Nil CIS 300 monthly return

If there are no subcontractors to be paid in a month, you must still submit a CIS300 as a NIL Return.

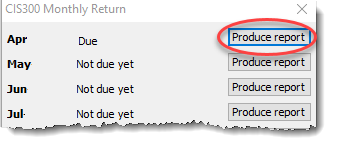

Click ‘CIS‘ then ‘Monthly return CIS300‘ from the main menu in Payroll Manager. Click the ‘Produce report‘ button next to the relevant month.

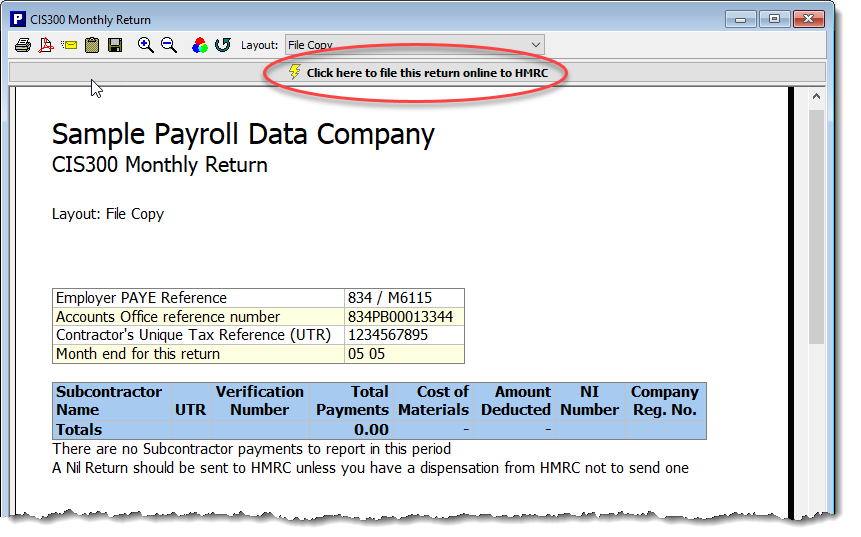

Select the ‘File Copy’ layout from the drop-down selector at the top of the report and check that it is a NIL return. (Note: the layout of the report has no effect on the actual data submitted to HMRC – the ‘file copy’ layout is simply easier to read on screen).

Click on text at the top of the report marked ‘Click here to file this return online to HMRC’. Your NIL CIS 300 will be submitted to HMRC in the usual way.

Note: HMRC have a mechanism whereby you can inform them that you do not expect to make payments to subcontractors during the next six months. This is NOT something that can be done via Payroll Manager. Instead you should file a CIS300 return each month, regardless of whether or not you have subcontractors to pay.