Direct Earnings Attachment (DEA)

This guide explains what to do in Payroll Manager if the Department for Work and Pensions (DWP) Debt Management department issues a formal notice to an employer instructing them to implement a Direct Earnings Attachment (DEA) in respect of an employee. Moneysoft Payroll Manager has all of the relevant rules and rates for the various types of DEA built in, and so once the relevant details have been entered into the software the amounts to be deducted from an employee in each pay period will be calculated automatically.

You should read the GOV.UK guidance Direct earnings attachment: a guide for employers – GOV.UK before proceeding.

How a DEA operates

DWP issue a formal notice to an employer instructing them to make deductions from an employee’s pay each pay period and to pay these amounts over to DWP Debt Management. An example of such a notice can be found at DEA – Example of formal notice to employer

DEA deductions are made using one of three methods:

- A deduction from net earnings at the ‘Standard Rate’.

- A deduction from net earnings at the ‘Higher Rate’.

- A deduction from net earnings of a ‘Fixed Amount’

The formal notice will specify which of the three methods should be used, the date that the order was made, and the total amount to be collected. Payroll Manager has the relevant ‘Standard Rate’ and ‘Higher rate’ tables built-in, and so is able to perform the calculations automatically.

How to enter the details of the DEA in Payroll Manager

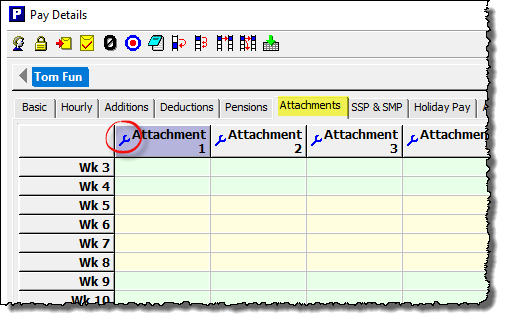

1) Select the appropriate employee on the ‘Pay Details‘ screen.

2) Click on the ‘Attachments‘ tab, then click on the (blue spanner) ‘Settings‘ button in the next available column.

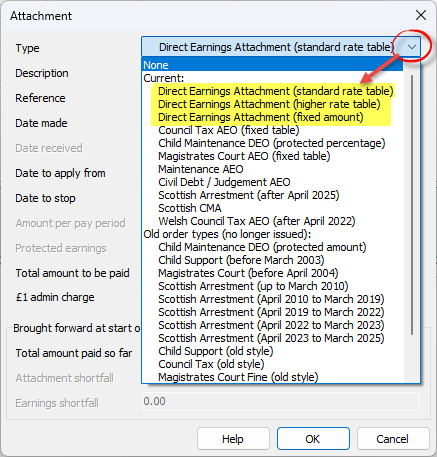

3) Choose the relevant DEA type from the drop-down list:

- If the formal notice issued by DWP refers to a ‘Direct Earnings Attachment – standard rate‘ then select the ‘Direct Earnings Attachment (standard rate table)’ option.

- If the formal notice issued by DWP refers to a ‘Direct Earnings Attachment – higher rate’ then select the ‘Direct Earnings Attachment (higher rate table)’ option.

- If the formal notice issued by DWP refers to a ‘Direct Earnings Attachment – fixed amount‘ then select the ‘Direct Earnings Attachment (fixed amount)’ option.

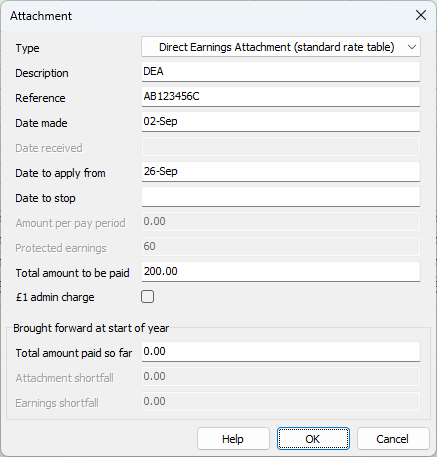

4) Complete the other fields on this screen as per the instructions below:

Complete each fields as follows:

– Description: – Enter a description for this particular attachment – this can be whatever you like (e.g. DEA) and is only used as a column ‘label’ on the ‘Pay Details’ screen for that particular attachment, and also appears on the employee payslip.

– Reference: The Department of Work and Pensions (DWP) ask that you use the National Insurance Number (NINO) of the employee as the reference, so enter this here. The NINO will be specified on the formal notice, so double-check that you are applying it to the correct employee.

