Payroll Manager New Features and Guides

This page gives details of new features, software improvements and data validations that have been implemented in Payroll Manager via scheduled software updates. This page also lists any new or improved support guides that have been published recently.

You will be automatically prompted to update your copy of Payroll Manager whilst using the software if a scheduled update is due. If you wish to check if there is a software update available click ‘Help‘ then ‘Program Update‘ from the main menu in Payroll Manager.

February 2026

Website support guides

See our newly published ‘Payroll Year End guides 2025-26‘ for detailed information on what you need to do at payroll year end:

Filing the last RTI return for 2025-26

Creating A Data File For 2026-27

Issuing P60 Forms for your Employees

For details of how the new Statutory Sick Pay (SSP) rules will operate from 6 April 2026 please see the following guide:

Statutory Sick Pay (SSP) from 6 April 2026

January 2026

Payroll Manager updates

Software improvement: We have added a 2026-27 ‘layout’ to the ‘Analysis – Tax & NIC rates‘ report so that you can view the tax, NIC, Student Loan, Minimum wage etc rates that will come into effect from April 2026.

Software improvement: We have added a ‘Quarterly‘ layout to the ‘CIS – Payment and Deduction statement‘ reoprt for CIS subcontractors.

Software improvement: A new auto enrolment pensions upload file template has been added for the pension provider ‘True Potential‘.

Software improvement: A new P60 layout (called ‘P60M’) has been added for tax year 2025-26 onwards for use with pre-printed hand-seal P60 stationery provided by the third party company ‘Hague Direct’.

November 2025

Chancellors Budget Statement 26 November 2025

In the Autumn Budget of 2025 the Chancellor announced a number of changes that will affect payroll calculations for the tax year 2026-27 onwards. There was nothing in the recent budget that will affect payroll calculations in the tax year 2025-26.

Changes announced include an increase to the various National Minimum Wage rates from April 2026 and a cap on the maximum amount of employer pension contributions that can be made using ‘salary sacrifice’ arrangements, which comes into force in 2029.

Each of these changes will be implemented via scheduled Payroll Manager software updates closer to the time.

.

Payroll Manager updates

Software minor terminology change – We have renamed what used to be called ‘BACS Payment Files’ within Payroll Manager to ‘Bank Transfer Files‘, as this name better reflects the actual use of these items. For details of how to use this system, click ‘Pay‘ then ‘Payments‘ from the main menu in Payroll Manager, select ‘Bank Transfer File‘ and then press the ‘F1‘ key on your keyboard for further guidance.

Software improvement: We have added ‘Bank Transfer File’ file layouts in the formats required for Santander Bulk Faster Payments and NatWest Standard Domestic Bulk Payments.

Software improvement: The ‘Forms – Employer’s Payments P32‘ report now has the National Insurance Contributions broken down into employers and employees amounts (previously these items were grouped together).

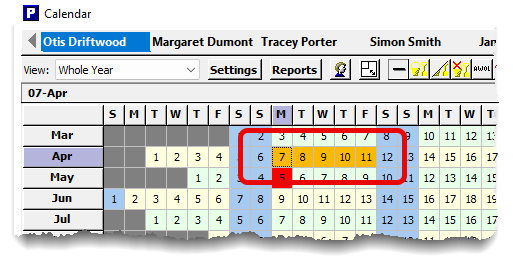

Software improvement: We have changed the colour of the ‘cursor/ highlighted days’ on the ‘Employee – Calendar’ screen from dark blue to gold, making it easier to read the selected date(s) (e.g. below):

October 2025

Payroll Manager updates

Software improvement: Following requests from some of our customers we have added ‘Bank Transfer / BACS Payment’ file layouts in the formats required by Allica, Monzo and Revolut banks. This will enable customers of these organisations to create ‘BACS payment’ files to upload via their online banking systems. Payroll Manager already has built-in formats for many other banks (over 40 in total). For details of how to use this system, click ‘Pay‘ then ‘Payments‘ from the main menu in Payroll Manager, select ‘Bank Transfer File‘ and then press the ‘F1‘ key on your keyboard for further guidance.

June 2025

Website support guides

Microsoft is ending support for Windows 10 on 14 October 2025. We have published a guide on how to upgrade to Windows 11 – End of support for Windows 10

A new guide to operating a Scottish Earnings Arrestment (EA) has been published.

The guide Expenses and Benefits – P11D .has been updated with the latest information regarding filing P11d and P11db returns. The deadline for filing P11D submissions to HMRC is 6 July 2025.

The Useful Links web page in the ‘Support’ section of the Moneysoft website has been updated, providing links to a number useful GOV.UK, ACAS and other pages.

May 2025

Payroll Manager updates

Software improvement: The ‘Click here to show calculation‘ report (accessible via the grey button at the bottom-left of the ‘Pay Details’ screen) now shows a more detailed calculation for ‘Attachment’ deductions (e.g. Direct Earnings Attachments, Council Tax AEO etc.). The report now specifically itemises the ‘Attachable earnings‘ amounts, and also shows the relevant deduction tables for attachment types that use them.

Software improvement: Entering or editing the Tax code of an employee. Previously when entering a tax code which operates on a ‘week1’ or ‘month 1’ basis it was necessary to tick the ‘week1/month1’ box on the tax code input screen. The software will now allow an ‘X’ to be entered at the end of the tax code instead (e.g. 1257LX), in which case the ‘w1m1’ basis will automatically be applied.

Software improvement: The ‘Employer PAYE reference‘ (on the ‘Employer – Employer Details – Tax Office’ screen) will now be ‘greyed out’ and non-editable once an RTI return for that employer has been sent by the software and received by HMRC. This change has been implemented because some users were (incorrectly) editing the reference after sending RTI returns, and then sending further RTI returns from the same Payroll Manager data file using a different Employer PAYE reference. This was then causing reconciliation problems with HMRC.

The correct way to proceed in cases where you realise you have been using an incorrect PAYE reference is to set up a brand new Payroll Manager data file, using the correct PAYE reference, and then to file the appropriate RTI returns using the new file. You should also contact HMRC to inform them of the error.

Website support guides

The following new support guides were published in May 2025:

Direct Earnings Attachment (DEA) A guide on how to process a Direct Earnings Attachment in Payroll Manager.

Council Tax Attachment of Earnings Order (CTAEO) A guide on how to process a Council Tax Attachment of Earnings Order in Payroll Manager.

Child Maintenance Deduction from Earnings Order (DEO) A guide on how to process a Child Maintenance Deduction from Earnings Order in Payroll Manager.

Magistrates Court Attachment of Earnings Order (AEO) A guide on how to process a Magistrates Court Attachment of Earnings Order in Payroll Manager.

April 2025

Payroll Manager updates

Data validation: HMRC RTI rule: A validation was added to check that National Insurance category ‘B’ was not being used for employees born after 5 April 1961. See National Insurance categories and rates – Moneysoft more details.

Website support guides

The following new support guides were published in April 2025:

Payroll ID in this employment A guide to the ‘Payroll ID’ and how it should be used.