IR35 – deemed payments – how to include in RTI to HMRC

Guidance and advice on the Intermediaries legislation (known as IR35) is beyond the scope of Moneysoft support and you should use the relevant HMRC guidance to determine how this legislation affects you. Links to the relevant pages of HMRC web site are given below. If having consulted the HMRC guidance you have established that a ‘deemed payment’ will be made, then please follow the steps below for details of how to set up columns to record this in Payroll Manager.

From April 2021 onwards, a ‘deemed employer’ must include an ‘Off-payroll RTI indicator’ in the FPS when making payments to a ‘deemed’ employee. Details of how to do this can be found towards the bottom of this guide:

Links:

IR35: working through an intermediary

HMRC Internal Manuals – ESM10000

Recording payments – To enter a payment that IS subject to tax & NIC

In order to do this you need to create a new column on the ‘Additions’ section of the ‘Pay Details’ screen, as below:

-

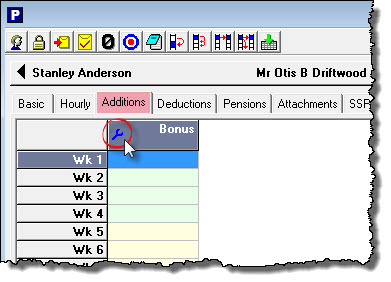

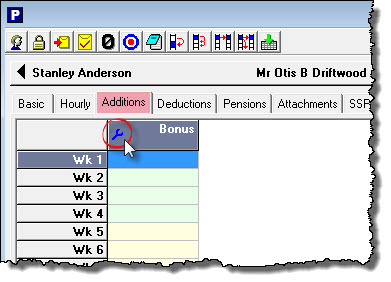

- Select the relevant employee on the ‘Pay Details‘ and click on the ‘Additions‘ tab.

- Click on any one of the blue ‘Spanner’ symbols that appear in the column headings.

-

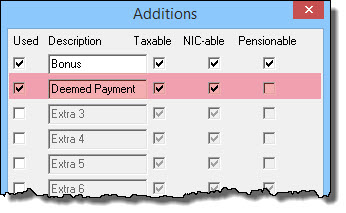

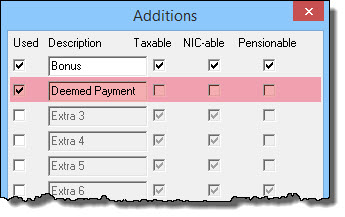

- Tick the next available ‘Used‘ box, then enter a suitable description of your choice (e.g. ‘Deemed Payment’)

-

- Tick the boxes marked ‘Taxable‘ and ‘NIC-able‘. Un-tick the ‘Pensionable‘ box, then click ‘OK‘

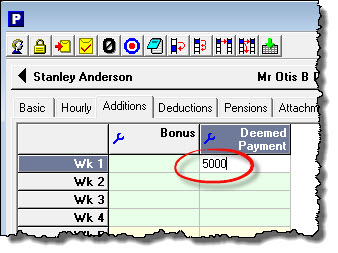

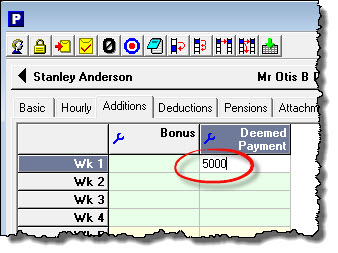

- Enter the amount of the payment into the column that you have just created.

The deemed payment amount will be included in the FPS for that pay period.

Recording Payments – To enter a payment that IS NOT subject to tax & NIC

In order to do this you need to create a new column on the ‘Additions’ section of the ‘Pay Details’ screen, as below:

-

- Select the relevant employee on the ‘Pay Details‘ and click on the ‘Additions‘ tab.

- Click on any one of the blue ‘Spanner’ symbols that appear in the column headings.

-

- Tick the next available ‘Used‘ box, then enter a suitable description of your choice (e.g. ‘Deemed Payment’)

-

- Un-tick the boxes marked ‘Taxable‘ and ‘NIC-able‘ and ‘Pensionable‘, then click ‘OK‘

- Enter the amount of the payment into the column that you have just created.

The deemed payment amount will be included in the FPS for that pay period.

Non-taxable and non-NICable payments are reported to HMRC using ‘data field 58A’ of the FPS, as per HMRC Guidance Off-payroll working in the public sector: reform of the intermediaries legislation – information for agents

Setting the Off-payroll RTI indicator

If you are operating the payroll for a company that is making deemed payments to a worker, then from April 2021 onwards you will need to include a ‘Off-payroll indicator’ in every FPS for which that worker is being paid.

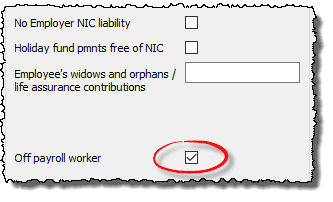

To set the indicator click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, select the appropriate employee, then click on the ‘Work‘ tab

Tick the box marked ‘Off payroll worker‘ and click ‘OK‘. The ‘Off-payroll indicator’ will then be sent in every FPS containing that particular worker (although the indicator does not appear on-screen)

The main purpose of the ‘Off-payroll RTI indicator’ is to prevent HMRC systems from automatically issuing Student Loan repayment notices to the deemed company on behalf of the worker. Setting this indicator will also stop any statutory payments being calculated for this worker within Payroll Manager, as such payments do not apply to deemed employees. Employer NICs attributed to these particular workers will also be disregarded when calculating any Employment Allowance due to the employer.

Note: You should only tick this box if you are processing the payroll of the deemed employer. If you are processing the payroll on behalf of an intermediary company then the RTI flag/indicator should not be set (as it will already have been set by the deemed employer).