Coronavirus Job Retention Scheme – Claims March – June 2020

Under the Coronavirus Job Retention Scheme (CJRS) the Government will provide employers with a grant to cover the Gross Pay of furloughed employees (i.e. 80% of their normal pay, up to a maximum of £2,500 per month), their Employer’s National Insurance Contributions (NIC), and the Employer Automatic Enrolment (AE) minimum pension contributions.

How will claims be made?

HMRC are not allowing payroll software to send details of the claim directly. Instead they are asking that employers or their authorised agents log on to the Government Gateway using their existing User ID and Password in order to submit a claim. The information required for each furloughed employee will include their name, National Insurance number, and the amounts claimed under the CJRS.

You should read the GOV.UK document – Coronavirus Job Retention Scheme: step by step guide for employers before proceeding further.

What can I do to prepare?

If you are an employer that uses Payroll Manager to file your own RTI returns then you should make sure that you know your Government Gateway ID and Password. Your Government Gateway ID is stored in Payroll Manager (click ‘Tools- Online Filing – IDs and passwords’ to view the ID), but your password is encrypted and cannot be viewed there. (If you do not have a record of your Government Gateway password elsewhere, then you could request a new password from HMRC, although if you do this then please remember to enter the new password in Payroll Manager.)

You should also ensure that you have the National Insurance number for each of your employees, as this will be required when you come to submit your claim.

If you are an agent that files RTI returns on behalf of your clients then you need to ensure that you have authorisation in place with HMRC to act on behalf of these clients in PAYE matters. Moneysoft are not able to advise on this – please see the GOV.UK page PAYE for Agents for more details.

If you are a ‘file-only‘ agent in the eyes of HMRC and you are not able to/do not wish to get authorisation to act on behalf of your clients then you should contact HMRC as soon as possible about how to proceed.

How Payroll Manager can help

Payroll Manager has a ‘CJRS calculator’ which can automatically calculate CJRS claim amounts for March, April, May and June 2020. You can use the information on the reports generated by Payroll Manager when you come to submit your claim on the Government Gateway website. The rules of the CJRS scheme change from July 2020, and the CJRS calculator in Payroll Manager cannot be used to calculate claims from that point onward.

You do not need to use the CJRS calculator in Payroll Manager if you do not wish to do so – if you prefer you can calculate your claim manually, or you can use the CJRS claim calculator provided on HMRC website.

The CJRS calculation methodology requires items of data that are not used in the normal day-to-day operation of payroll, and so it will be necessary for you to enter this additional data before calculating a claim. You will be asked to enter the exact furlough start dates and (if applicable) furlough end dates for each employee, to specify the days in a period that employees are usually paid for (which may or may not be the same as your normal pay dates), and also to make a decision on the method that you wish to use to establish what an employees ‘usual’ wage is, in order to perform these calculations. The additional data that you enter is NOT sent to HMRC in an RTI return, and will NOT affect your payroll calculations in any way – it is ONLY used to calculate CJRS claim amounts.

The instructions given below will guide you through this process, but you should be aware that a fair amount of data input is required before a claim can be calculated. If you are only claiming for a very small number of employees then you may find the CJRS claim calculator provided on HMRC website to be a suitable alternative.

Important: Please be aware that it is not practically possible for us to explain to you (either by phone or email) the CJRS claim calculation for individual employees. For this reason we have included links to the exact methodology used, and have provided features in the software that allow you to view a step-by-step breakdown of each calculation. If the calculation does not give the result that you expected then we ask that you use these resources to find out why. We also suggest that you look at the FAQ section at the end of this guide for help.

Before you start

You should ensure that both the guide that you are working from and your version of Payroll Manager are up to date.

If you are working from a printed version of this guide then please go to https://moneysoft.co.uk/support/coronavirus-job-retention-scheme-online-claims/ and ensure that you are using the latest version. (The version number is shown at the bottom-right hand side of the guide). Click ‘Help – Program Update’ from the main menu in Payroll Manager to check that you have the latest version installed.

Stages of calculation

There are two main stages of the calculation:

The first stage, ‘Determining the Reference Pay‘ establishes what an employees ‘usual’ wage is, which then forms the basis of the subsequent calculations. This stage only needs to be performed once.

The second stage, ‘Calculating claim amounts for.. (tax year)’ involves entering the furlough start and end dates for furloughed employees, and is performed each time that you wish to calculate claim amounts. There are subtle differences between the requirements for 2019-20 and 2020-21, so we have provided a separate step by step guide for each of these years.

Determining the Reference pay

You only need to perform this procedure once in preparation for your first claim using Payroll Manager

The ‘reference pay‘ for an employee is whatever their ‘usual’ wage was in 2019-20 (i.e. before they were furloughed) and is used to calculate CJRS claims for pay periods in 2019-20 and also for pay periods in 2020-21. HMRC ask that you select a suitable method to determine the ‘usual’ wage depending on the way that the employee is paid.

If the employee is paid a regular amount (either monthly, weekly, 2-weekly of 4-weekly) then HMRC suggest that the reference pay is based on the employee’s pay in the last pay period before 19 March 2020. For monthly paid employees paid on the last day of the calendar month then this is likely to be their monthly pay for February 2020. For weekly paid employees paid on a Friday then this is likely to be the pay they received on Friday 13th March.