– Date made: Enter the date that appears on the formal notice letter received from DWP.

– Date to apply from: DWP guidance states that “The order has effect from the next pay day which falls on or after 22 days following the day on which it is given or sent. The period of 22 days has been put in place to allow the employer time to set up the DEA“.

To determine the ‘Date to apply from’, look at the date on the letter from DWP, count forward 22 days, and then find the next pay date for that particular employee. Enter the relevant pay date in this box. You should make sure that the date that you enter is for a pay period for which the employee has not yet been paid.

– Date to stop: Leave this field blank. Payroll Manager will automatically stop making deductions once the ‘Total Amount to be paid’ (see below) as been reached. If DWP subsequently ask the employer to stop applying the DEA before it has been fully paid off then the applicable date can be entered here.

– Amount per pay period: This field will be greyed out if the ‘Type’ has been set to either ‘Direct Earnings Attachment (standard rate table) or ‘Direct Earnings Attachment (higher rate table)’, as in these cases Payroll Manager uses the relevant deduction tables provided by DWP to calculate the deductions automatically.

To deduct a specific amount, rather than using the tables

If DWP have requested that you deduct a specific amount each pay period then ‘Type’ should be set to ‘Direct Earnings Attachment (fixed amount)’ and the amount to deduct per pay period should be entered into this box. Please note this is an unusual circumstance, and in the majority of cases DWP will ask that the ‘standard rate table’ or ‘higher rate table’ method is used.

– Protected earnings: This box will be greyed-out in all cases, as Payroll Manager will automatically apply the 60% ‘protected earnings’ rule – (see Protected Earnings Limit for more details).

– Total amount to be paid: Enter the ‘Total Amount to be Recovered‘ as specified by DWP in their formal notice letter to the employer. Note that this is NOT the amount to be deducted per pay period, but is the total amount to be paid across the whole of the DEA. Payroll Manager will automatically stop calculating deductions once this limit has been reached.

– £1 admin charge: DWP rules state that the employer is allowed to deduct £1 for each pay period in which a DEA deduction is made if they wish, to cover their own admin costs. This is optional – tick/untick the box accordingly.

If you have figures to bring forward from a previous year / other software

– Brought forward at start of year – Total amount paid so far: this field is for situations where you are using Payroll Manager for the first time for a particular employer, and an employee has a DEA which has been in operation before the start of the tax year, or if you are starting to use Payroll Manager mid way through the tax year, having used other software previously. The box allows you to enter the amount that has already been paid by the employee, effectively reducing the ongoing balance.

Click ‘OK‘ when you have finished entering information on this screen.

