Lay-offs and short-time working

‘Guarantee Pay’ and ‘Lay-off pay’ are payments that employees may be entitled to during periods of short time working. Please see the GOV.UK guide on Lay-offs and short-time working for details of eligibility and amounts.

This type of pay cannot be reclaimed by the employer, and as such there is no specific place in Payroll Manager where it needs to be entered (ie. you could just use the ‘Basic Pay’ or ‘Hourly Pay’ columns if you wish).

If you wish to show this pay as a separate item on the payslip then you could create a new ‘Addition’ within the payroll in which to record such payments.

To create a new addition column

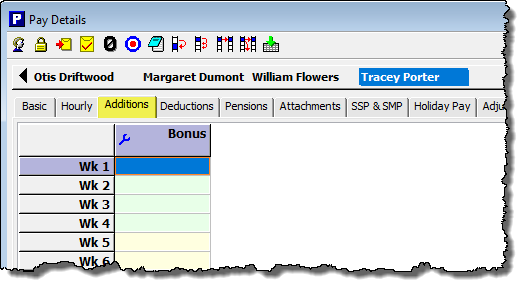

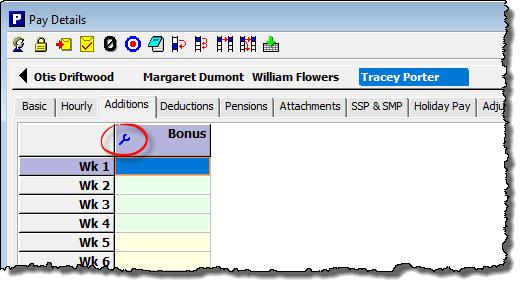

1. Go to the ‘Pay Details‘ screen and click on the ‘Additions‘ tab.

2. Click on the ‘blue spanner‘ symbol in the column heading furthest to the right (this column may be labelled ‘User-defined’, ‘bonus’, or something else, depending on your use of the software).

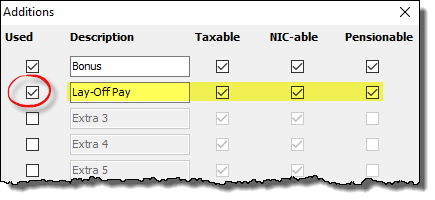

3. A box will appear. Tick the next available ‘used‘ box, enter a suitable description (e.g. ‘Lay-Off Pay’), and tick the ‘taxable’, ‘NIC-able’ and ‘Pensionable’ boxes as appropriate. Click ‘OK‘

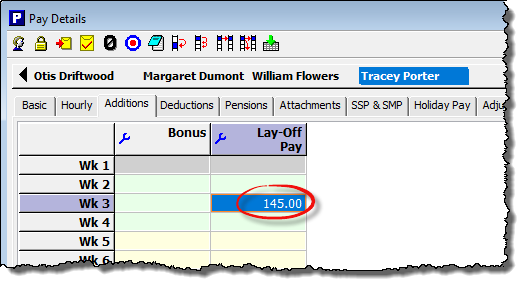

4. The ‘Pay Details’ screen will now display your new column, into which you can enter the appropriate payment.