Freeports Employer NIC relief

As part of the government’s work to ‘level up’ and boost economic activity, they aim to create a number of ‘Freeports’ to generate employment opportunities in some of the most deprived communities across the UK. One of the benefits to employers that operate within a Freeport location will be a reduction in the amount of employer NIC payable with respect to new employees that they take on from 6 April 2022.

A new ‘Freeport Upper Secondary Threshold (FUST)’ is being introduced, set at £25,000, below which a zero-rate of employer NIC will be applied. The calculation of employee NIC is unaffected.

The ‘Links‘ section at the bottom of this guide gives more details on where these Freeports are located and how to scheme will be operated.

Eligibility:

For an employer to be eligible:

- The employee must be newly employed on or after 6 April 2022 and before 6 April 2026 and

- they must spend at least 60% of that employment in a single Freeport tax site, and

- the employer must have business premises in that tax site.

The zero rate can be claimed for a maximum of three years from the first day of employment. HMRC have introduced new National Insurance category letters to support this.

Payroll Manager is not able to verify the eligibility of an employer to apply this relief, so it is up to the employer themselves to determine whether or not they qualify. Please see the ‘Links‘ section at the bottom of this guide for further guidance.

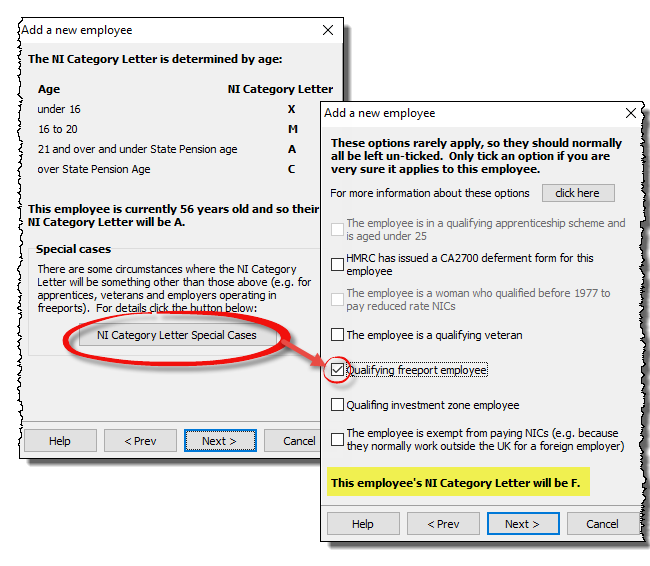

How to apply the correct Freeport NI category when adding a new employee

When adding a new employee using Payroll Manager you are taken through a number of screens where you input details such as the employee’s name, date of birth, tax code etc. On one of these screens (below) you will see the NI category that has been assigned, which is primarily determined by the age of the employee. In order to add a ‘Freeport’ employee you should click on the button marked ‘NI Category Letter Special Cases‘, and then tick the box marked ‘Qualifying freeport employee‘. (Note: In the rare circumstance that any of the other conditions on this screen also apply to this employee, then you should tick these boxes too.)

From April 2025 onwards

From April 2025 onwards HMRC require that the ‘Workplace postcode‘ of a ‘freeport’ employee is sent in each RTI return. The workplace postcode for any qualifying employee must be located within a designated special tax site. You can enter the workplace postcode of the employee by clicking ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, and selecting the ‘Work‘ tab. Enter the workplace postcode, and click ‘OK‘

How Employer relief is claimed for Freeport employees

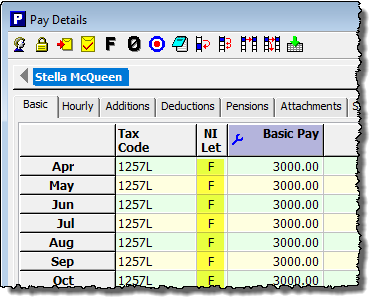

The NI category letter assigned to a new Freeport employee can be viewed on the ‘Pay Details’ screen (e.g. below).

The actual NI category letter assigned depends on a number of factors.

- Category F is the most common, and is the Freeport equivalent for those that pay standard rate Employee NIC contributions (i.e. those otherwise on letter ‘A’)

- Category I is the Freeport equivalent for the very rare group of married women that qualified before 1977 to pay reduced rate NIC contributions (i.e. those otherwise on letter ‘B’)

- Category L is the Freeport equivalent for those that have a deferred rate of NIC contributions (i.e. those otherwise on letter ‘J’, who have another job and have provided the employer with form CA2700)

- Category S is the Freeport equivalent for employees over state pension age (i.e. those otherwise on letter ‘C’).

Payroll Manager will automatically calculate the correct amount of employer NIC for employees with these NI category letters, and this will be reflected in the amount of tax and NIC reported as being due at the end of each tax period.

Links

Check if you can claim National Insurance relief in UK Freeport tax sites – GOV.UK (www.gov.uk)