HMRC had previously advised that you should use the last pay period before 28 February 2020 as the calculation basis for employees that were paid a regular amount, and you are still permitted to choose this method if you wish.

For employees with variable pay HMRC ask that you calculate their average pay for 2019-20 and use that figure as their reference pay. Alternatively you are allowed to use the employee’s pay for the corresponding pay period in 2018-19 if that figure is higher. Payroll Manager is able to calculate the average pay for 2019-20, based on the methodology shown at the bottom of our CJRS Claim Calculation Method page.

HMRC guidance states that they (HMRC)” ..will not decline or seek repayment of any grant based solely on the particular choice of pay calculation, as long as a reasonable choice of approach is made“.

You should decide on the method that you wish to use to determine the reference pay for each employee, or groups of employees, based on how they are paid.

(If you do not have a Payroll Manager data file for 2019-20 then you will need to calculate the reference pay for each employee manually. If this is the case then ignore the rest of this section and go straight to the section headed ‘Calculating claim amounts for 2019-20’ or ‘..for 2020-21’ as appropriate.

1. Make sure that you have your 2019-20 file open Payroll Manager (click ‘File – Open’ from the main menu in Payroll Manager and select the correct year).

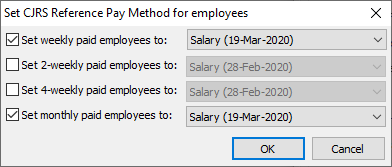

2. Click ‘Employer ‘ then ‘Employer Details‘ from the main menu in Payroll Manager and select the ‘Tax Office’ tab. Click on the button marked ‘Set CJRS Reference Pay Method for employees‘.

Tick the boxes that are relevant to your payroll (e.g. if you have both weekly and monthly paid employees then tick both of these boxes – if you only have 4-weekly paid employees then just tick that box etc), and set the reference pay method accordingly. Click ‘OK‘ when you have finished.

(Note: After setting the reference pay method for all employees within a particular pay frequency, it is possible to change the method for individual employees if you wish. This can be done on the ‘Employees – Employee Details – Work’ screen)

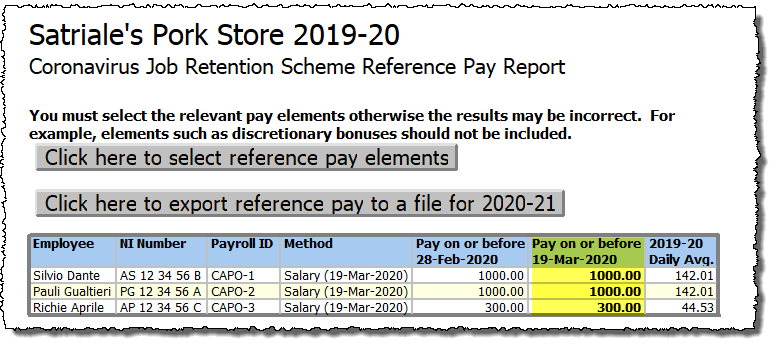

3. Click ‘Tools‘ from the main menu in Payroll Manager, select ‘Coronavirus Job Retention Scheme‘ and then select ‘Reference Pay Report‘.

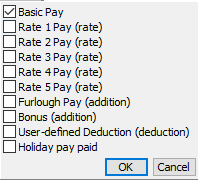

IMPORTANT: Click on the button towards the top of the report marked ‘Click here to select reference pay elements‘.

You need to select the pay elements that you wish to include in the calculation of reference pay (elements such as discretionary bonuses and tips should not be included- see the ‘What to include when calculating wages’ section of the HMRC guidance for details). Click ‘OK‘ when you have finished.

The reference pay report will then show a list of all employees (including those who are not furloughed) and highlights their reference pay figure in bold according to the method that you selected in step 2 above.

The calculation of the ‘daily average’ figure (for use by those whose pay varies) is based on the methodology shown at the bottom of our CJRS Claim Calculation Method page.

You should print the reference pay report as it will be used to calculate your CJRS claim (below)

Click on the button marked ‘Click here to export reference pay to a file for 2020-21‘, and save the file somewhere on your computer. This file will be used later if you are claiming for periods in 2020-21.

***********************************************************************************

Calculating claim amounts for 2019-20

This procedure calculates the claim amounts for each furloughed employee within the claim period.

1. Make sure that you have the 2019-20 Payroll Manager file open. (Click ‘File – Open‘ from the main menu in Payroll Manager if the file is not already open)

2. Ensure that all furloughed employees have been marked with the ‘F’ furloughed symbol for all pay periods in which they were furloughed on the ‘Pay Details’ screen (even if they were furloughed for only one day in that pay period) – This is explained in our furloughed workers guide.

3. Ensure that you have finished entering the pay details of all employees for each pay period that you are claiming for. If an employee was paid for work that they did, and also received ‘furlough pay’ in the same pay period then it is important that these two items of pay have been recorded separately in the payroll. If you have not done this then please see our furloughed workers guide for details.

4. Set the ‘Period dates’

This is a very important step and only needs to performed once for all CJRS claims in 2019-20. (If you have already performed this step for a previous CJRS claim in the 2019-20 tax year then go to step 5). You should take your time to ensure that you have set these dates correctly, as they form the basis for all CJRS claim calculations in 2019-20.

