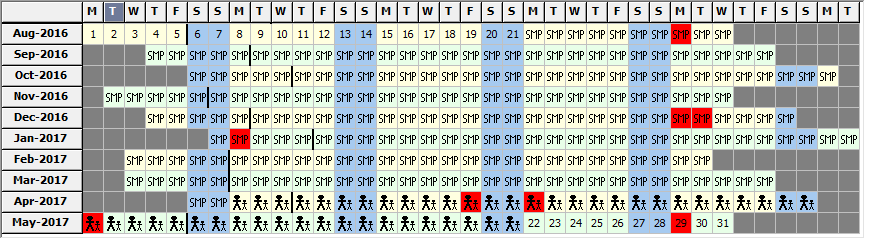

If SMP is due, the calendar will show a series of ![]() symbols for the applicable dates.

symbols for the applicable dates.

If no SMP is due, or if the pay period falls outside of the current tax year, the ![]() symbol is displayed.

symbol is displayed.

SMP reporting

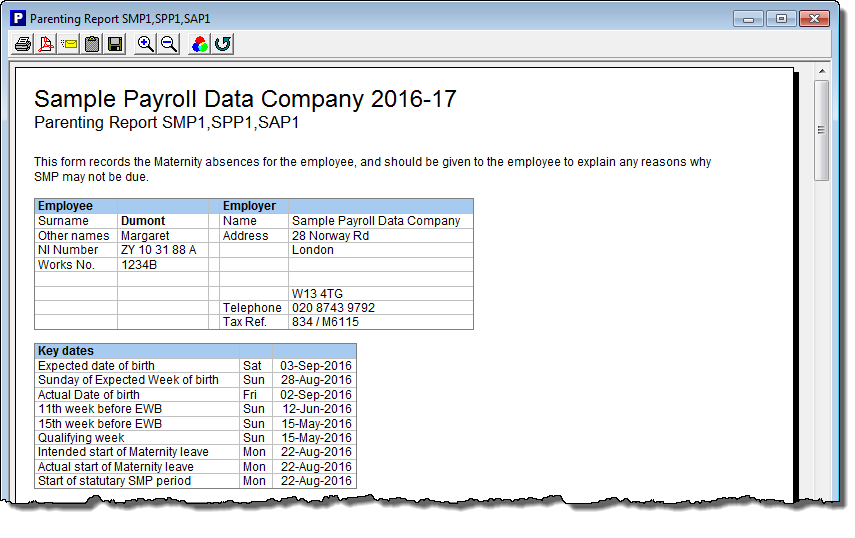

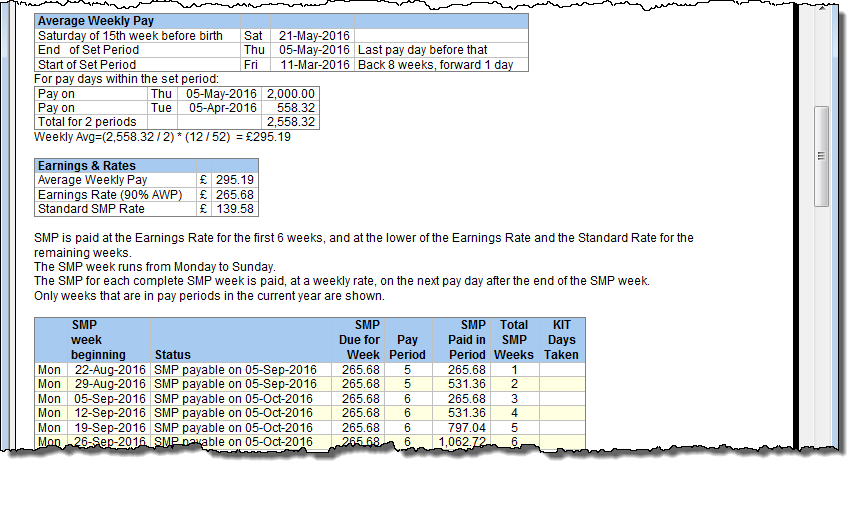

Click on the ‘Reports’ button on the calendar screen and then select ‘Parenting’. This reports shows the keys dates used in the calculation of SMP and how much the employee will receive. If your employee is not entitled to maternity pay this report will explain why, and the report itself can be given to the employee as an explanation.

The report also shows how the average weekly pay is calculated and the employee’s entitlement for each pay period. SMP is a weekly entitlement. For employees paid on a monthly basis Payroll Manager allocates each complete week of SMP into the relevant month.