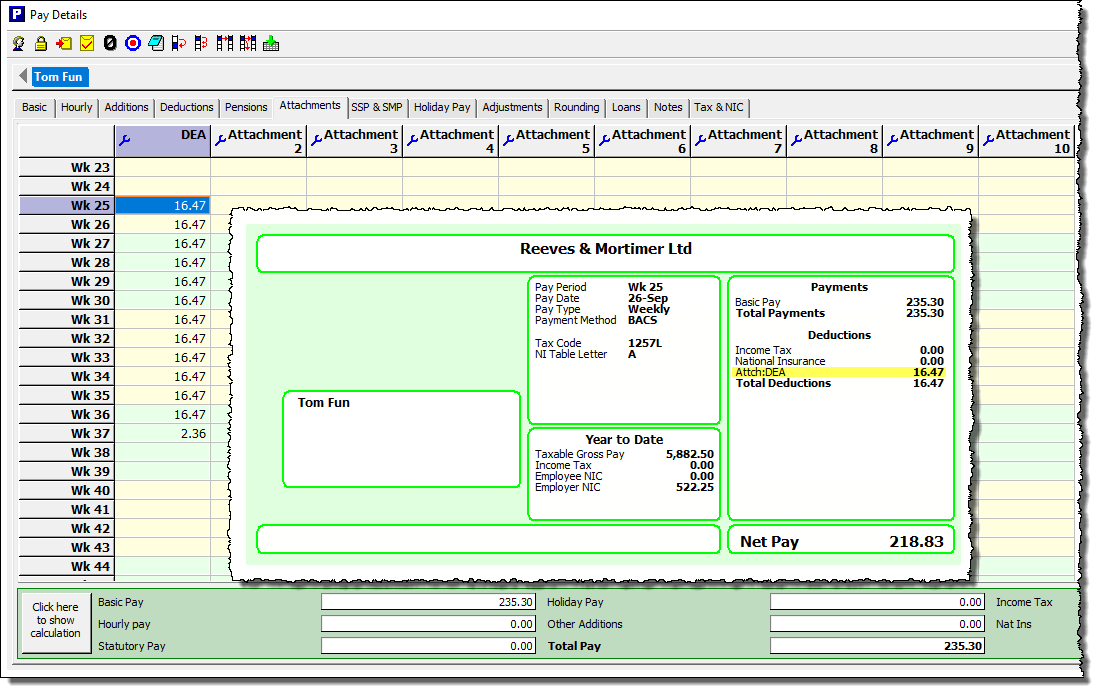

How the DEA deductions are calculated

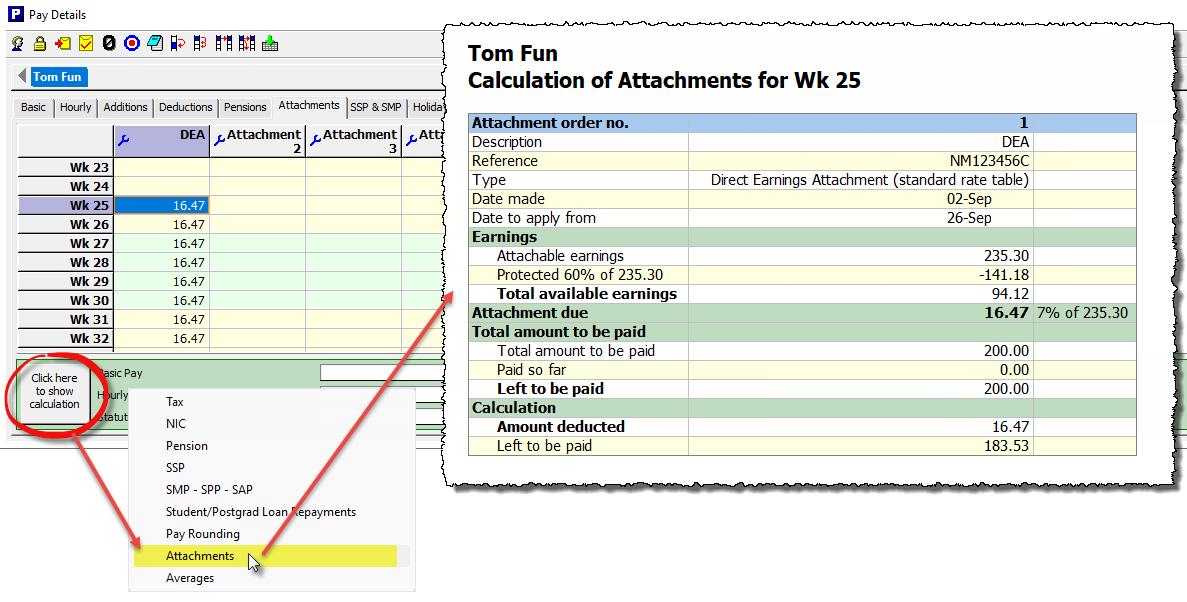

Payroll Manager automatically calculates the amount to be deducted from the employee each pay period, according to the rules specified by DWP. These rules and tables are built into the software. The calculated deduction amounts are then shown in the ‘Attachments‘ column of the ‘Pay Details‘ screen and are also itemised on the employee payslip.

If you wish to see a full breakdown of how Payroll Manager has calculated the DEA deduction then click the button marked ‘Click here to show calculation‘ towards the bottom-left of the Pay Details screen, and select ‘Attachments‘.

Note that the actual deduction is based on the ‘Attachable Earnings‘, which is not the same as the gross pay, but instead is the employee’s pay after the deduction of tax, national insurance, student/postgraduate loans, pension contributions and statutory parenting payments such as SMP. The DWP definition of what counts as ‘Earnings’ for this purpose can be found at DEA Guide – What Counts As Earnings

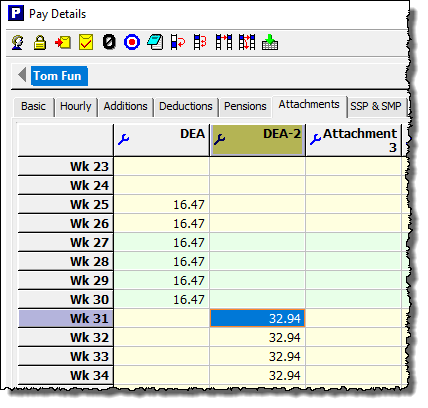

Ending or editing a DEA – changes of circumstances

Payroll Manager will continue to calculate DEA deductions until the ‘Total amount to be paid’ has been reached, or if an employee leaves employment. If the employer is contacted by DWP asking them to change the terms of the DEA (e.g. to switch from the ‘Standard rate’ to ‘Higher rate’ deduction tables) then it is very important NOT to edit an existing DEA within the software. Instead you should ‘end’ the existing DEA, and set up a brand new DEA column on the Pay Details screen. This can be done as per the instructions below:

1) Click on the (blue spanner) ‘Settings‘ button in the column relating to the original DEA (i.e. the one that is ‘ending’).

