Council Tax Attachment of Earnings Order (CTAEO)

This guide explains what to do in Payroll Manager if a Local Authority in England & Wales issues a formal notice to an employer instructing them to implement a Council Tax Attachment of Earnings Order (CTAEO) in respect of an employee. Moneysoft Payroll Manager has all of the relevant rules and tables for the various types of CTAEO built in, and so once the relevant details have been entered into the software the amounts to be deducted from an employee in each pay period will be calculated automatically.

You should read the guidance provided by the relevant Local Authority before proceeding.

How a CTAEO operates

Local authorities in England and Wales, after obtaining a liability order from a Magistrates’ Court, may raise a Council Tax AEO (CTAEO) in order to enforce the payment of Council Tax against employed debtors. The ‘Council Tax (Administration and Enforcement) Regulations 1992′ (see links section at the bottom of this guide) set out the rules and rates which apply. This legislation applies only in England and Wales.

The order is then issued to the employer, requiring them make deductions from the employee’s pay, and to pay these amounts over to the Local Authority until the amount owing has been paid in full.

The CTAEO will specify:

- The name of the debtor, and their payroll number (if known).

- A local authority reference, specific to that particular order.

- The total amount of charge to be paid.

The employer should then start making deductions from the employee’s pay as soon as possible, according to a set of tables as prescribed in the regulations. It is likely that the Local Authority will include a copy of these tables when issuing the CTAEO to the employer. Payroll Manager has these tables built-in, and so can perform the necessary calculations automatically.

There are separate sets of tables for use in England and in Wales.

How to enter the details of the CTAEO in Payroll Manager

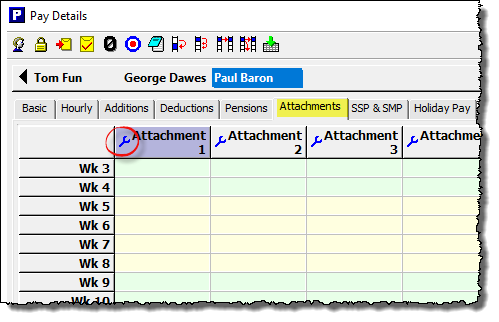

1) Select the appropriate employee on the ‘Pay Details‘ screen.

2) Click on the ‘Attachments‘ tab, then click on the (blue spanner) ‘Settings‘ button in the next available column.

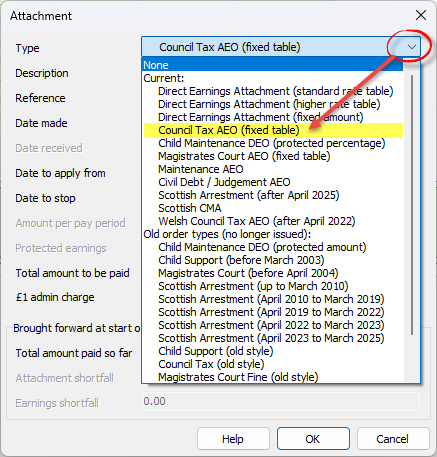

3) Choose the relevant CTAEO type from the drop-down list:

- For Council Tax AEO in England select ‘Council Tax AEO (fixed table)‘.

- For a Council Tax AEO issued in Wales, select ‘Welsh Council Tax AEO (after April 2025)‘.

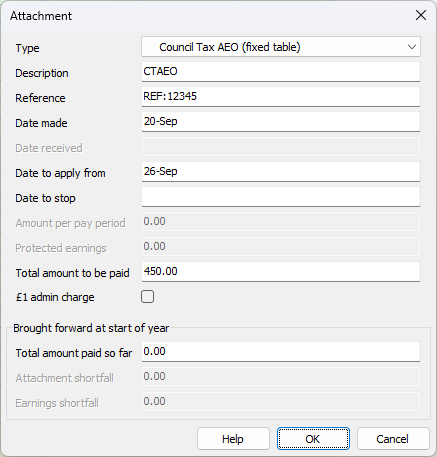

4) Complete the other fields on this screen as per the instructions below:

– Description: – Enter a description for this particular attachment – this can be whatever you like (e.g. CTAEO) and is only used as a column ‘label’ on the ‘Pay Details’ screen for that particular attachment, and also appears on the employee payslip.

– Reference: The issuing Local Authority will include a reference specific to that particular order, which you should enter here.

– Date made: Enter the date that appears on the formal notice letter received from the Local Authority.

– Date to apply from: Enter the next pay date for that particular employee. You should make sure that the date that you enter is for a pay period for which the employee has not yet been paid.

– Date to stop: Leave this field blank. Payroll Manager will automatically stop making deductions once the ‘Total Amount to be paid’ (see below) as been reached. If the Local Authority contacts the employer to request that deductions are should be stopped for any reason, then the relevant date can be entered here.

– Amount per pay period: This field will be greyed out in all cases as it is not applicable to CTAEO calculations which are made by way of ‘fixed tables’ ,built into Payroll Manager.

