Paying an employee after they have left

Use this step-by-step guide if an employee needs to be paid after their leaving date

Enter in the amount.

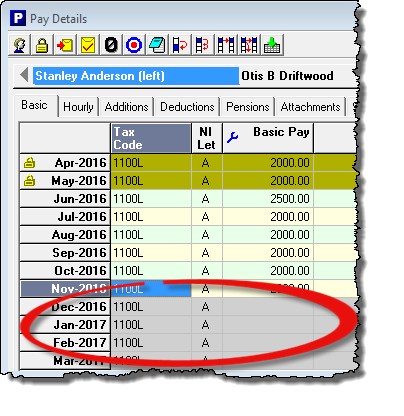

- Click ‘Pay – Pay Details’ from the main menu and select the relevant employee.

- After an employee has left, the remaining pay periods of the tax year will be shaded grey, but pay can still be entered into these periods.

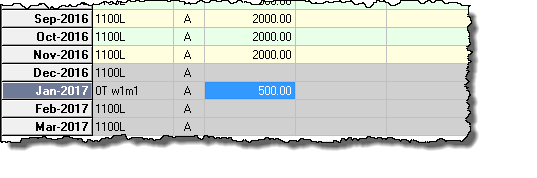

- Enter the pay into the relevant period.

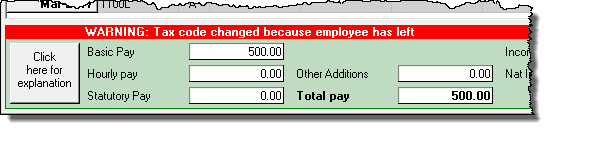

- A message will appear at the bottom of the Pay Details screen – “WARNING: Tax code changed because employee has left” and the tax code for the period will automatically be changed to 0T w1/m1* which is required under HMRC rules. (Note: In some circumstances, according to the pay dates set in the software, the tax code may not change automatically. In such cases you should amend the tax code manually on the ‘Pay Details’ screen. Enter a tax code of 0T* and tick the box marked ‘week1/month1’). (*Note: Use tax code S0T/C0T for Scottish/Welsh tax payers as appropriate).

- Print the payslip as normal and pay the employee the amount required.

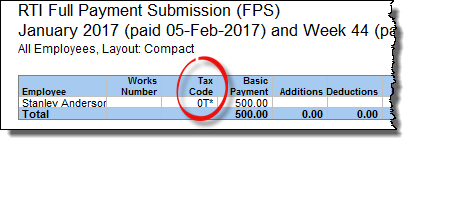

Informing HMRC of the payment

- When the next FPS (Full Payment Submission) return is filed, the details of this extra payment will be sent and a flag will automatically be set by Payroll Manager to inform HMRC that this amount is pay after leaving (NB you do not actually ‘see’ this flag, but it is sent to HMRC alongside the other FPS information).

Even though an extra payment has been made to the employee, you SHOULD NOT issue a revised P45.