2) Enter a ‘Date to stop‘ and click ‘OK‘. The ‘Date to stop’ should be the pay date of the last period for which you wish to original DEA to operate.

3) Click on the (blue spanner) ‘Settings‘ button in the next available attachments column.

4) Enter the details of the ‘new’ DEA, making sure that the ‘Date to apply from’ is the pay date of the next pay period for that employee (i.e. the next pay date subsequent to the one entered in step 2, above). Click ‘OK‘ when you have finished.

The ‘Pay Details‘ screen will then show the details of the two DEA orders, as per the example below.

Reports in Payroll Manager

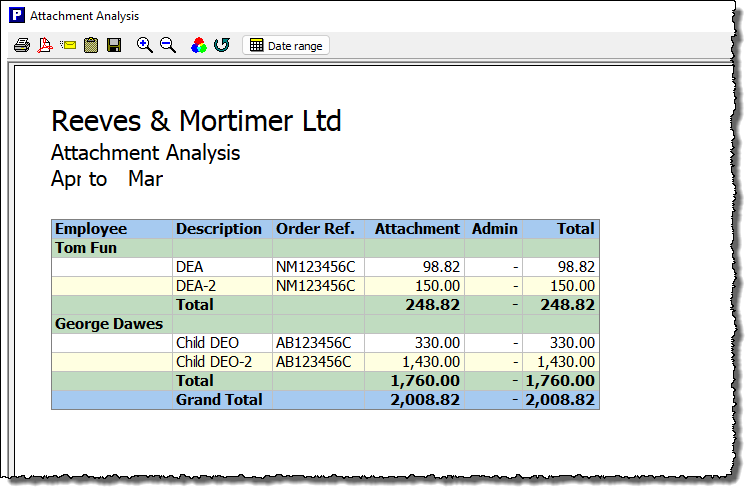

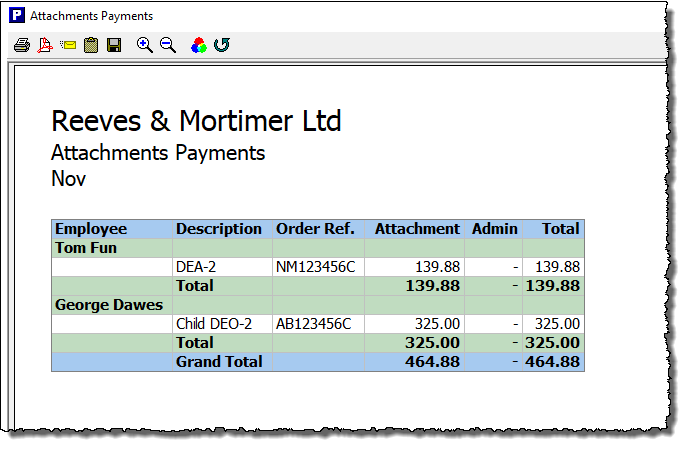

Payroll Manager has a number of reports available to help with the administration of DEA.

Click ‘Analysis‘ then ‘Attachments‘ from the main menu in Payroll Manager to view a report which gives the details of all attachments in operation for each employee.

Click ‘Pay‘ then ‘Payments‘ and select ‘Attachments report’ to see a list of attachment payments due in any one particular pay period.

Paying DWP

The employer is required to pay the amounts deducted from their employees net wages to the DWP Debt Management as soon as possible. Ideally this would be at the same time as the deduction(s) were made from the employee’s salary, but must be no later than the 19th day of the month following the month in which the deduction was made. See DEA – making payments to DWP debt management for more details.

FAQ

If an employee has a number of different attachments in operation at the same time, which one takes priority? – Different attachment orders take priority over each other according to their type (e.g. Child Maintenance, Council Tax, DEA etc) and the date that they were issued. Payroll Manager has all of the rules regarding priority built-in, and will automatically apply attachments in the correct priority order.

Links

Direct earnings attachment: a guide for employers – GOV.UK

Direct earnings attachment: a more detailed guide – GOV.UK