Directors NIC

There are two main methods for calculating National Insurance Contributions for a director : the ‘Standard Annual Earnings Period‘ method, and the ‘Alternative arrangements‘ method. Both methods result in a director paying exactly the same amount of National Insurance over the course of a tax year, although one method may be more suitable than the other, depending on the level and frequency of pay of the director. This guide explains briefly how each method operates, and shows how to select the appropriate method in Payroll Manager. The GOV.UK publication CA44: National Insurance for Company Directors provides more comprehensive guidance, including what to do in more unusual situations.

1) Standard Annual Earnings Period method of calculating NIC

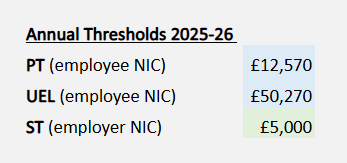

When using the ‘Standard Annual Earnings Period’ method, a director pays (employee) NICs if the director’s total earnings in the year to date exceed the annual Primary Threshold (PT) and the company pays (employer) NICs if the director’s total earnings in the year to date exceed the annual Secondary Threshold (ST). These thresholds are shown below:

Typically a director pays employee NICs at a certain percentage rate on all earnings above the annual PT, until their earnings exceed the annual ‘Upper Earnings Limit’ (UEL), whereby they pay NICs at a different (typically lower) rate.

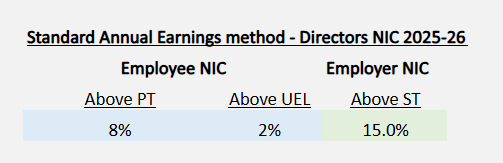

NIC calculation rates for directors for tax year 2025-26 using the Standard Annual Earnings method are shown below.

When using the ‘Standard Annual Earnings Period’ method of calculating NIC, it is always the directors pay in the year to date that is taken into consideration when calculating the amount of NIC due.

2) Alternative arrangements method calculating NIC

When using the ‘Alternative arrangements’ method, payments are made on account of directors’ NICs during the tax year based on the actual intervals of payment – usually weekly or monthly – in the same way as for other employees, except in the final pay period of the year, where an annual calculation for NIC is made.

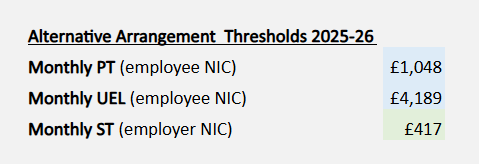

This means that if the director is paid regularly each month for example, then it is the monthly Primary Threshold (PT) that is used to calculate the NIC, rather than the annual PT (unless it is the final pay period of the year). These thresholds are shown below:

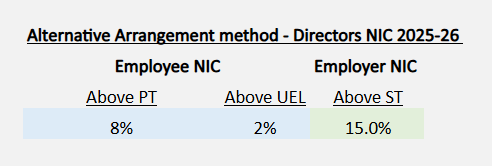

NIC calculation rates for directors for tax year 2025-26 using the Alternative arrangements method are shown below.

When using the ‘Alternative arrangements’ method of calculating NIC, it is the directors pay in that particular pay period (and not their pay in the year to date) that is taken into consideration when calculating the amount of NIC due, up until the final pay period of the year, where an annual calculation of NIC is made.

In the final pay period of the year

In the final period of the year (i.e. month 12 /week 52 or their final pay period if they leave employment before the end of the year) the ‘Standard Annual Earnings Period’ method is used to calculate NIC for a director (as in Step 1, above). The total pay in the year to date is taken into account when calculating the amount of NIC due for the tax year, using the annual thresholds for directors NIC. Any NIC already paid in the year to date is then subtracted from this total, to give a final balancing figure. This is then deducted from the director’s pay in the final pay period of the year.

3) How to choose which method to use

Both the ‘Standard Annual Earnings Period’ method and the ‘Alternative arrangements’ method result in a director paying exactly the same amount of National Insurance over the course of a tax year, so there is no monetary advantage to choosing one method over the other.

Standard Annual Earnings Period method

If a director is to be paid irregularly, and/or if they are likely to be paid a large bonus at some point during that year, then it is best to use the ‘Standard Annual Earnings Period’ method of calculation. Directors using this method will pay no employee NIC at all until they exceed the annual PT, at which point employee NIC payments become due. (Important – Secondary (Employer) NIC becomes payable once the earnings of the director has exceeded the Secondary Threshold (ST) – which is often lower than the Primary Threshold (PT)

Alternative arrangements method

Some directors wish to be paid fixed monthly (or weekly) amounts in each pay period of the year. Such directors may elect to use the ‘Alternative arrangements’ method for the calculation of NIC, to ensure that their net pay remains the same in every pay period.