– Protected earnings: This box will be greyed-out in all cases, as it does not apply to CTAEO attachments.

– Total amount to be paid: Enter the ‘Outstanding Amount‘ of Council Tax to be recovered, as specified on the CTAEO documentation issued by the Local Authority. Payroll Manager will automatically stop calculating deductions once this limit has been reached.

– £1 admin charge: CTAEO rules state that the employer is allowed to deduct £1 for each pay period in which a CTAEO deduction is made if they wish, to cover their own admin costs. This is optional – tick/untick the box accordingly.

– Brought forward at start of year – Total amount paid so far: this field is for situations where you are using Payroll Manager for the first time for a particular employer, and an employee has a CTAEO which has been in operation before the start of the tax year, or if you are starting to use Payroll Manager mid way through the tax year, having used other software previously. The box allows you to enter the amount that has already been paid by the employee, effectively reducing the ongoing balance.

Click ‘OK‘ when you have finished entering information on this screen.

How CTAEO deductions are calculated

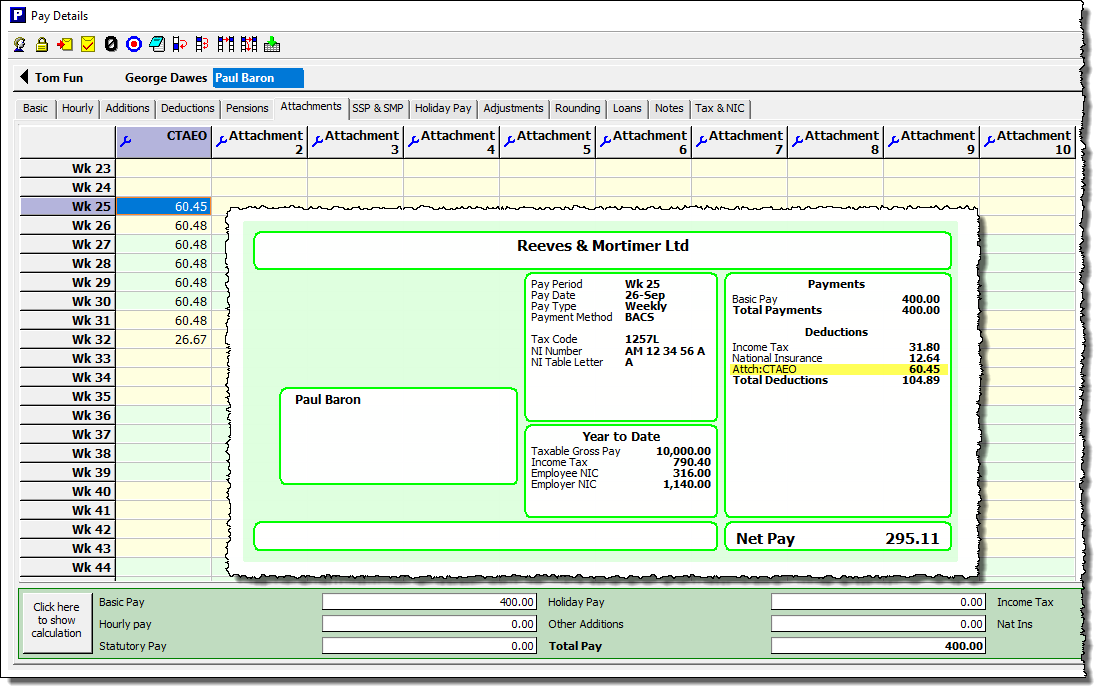

Payroll Manager automatically calculates the amount to be deducted from the employee each pay period, according to the rules and deduction tables specified by the regulations.. These rules and tables are built into the software. The calculated deduction amounts are then shown in the ‘Attachments‘ column of the ‘Pay Details‘ screen and are also itemised on the employee payslip.