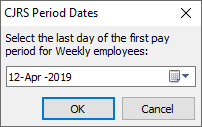

Click ‘Tools – Coronavirus Job Retention Scheme’ from the main menu and select ‘Set Period dates’.

A box will appear for each pay frequency in that payroll.

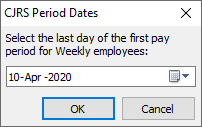

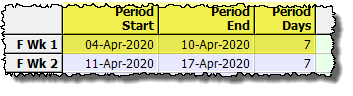

If you have weekly paid employees then you will see this box:

You need to tell Payroll Manager what the last day of the first pay period of the year for weekly paid employees was in 2019-20. In many cases you will not need to change this, as Payroll Manager will automatically set this field to be the same as the first weekly pay date of the 2019-20 year. If employees are paid in arrears, then edit this date accordingly (see weekly examples below). Click ‘OK‘ when you have finished.

Weekly examples:

If your weekly paid employees were paid on Friday 12th April 2019 for work that they did up to and including Friday 12th April 2019, then set the last day of the first pay period to 12th April 2019.

If your weekly paid employees were paid on Friday 12th April 2019 for work that they did up to and including Friday 5th April 2019 (i.e. they are paid a week in arrears), then set the last day of the first pay period to Friday 5th April 2019.

If you have 2-weekly or 4-weekly paid employees then you will see similar ‘Period dates’ setup boxes for these too, which work in a similar way to the weekly setup box.

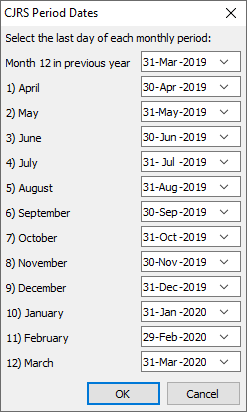

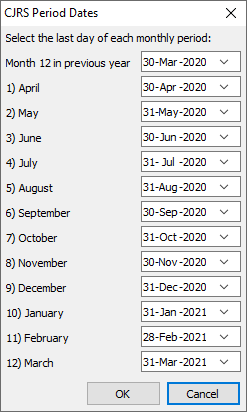

If you have monthly paid employees then you will see this box:

You need to tell Payroll Manager what the last day of each monthly pay period in the year was in 2019-20. In many cases you will not need to change this, as Payroll Manager will automatically set this field to be the same as the monthly pay dates for 2019-20. If employees are paid in arrears, then edit this date accordingly (see examples below). Click ‘OK‘ when you have finished.

Monthly examples:

If your monthly paid employees were paid on 30th April 2019 for work that they did up to and including 30th April 2019, then set the last day of the first pay period to 30th April 2019. Set the last day for each of the subsequent months accordingly.

If your monthly paid employees were paid on 30th April 2019 for work that they did up to and including 25th April 2019 (i.e. you have a ‘cut-off’ date which is 5 days before the monthly pay date) then set the last day of the first pay period to 25th April 2019. Set the last day for each of the subsequent months accordingly.

If your monthly paid employees were paid on 30th April 2019 for work that they did up to and including 5th May 2019 (i.e. you pay them for work that they do in the ‘tax month’) then set the last day of the first pay period to 5th May 2019. Set the last day for each of the subsequent months accordingly.

5. Entering the employee furlough information

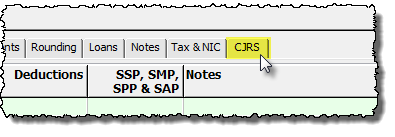

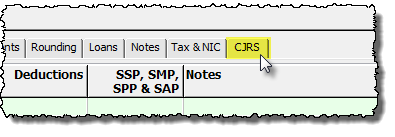

Click ‘Pay‘ then ‘Pay Details‘ from the main menu, then click on the ‘CJRS‘ tab.

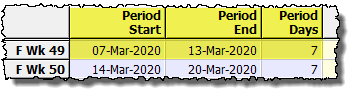

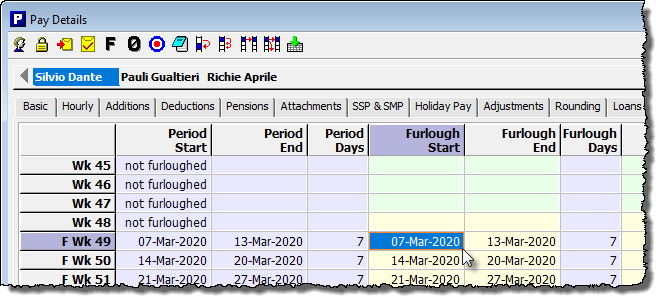

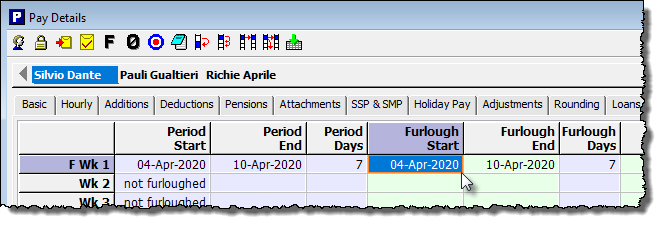

You will see that the ‘Period Start‘, ‘Period End‘ and ‘Period Days‘ columns have all been populated according to the ‘Period dates‘ that you selected in step 4 (above). These items are fixed and cannot be edited.