The GOV.UK publication CA44: National Insurance for Company Directors specifies the ‘Qualifying Conditions’ that need to be met in order to use the Alternative arrangements:

You’ll be able to take advantage of this arrangement if:

• the director agrees to NICs being assessed in this way

• the director normally receives his earnings in a payment pattern for which a regular earnings period can be established for the assessment of NICs

• those payments normally exceed the LEL for the pay period concerned

You should not choose the Alternative arrangements method if you expect the director to be paid above the monthly UEL in some pay periods but below the monthly UEL in others (e.g. if the director is to be paid a large bonus in one month, but a much smaller amount in other months). Doing so may result in a ‘larger than usual’ calculation of NIC in the final pay period of the tax year, as the ‘annual’ method is then used to determine the final amount of NIC due. For directors whose pay is expected to vary throughout the year the Standard Annual Earnings Period method should always be used.

4) Where to specify the calculation method to use in Payroll Manager

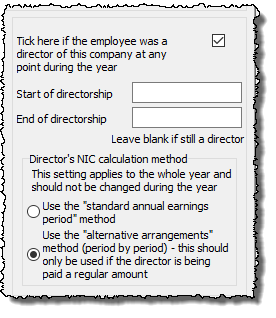

When adding a new employee to Payroll Manager there is a ‘tick-box’ where you indicate that the employee is a director. By default, the software will use the ‘Standard Annual Earnings Period’ method of calculation.

If you wish to use the ‘Alternative arrangements’ method for a particular director, then this must be specified at the beginning of the tax year. Click ‘Employees‘ then ‘Employee Details‘ from the main menu in Payroll Manager, then click on the ‘Work‘ tab. Select the option to use the ‘alternative arrangements‘ method and click ‘OK‘.

Once a calculation method has been set and the director has been paid then you must keep using the same NIC calculation method for the remainder of the tax year. The chosen calculation method is automatically carried forward, year-by-year, by Payroll Manager.

5) Viewing the calculation of directors NIC

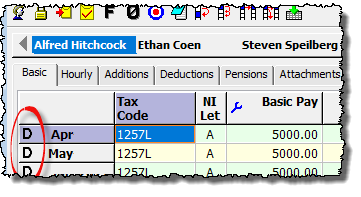

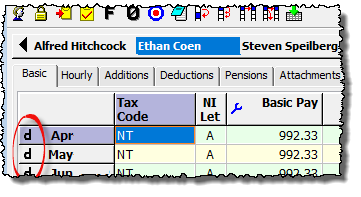

When an employee has been set as a director, an indicator appears on the left hand side ‘Pay Details‘ screen in each pay period.

An upper case ‘D‘ indicates that the ‘Standard Annual Earnings Period’ is in use for this director (below):

A lower case ‘d‘ indicates that the ‘Alternative arrangements’ method is being used (below):

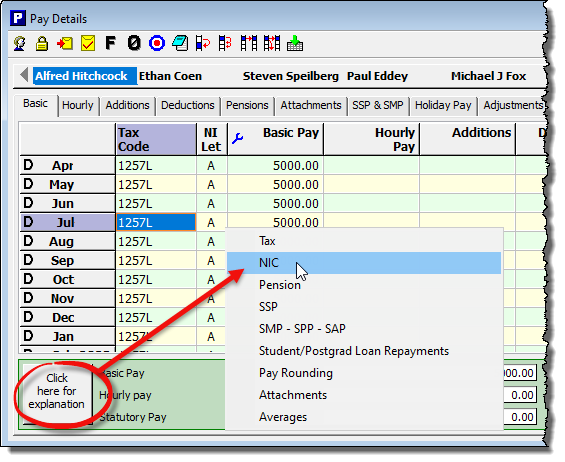

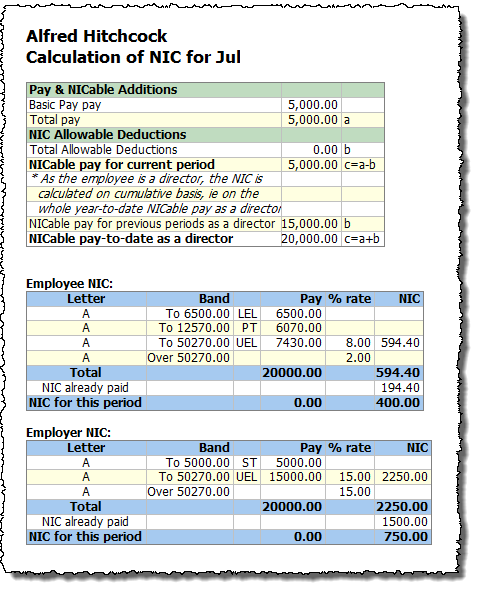

If you wish to see how the NIC has been calculated for a director, then select the relevant pay period on the ‘Pay Details‘ screen, then click on the ‘Click here for explanation‘ button at the bottom-left hand side of the screen, and select ‘NIC‘.

