Flexible Drawdown of Pension Rights

This guide shows how to enter the details of ‘Flexibly accessing pension rights’ payments into Payroll Manager in order to report them correctly to HMRC. Moneysoft is not able to advise on whether such payments are taxable / non-taxable, and you should consult HMRC if you require further guidance. HMRC Pension Schemes Newsletters give more information about the reporting of these payments.

Payroll Manager requires that you enter the amount of each Flexible Drawdown payment twice – once in a column on the ‘Additions’ screen, and then again in the ‘Adjustments’ screen in order that the correct details are reported to HMRC via RTI.

1) Entering the payment in the ‘Additions’ screen:

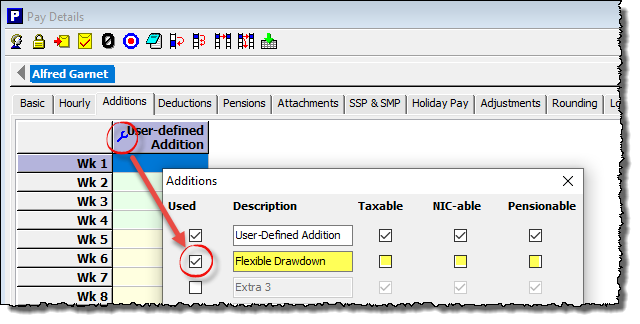

- If you have not already done so you should create an ‘addition’ for each payment type . Go to the ‘Pay Details’ screen and click on the ‘Additions’ tab.

- Click on the ‘blue spanner’ symbol at the top of one of the columns (the exact column headings will vary according to your use of the software).

- Create a new addition:- Tick the box marked ‘Used’, add a suitable description, and specify whether the particular payment is subject to tax and / or NIC as appropriate, then click ‘OK’.

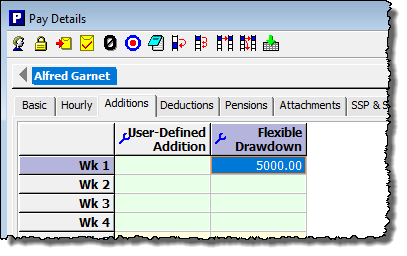

- Enter the payment amounts in the relevant column(s) that you have created on the Pay Details screen.

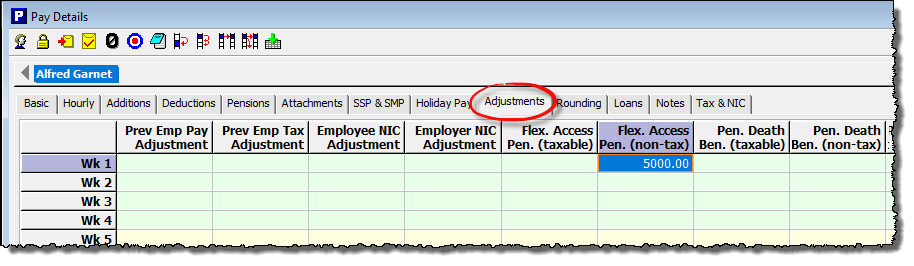

2) Entering the payment in the ‘Adjustments’ screen:

For payments made up to and including tax year 2024-25:

- Click on the ‘Adjustments’ tab on the Pay Details screen and enter the drawdown payment amount in the relevant column(s).

For payments made in tax year 2025-26 onwards:

-

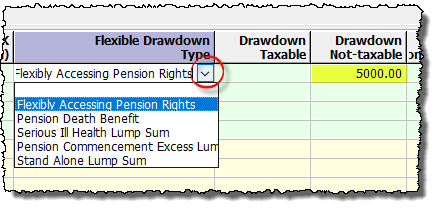

- Click on the ‘Adjustments’ tab on the Pay Details screen and select the relevant Flexible Drawdown type using the drop-down selector. Then enter the amount in the relevant column(s).

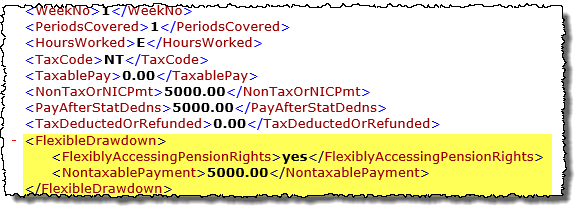

HMRC require that your RTI submission includes the relevant Flexible Drawdown Indicators’ as appropriate, depending on the types of payment made. Payroll Manager automatically includes these indicators according to which column you have used to enter the adjustments. These indicators are not shown on the RTI report, but will be present in the underlying xml data sent to HMRC (see example below).