Minimum Wage and National Living Wage

The minimum wage a worker should get depends on their age. More details about age limits and rates can be found at The National Minimum Wage and Living Wage: Employers and the minimum wage – GOV.UK (www.gov.uk)

From April 2024, workers aged 21 and over will be entitled to the National Living Wage. The rates from April 2024 are as follows:

- Under 18 – £6.40

- 18 to 20 – £8.60

- 21 and over – £11.44

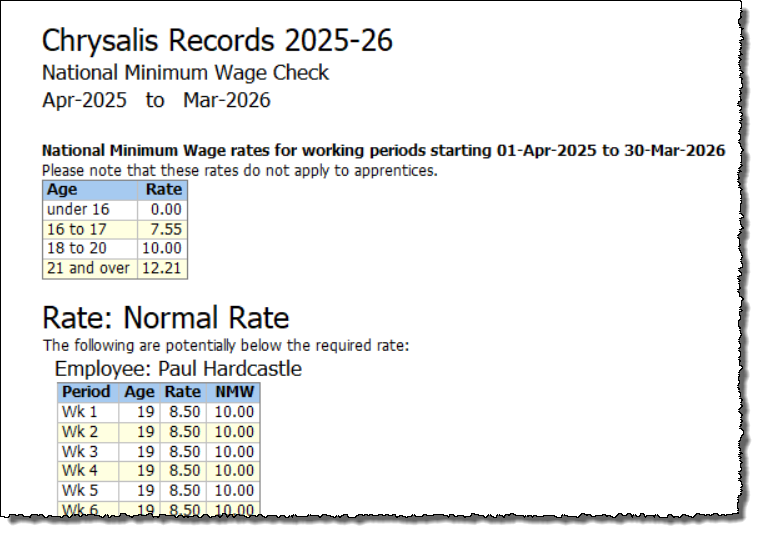

In the Autumn Budget it was announced that the rates from April 2025 will be as follows:

- 16 to 17 Year Old – £7.55

- 18 to 20 – £10.00

- 21 and over – £12.21

How Payroll Manager can help

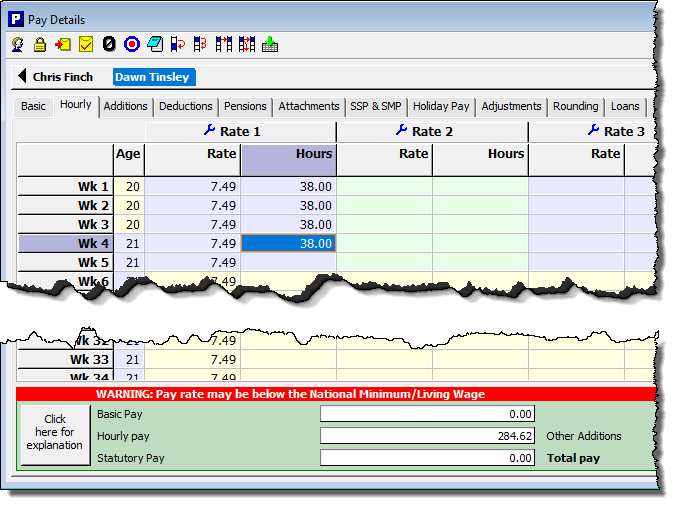

Payroll Manager is able to cross reference the hourly pay of an employee with their age in each pay period. If the hourly rate of pay for the employee is lower than the relevant minimum for their age then a warning message will be displayed in red towards the bottom of the Pay Details screen.

e.g. in the example below, the employee turns 21 in week 4 of the tax year. Payroll Manager warns that the hourly rate for this employee may be below the National Minimum Wage level:

Turning the National Minimum Wage features on / off

It is possible to turn these warnings on / off at both an employer and an employee level.

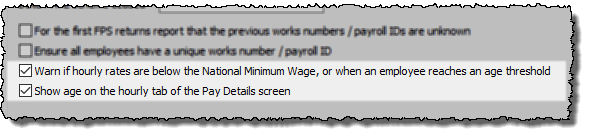

- To activate these feature for the employer (i.e. for all employees) then click ‘Employer‘ from the main menu, then ‘Employer Details‘. Tick the box towards the bottom of the screen marked ‘Warn if hourly rates are below the National Minimum Wage, or when an employee reaches an age threshold‘

- If you wish, you may also tick the box marked ‘Show age on the hourly tab of the Pay Details screen‘, so that the age of the employee will be displayed in each pay period. Click ‘OK‘.

- If you wish to turn off the minimum age warnings for a particular employee, then click ‘Employees‘ then ‘Employee Details‘ from the main menu, select that particular employee, and click on the ‘Work‘ tab. Tick the box marked ‘Exclude from NMW checks‘ and click ‘OK‘. This will turn off the warnings for that particular employee only.

Limitations

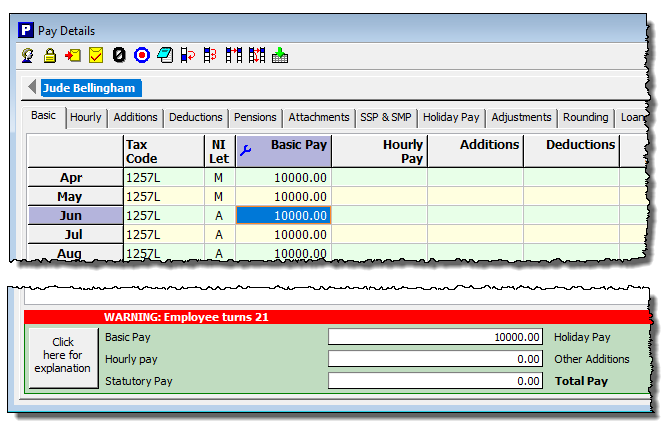

The Minimum Wage warnings will only appear if you use the ‘Hourly’ paid columns to record the pay of the employee. If you use the ‘Basic’ pay column to record the employee’s pay then it is not possible for the software to determine how much they are being paid per hour. The warnings will however still appear when an employee reaches a new age threshold, such as in the example below, where an employee with a basic salary reaches 21.

It is important to note that when minimum wage rates change, the increase applies to the first pay reference period starting on or after the date of any change. Payroll Manager does not hold information about the ‘Pay reference period’ (i.e. the period in time for which the employee is being paid) and instead simply holds the ‘Pay Date’. You should ensure that you are applying any changes to the minimum wage at the correct time. Please see Calculating the minimum wage – Calculating the minimum wage – Guidance – GOV.UK (www.gov.uk) for more information.

The ‘National Minimum Wage Check’ report

It is possible to run a report to check that all hourly paid workers are being paid at the correct rates. Click ‘Analysis‘ then ‘National Minimum Wage Check‘ from the main menu in Payroll Manager. This report will highlight any hourly paid employees that have an hourly rate below the minimum required for their age (e.g. below):

Links

The National Minimum Wage and Living Wage: Employers and the minimum wage – GOV.UK (www.gov.uk)

What is the minimum wage: National Minimum Wage entitlement – Acas

Calculating the minimum wage – Calculating the minimum wage – Guidance – GOV.UK (www.gov.uk)