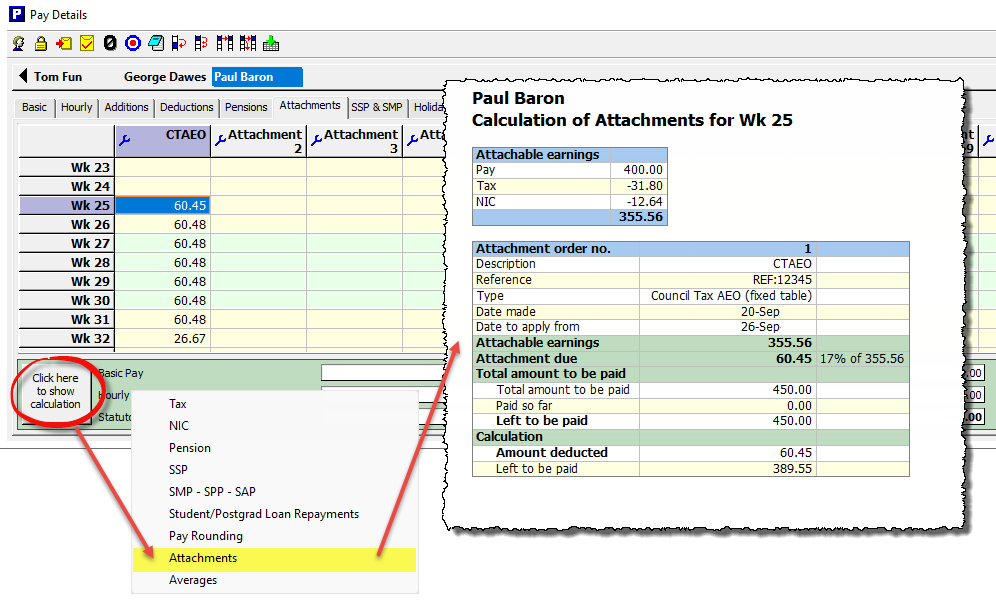

If you wish to see a full breakdown of how Payroll Manager has calculated the CTAEO deduction then click the button marked ‘Click here to show calculation‘ towards the bottom-left of the Pay Details screen, and select ‘Attachments‘.

Note that the actual deduction is based on the ‘Attachable Earnings‘, which is not the same as the gross pay, but instead is the employee’s pay after the deduction of tax, national insurance, student/postgraduate loans, pension contributions and statutory parenting payments such as SMP.

Ending or editing a CTAEO – changes of circumstances

Payroll Manager will continue to calculate CTAEO deductions until the ‘Total amount to be paid’ has been reached, or if an employee leaves employment. If the employer is contacted by the Local Authority asking them to end the CTAEO then this can be done as per the instructions below:

1) Click on the (blue spanner) ‘Settings‘ button in the column relating to the CTAEO (i.e. the one that is ‘ending’).

2) Enter a ‘Date to stop‘ and click ‘OK‘. The ‘Date to stop’ should be the pay date of the last period for which you wish the CTAEO to operate. Make sure that the date you enter is NOT in a pay period that has already been paid.

Reports in Payroll Manager

Payroll Manager has a number of reports available to help with the administration of CTAEO.

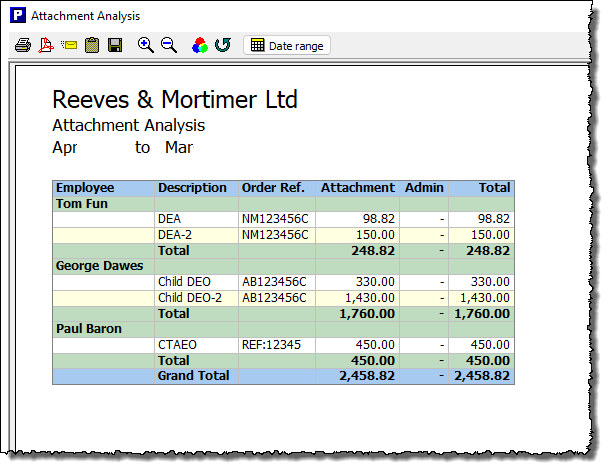

Click ‘Analysis‘ then ‘Attachments‘ from the main menu in Payroll Manager to view a report which gives the details of all attachments in operation for each employee.

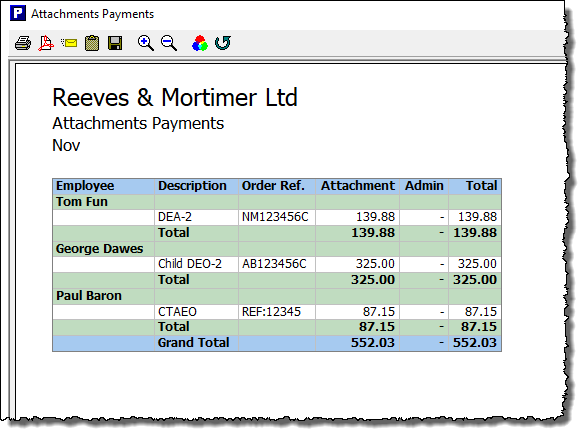

Click ‘Pay‘ then ‘Payments‘ and select ‘Attachments report’ to see a list of attachment payments due in any one particular pay period.

Making payments to the Local Authority

Payment is always to the Local Authority which raised the CTAEO. The documentation provided by the Local Authority to the employer when issuing the CTAEO will give details of how and when to make payments.

FAQ

If an employee has a number of different attachments in operation at the same time, which one takes priority? – Different attachment orders take priority over each other according to their type (e.g. Child Maintenance, Council Tax, DEA etc) and the date that they were issued. Payroll Manager has all of the rules regarding priority built-in, and will automatically apply attachments in the correct priority order.

Links

The Council Tax (Administration and Enforcement) Regulations 1992

Council Tax DEO deduction tables