Employment Allowance

Many organisations are able to claim the Employment Allowance (EA) in order to reduce their employer Class 1 National Insurance contributions (‘Employer NIC’). For tax years 2026-27 and 2025-26 the maximum amount of Employment Allowance that can be claimed is £10,500.

The rules regarding eligibility are beyond the scope of Payroll Manager and you should consult the information provided by the government to determine whether or not you can claim. See GOV.UK – Claim Employment Allowance for more information.

How to claim the Employment Allowance in Payroll Manager

For Tax Years 2026-27 and 2025-26

You should claim the Employment Allowance as soon as you that you are eligible to claim it, ideally at the end of the first month of a new tax year.

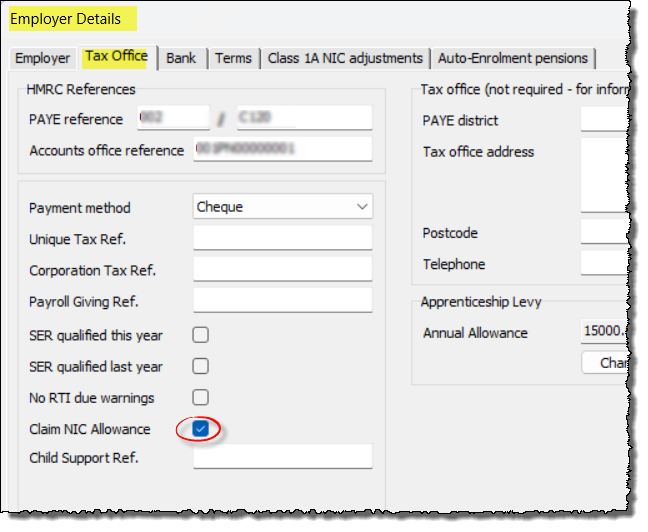

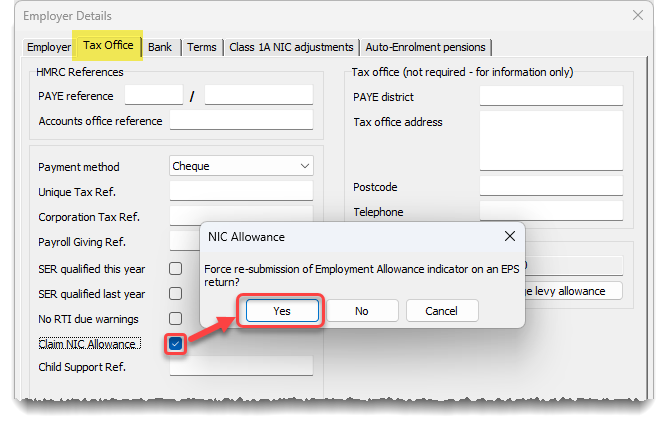

Click ”Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager and select the ‘Tax Office‘ tab. Tick the box marked ‘Claim NIC Allowance‘ and click ‘OK‘.

Payroll Manager will schedule an RTI return called an Employer Payment Summary (EPS) on the ‘Pay – Employers RTI schedule‘ screen which you should submit to HMRC to inform them that you are claiming the Employment Allowance in that tax year. You only need to inform HMRC once per tax year that you are claiming the Employment Allowance, so any further EPS submissions will not include this information.

For tax Year 2024-25

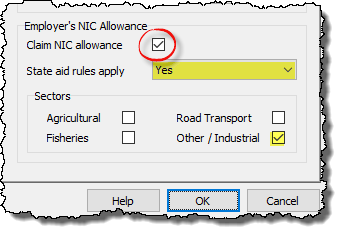

You should consult the GOV.UK web page Changes to Employment Allowance , which will help you to correctly complete the relevant sections on this screen.

- If you are claiming the EA then tick the Claim NIC allowance box.

- If State Aid rules apply to your business then select ‘Yes‘ (the GOV.UK document linked above suggests that “de minimis state aid will apply to most businesses claiming the EA“.)

- Tick the business sector(s) that applies to you. (Note: Moneysoft does not know/ is not able to tell you which sector your business is in – please contact HMRC if you are in any doubt about which box/boxes to tick).

How the Employment Allowance affects payroll calculations and reports

The Employment Allowance does not affect the amount of Employer NIC calculated, Employer NIC still needs to be calculated by Payroll Manager and reported to HMRC in the regular Full Payment Submission (FPS) RTI returns, regardless of whether the EA is being claimed or not. The EA only affects the amount of Employer NIC that is due to be paid to HMRC at the end of each tax month or quarter.

EA amounts are calculated at the end of each month (or quarter), so you will not ‘see’ the allowance until then. The allowance will not show on a payslip or on any reports detailing what has been deducted from employees – it will only appear on reports showing what the employer owes (see FAQ section below for an exception to this, when an RTI report coincides with the end of a tax month)

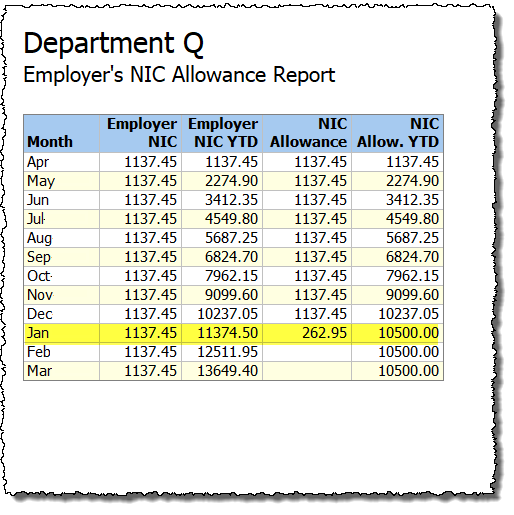

A report showing the amount of EA claimed month by month (below) can be produced by selecting ‘Analysis‘ then ‘Employer’s NIC Allowance‘ from the main menu in Payroll Manager. This report will also show when the allowance has been ‘used-up’ (in the example below, the allowance threshold of £10,500 was reached in the month of January).

