Claiming / Unclaiming the NIC Employment Allowance for a previous year

Sometimes you may need to inform HMRC that you wish to claim the NIC ‘Employment Allowance’ for a tax year that has already ended (and in some cases, where you have mistakenly ‘claimed’ the allowance you may wish to inform HMRC that you no longer wish to claim). In order to do this you should resend the final EPS for that tax year with the ‘Employment Allowance Indicator‘ ticked or un-ticked as appropriate. This guide takes you through the correct procedure.

1) Open up the relevant file – click ‘File – Open‘ from the main menu in Payroll Manager and select the file for the relevant year.

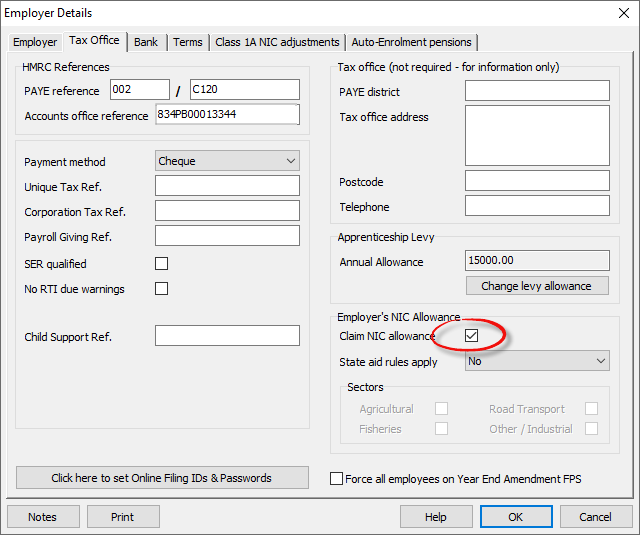

2) Click ‘Employer‘ then ‘Employer Details‘ from the main menu, and select the ‘Tax Office‘ tab.

3) Tick (or un-tick if not claiming the allowance) the box marked ‘Claim NIC Allowance‘. Answer the ‘State aid rules apply‘ questions as applicable, and click ‘OK‘.

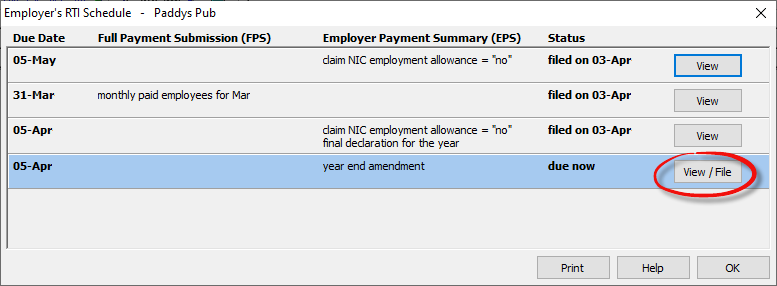

4) Click ‘Pay‘ then ‘Employers RTI schedule‘ from the main menu in Payroll Manager. You will see a ‘Year End Amendment’ EPS item on the schedule which allows you to send an amendment to the EPS. Click ‘View/File‘ to view this report.

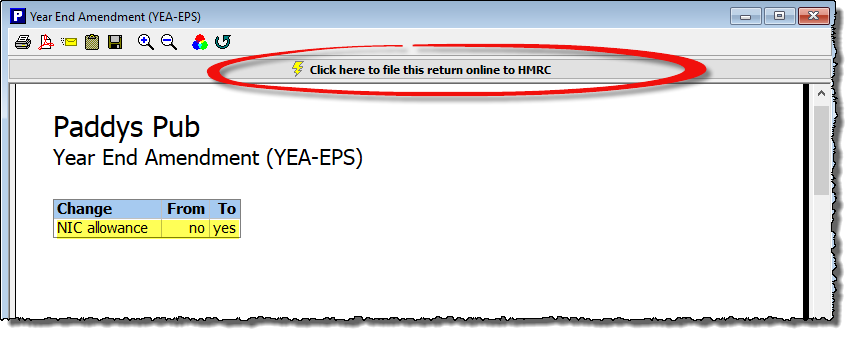

5) The EPS – Year End Amendment’ report shows what has changed in your data since the final EPS was filed. In this case it is the fact that the NIC allowance indicator has been changed (from either ‘No’ to ‘Yes’, or vice versa, according to your situation). Select ‘Click here to file this return online to HMRC‘ to file the amended EPS.

Note: As EPS reports also show items such as ‘SMP recovery’ and ‘CIS deductions suffered’ in the year then you should only follow this procedure if you were using Moneysoft Payroll Manager for the tax year in question. You should not create a brand new file in order to submit and EPS for previous years, unless you know that these other EPS items were zero for the entirety of that tax year.