Payroll ID in this employment

HMRC use a number of items to identify each employee present in RTI returns i.e.- their Name, Date of Birth, National Insurance number, address, and where present, something called the ‘Payroll ID in this employment’ (referred to as the ‘Payroll ID‘ in the rest of this guide)

The Payroll ID is an optional field that can be used to identify the ’employment’ of an individual within an organisation. It is not mandatory to use a Payroll ID and as such, Payroll Manager does not automatically assign an ID to each employee. However, we strongly recommend that you DO use a Payroll ID for all new employees, and in cases where a Payroll ID has already been used for an employee in a previous RTI submission (perhaps by the previous software/payroll processor) then it is vitally important that the same Payroll ID is used for that employee in subsequent RTI submissions. Failure to do this may lead HMRC to (wrongly) assume that this is a totally different individual, leading to errors and possible duplication of HMRC records. The ‘Payroll ID’ (if present) is sent to HMRC in every Full Payment Submission (FPS).

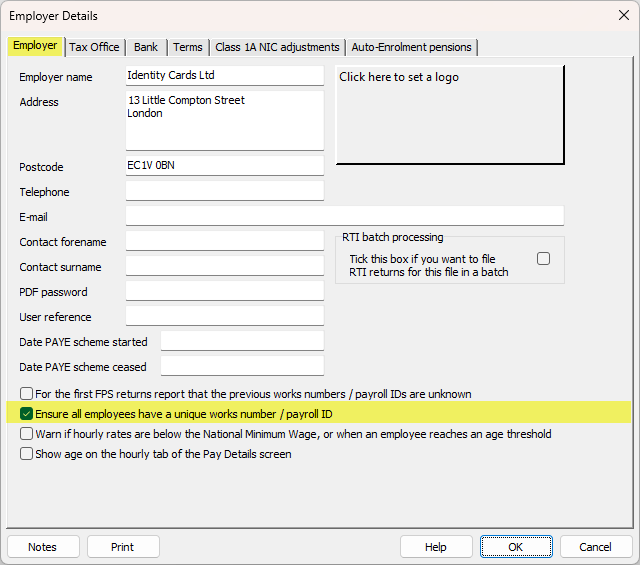

You can if you wish use your own system of assigning Payroll IDs to your employees – the only stipulation is that they are unique to each employee and their employment. If you wish you can ask Payroll Manager to generate unique Payroll IDs for each employee by clicking ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager, and then ticking the box marked ‘Ensure all employees have a unique works number / payroll ID‘ (below).

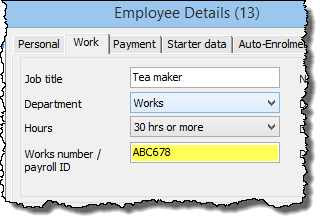

The Payroll ID can be viewed / manually entered in the ‘Work‘ section of the ‘Employee Details‘ screen:

You should establish whether or not a Payroll ID has been used for this employee in a previous RTI submission, and if so, ensure that the exact same ID is used in Payroll Manager. If you are sure that the previous processor/software did not use a Payroll ID then you can leave this field blank. If you are unsure whether or not a Payroll ID was used previously then please see the section below:

- As far as we are aware, Sage software automatically generates a 32 character Payroll ID for each employee, so if the payroll was previously processed using Sage you should ensure that this information is entered correctly.

- If the previous payroll processor was using HMRC Basic Tools they can find the Payroll ID under ‘Employee Details > Employment Details > Payroll ID’.

- You should be aware that some software may use both a ‘works number’ (often displayed on the employees payslip) and also a separate ‘Payroll ID’ (used in RTI returns) and so you should be careful to ensure that it is the ‘Payroll ID’ that you enter into Payroll Manager.

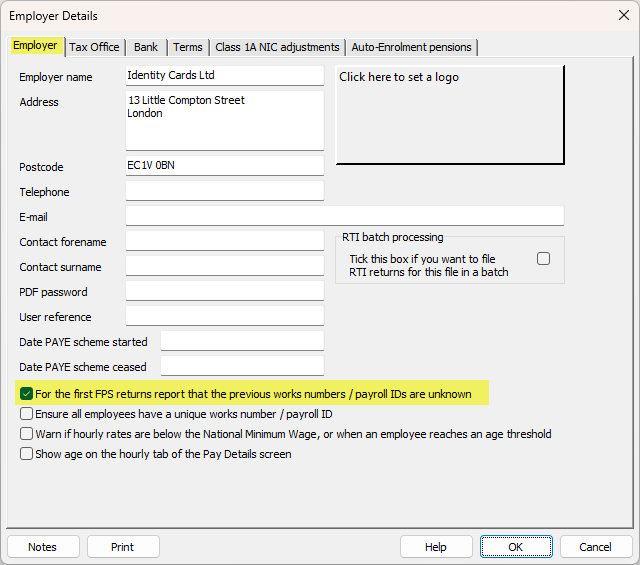

If you have just taken over a payroll and are unsure as to whether or not a Payroll ID was used for an individual by a previous processor then click ‘Employer’ then ‘Employer Details‘ from the main menu in Payroll Manager, and tick the box marked ‘For the first FPS returns report that the previous works numbers / payroll IDs are unknown’ (e.g. below).

When you submit the first FPS for that particular employer the software will include an indicator informing HMRC that the Payroll ID for each employee has been changed (from an unknown quantity), as well as showing the new Payroll ID that you have specified for each employee.

FAQ

What if an employee leaves, and then returns again? You should set the employee up as a brand new employee (as this is s new ’employment’) – and issue this ‘new’ employee with a brand new, unique Payroll ID.