Repeat the following procedure for each pay period that you wish to claim for, and for each employee that is furloughed in that period:

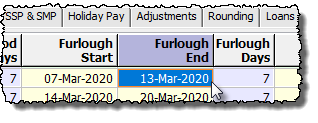

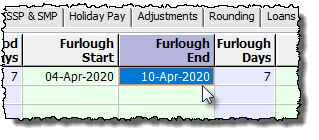

i) Set the ‘Furlough Start‘ date. By default this will be set to the first day of the pay period. If the employee was furloughed for the whole period then leave this date as it is. If the employee began their furlough after the ‘Period Start’ date then click in the ‘Furlough Start‘ column to edit it.

For the first period that the employee was furloughed the ‘Furlough start’ date should be the day after they last worked (even if this was normally a non-working day).

e.g. A weekly paid employee whose pay period ends on a Friday is furloughed for the first time. They last worked on Friday 6th March 2020. Their first ‘furlough start’ date will be Saturday 7th March 2020.

ii) Set the ‘Furlough End‘ date. By default this will be set to the last day of the pay period. If the employee was furloughed for the whole period or if their furlough is ongoing then leave this date as it is. If the employee’s furlough ended before the ‘Period End’ date then click in the ‘Furlough End‘ column and enter the date of the last day before they returned to work, even it that was normally a non-working day.

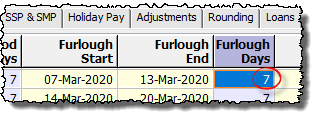

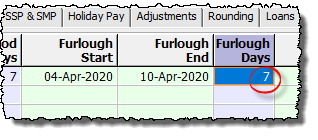

The next column displays the total number of furlough days in that particular period, according to what is entered in the previous two columns. If a weekly paid employee is furloughed for the entire pay period then the ‘furlough days’ in that period will be 7. If a monthly paid employee is furloughed for the entire pay period, then the ‘furlough days’ in that period will be 30 or 31.

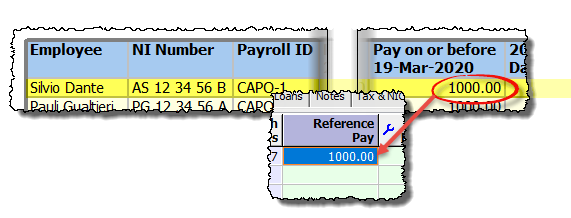

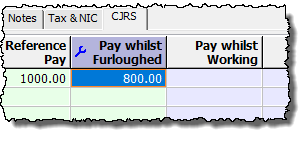

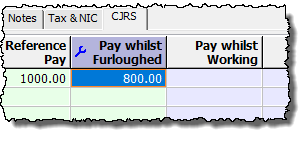

iii) Set the ‘Reference pay‘.

Use the report that you produced in the ‘Determining the Reference Pay‘ section above. Click in the ‘Reference Pay‘ column and enter the appropriate figure.

If you have chosen to use the ‘Pay in the last period on or before 19 March 2020’ as the reference pay then enter that figure.

If you have chosen to use the ‘Pay in the last period on or before 28 February 2020’ as the reference pay then enter that figure.

If you have chosen to use the ‘variable’ method of determining the reference pay for an employee then you have two options. You are allowed to use the greater of the following two figures:

a) The ‘daily average’ (as per the ‘Reference Pay’ report) multiplied by the number of days in that particular pay period.

b) The pay for the corresponding pay period in the 2018-19 year.

If you were not using Payroll Manager in 2019-20, or if you have already performed your own calculation of reference pay, then you can enter this figure manually if you wish.

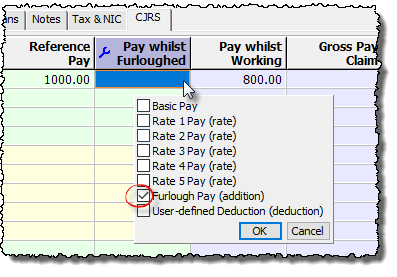

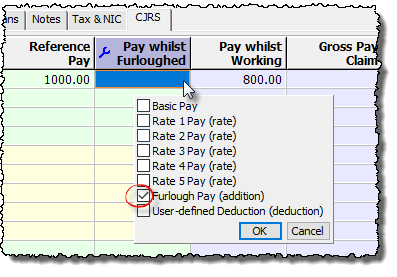

iv) Set the ‘Pay whilst Furloughed‘.

The ‘Pay whilst furloughed’ is the pay that the employee received whilst away from work. Click on the blue ‘spanner’ symbol at the top of the ‘Pay whilst furloughed‘ column and select the pay elements that were used to record the payments made to the employee whilst they were furloughed, then click ‘OK‘. If the employee received ‘top-up’ pay whilst they were furloughed then the pay element that was used to record this ‘top-up’ pay should be included too.

If the employee was furloughed part-way through a pay period, and was also paid for the work that they did in that period, then it is important that you do not include any pay elements that were used to record any pay they received for working. If you have not recorded ‘furlough pay’ and ‘working pay’ separately in these periods then then you would need to go back to these periods, unlock them if necessary, and separate the pay out accordingly, as per our Furloughed workers guide.

