National Insurance Contributions (NICs) in 2022-23

In most tax years the ‘Primary Threshold (PT)’, the level of earnings at which an employee starts making National Insurance Contributions (NICs), remains the same throughout the year. The tax year 2022-23 is unusual in that the PT increases part way through the year (from 6 July 2022), affecting the amount of NICs that an employee will pay.

In addition to this, between 6 April 2022 to 5 November 2022 NIC rates were raised by an extra 1.25% compared to their 2021-22 levels to fund health and social care. Then, from 6 November onwards the rate of employee NIC was lowered from 13.25% to 12.00%.

This short guide is designed to show how these changes may affect the pay of a typical employee throughout the year. (It does not cover NICs made by the employer, nor does it apply to NICs for a director).

What is the Primary Threshold (PT) ?

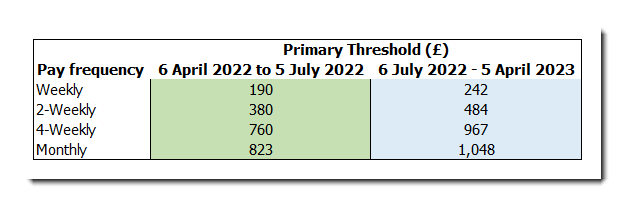

The Primary Threshold is the level of earnings in a pay period above which an employee starts to pay NICs. There is a different PT for weekly, 2-weekly, 4-weekly and monthly paid employees. An employee whose earnings are below the PT will pay no NICs in that period.

In the Chancellor’s Spring Statement of 2022 it was announced that the PT for 2022-23 would be increased from 6 July 2022 onwards. This means that there are two different PTs for each pay frequency in tax year 2022-23, one which operates from 6 April 2022 to 5 July 2022, and another that operates from 6 July 2022 to 5 April 2023. These are shown in the table below:

It is the Pay Date of the employee that determines which Primary Threshold to use for the calculation of NICs, and not when the work was done.

e.g. For weekly paid employees paid on Friday 1st July 2022 the PT is £190. For weekly paid employees paid on Friday 8th July the PT is £242.

What are the NIC rates for 2022-23 ?

In 2021-22 employees typically paid NICs at a rate of 12%* on their earnings above the PT (until their earnings reached the ‘Upper Earnings Limit (UEL)’, equivalent to £50,270 per year, at which point NICs were charged at 2%).

In 2022-23 (to fund health and social care) employees will typically pay NICs at a rate of 13.25%* on their earnings above the PT (and 3.25% on earnings that exceed the UEL) up until 6 November 2022.

(*There are some exceptions to this – e.g. employees that have reached State Pension Age will pay no employee NICs at all, and those employees who have ‘deferred’ will pay NICs at a lower rate. See GOV.UK – Rates and thresholds for employers 2022 to 2023 for full details).

It is the Pay Date of the employee that determines which rates to use for the calculation of NICs, and not when the work was done.

e.g. For weekly paid employees paid on Friday 1st April 2022 the rate is 12%. For weekly paid employees paid on Friday 8th April the rate is 13.25%.

How does this affect the pay of a typical employee?

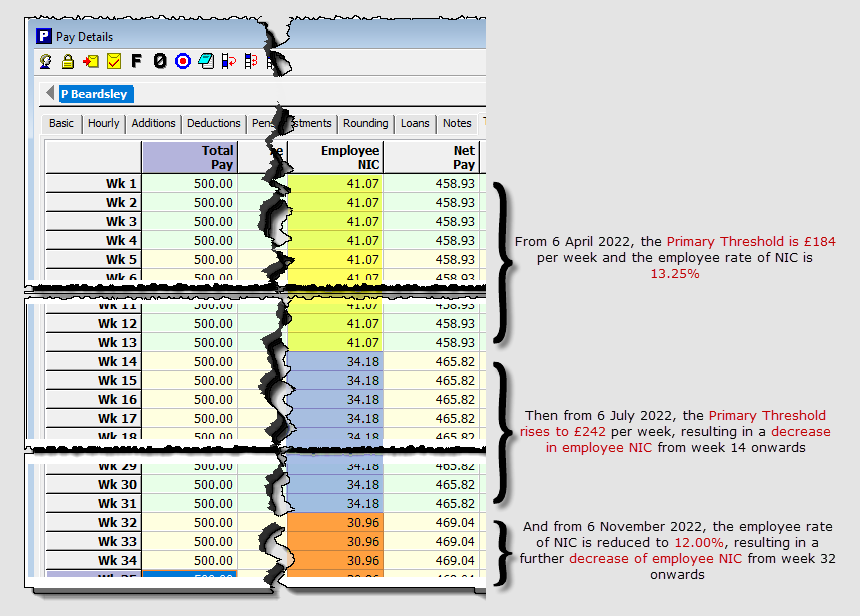

Because of the increase to the rate of NICs from April 2022, a typical employee on a set salary may pay slightly more NICs in first pay periods of 2022-23 than they did in 2021-22. Then, because of the increase to the PT they may see a reduction in NICs for pay dates from 6 July 2022 onwards (i.e. week 14 / month 4). A further reduction in NICs may be seen from 6 November 2022 as the rate at which employee pay NIC is reduced from 13.25% to 12.00%.

The example below shows how the NIC of a typical weekly paid employee on a fixed weekly salary of £500 changes throughout the year. A similar pattern would be observed for employees with other pay frequencies.

How does Payroll Manager handle the changes to the PT and rates of NICs ?

Payroll Manager has all of the NIC rules, thresholds and rates built in, and will handle all of these NIC calculations automatically. If you wish, you can view the rates and thresholds being used by the software by clicking ‘Analysis‘ then ‘Tax & NIC rates‘ from main menu in Payroll Manager.

If you wish to view the detailed NIC calculation for a particular employee then click on the ‘Click here for explanation‘ button towards the bottom-left of the ‘Pay Details‘ screen, then select ‘NIC‘.

Links

GOV.UK – Rates and thresholds for employers 2022 to 2023