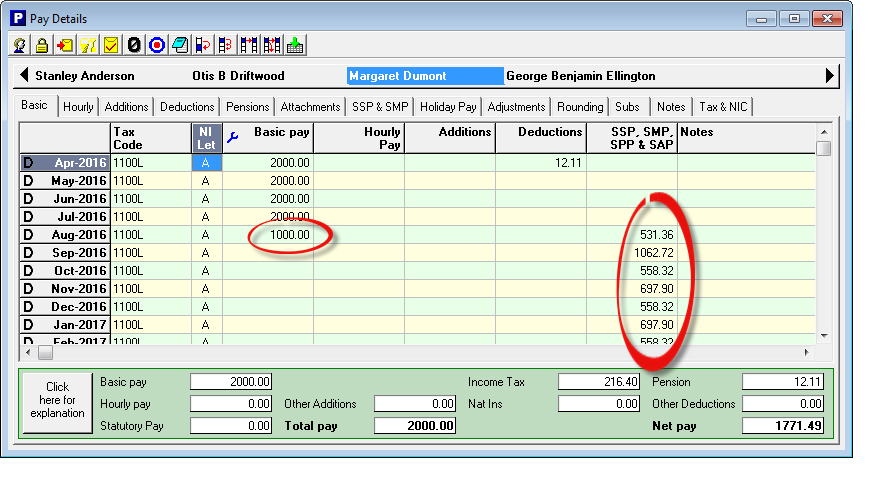

SMP – Pay Details

Once SMP has been entered onto the calendar the amounts payable will be shown on the ‘Pay Details’ screen. You may need to amend the basic or hourly pay as by default the SMP is added to the payslip. Some companies just choose to pay the statutory amount of SMP, whereas some will continue to pay a salary as normal. This will depend on the company policy and contract with the employee.

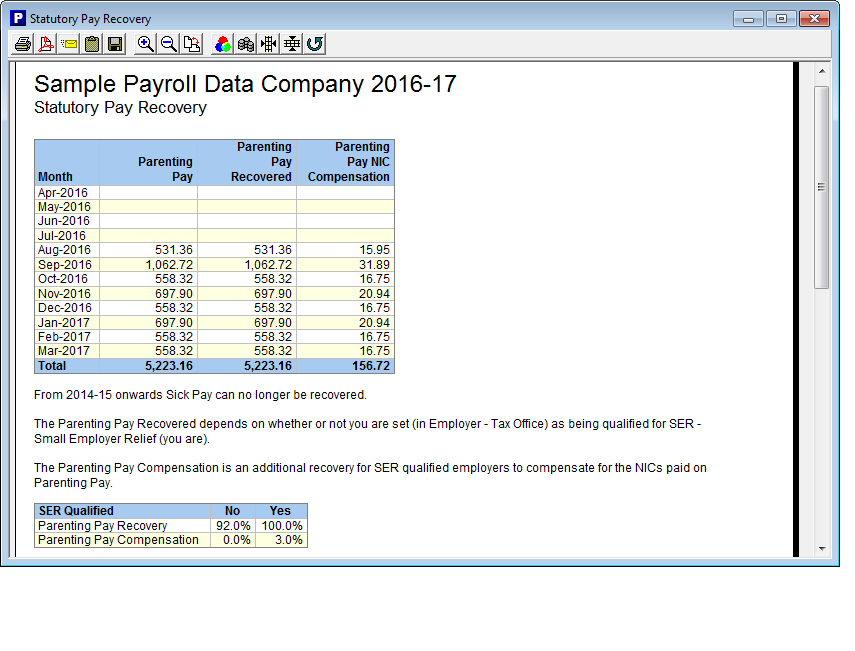

Recovering SMP

Payroll Manager can also produce a report showing how much maternity pay you can recover. Click on ‘Analysis – Statutory Pay Recovery’. Employers with a total employee/employer NIC liability of less than £45,000 qualify for SER (small employers relief). This means that they can recover 100% of their SMP payments plus 3% compensation (from April 2025, the amount of compensation rises to 8.5%). Employers who do not qualify can only recover 92%. To set the employer as SER qualified click on ‘Employer – Employer Details – Tax Office’ and tick the box marked ‘SER qualified’

Any SMP recovery / compensation due in a tax month reduces your NIC liability to HMRC for that period – Payroll Manager calculates the appropriate amounts automatically.

