How to proceed after restoring or reverting to a previous copy of a payroll data file

Sometimes you may need to go back to a previous, older copy of a payroll data file (e.g. if your file has become corrupted, or if your computer has broken down). This might be your own backup copy, or a copy that the software offered to revert to if your main data file was corrupted for some reason. It is very important when doing this to check what data the restored copy of the file contains, and also to ensure that you do not resend any RTI returns that HMRC have already received. Details on how to proceed can be found in this guide.

Check for ‘missing’ data:

Go to the ‘Pay Details‘ screen. Check that the pay information for all employees is up to date, and re-key any missing figures as necessary. Ideally you should cross reference any figures that you enter against any reports that you may have printed when using the ‘original’ data file.

Go to the ‘Employees – Calendar‘ screen and check that any recent periods of sickness or parenting leave are entered correctly.

If you have had any new starters / leavers in recent pay periods then go to the ‘Employees – Employee Details‘ screen and check that the start date/leaving dates of relevant employees are correct, and that their ‘Starter Data‘ (e.g. P45 joiner details, if applicable) are correct.

When you wish to send an RTI return:

If you have gone back to a copy of the data file that was saved before an RTI submission was made then the software will not have a record of that particular return having been sent. This will not cause a problem as far as HMRC are concerned (as they already have the submission), and will also not cause a problem to Payroll Manager.

It is very important that you do not resend any RTI returns that have already been received by HMRC. Instead, you should wait until the next RTI is due to be sent, and submit that particular return when you are ready to do so. At that point, the software will ‘complain’ that earlier returns are due, and will ask ‘are you sure’? You should answer ‘Yes‘ at this point to continue.

To check what RTI records Payroll Manager has, you can either click ‘Pay – Employers RTI schedule‘ from the main menu in Payroll Manager, or click on the red text towards the top of the Pay Details screen if you see a message similar to the one below:

Example

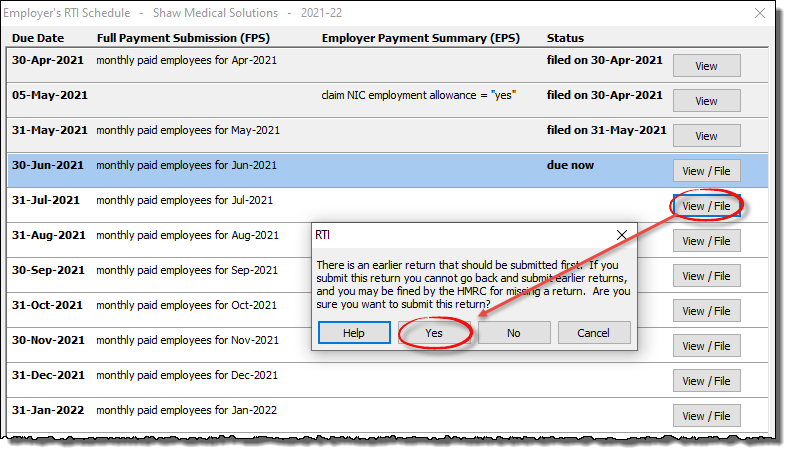

In the example below, the employer has already submitted RTI returns for Months 1, 2 and 3 (April, May and June). Before they came to process the payroll for Month 4 (July) they had a problem with their computer, and had to restore a backup copy of their data. The last available backup that they had was from early June, before the RTI for June had been sent.

The ‘Employer’s RTI schedule’ therefore had no record of the month 3 (June) RTI having been submitted, although the employer knew that it had already been received by HMRC.

When the employer clicked on the ‘View/File’ button to submit the RTI for the next applicable pay period, month 4 (July), the software displayed a warning message, asking if they were sure that they wished to proceed. The employer correctly answered ‘Yes’ to continue, and filed the RTI for month 4 (July).

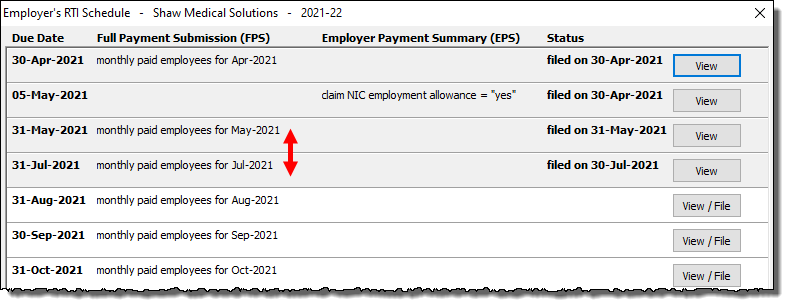

After the RTI for month 4 (July) has been filed, then the ‘Employer’s RTI schedule’ will ‘remove’ month 3 (June) from the list, as it does not have a record of this particular return. Again, this is deliberate, and will not cause a problem to either the software or to HMRC (as they have already received an RTI submission for that particular pay period)