Payroll Manager will display the total of these pay elements in the ‘Pay whilst furloughed’ column

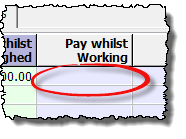

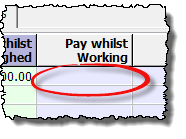

v) ‘Pay whilst working‘

Payroll Manager takes the total pay that the employee was paid in the period and subtracts the ‘Pay whilst furloughed’ figure to arrive at the ‘Pay whilst working’ figure. This figure will be zero (as in the example below) if the employee was furloughed for the entire pay period.

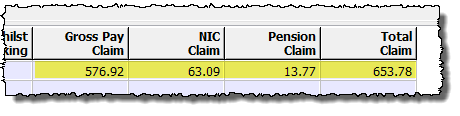

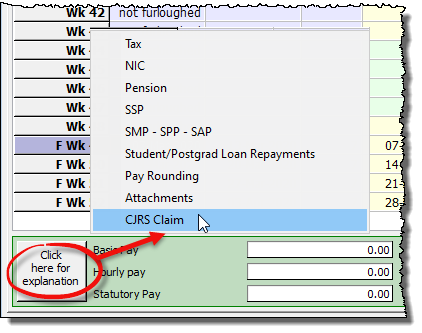

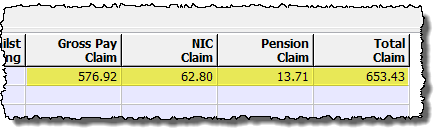

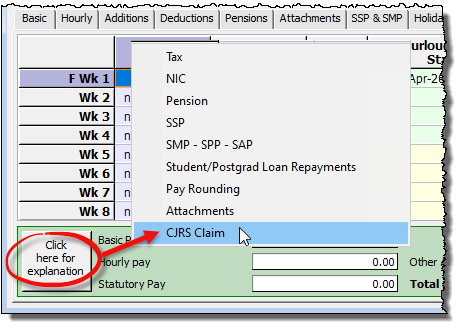

vi) The claim amounts

Payroll Manager will display the claim amounts for that employee. There are separate columns for the Gross Pay claim, the Employer NIC Claim, the Employer Pensions Contributions Claim and the Total Claim.

If you wish to see how these figures have been calculated then click on the ‘Click here for explanation‘ button at the bottom-left hand corner of the ‘Pay Details’ screen. Select the ‘CJRS Claim‘ layout.

Payroll Manager will display a step-by-step calculation of each of the three claim elements (Gross pay, NIC and Pension).

The methodology used to calculate these amounts can also be seen on our CJRS Claim Calculation Method page.

vii) Repeat steps i to vi for all furloughed employees in the period, and for all periods that you wish to claim for.

6. Producing the Calculation Summary report for use when processing a claim via the HMRC portal

Click ‘Tools‘ then ‘Coronavirus Job Retention Scheme‘ from the main menu in Payroll Manager then select ‘Calculation Summary‘.

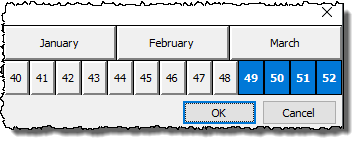

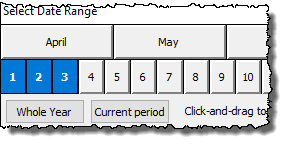

IMPORTANT: Click on the ‘Date Range‘ button at the top of the report and select the relevant weeks/months to include in your claim.