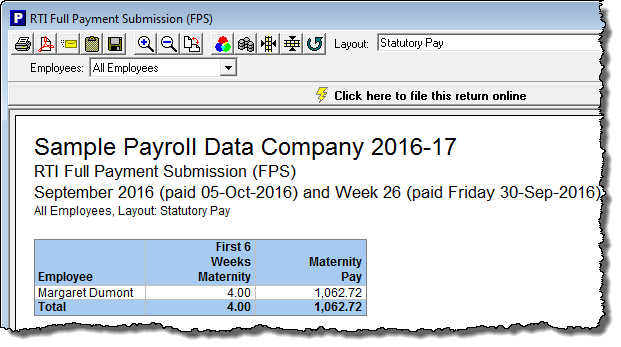

SMP and RTI reporting

SMP payments made to the employee are reported via the Full Payment Submission (FPS) for the appropriate period, and can be viewed by selecting the ‘Statutory Pay’ layout on the FPS report.

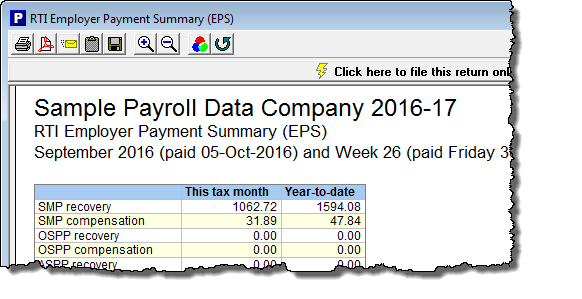

SMP recovery and compensation is reported on a monthly basis to HMRC via the Employer Payment Summary (EPS).

Employer pension contributions whilst on Maternity leave

If the employee is a member of a workplace pension scheme then special rules apply which mean that the employer should still pay pension contributions based on the employees pensionable earnings before their maternity leave. Payroll Manager is not able to do this automatically, and the employer pension contributions should be manually entered on the Pay Details screen during this period. Please see our guide to Workplace pension scheme contributions during periods of parental leave for details of how to do this. The Pensions Advisory Service website offers further information.

FAQs

-

- What happens if the employee does not qualify for SMP? – You should return the MAT B1 to the employee, then complete form SMP1 within 7 days of the decision being made. This must be done within 28 days from the date the employee gave notice of absence (or the date she gave birth if earlier) as she may be able to claim Maternity Allowance (MA)

- How is the average weekly pay calculated? – As a rough guide the average weekly pay is calculated over a period of 8 weeks. The 8 week period is taken just before the qualifying week (the qualifying week is 15 weeks prior to the expected date of birth). In some cases (if there is not enough payment history in Payroll Manager) you will need to calculate the average weekly pay* and enter it into the ‘Over-riding Average Weekly pay’ box on the ‘Calendar – Settings’ screen.

- What happens if the employee has a pay rise between the start of the ‘relevant period’ and the end of the maternity pay period? – In circumstances such as this you will need to manually calculate the Average Weekly pay and enter the correct figure in the ‘Over-riding weekly pay’ box. This is due to the ‘Alabaster ruling’ – see Statutory Maternity Pay: employee circumstances that affect payment – GOV.UK

- What happens if the employee comes back to work early? – If the employee wants to return to work early you will need to remove the maternity pay from the calendar. To do this set the day they return back to a normal day by clicking on the

button. Click back on the normal day and drag the mouse to select the remainder of their maternity leave and set it back to a normal working day. You should bear in mind that maternity pay is only payable on complete weeks so care should be taken to make sure that the employee does not lose any of their entitlement.

button. Click back on the normal day and drag the mouse to select the remainder of their maternity leave and set it back to a normal working day. You should bear in mind that maternity pay is only payable on complete weeks so care should be taken to make sure that the employee does not lose any of their entitlement. - What are KIT days? – Your employee is allowed to work for up to ten days during their maternity leave without it affecting their maternity pay. These are called ‘Keeping in Touch Days’. Both the employee and employer must agree whether ‘Keeping in Touch Days’ will be worked, how many they will work, when they will work them and how much they will be paid for them. The employee is under no obligation to work them and the employer is under no obligation to offer them to the employee. To set a KIT day in Payroll Manager, from the calendar screen select the day the employee is to work and then click on the

icon. An employee can take up to a total of 10 KIT days.

icon. An employee can take up to a total of 10 KIT days. - What should I do if the same employee has two periods of SMP in the same year?

- 1) Enter the details of the first maternity/paternity period and let the program calculate the SMP/SPP

- 2) On the PAY DETAILS screen click the ADJUSTMENTS tab and manually copy the SMP/SPP payments into the SMP/SPP ADJUSTMENT column

- 3) Replace the details of the first maternity with those for the second period and the program will calculate the SMP/SPP for that.