Accounts Office Reference

The employer’s ‘Accounts Office Reference‘ is a unique, 13 character code. It can be found on letters from HMRC about PAYE and when you registered as an employer.

Accounts office references all have the same strict format, as follows:

The three digit number of your tax office (e.g. 123)

Two alpha characters (e.g. PA)

Eight numeric characters (e.g. 12345678)

e.g. 123PA12345678

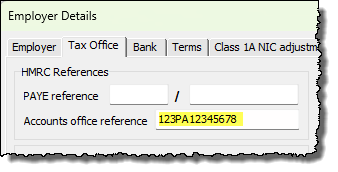

The Accounts Office Reference is entered by clicking ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager, then selected the ‘Tax Office‘ tab:

HMRC issue software providers with a ‘checking algorithm’, which is used by Payroll Manager to determine whether or not the Accounts Office reference that you enter is valid. If the entry box remains ‘pink’ after you enter the reference then this means that it has failed HMRC checks, and you should try again.

HMRC also have a page on their website where you can check the validity of the Accounts Office reference: Simply enter the number into the box (step 1) and click ‘Check reference’ (step 4) – there is no need to complete the other fields in order to check a reference.

PAYE / NIC current year reference checker

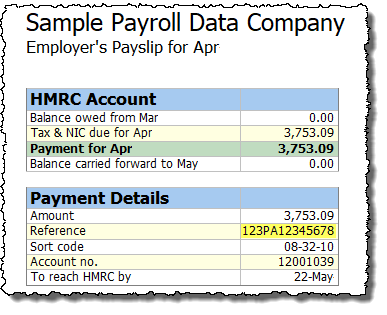

P30 Employer’s Payslip

The ‘Pay – Employer’s Payslip (P30)‘ report shows the 13 character Accounts Office Reference, which should be used when making payments to HMRC.

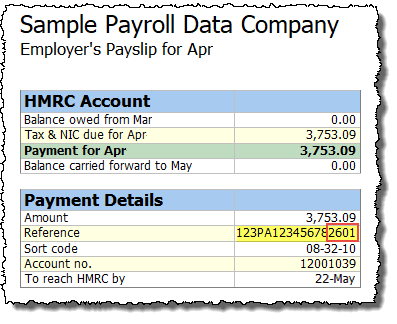

Early or Late payments

If you are making an ‘early’ or ‘late’ payment to HMRC ( see Pay employers’ PAYE: Reference numbers for early and late payments – GOV.UK for details), then you should add an extra 4 numbers to the Accounts Office Reference so that HMRC know which period the payment is for. On occasions when you need to add these 4 extra digits, click ‘Tools‘ then ‘Setup‘ from the main menu in Payroll Manager, select the ‘General‘ tab, and tick the box marked ‘Add 4 digit date to HMRC paying-in reference‘, and click ‘OK‘. Payroll Manager will then add the appropriate 4 digits to the Accounts Office Reference (e.g. below) . You should go back and ‘untick’ this box once you have produced your reports.