Making Tax Digital (MTD) for VAT

HMRC is changing the way you submit your VAT Returns (although in practice, for users of our Money Manager software, there is very little difference). From April 2019, most VAT registered businesses with a taxable turnover above £85,000 must keep their VAT records digitally and use Making Tax Digital (MTD) compatible software to submit their VAT Returns. More detailed information about MTD for VAT can be found in the ‘Links’ section below. VAT Notice 700/22: Making Tax Digital for VAT, published on 5 March 2019, gives a good overview of the new rules.

This guide shows you how to use our Money Manager software to submit MTD VAT returns to HMRC.

Money Manager 7 Business Edition

Our Money Manager 7 Business Edition software has been used to keep digital records and file VAT returns online for many years. We have now developed the software to make it compatible with the new MTD for VAT requirements.

See HMRC list of software suppliers for MTD VAT

There is no charge for this update as we are providing MTD for VAT capability at no additional cost to existing users of our Money Manager 7 Business Edition software.

Sign Up for Making Tax Digital for VAT with HMRC

In order to start using the new service you should first Sign up for Making Tax Digital for VAT with HMRC. You should allow plenty of time (i.e. a number of days) for HMRC to set things up at their end before your VAT return is due.

Setting up Money Manager to work with MTD

Click ‘Help‘ then ‘Program Update‘ from the main menu in Money Manager, and following the on screen update procedure in order to ensure that you are using the latest version of the software. Note: If you see the message “You already have the latest program version” then your copy of Money Manager already includes the necessary MTD for VAT updates.

In order to start using MTD for VAT with Money Manager you must have already signed up to with HMRC to use the new MTD for VAT service. You then need to tell Money Manager when you wish to use the new service from.

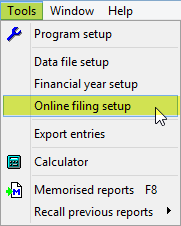

Click ‘Tools‘ then ‘Online Filing Setup‘ from the main menu in Money Manager.

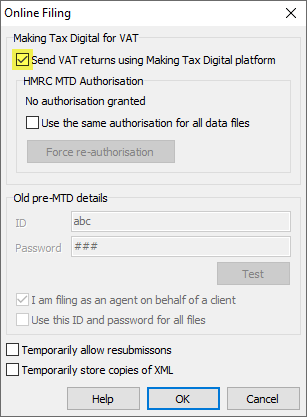

Tick the box at the top of the screen in order to use the new MTD service, and click ‘OK‘.

Money Manager is now set up to file MTD VAT returns online.

(Note: If you are an agent who files VAT returns for a number of different clients then you should also tick the box marked ‘Use the same authorisation for all data files’)

Filing a VAT return

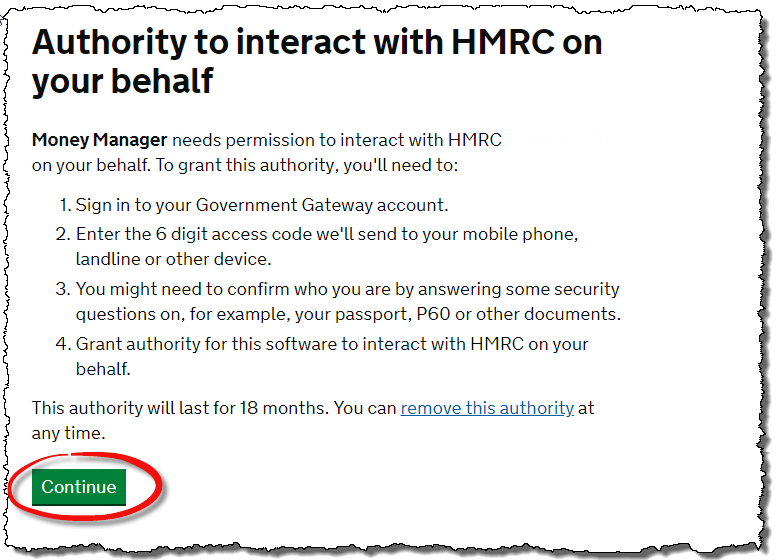

When you are ready to file a VAT return, follow the procedures below. Please note that the first time you do this HMRC require that you grant authority to Money Manager in order to use the MTD system (steps 5 to 10, below). HMRC generally ask for you to grant authority every 18 months or so (or if you change your HMRC ID or password). Once authority is in place, steps 5 to 10 will no longer be required in order to submit a VAT return. You will need your Government Gateway ID and Password (issued to you by HMRC) in order to grant this authority, so please ensure that you have these to hand before proceeding further.