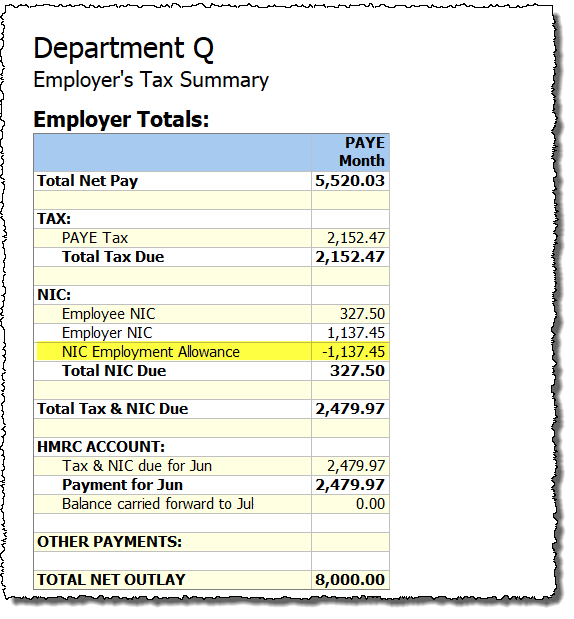

The Employment Allowance is also shown on the ‘Pay – Employer’s Summary for Tax Period‘ report (below), and serves to reduce the total Employer NIC due to HMRC in that particular period.

How HMRC apply the allowance

An employers ‘HMRC PAYE online service’ account will give details of all the tax, student loan deductions, Employee NIC and Employer NIC reported via FPS returns in any one particular tax period. In addition to this, if an employer is claiming the EA in that tax year, a ‘credit’ will be shown, equal to the amount of Employer NIC due in that period (until the total amount of EA for the year has been ‘used’).

FAQ

-

- I am taking over a payroll mid way through the year and am using the ‘Tools – Mid Year Start’ feature. How do I enter the employment allowance that has already been used up/is still remaining? – Payroll Manager is able to calculate this automatically. When you enter ‘mid year start’ figures into the system, one of the fields that you need to complete for each employee is ‘Employer NIC’. Payroll Manager then calculates the total Employer NIC entered and compares it to that years Employment Allowance limit. From this Payroll Manager can determine how much of the allowance (if any) remains.

-

- Why does the EA show on some RTI returns, but not on others? – EA amounts are only displayed on reports which show the amount of Tax & NIC due to HMRC in a tax period. If the employee pay date of a Full Payment Submission (FPS) happens be in the last week of a tax month, then Payroll Manager will display an additional column in the ‘Employer Totals’ section of the FPS labelled ‘PAYE Month’. The information contained in this column is not actually sent to HMRC, but is displayed solely as a guide to how much will be due to HMRC in that tax period. If an employer is claiming the EA, then any relevant amounts will be shown in this column, although again, this information will not actually be submitted to HMRC in the FPS. Many FPS returns do not coincide with the last week of a tax month, and so for those pay periods this additional ‘PAYE Month’ column will not be displayed. If the employer has employees that are paid 4 weekly for example, then they may find that some FPS reports will show this extra column (i.e. when the pay date is in the final week of the tax month), and some FPS reports will not show this column (i.e. when the pay date is not in the final week of the tax month). This is normal and is not something to be concerned about. The correct report to refer to when determining how much is owed to HMRC is the ‘Pay – Employer’s Summary for tax period‘ report, which will always show the EA (if applicable).

- I need to claim the EA for a previous tax year – how can I do this? Please refer to our guide Claiming/Un-claiming the Employment Allowance for a previous year.

- HMRC have asked me to resend the Employment Allowance indicator – how do I do this? – In some circumstances HMRC systems are at fault and may report that you not claiming the Employment Allowance for a tax year, even though you have already filed an EPS stating that you are claiming it. It is possible to submit another EPS with the Emloyment Allowance indicator set to ‘Yes’ (again), which should resolve the issue. To resend the Employment Allowance Indicator then click ‘Employer‘ then ‘Employer Details‘ from the main menu in Payroll Manager, and select the ‘Tax Office‘ tab. Click in the box marked ‘Claim NIC Allowance‘ to remove the tick, and immediately click inside the same box again to re-instate the tick. Once you have done this a box will appear asking if you wish to ‘Force re-submission of the EA indicator‘. Answer ‘Yes‘ to this question, and then click ‘OK‘ (example below). Next go to the ‘Pay – Employers RTI schedule‘ screen and you will see that Payroll Manager has scheduled an ‘Employer Payment Summary (EPS)’, that you should file to HMRC to inform them (again) of the fact that you are claiming the EA for that tax year.

Links

Employment Allowance: further guidance for employers – GOV.UK