CIS suffered – reporting a new figure after the final EPS has been sent

On some occasions you may need to adjust the amount of CIS suffered that you are reporting to HMRC after submitting your final EPS for the year. This guide shows how to make the necessary corrections and submit a ‘Year End Amendment – EPS‘, which will inform HMRC of the new totals.

1) Make sure that you have the correct file open on the screen. Click ‘File’ then ‘Open’ from the main menu if you need to select a different year.

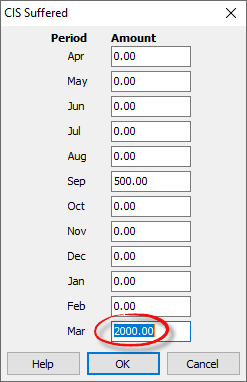

2) Click ‘Employer’ and then ‘CIS Suffered’ from the main menu. Adjust the figure in March (or earlier if the scheme was ceased before the end of the year) so that the total of all the rows on the screen equals the total amount of CIS suffered for the year. Click ‘OK’.

- Example: In the example below, £500 had previously been reported to HMRC as the amount of CIS suffered in September. It then becomes evident that a total of £2500 was suffered during the entire tax year. In this case an amout of £2000 should be entered into the row for March, so that the cumulative total for the year is recorded as £2500.

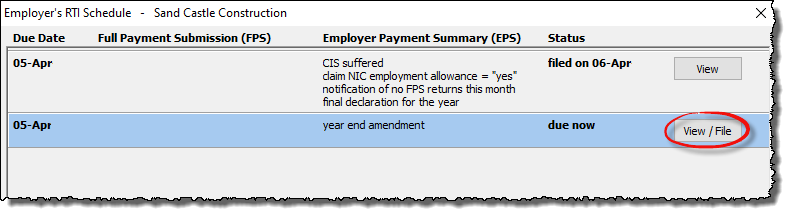

3) Click ‘Pay’ then ‘Employer’s RTI Schedule’ from the main menu, then click on the ‘View/File’ button to display the ‘Year End Amendment – EPS’ that Payroll Manager will have created as a result of the changes that you made in step 2.

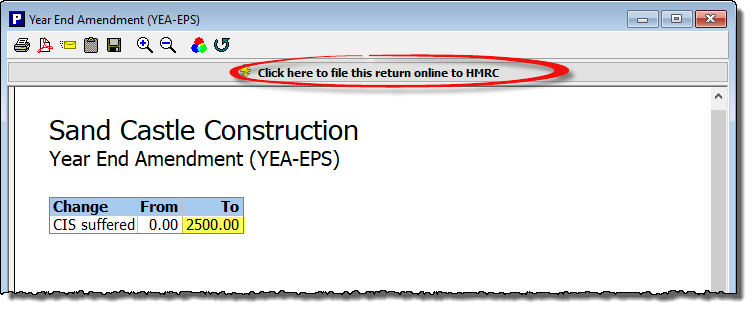

4) Details of the changes that you have made are shown on the report. Check that the Year-to-date CIS suffered figures are correct (i.e. those shown in the ‘To‘ column, highlighted below) before clicking on the bar along the top marked ‘Click here to file this return online to HMRC’.

Payroll Manager will submit the EPS in the usual way. You should then check for the HMRC response to verify that the submission was successful.

Please note that when submitting CIS suffered figures on an EPS you must have the correct Corporation Tax reference entered in the ‘Employer – Employer Details – Tax Office‘ screen. This reference consists of 10 digits, ( e.g. in the format 1234567895), and is usually the same as the UTR for that employer.