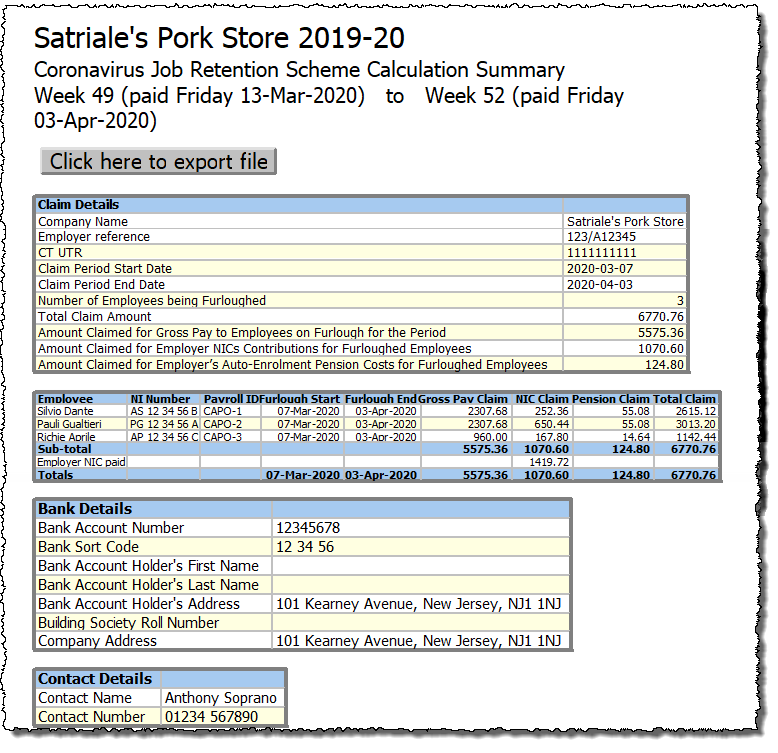

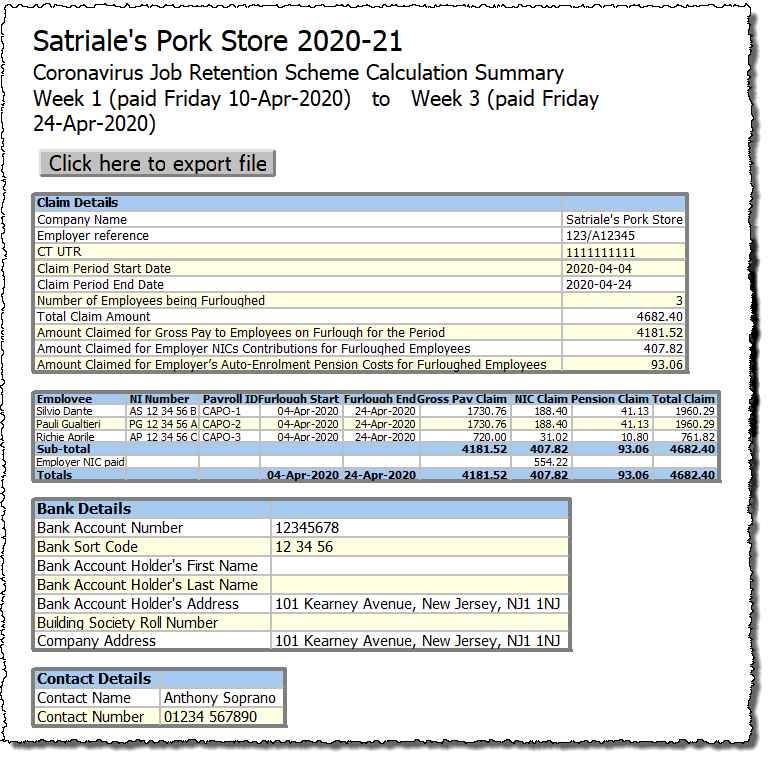

The ‘Calculation Summary’ report shows all of the relevant employer information, together with a list of employees and their individual claim amounts. The ‘click here to export file’ button produces as csv file, which can then be edited as you wish. (This file can also be used by employers with 100 or more employees to upload to HMRC website)

Important: Please note that the Employers NIC claim in a period cannot exceed the amount of Employers NIC that the employer has actually paid in that period. In the example below, the employer was claiming the £3000 Employment Allowance for 2019-20, and so the amount of ER NIC that they actually paid to HMRC in these periods was zero. The report breaks down the amount of ER NIC which would normally be claimable per employee, but the actual amount of ER NIC that can be claimed in this period is zero.

7. Go to the GOV.UK Coronavirus Job Retention Scheme website and process your claim using the information in the ‘Calculation Summary’ report. Please remember that it is your responsibility to check the amounts that you are claiming under the scheme, and that Moneysoft are not accountable for any errors or oversights that you may have made when entering your data.

***********************************************************************************

Calculating claim amounts between April and June 2020

This procedure calculates the claim amounts for each furloughed employee within the claim period.

1. Make sure that you have the 2020-21 Payroll Manager file open. (Click ‘File – Open‘ from the main menu in Payroll Manager if the file is not already open)

2. Ensure that all furloughed employees have been marked with the ‘F’ furloughed symbol for all pay periods in which they were furloughed on the ‘Pay Details’ screen (even if they were furloughed for only one day in that pay period). This is explained in our furloughed workers guide.

3. Ensure that you have finished entering the pay details of all employees for each pay period that you are claiming for. If an employee was paid for work that they did, and also received ‘furlough pay’ in the same pay period then it is important that these two items of pay have been recorded separately in the payroll. If you have not done this then please see our furloughed workers guide for details.

4. Set the ‘Period dates’

This is a very important step and only needs to performed once for all CJRS claims in 2020-21. (If you have already performed this step for a previous CJRS claim in the 2020-21 tax year then go to step 5). You should take your time to ensure that you have set these dates correctly, as they form the basis for all CJRS claim calculations in 2020-21.

Click ‘Tools – Coronavirus Job Retention Scheme’ from the main menu and select ‘Set Period dates’.

A box will appear for each pay frequency in that payroll.

If you have weekly paid employees then you will see this box:

You need to tell Payroll Manager what the last day of the first pay period of the year for weekly paid employees was in 2020-21. In many cases you will not need to change this, as Payroll Manager will automatically set this field to be the same as the first weekly pay date of the 2020-21 year. If employees are paid in arrears, then edit this date accordingly (see weekly examples below). Click ‘OK‘ when you have finished.

Weekly examples:

If your weekly paid employees were paid on Friday 10th April 2020 for work that they did up to and including Friday 10th April 2020, then set the last day of the first pay period to 10th April 2020.

If your weekly paid employees were paid on Friday 10th April 2020 for work that they did up to and including Friday 3rd April 2020 (i.e. they are paid a week in arrears), then set the last day of the first pay period to Friday 3rd April 2020.

If you have 2-weekly or 4-weekly paid employees then you will see similar ‘Period dates’ setup boxes for these too, which work in a similar way to the weekly setup box.

If you have monthly paid employees then you will see this box:

You need to tell Payroll Manager what the last day of each monthly pay period in the year was in 2020-21. In many cases you will not need to change this, as Payroll Manager will automatically set this field to be the same as the monthly pay dates for 2020-21. If employees are paid in arrears, then edit this date accordingly (see examples below). Click ‘OK‘ when you have finished.