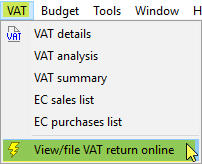

1 – From the main menu in Money Manager click ‘VAT‘ then ‘View/file VAT return online‘

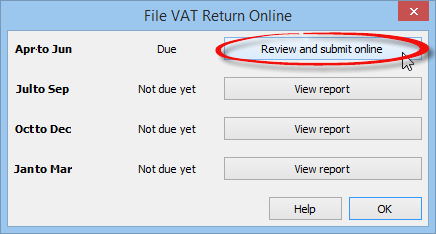

2– Select the relevant VAT period and click on the ‘Review and submit online‘ button

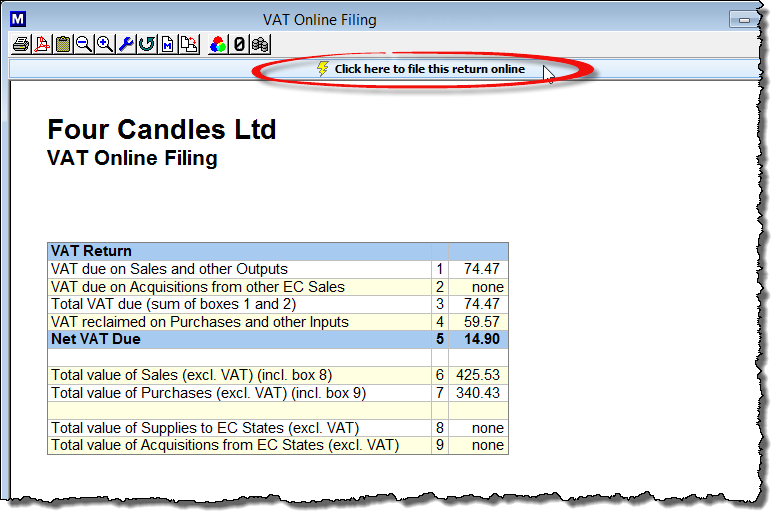

3 – A report will appear showing details of the VAT return – check that these details are correct then click on the button marked ‘Click here to file this return online‘

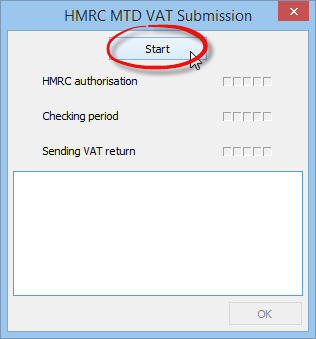

4 – Click on the ‘Start‘ button at the top of the next window

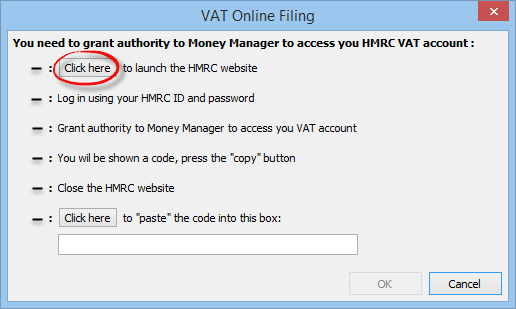

5 -The first time that you do this a box will appear asking you to grant authority to Money Manager. Select ‘Click here‘ to launch the HMRC website.

6 – Your web browser will open a page on HMRC website. You should read the information then click ‘Continue‘

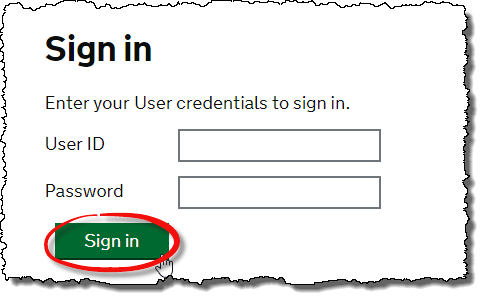

7 – Enter the HMRC User ID and Password and click ‘Sign in‘

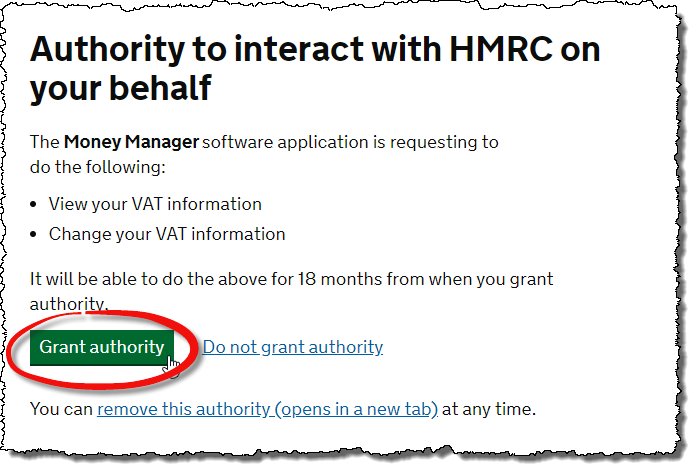

8 – After answering any applicable HMRC security questions you will be taken to the following screen. Click to Grant authority to Money Manager

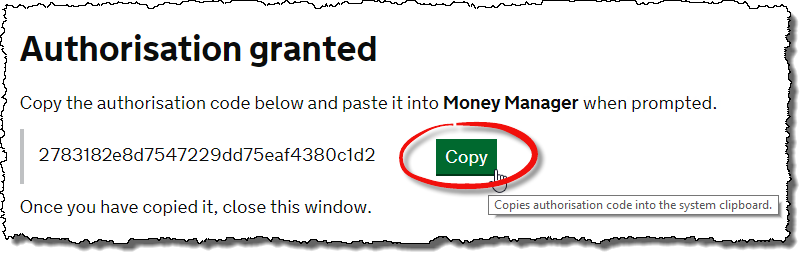

9 – HMRC will issue an ‘authorisation code – click the ‘Copy‘ button to save this code to the Windows clipboard

Note: Some antivirus software will prevent the autorisation code from being copied and pasted in this way. If you have problems then simply manually enter the autorisation code instead.