A report will appear giving a full breakdown of the NIC calculations (for both employee and employer NIC).

6) If a director is appointed mid way through a tax year, or leaves before the end of a tax year

Director appointed during tax year

A director that is appointed during a tax year will have a pro rata annual earnings period for the remainder of that year. This is determined by the number of weeks in that tax year for which the employee is a director (regardless of their pay frequency).

e.g. in 2025-26 the Primary annual threshold for directors is £12,570. If an employee is appointed as a director on 1st October 2026, then they will be a director for the remaining 27 weeks of that tax year. The pro rata annual PT for that director will therefore be £12,570 x 27/52.

Payroll Manager handles these calculations automatically, based on the date entered as the ‘Start of directorship‘ on the ‘Employees – Employee Details – Work‘ screen. (If this field has been left blank, but the director has a ‘Date Started’ entered on the Employee Details screen that is in the current tax year, then Payroll Manager will use this date instead).

Director leaves / terminates directorship during tax year

If a director leaves / terminates their directorship during the tax year, then NIC is still calculated based on the full annual earnings period, and is not pro rated. If the ‘Alternative arrangements’ method of calculating NIC is in use for a director that leaves before the end of the tax year then the pay period in which they leave is deemed to be the ‘final’ period of the year, and the ‘Standard Annual Earnings Period’ method is used to calculate the amount of NIC due (as per section 2, above).

7) Potential problems at year end when using the Alternative arrangements method

The ‘Alternative arrangements’ method should only be used if the director is to be paid regularly throughout the year (see section 3). In cases where the Alternative arrangements method has been used in error, and where the pay for a director has not been regular throughout the year, then the mathematics of the calculation of NIC in the final pay period of the year may mean that more NIC is due in that period than the director is actually being paid.

(The reasons behind this are complex, but typically this happens because the ‘Alternative arrangements’ method uses monthly (or weekly) NIC thresholds in all pay periods except the final one, and it may be that the directors earnings have exceeded the monthly UEL in some periods, but not in others (perhaps if the director was in receipt of a large bonus in one particular pay period, or perhaps they were paid nothing at all in some pay periods). Earnings above the UEL typically attract a lower rate of NIC, which can then mean that more NIC is due at the end of the year, when the annual UEL is used.)

In order to prevent an underpayment of NIC for the year, the director must be paid enough in the final period of the year to cover any NIC still due. The ‘net-to-gross‘ calculator in Payroll Manager can help with this.

Using the net to gross calculator

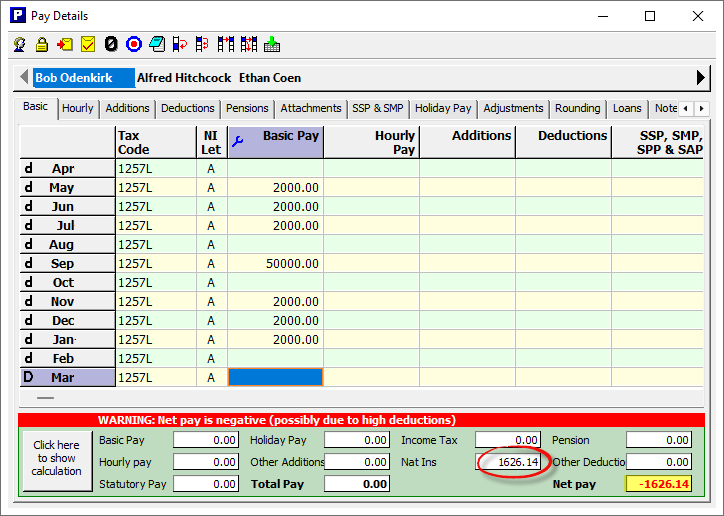

Example. The ‘Alternative arrangements’ method has been used for a director who had variable pay in the year, and as such is not being paid enough in the final pay period to cover the NIC due. A warning message may appear at the bottom of the Pay Details screen to indicate this (below).

The employer would then need to calculate how much to pay the director in the final period of the year to make the net pay positive and to prevent an underpayment of employee NIC to HMRC. These problems can be avoided by not using the Alternative arrangements method for directors with variable pay.

If it is expected that the directors pay will not be regular in the following tax year then the user should change the method of calculation to the ‘Standard Annual Earnings Period’ method from the start of that tax year ( see section 4)

8. Changes from April 2025

There were a number of changes from 6 April 2025 which may affect how much a company director chooses to pay themselves. Please see the ‘Directors’ section of the following guide for more information: Employer National Insurance Contribution (NIC) changes from April 2025 – Moneysoft

Links

The GOV.UK CA44: National Insurance for company directors

Payroll Manager: National Insurance categories and rates