Monthly examples:

If your monthly paid employees were paid on 30th April 2020 for work that they did up to and including 30th April 2020, then set the last day of the first pay period to 30th April 2020. Set the last day for each of the subsequent months accordingly.

If your monthly paid employees were paid on 30th April 2020 for work that they did up to and including 25th April 2020 (i.e. you have a ‘cut-off’ date which is 5 days before the monthly pay date) then set the last day of the first pay period to 25th April 2020. Set the last day for each of the subsequent months accordingly.

If your monthly paid employees were paid on 30th April 2020 for work that they did up to and including 5th May 2020 (i.e. you pay them for work that they do in the ‘tax month’) then set the last day of the first pay period to 5th May 2020. Set the last day for each of the subsequent months accordingly.

5. Entering the employee furlough information

Click ‘Pay‘ then ‘Pay Details‘ from the main menu, then click on the ‘CJRS‘ tab.

You will see that the ‘Period Start‘, ‘Period End‘ and ‘Period Days‘ columns have all been populated according to the ‘Period dates‘ that you selected in step 4 (above). These items are fixed and cannot be edited.

Repeat the following procedure for each pay period that you wish to claim for, and for each employee that is furloughed in that period.

i) Set the ‘Furlough Start‘ date. By default this will be set to the first day of the pay period. If the employee was furloughed for the whole period then leave this date as it is. If the employee began their furlough after the ‘Period Start’ date then click in the ‘Furlough Start‘ column to edit it.

For the first period that the employee was furloughed the ‘Furlough start’ date should be the day after they last worked (even if this was normally a non-working day).

e.g. A weekly paid employee whose pay period ends on a Friday is furloughed for the first time. They last worked on Friday 3rd April 2020. Their first ‘furlough start’ date will be Saturday 4th April 2020.

ii) Set the ‘Furlough End‘ date. By default this will be set to the last day of the pay period. If the employee was furloughed for the whole period or if their furlough is ongoing then leave this date as it is. If the employee’s furlough ended before the ‘Period End’ date then click in the ‘Furlough End‘ column and enter the date of the last day before they returned to work, even it that was normally a non-working day.

The next column displays the total number of furlough days in that particular period, according to what is entered in the previous two columns. If a weekly paid employee is furloughed for the entire pay period then the ‘furlough days’ in that period will be 7. If a monthly paid employee is furloughed for the entire pay period, then the ‘furlough days’ in that period will be 30 or 31.

iii) Set the ‘Reference pay‘.

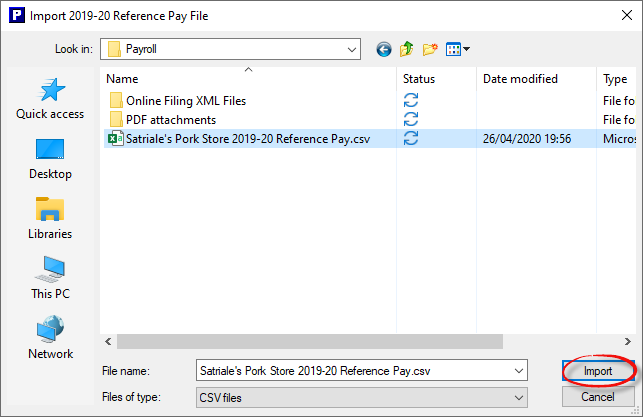

It is possible to import the reference pay for all employees and for all pay periods at the same time from the file that you exported in the ‘Determining the reference pay’ procedure above. To do this click ‘Tools‘ then ‘Coronavirus Job Retention Scheme‘ from the main menu in Payroll Manager and select the option to ‘Import 2019-20 Reference pay File‘. Browse to the location that you chose to save the file, select the file and click ‘Import‘.

This will import the reference pay for all employees at the same time. If you choose this method then you can skip this step of the procedure next time as the reference pay will automatically appear for all employees for all pay periods in 2020-21.

If you have chosen to use the ‘Pay in the last period on or before 19 March 2020’ as the reference pay for an employee then it is this figure that will be imported.

If you have chosen to use the ‘Pay in the last period on or before 28 February 2020’ as the reference pay for an employee then it is this figure that will be imported.

If you have chosen to use the ‘variable’ method of determining the reference pay for an employee then the software will calculate, and import the greater of the following two figures:

a) The ‘daily average’ (as per the ‘Reference Pay’ report) multiplied by the number of days in that particular pay period.

b) The pay for the corresponding pay period in the 2019-20 year.

If you were not using Payroll Manager in 2019-20, or if you have already performed your own calculation of reference pay, then you can enter this figure manually if you wish.

iv) Set the ‘Pay whilst Furloughed‘.

The ‘Pay whilst furloughed’ is the pay that the employee received whilst away from work. Click on the blue ‘spanner’ symbol at the top of the ‘Pay whilst furloughed‘ column and select the pay elements that were used to record the payments made to the employee whilst they were furloughed, then click ‘OK‘. If the employee received ‘top-up’ pay whilst they were furloughed then the pay element that was used to record this ‘top-up’ pay should be included too.

If the employee was furloughed part-way through a pay period, and was also paid for the work that they did in that period, then it is important that you do not include any pay elements that were used to record any pay they received for working. If you have not recorded ‘furlough pay’ and ‘working pay’ separately in these periods then then you would need to go back to these periods, unlock them if necessary, and separate the pay out accordingly, as per our Furloughed workers guide.

