Cycle to work scheme

This guide shows how to set up a ‘salary sacrifice’ deduction in Payroll Manager when an employee is making hire payments for a bicycle provided by their employer under the Government ‘Cycle to work’ scheme. You should read the Department of Transport publication ‘Cycle to work scheme – guidance for employers‘ for more details about how this scheme operates.

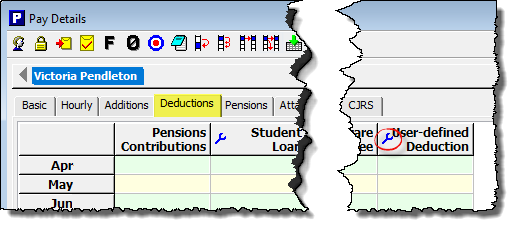

Create a new ‘deductions’ column

Click on the ‘Deductions‘ tab on the ‘Pay Details‘ screen in Payroll Manager, then click on the blue ‘spanner‘ symbol in the column furthest to the right (note – in this example, this column is labelled ‘user-defined deduction’, but in your case the column furthest to the right may have a different name, according to your use of the program).

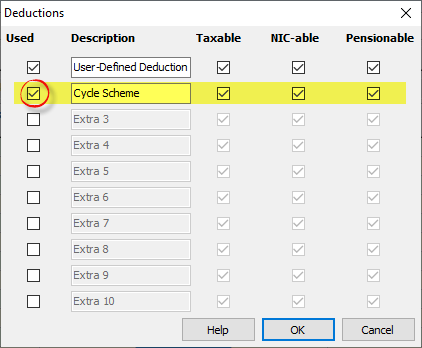

Tick the next available ‘used‘ box, add a suitable description for the column (e.g. ‘Cycle scheme’), and tick the boxes marked ‘Taxable‘, ‘NIC-able‘ and ‘Pensionable‘. Click ‘OK‘.

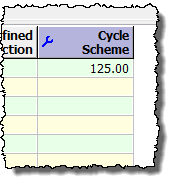

You have now created a new column, into which you can enter the amounts to be deducted from the employee.

These amounts will be deducted from the employee’s pay BEFORE the calculation of Tax, NIC and so the employee will pay less tax & NIC as a result. (The employer will also benefit from paying lower Employer NIC).