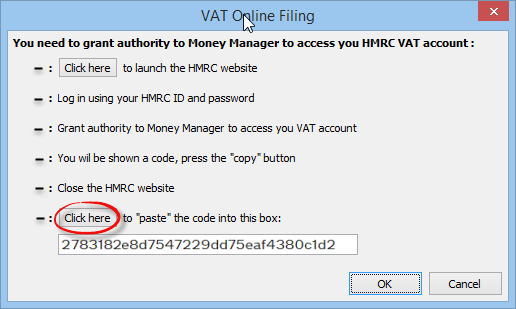

10 – Go back to the Money Manager screen (below) and select ‘Click here‘, which will automatically paste the authorisation code into the box. Note: this screen may be obscured by one of the HMRC website windows. If this is the case then close your internet browser in order to display this screen. Click ‘OK‘ after entering this code.

11 – Money Manager sends this code to HMRC and requests an ‘authorisation token’. (This ‘token’ is stored internally in Money Manager and is valid for a set period of time as determined by HMRC).

12 – Next the program will ask HMRC for a list of open VAT periods (i.e. periods they will accept a return for). If the period you are trying to submit is not in that list then you will get a red cross next to “Checking period”.

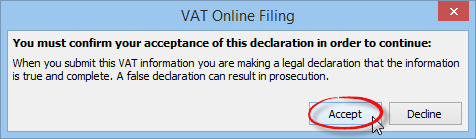

13 – Click the ‘Accept‘ button to confirm that the VAT information that you are about to send is true and complete.

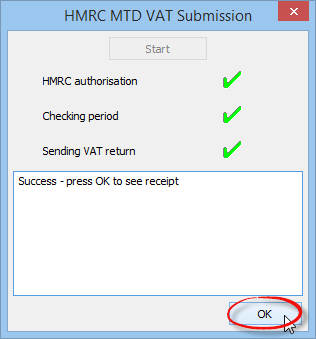

14 – Money Manager will submit your VAT return to HMRC. Click ‘OK’ to view your receipt.

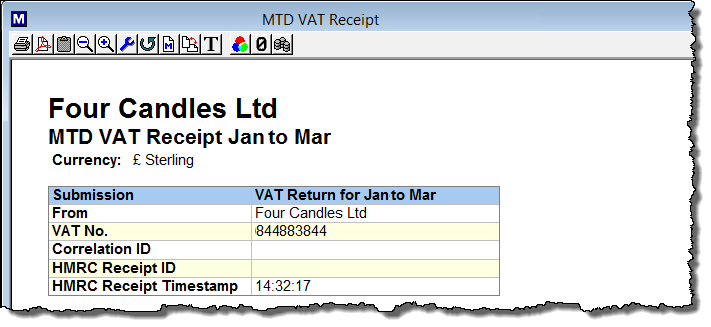

15 – Your receipt is proof that the VAT return has been successfully received by HMRC.

And that’s it! For subsequent VAT returns, whilst your authorisation remains valid, you will not see/require steps 5-10 when filing the return to HMRC.

Problems

If you experience any problems whilst using Money Manager MTD VAT system then please see our MTD for VAT problems and errors guide.

Links

HMRC – Check when a business must follow the rules for Making Tax Digital for VAT

HMRC MTD for VAT Guidance for Businesses

HMRC MTD for VAT Guidance for Agents

HMRC MTD for VAT Stakeholder Partner Pack

VAT Notice 700/22: Making Tax Digital for VAT

FAQ

– Is the Personal Edition of Money Manager 7 compatible with MTD for VAT? – No – in order to process VAT you must use the Business Edition of Money Manager 7. If you wish to upgrade then please refer to the FAQ section on our Money Manager page.

– Is Money Manager 7 ‘Bridging Software’? – No. ‘Bridging Software’ is software that takes existing data (stored in an Excel spreadsheet, or other ‘accounting’ software’ for example), and then submits this data to HMRC in the new MTD format. Money Manager 7 is a ‘complete’ bookkeeping program i.e. you enter all of your transaction data (sales, purchases etc) into Money Manager initially on a day-to-day basis, and then click a button to file the MTD VAT return at the end of each VAT period.

– Does Making Tax Digital (MTD) affect payroll ? – No, not in the near future. MTD is initially concerned with a businesses VAT returns, and will later be extended to include individual tax returns, which are currently handled through self assessment.