Payroll Manager will display the total of these pay elements in the ‘Pay whilst furloughed’ column

v) ‘Pay whilst working‘

Payroll Manager takes the total pay that the employee was paid in the period and subtracts the ‘Pay whilst furloughed’ figure to arrive at the ‘Pay whilst working’ figure. This figure will be zero (as in the example below) if the employee was furloughed for the entire pay period.

vi) The claim amounts

Payroll Manager will display the claim amounts for that employee. There are separate columns for the Gross Pay claim, the Employer NIC Claim, the Employer Pensions Contributions Claim and the Total Claim.

If you wish to see how these figures have been calculated then click on the ‘Click here for explanation‘ button at the bottom-left hand corner of the ‘Pay Details’ screen. Select the ‘CJRS Claim‘ layout.

Payroll Manager will display a step-by-step calculation of each of the three claim elements (Gross pay, NIC and Pension).

The methodology used to calculate these amounts can also be seen on our CJRS Claim Calculation Method page.

vii) Repeat steps i to vi for all furloughed employees in the period, and for all periods that you wish to claim for.

6. Producing the Calculation Summary report for use when processing a claim via the HMRC portal

Click ‘Tools‘ then ‘Coronavirus Job Retention Scheme‘ from the main menu in Payroll Manager then select ‘Calculation Summary‘.

IMPORTANT: Click on the ‘Date Range‘ button at the top of the report and select the relevant weeks/months to include in your claim.

The ‘Calculation Summary’ report shows all of the relevant employer information, together with a list of employees and their individual claim amounts. The ‘click here to export file’ button produces as csv file, which can then be edited as you wish. (This file can also be used by employers with 100 or more employees to upload to HMRC website)

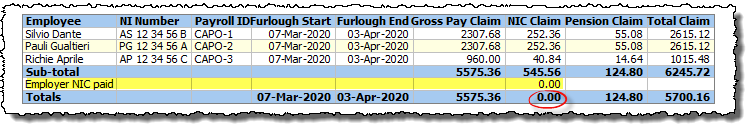

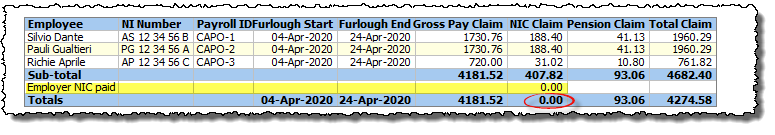

Important: Please note that the Employers NIC claim in a period cannot exceed the amount of Employers NIC that the employer has actually paid in that period. In the example below, the employer was claiming the £4000 Employment Allowance for 2020-21, and so the amount of ER NIC that they actually paid to HMRC in these periods was zero. The report breaks down the amount of ER NIC which would normally be claimable per employee, but the actual amount of ER NIC that can be claimed in this period is zero.

7. Go to the GOV.UK Coronavirus Job Retention Scheme website and process your claim using the information in the ‘Calculation Summary’ report. Please remember that it is your responsibility to check the amounts that you are claiming under the scheme, and that Moneysoft are not accountable for any errors or oversights that you may have made when entering your data.

*******************************************************************************************

FAQs

– What do I do if I wasn’t using Payroll Manager for 2019-20, or started using the software mid-year? – In these cases the software will not have enough data to calculate the ‘reference pay’. You should calculate and enter the reference pay for each employee manually.

– Why are the Pension claim amounts lower than the amounts that the employer has actually contributed to the pension scheme? – The CJRS scheme only allows you to claim an amount equal to the minimum employer pension contributions required by law – that is, 3% on earnings above the ‘Qualifying Earnings Level’ (£512/ month in 2019-20 and £520/month in 2020-21). If your employer contributions are higher than 3%, or if they are based on all earnings, rather than just ‘Qualifying’ earnings, then these additional contributions cannot be reclaimed.

– I need to claim for some weeks in 2019-20 and other weeks in 2020-21. How do I get a report to cover both tax years? – The CJRS Calculation Summary report only covers one tax year at a time. You would need to run the report in 2020-21 for the relevant pay periods, then open up your file for 2019-20 (click ‘File – Open’) and run another report for the relevant pay periods in that year. Then add the 2 sets of figures together.

– I have employees under the age of 21 / apprentices under the age of 25 whose Employer NIC grant is showing as zero – why is this? – Employers NIC is not charged on payments to these employees ( with NI table letters ‘M’ and ‘H’ respectively) and so there will be no ER NIC grant to claim.

– If I add up all of the Employer NIC figures, employee by employee, they do not match the total Employer NIC claim for the period – why is this? – This is because the total Employer NIC grant claim is taking into account the Employment Allowance (if applicable) and so serves to reduce the total amount of ER NIC that is claimed.

– I am having problems processing my claim on the Government Gateway website, what can I do? – This is not something that Moneysoft can help with, please see the GOV.UK Get help with the Coronavirus Job Retention Scheme page for advice.

Other questions – e.g. What if I made someone redundant and now wish to furlough them? Do directors qualify? What if the employee has more than one job – Answers to these, and many more questions can be found on the GOV.UK guide Claim for wages under the CJRS scheme

Version:2006161